By Daniel Hynes and Soni Kumari*

Highlights

• Aggressive monetary policy tightening and a stronger US dollar will keep gold prices under pressure.

• Increasing recession fearsin developed markets and geopolitical risk could provide support to gold’s haven demand.

• Technically, price action is bearish. Downside support level sits at USD1,675/oz. If this level breaks, prices could fall toUSD1,600/oz.

Outlook

High inflation is still the Fed’s main concern. Expectations of 75bp or even 100 bp hikes at coming meetings suggest the gold price will remain under pressure.

Europe’s energy crisis is raising downside risks for growth. If worst case fears over supplies of gas from Russia eventuate, the risk of gold moving sharply below parity with the US dollar cannot be ruled out. The European Central Bank’s hesitant approach to monetary normalisation is adding further support to the US dollar and exacerbating short term risks.

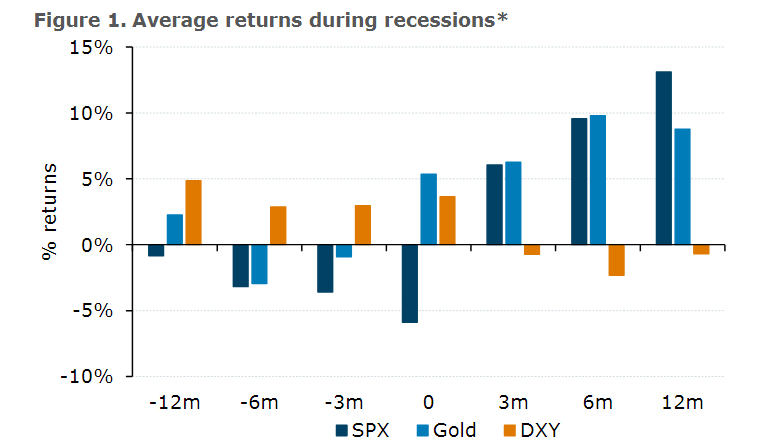

Investment demand for gold is weakening. Following an initial liquidation of long positions in April, fresh short positions are building and pushing net long positioning to a three-year low. Exchange traded funds outflows have also continued, as the gold price has fallen. But we see investment demand improving as recession risks gain attention. Historically, gold prices have fallen in the three to six months prior to a recession, and that downtrend reverses during and after the recession.

Figure 1. Average returns during recessions

Source: Bloomberg, ANZ Research

*Calculated during recessions in 1980, 1981,1990, 2001, 2007, 2020.

Q&A

What are key drivers for gold prices?

A strong US dollar and expectations of aggressive rate hikes are currently driving gold prices.US inflation hita41-year high of 9.1% in June, but gold’s status as a hedge against inflation was not enough to offset concerns of faster monetary tightening by central banks. If the Fed raises rates by 75bp in the next two meetings, interest rates would rise to 2.25% by the end of July and 3% by end of September. Such a steep trajectory will be bearish for gold prices. This bearishness could be offset by the weakening economic outlook. The inversion of the 2s/10syield curve has deepened, which would usually indicate an impending recession. Rising geopolitical risks and an equity market sell-off could also provide support. The US dollar is also likely to lose steam towards the end of the year, providing some tailwind for gold. We expect the gold price to find a floor near USD1,700/oz.

Is gold losing its haven appeal?

Gold’s performance should not be a surprise, given its history. Normally, 3mthand 6mthreturns prior to a recession are negative, but weak equity markets don’t guarantee support for gold. Sometimes they move together. In the 2008financial crisis investors liquidated gold positions to meet margin calls. Having said that, gold maintains its status as a risk diversifier. Prior to and during recessions, gold has tended to outperform equities. So far this year, the S&P has fallen by 17%,but gold by only 5%.

What are financial positions suggesting for the gold price?

Investment demand is lacklustre. Investors have liquidated long positions by 27% to 833t since March. Short positions doubled to 379t in Q2 but are well below the 670t of 2018. Overall, net-long positions have fallen by 348t since April to a three-year low. Although positioning looks bearish, there is scope for this to continue if macro headwinds stay strong or worsen. Still, ETF holdings are high and thus vulnerable to long liquidation if the Fed hikes by more than 75bp in its July meeting. If inflation expectations subside, as we expect, and central banks become less hawkish, the US dollar could weaken. This would ultimately revive investment demand for gold.

What will be the impact of bans on Russian gold?

G7 countries have banned imports of Russian gold. Gold is different from other commodities as the annual supply is negligible compared to total available reserves, so there is likely to be limited impact on supply. This ban will not have any significant impact on Russian gold mine production, as miners will have no trouble finding buyers outside the G7. It’s also likely the Russian central bank will buy from domestic miners to add to its reserves.

What could cushion weakening physical demand?

We expect to see central bank buying off-set some of the weakness in demand for physical gold in India and China. Currency devaluation against the US dollar could prompt this. Central banks added 35t in May, the second consecutive month of buying. Year-to-date, Turkey has been the largest purchaser, followed by Egypt at 44t and Iraq at 34t. Other banks including India, Kazakhstan and Uzbekistan have also added to their reserves, and they see long-term value in the precious metal.

Technical

Under pressure

The economic backdrop has triggered a heavy sell-off of gold. Trendline support of USD1,760/oz was broken, with prices hitting an11-month low recently. Market sentiment is growing bearish as the price heads towards USD1,675/oz. We expect it to hold this support level, if not it could fall to theUSD1,600/oz zone. A Fibonacci retracement from the September 2018 low to this year’s high suggests the next support levels are USD1,614/oz and USD1,500/oz. There is no sign of reversal of trend now, while immediate resistance could be seen at USD1,744/oz. The downtrend looks intact until prices break above USD1,800/oz.

Figure 2.Gold daily technical chart

Source: Bloomberg,ANZ Research

Daniel Hynes and Soni Kumari are commodity strategists at ANZ. This article is a re-post from ANZ and is here with permission.

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

Precious metals

Select chart tabs

2 Comments

Does anyone have a gold bar or coin stashed in their homes, not me. NZ banks seem to be healthy, my savings are in good hands. If the NZ currency is declining, its another scene.

One can trade in gold and crypto, via derivatives these days. Its like any other commodity, oil etc.

I do. When I bought them there was a large range of bullion to choose from, at a fair exchange. Spot price is always assumed to be the cost you pay for and it is freely available. Try buying a wide assortment now versus November 2014. Producers will stop making it due to high energy prices and exploitation by traders with "paper gold" derivatives as you allude to. If you don't possess it, you don't really own it. Too many people believe that THIS TIME IS DIFFERENT. It is a good store of wealth and is an assurance versus your Fiat currency which Voltaire described as something that will return to its inherent value, nothing. Crypto is fine as a divestment (I hold some too), but it is hardly tangible and in your hands/something you can see.

Look up Exter's Pyramid.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.