As we head into 2022, it is clear that home owners need to be prepared for higher mortgage interest rates.

In fact, the signals have been around for a while, and the latest RBNZ data (S33) shows that many borrowers have made an adjustment, taking out interest rate contracts with longer terms. Still, they are the minority.

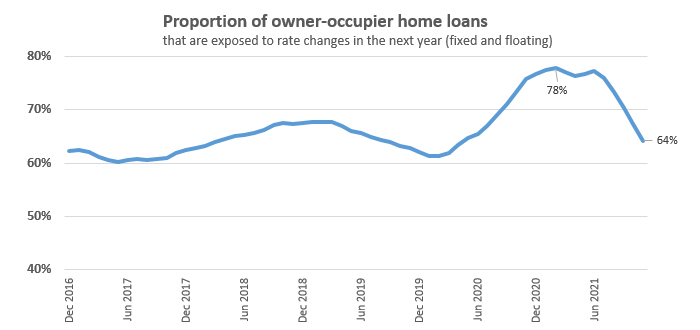

During 2022, a whopping $151.0 bln is exposed to rate rises this year - and that is only for owner-occupiers. Investors have another $60.2 bln exposed to rate rises in 2022. (And there is another $3.9 bln exposed in mortgages taken out to support business loans.) That means that $215 bln will be rolled over in 2022 at sharply higher interest rates.

For every +25 bps rate rise, that is an extra annual interest cost of $537 mln. If we get two or three +25 bps rate rises in 2022, that could cost mortgage borrowers up to $800 mln. Almost all borrowers will be able to afford it. Banks have been diligent in ensuring they have stress-tested their customers (and especially their newest borrowers) for rate rises well above an extra +75 bps. But in turn, that will be $800 mln that will not be spent in the wider economy. Although annual retail sales exceed $107 bln, taking 0.75% off the top of that will be noticed. And the behavioural change as household tighten their belts with a crimped level of disposable income, could well mean there will be a multiplier impact.

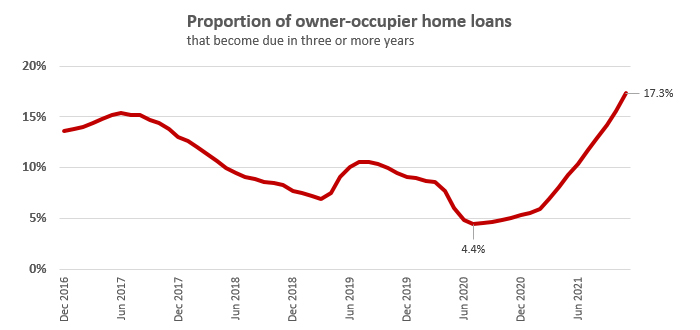

Those that do roll over their mortgages in 2022 could follow the growing trend of taking out longer term rate contracts.

2021 started with 73% of household fixed mortgages due to be rolled over in the year, but ended with just under 60% like that. That is a big shift. Many cottoned on to the wisdom of locking in the very low rates that were on offer through much of 2021 and doing so for longer fixed terms.

Interestingly, investors made the same switch, but not as aggressively as owner-occupiers, taking their exposure to fixed rate contract from 77% rolling over within the year to 64%. Investors have stayed more short-term in their forward outlook.

The same data shows that the fixed term extension by owner-occupiers was away from the 2 year fixed, with more on three years, some more on four years, and a lot more on five year fixed terms.

The psychology might be slightly different in 2022. Rates on offer are no longer at record lows and have already risen about +2%. They are still 'low' in an historical context, but another +2% coming in the next year or two will put them back to the 6% range and more 'normal' from a longer term perspective. However, for some, a 6% home loan rate will be a 'shock'. So the drive to lock in current rates won't be so much as seizing on an unusual benefit, it will be more fear-based, trying to avoid a larger hit to the household budget.

Of course, many of those who did take advantage of the historically low 2+% mortgage rates only took them out for a one year term. And those that took them out early for a two year fixed term will also be facing a noticeable change in monthly payments as they contemplate 2022. Following their fellow borrowers into 3, 4 and 5 years locked-in options will seem like a good option to consider - if your housing situation is likely to be stable.

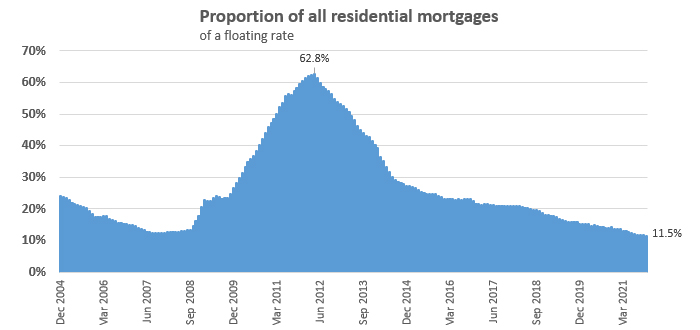

Floating rates are used by fewer borrowers now than at any time in our history. And in a rising rate environment, the use of floating rates home loans is likely to be driven even lower.

122 Comments

Heard of several stories where owners’ mortgages are up for renewal (fixed period has ended) and banks are now demanding additional cash injection from the owner or have the other option to go elsewhere for a mortgage or sell… Also examples of people taking out a mortgage for a new build (which comes with delays) and bank asking for additional deposit (house wasn’t even finished yet!)

Sounds fanciful. If banks are seeking to meet their capital requirements why don't they just increase term deposit rates?

GREED.

Despite all the doom and gloom about mortgage interest rates rising over 2022, there's still a reasonable chance that house prices will continue to increase.

And if some homeowners have to sell up because they can't afford their repayments, that will raise the demand for rental dwellings - putting further upward pressure on rents.

TTP

P.S. Certainly, banks need to increase their term deposit rates.

there's a reasonable chance that house prices will continue to increase

...a reasonable chance, you say? I'll take it!

To the moon!

Yes, and where on Earth do the banks manage to get these hundreds of billions to loan out? By the push of a button! That's the magic of Fractional Reserve Banking. Poof!! It just comes into existence and then they can charge the people for it, in turn driving house prices up and soon we could end up like Ireland just before the 2008 crash. Oh happy days! That's when it's time to buy!

And even with the ability to create money from nothing and lend at interest, they still manage to foul it all up and need a bailout!

Sounds legit. Westpac wanted me to fill out a brand new application to continue my interest only mortgage for the renters. Said it was due to a law change to protect overleveraged.

Went from 2.29% to 3.69%, extra $300 week in interest payments and only 75% deductible. I'll be doing my part to get CPI down now.

So be it for people with multiple rentals, living off the back of others, and only paying interest.

Ummm... Can't say HeavyG is in synch with my own thinking but tell me: why should this person be required to pay back principal on an investment-related loan, compared to an FHB or other owner-occupier?

Surely the whole logic of interest-only lending in all cases is to reduce cash flow risks?

Are we seeing FOMO of fixed mortgage instead of FOMO on house now...........

I have 2.5% till mid November this year.

Will play it by ear of course, but at this stage I'd say I will go onto floating after November, the reason being I think the OCR will be cut multiple times from late this year / early next year.

So will look to fix again around April- June 2023 following OCR cuts.

Be careful, as you are literally betting on your ability to forecast future interest rate movements, and moreover your personal forecast is completely against the forecast of all fixed rate markets, in NZ as well as internationally, and also against most central scenario forecasts by many central banks. The overwhelming majority firmly forecasts sustained increased rates. Just look at current swap rates and bond pricing, to realize that your opinion is a real outlier.

Maybe you are privy to information that nobody else in the market is aware of, but your statement does leave the strong impression of wishful thinking.

Not wishful thinking, totally dreaming the way things are heading.

I thought you are on record here as predicting big problems for the economy?

You don't think that will eventually result in OCR cuts?

HM, note 6 times more thumbs up on fortunr's post than yours, a sure sign that your thinking is on point!

You are entitled to your opinion. I see a big weakening in the NZ economy this year, and eventually cuts to the OCR.

BTW an international (not local bank with vested interest) economics consultancy is forecasting pretty much the same.

Anyway, I said I am not locked into that mindset and will play it by ear.

Ever heard of stagflation? Weakening in the economy doesn't necessarily mean lower rates in this environment.

Yep definitely possible.

But I think a lot of the non-supply side inflation will dry up once the SHTF with the economy.

Picking interest rate directions (macro) is inherently difficult and with low probability of success (i.e. you'd be a legend if you got it right 60% of the time). You are welcome to take an educated view but only do so if you can afford to be wrong.

Well:

1. It's just my opinion, it might be wrong and I will monitor through the year

2. I don't have much choice as I am locked in till November anyway

3. Although I would rather not, I could fairly comfortably handle a mortgage rate of 5% plus from November, especially as I have a couple of other loans being paid off just before then.

Btw, remember the RBNZ'S mandate is much wider than inflation, it includes employment and financial stability. Both would be threatened by a recession and significant house price falls, and who around here really thinks that the RBNZ doesn't care about house prices?

That's good. If you feel confident in your abilities to take a bit of position against the interest rate market and can afford to be wrong then go for it. But how high could rates go before you cannot afford it? I would recommend maybe refixing an appropriate portion if there is a >5% probability of you being unable to afford those less likely, higher interest rate scenarios.

Yes the RBNZ's mandate is wider than inflation these days (and arguably weighted towards full employment given recent examples) and of course inflation and employment are correlated (albeit in recent decades not as strongly as they used to).

I recommend reading the Capital Economics report, whose view is similar to mine (independently).

House price falls of 10%, markedly weakening economy and OCR cuts in 2023.

It's not just some random punter called HouseMouse who holds this view!

HM, don't let the masses scare you (note the "m" is sometimes silent). I'm with you on interest rates although I think Nov 2022 is probably too early. In August 2021, I fixed for 2 years at 2.49% and 3 years at 2.89%. It was the first time in over a decade that I have fixed longer than 1 year. I'm very happy with that call

Good call there Yvil.

I come off fixed mid November, I'm happy enough to float at 5 - 6% from there then fix again say mid 2023 at say 3.5%-4% once the OCR is back down at around 1%.

If the economy holds up a lot better through this year than I expect, and it seems unlikely that the OCR will drop, then I might fix again for a year from November, but only for a year.

I am pretty comfortable with all this and far from a problematic situation if I end up being wrong.

I think our economy is a credit driven one and I think it will seize up with significantly increasing cost of finance. Increased cost of finance, greater barriers to access it, low/negative net migration, end of covid subsidies... I seem to be in a very small minority who think this, but so be it.

People need to weigh up things and form their own view. I have formed mine but will also monitor things and revise if necessary.

"I think our economy is a credit driven one and I think it will seize up with significantly increasing cost of finance"

We certainly share the same view on this most important point

We just sold our first home, knocked us out of a 3.05% for 5 year fix into a 4.95% 5 year fix. Our 3.05% fix was only put in place around 6 months ago.

These are uncertain times, interest rates could go either way. My thinking is if we lock long and interest rates drop, then we will "lose" money that we weren't already seeing. But if we lock short and rates go up further, then we may have to adjust our lifestyle.

The other plan is when rolling off your last low fixed rate is to stay on floating for a while and wait for the dust to settle in 2022.

Because a) the fixed rates on offer atm are not that flash, and b) it’s possible for another decline in rates as events hit and the economy struggles.

Rates go up and down all the time. No one was complaining when they were exposed to lower interest rates and I don't see why should they fear a minute rise close to the long term rate.

Locking into a fixed rate is a cat and mouse game. In locking in your mortgage, you are literally betting on your ability to forecast future interest rate hike- which is no different from futures trading.

However, even if you are right, you won't reap the full benefits as what the banks offer out beyond the 1 year low rates; as those (2 year and beyond) will be priced above what the market thinks that would be as of today.

We've simulated this before, even if you are right most of the time on rising rates over a 25 - 30 year terms, you'll likely to average out the same as just sticking to floating rates. But that's half the story, the bank does not compensate you for the risk of rates falling while you were still locked in; therefore, the risk reward ratio is skewed in favour of the banks you signed up to.

Imagine if you had locked in a 3 year rate in 2019, what a disaster that is.

If your holding period is beyond a few years, I don't see a overly enticing reason to play the futures game with the banks.

That is unless you really think you are that good to beat them.

I think of long fixed mortgages as insurance policies - likely to cost you more but gives you certainty and protection. Useful for people without much buffer.

Regarding your assertion that floating is best - given the strangely high cost of floating mortgages in NZ, I'd be surprised you weren't better off just rolling over ~1-year fixes.

The disjunct between fixed rate lending (where the bank knows exactly what its margin is) and floating (where they take as much as they can get) is one of New Zealand's biggest red flags when it comes to the behaviour of our major banks.

Individuals betting against entire teams of professional analysts with better information and data systems to support.

For my own finances I've alway likened sticking with floating rates as dollar cost averaging or sticking to etfs vs picking companies.

CWBW, I don't agree that sticking to floating is best long term, I think I have significantly outperformed the floating rate by fixing for 1 year for over a decade and now fixing for 2 years at 2.49% and 3 years at 2.89% in August 2021

This isn’t true. The banks don’t compete on the floating rate and it is always higher than the fixed rates. Higher when the fixed rates are falling, higher when the fixed rates are rising, and higher when the fixed rates are flat.

Logically it shouldn’t be this way but it is. The floating rates seem just an excuse to milk home owners who want flexibility to pay down their debt faster.

Imagine being recently conned into a million dollar mortgage for a lousy terrace in one of Auckland's future slums.

Mortgage rates hit 6% (it's coming) and suddenly you find that you and the missus are paying $1150 a week in interest dead money to the bank, then principal repayments as the cherry on top.

Then imagine you can't even re-sell it without realising heavy capital losses because the easy credit and supply of fools has dried up and the market is now flooded with the same cookie cutter boxes that failing developers are desperately trying to offload.

Your social media is saturated with all the great times your mates who buggered off overseas are having with their better jobs, cheaper housing and exotic vacations.

Then one of you loses your job or gets knocked up.

Fun times ahead.

Be Quick!

Nobody "Just gets knocked up" its called planning Brock and life now requires you to think ahead. Cannot afford to have kids ? don't have any kids its that simple. Interest is not dead money, rent is dead money. With one option you end up with nothing and the other you end up with an asset that has tripled in value, if you cannot tell which is which you need financial help.

If only real life was that simple..

"Cannot afford to have kids ? don't have any kids its that simple".

"Just keep looking the other way while we spike property prices by double-digits year-on-year, you focus on dead-ending the country's demographics through increasingly constrained and curtailed reproductive choices".

Frankly this sort of attitude and comment should be considered on the same level as promoting eugenics. It's either insane or just a really crappy troll. Either way, it drags the tone of debate down here hugely and Carlos has form for it.

Planning ahead is impossible with out of control central bankers.

Hi Carlos69,

I hate to break it to you but both rent money and interest money are as dead as your lineage if you fail to raise a family. But I am heartened to hear that nobody down in ten dollar Tauranga has ever accidently fallen pregnant.

If you believe fairy tales about assets magically tripling in value in perpetuity and have never heard of opportunity cost I suggest that you may want seek financial help.

But values of 3 bed detached weatherboards seem to keep going up according to Homes.

Mines up another 40k again. 1.28M and that is from a 920k purchase in Dec 2020.

All Homes.co.nz shows is what local agents want the house to sell for.

Nah it’s ballpark algorithmic figure based on recent sales so should go down just as easily if there are price falls.

Homes.co.nz is like p0rnhub for home owners.

Delivers hits of dopamine though displaying a fantasy to the user.

Mentioning your viewings is usually avoided in polite company.

"But I am heartened to hear that nobody down in ten dollar Tauranga has ever accidently fallen pregnant."

Lol. Gold.

Why would you want an asset that has recently tripled in value? Just means it's less likely to increase in value in future, unless the laws of finance and physics have perminently been suspended.

My wife 'just got knocked up', while on contraceptives. So, planning doesn't necessarily mean no more sex trophies.

were you taking them or her?

Her. And additionally to the GP prescribed birth control medication, we had the layer of protection that the demands of the first two children brings. But a happy change in plans!

Congratulations to you both. Happy accidents are the best accidents of all!

And I think that went over my head at the time... she's been accused for sure!

Congratulations!

Thanks Brock!

Sign of a Well balanced society, something to be proud of.

Take away migration and we are a declining population. Things are getting so shite for our 20 somethings that people are actively choosing not to reproduce. Or moving away.

I'm being somewhat cynical of Course. I'm personally proud to be part of team 5 mil. Just about to reinvest some rental returns now...

So an entire generation should not have kids just because a bunch of boomers bid house prices into the stratosphere? (while also driving their new gas guzzlers and trashing the planet as much as possible too).

BTW I own one house which is now "worth" a crazy amount of money and am not a millennial or a boomer, but that doesn't mean I think its right.

Actually I see mostly millennials driving the gas guzzling ford rangers and the like, certainly not boomers

Have you seen the price of vehicles from the 1960s and the fuel efficiency of them... what a laugh your statement is and how easy to disprove as the purchases of vehicles by each generation is mostly lower cost (when inflation & maintenance is considered), more modern vehicles than the last generation. This is because time and product development does not stop for everyone just because you think it should. Next you will be complaining the younger generation are not posting letters anymore and they are using mobile phones in their daily lives & say they need them for their work; meanwhile banks and post offices have closed most branches and branch access.

It's not all boomers fault Jimbo, I know a guy who is 30 and started buying houses as a teenager. He now has 10. There is something in the NZ psyche that promotes house buying as a investment choice. I think it has become more prevalent in recent times.

Sadly the washout from previous housing peaks has not been kind to the bold..

Interest is rent on money, and equally dead.

Even worse if its a renter as no tax deduction for interest. Probably making a loss and still paying tax, that's gotta hurt.

Brock,

I haven't had a loan of any sort for almost 25 years and have a fair amount in TDs, so rising interest rates hold no fears for me. Bring them on. However, i tend to agree with Capital Economics-an international research consultancy- that the RB will end its hiking cycle earlier than financial markets anticipate. Indeed, they see the RB actually cutting rates in 2023.

I think there are growing economic storm clouds on the not so distant horizon. I think we will see this reflected in financial markets which is why i have much more cash than I need. I have gradually reduced my stockmarket exposure from over 60% of the total portfolio to 50% and I will probably go lower still.

Of course, I may be quite wrong.

I doubt you are wrong but a share portfolio of 20% of your assets may be a better bet as bear signals abound awaiting a trigger.

I believe that his taper tantrum will make all previous look miniscule. The FED will not have the option of cutting rates to restore normality as inflation is now a political priority. The FED are indicating March as the start but I think it may be sooner. This is why I have stepped out of the stock market for now.

The size of US debt is such that any rise in interest rates would be impossible to service.

I say the Fed is trying to talk down inflation - they are out of options.

I don't think you're wrong. The only question is whether to minimise the risk now or ride it out. We've opted for the latter but I'm getting colder feet every week.

The fear mongering from you lot is getting really tiresome.

They are still 'low' in an historical context, but another +2% coming in the next year or two will put them back to the 6% range and more 'normal' from a longer term perspective.

$1150 pw in interest payments @ 6% on a $1,000,000 mortgage isn't fearmongering. It's just good old-fashioned maths.

"lousy terrace in one of Auckland's future slums."

"Then imagine you can't even re-sell it without realising heavy capital losses because the easy credit and supply of fools has dried up and the market is now flooded with the same cookie cutter boxes that failing developers are desperately trying to offload."

"a very deep hole has been dug."

"Genuine investors went extinct a long time ago."

"Anyone getting in now is gambling"

"Start of the house price correction, possibly crash."

Fear mongering. Tiresome.

Imagine coming to a financial website and moaning that people are discussing risk.

Imagine coming to a financial website and posting the same fear mongering for months on end.

The same risks have been apparent for months.

When getting nervous about dark clouds on the horizon you don't need a safe space, you need to reduce your exposure.

Be quick!

Panic everyone, sell all your assets and buy Bitcoin.

The astute investor should be holding at least 3-5% of their portfolio in crypto-assets.

It's a far less crazy proposition than being leveraged 80% or 90% into the tail-end of a property bubble.

Brock you left out "one family member dies of Covid" how could you possibly forget that one! One penalty point for you

One family member loses their employment due to Covid restrictions is the vastly more probable scenario.

The astute investor should be holding at least 3-5% of their portfolio in crypto-assets

Bill Miller has 50% of his personal wealth in Bitcoin. If you're not aware of Bill Miller, he's an investor with a legendary track record and a billionaire.

I'm not recommending people try to be like Bill.

https://finance.yahoo.com/news/billionaire-investor-bill-miller-now-182…

https://twitter.com/LudiMagistR/status/1481706255307751429?s=20

https://twitter.com/invest_answers/status/1482021712606629890?s=20

If you don't have anything up to 6% of your portfolio in Bitcoin, you are literally failing maths and investing.

To be fair 6% is pretty low and the reason why it is only 6% is you can afford to lose the lot. Pretty happy to keep my investment in Bitcoin at 0%. The only possible investing mistake I have made is perhaps not pouring more money into a bigger and more expensive house, the gains have been epic.

To be fair, many people have been pointing out the one way street that is QE for years.

Lol. Take a Drive through flat Bush. Papakura etc. Even 10 years old a lot of near new high density housing stock is starting to look real ratty. Plenty of on the cheap townhouses popping up anywhere a mixed residencial site is available. And most of these buildings will not be standing in 100 years time.

100% we are creating squalor. These new zoning laws upcoming will just make it worse.

But accurate.

There’s the door chief…. Don’t let it hit you on the way out

*yawn*

Yes, all those scared people petrified that they will be able to afford a house soon?

If house prices fall as much as you guys are hoping they will then you may have the deposit to buy a house, but the resulting greatest depression the world has ever seen will mean you have no jobs to service it.

Plenty of jobs are fairly recession proof. Medical, IT, Food, Transport, Education and many more especially Govt funded. Those around speculative assets and trading in them etc...I agree probably not so much. 1987 was a good example of this with the fallout lasting well into the mid 90s.

So say those that might be affected to the downside.

In reality nothing 'real' has changed - same people, same resources, same house, same everything. Its only those little screen digits that have moved.

The fear of the banksters + is the change in direction of wealth flow.

No necessarily. A 40% reduction would only affect people who bought in the last 3 years. And only then if you are leveraged.

Employment remains high and banks in nz are well regulated.

Life will go on.

Unless we run out of energy sources in which case we are buggered.

Some chance is better than the current no chance. Bring it on.

If you wanted to increase your personal chances of home ownership, waiting for the government or some great reset aren't great strategies.

I agree. If it’s not the housing market it’s the stock market. Everything is D&G. It’s not healthy to be so perpetually negative.

Alternatively, imagine being in a position where you could have bought a place 3 years ago but sat on the sidelines convinced prices were going to fall and are now locked out of the market forever.

Imagining the housing bubble inflating for further three years is quite a stretch of the imagination given the headwinds.

Forever is an awfully long time for nothing to improve.

I think we all thought that 3 years ago! But yes I don't see house prices going up if interest rates continue to do so, in fact I see a large fall on the horizon too.

We are overdue some sort of correction, though it won't be anything like the numbers mentioned. There is a non-trivial chance they continue to rise as well, but on balance I see 5% to 10% fall over 2 years.

"though it won't be anything like the numbers mentioned" - is that because the "experts" in the media aren't picking it?

House prices went up massively due to low interest rates and lack of supply, so why shouldn't we expect the opposite with higher interest rates and increased supply?

Yeah, although price changes tend to be 'stickier' on the way down.

Honestly I would not be surprised by any scenario at this point.

This economy needs cheap money. If money gets too expensive, the wheels will fall of for sure. I wouldn't expect rates to get much higher, unless the government is keen for the great reset.

The economy needs general price stability. This is enshrined into law in the Reserve Bank of New Zealand Act 1989. The reserve bank is required, by law, to take all actions necessary to control general price inflation.

The wheels "falling off" is simply the desired cooling of the economy. Adrian Orr has stated as bluntly as he can, several times, that asset prices are not in his mandate.

Looking forward to the total collapse in discretionary spend that would follow a house price walkback somehow not threatening financial stability.

Inflation is a far greater threat to financial stability than the paper wealth of homeowners.

It's not the only threat though. People have target fixation issues when it comes inflation, when it's quite likely people will simply spend less. The cascade effect of already-suffering businesses (think hospo, events) would mean even even less spending.

We are primed for a high cost, low wage, high price, low spend economy, and that feedback loop will be very very difficult to get ourselves out of.

This from decades of fake prosperity that's been more of living off the wealth of preceding and succeeding generations.

In other words, a very deep hole has been dug.

Inflation caused by panicked money printing and supply chain issues from the incarceration of workers is not real. If you respond to it by normal measures, you won't get price stability. You will get a big crash!

Look forward to the "look through" statements being rocked out again. More difficult to get away with it now, though.

The Fed was expected to rise 3 times this year, then 4, then X.....

If the FED rises 1, NZ rises 1.5.

If I had an investment property today, it would be for sale tomorrow.

https://www.cnbc.com/2022/01/10/goldman-predicts-the-fed-while-hike-rat…

And that's why you don't own an investment property. Yes just wait until the Fed starts cranking rates, the floodgates will open on banks raising rates worldwide.

Rising headwinds on holding debt and not just in NZ are building fast. The US and China have announced rate increases, and more normal lending standard to try and control roaring inflation. Both have their own significant bubbles to deal with as well.

Not wanting to sound DGM but the whole thing appears not unlike a giant game of Jenga. That said, high equity entites that still have a decent grip on the word "yield" and steady incomes will not be feeling stress. If anything they will be happy that the speculative malinvestment models of the last ten years may finally be approaching a margin call.

Will be interesting to see what transpires in the next 12 months and if there is a tipping point what it will be.

But in turn, that will be $800 mln that will not be spent in the wider economy

All groups are forecasting that the increases to interest rates will serve to slow down or revert house price rises a little, which I think nicely negates some of that $800 mln lost impetus.

Guessing at some of the numbers involved, if the average house price were to rise another $100,000 this year, that is $20,000 more deposit required by all FHB (every year). If we imagine 10,000 households saving to become FHB then that is $200 mln they are unable to spend in the wider economy (spent only into the black hole of RE and property speculators).

That will be $800 mln that will not be spent in the wider economy. Although annual retail sales exceed $107 bln, taking 0.75% off the top of that will be noticed.

I also thought higher interest rates would make a significant dent into discretionary spending but $800 million is only 0.7% of $107 billion. So you're saying that a 0.75% rise in the OCR reduces retail spending by less than 1%, that seems a very low reduction and I doubt that "That will be noticed" very much at all.

Banks test rate (6 or 7% or whatever) is still way above current interest rates. It seems wildly speculative to talk about borrowers struggling to make mortgage payments at what are historically very low rates. RBNZ have huge scope to start to get a grip on inflation now without any real risk of negative consequences.

The biggest risk now is that they lose control if, in the couple of months it'll take us to get through Omicron, there is a cost-push factor as business have staff off with flu. We're heading into this from an already elevated level of inflation that must not be allowed to surge further.

The risk is far less about existing mortgage holders struggling with much higher mortgage rates, and far more about killing demand for both existing and new housing moving forward.

Having said that, while many mortgage holders will cope ok, it's likely to put a dent in discretionary spending. The strength of hospo, retail and tourism is already fragile...

I dont have a mortgage BUT STILL get peanuts in the bank..............

Yeah so do I but once you have paid off that mortgage and have a decent amount in the bank you simply don't care about returns. A few hundred bucks gets thrown into your account every month and its a nice surprise. Rates are on the rise and if they ever get back to the historic average, then sure it would be nice for savers who have toiled away to get there.

I knew mortgage rates were going to rise last year, but the bank wouldn't let me refix the rate until 60 days before the current fixed rate finished, which is end of January, meaning I missed the opportunity for a lower rate and had to settle for a 4.99%, discounted at my request to 4.89%, fixed for 5 years.

I chose a 5 year rate, as the variation between the 1 year and 5 year is only 1.34%, the RB is indicating increases to the OCR, and the main banks bumped their rates very quickly after the last increase in November, so I suspect 1 year rates to be > 4% pretty soon, and > 5% by years end.

If not, it doesn't really matter, as a fixed rate just gives me certainty with repayments over the floating rate.

Yup it's that certainty. Personally I'd rather be fixed long and see rates drop slightly than be fixed short and come out with rates higher.

It's the difference between missing out on extra money that you weren't seeing anyway and forgoing extra money you originally had budgeted elsewhere.

Couldn't you of broken the rate early and refixed?

I could have but I was on 2.09% fixed at the time and the break fees would have sucked up the savings I had made over the year, and probably over the next couple of years since the rate I would have got was only 20 bps lower. Plus, it's a pain going through that process when the banks only want to do business via scheduled phone calls nowadays.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.