precious metals

Demand volumes for gold and the gold price both smash records

31st Jan 26, 5:04pm

Demand volumes for gold and the gold price both smash records

The World Gold Council sees the sharp rises in precious metal prices as quite divergent. Silver and platinum are responding to short supply, while gold to risk. Gold may be more resilient in the long term as politics skews the economic cycle

10th Jan 26, 3:36pm

2

The World Gold Council sees the sharp rises in precious metal prices as quite divergent. Silver and platinum are responding to short supply, while gold to risk. Gold may be more resilient in the long term as politics skews the economic cycle

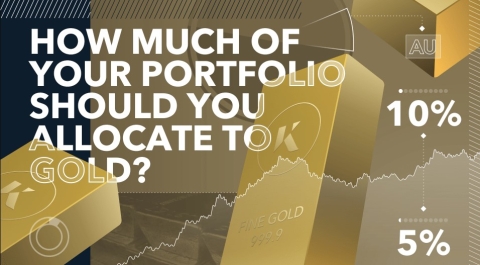

Gold's volatility rose in 2025 but from a low base, back to normal levels. Despite the rise, adding gold to a diversified portfolio continues to help reduce overall risk

22nd Dec 25, 1:33pm

12

Gold's volatility rose in 2025 but from a low base, back to normal levels. Despite the rise, adding gold to a diversified portfolio continues to help reduce overall risk

Gold’s outlook for 2026 is being defined by the uncertain economic environment that investors currently face. And, just like 2025, the upcoming year may bring significant volatility across financial markets

6th Dec 25, 10:21am

Gold’s outlook for 2026 is being defined by the uncertain economic environment that investors currently face. And, just like 2025, the upcoming year may bring significant volatility across financial markets

Jim O'Neill consider both the bullish and bearish case for the yellow metal and markets carry it to record highs

10th Nov 25, 11:12am

4

Jim O'Neill consider both the bullish and bearish case for the yellow metal and markets carry it to record highs

The World Gold Council says a momentum flush out and stronger US dollar contributed to a see-saw for gold from its 50th all-time high. But gold still managed good gains in October

8th Nov 25, 9:16am

1

The World Gold Council says a momentum flush out and stronger US dollar contributed to a see-saw for gold from its 50th all-time high. But gold still managed good gains in October

A gold analyst says a portfolio that includes gold adds resiliency, and the diversification benefits remain as relevant as ever amid raging political & economic crosscurrents

26th Oct 25, 10:52am

A gold analyst says a portfolio that includes gold adds resiliency, and the diversification benefits remain as relevant as ever amid raging political & economic crosscurrents

The World Gold Council says gold will hold its ground and perhaps see further uplift should equities experience a correction, given the plethora of supportive factors elsewhere. But a major liquidity squeeze could upend both gold and equities

12th Oct 25, 12:01pm

3

The World Gold Council says gold will hold its ground and perhaps see further uplift should equities experience a correction, given the plethora of supportive factors elsewhere. But a major liquidity squeeze could upend both gold and equities

Gold rallied into month-end on a US dollar reversal, geopolitical tensions, while US stagflationary forces and the prospect of lower rates, alongside policy risk, could dominate pricing

6th Sep 25, 9:30am

1

Gold rallied into month-end on a US dollar reversal, geopolitical tensions, while US stagflationary forces and the prospect of lower rates, alongside policy risk, could dominate pricing

Jennifer Johnson-Calari says that over history, the world has adopted the currency of the leading country for global payments. The USD is, arguably, the first global currency untethered from precious metals

23rd Aug 25, 3:53pm

2

Jennifer Johnson-Calari says that over history, the world has adopted the currency of the leading country for global payments. The USD is, arguably, the first global currency untethered from precious metals

The World Gold Council looks at the likely trajectory for the gold price in multiple scenarios; BAU, stagflation, rising geopolitical tensions, or conflict resolution

19th Jul 25, 9:15am

1

The World Gold Council looks at the likely trajectory for the gold price in multiple scenarios; BAU, stagflation, rising geopolitical tensions, or conflict resolution

A gold analyst says ongoing fiscal concerns will likely lead to bond market volatility, ultimately supporting the gold market as investors look for alternative safe-haven assets

29th Jun 25, 12:46pm

A gold analyst says ongoing fiscal concerns will likely lead to bond market volatility, ultimately supporting the gold market as investors look for alternative safe-haven assets

A gold analyst suggests when the bond-equity correlation flips from negative to positive, a larger allocation to gold is required to retain the initial level of portfolio risk

25th May 25, 9:30am

1

A gold analyst suggests when the bond-equity correlation flips from negative to positive, a larger allocation to gold is required to retain the initial level of portfolio risk

When sentiment slumps and bond vigilantes return, is the only way for gold 'up'? especially when equity valuations seem unreasonably high

17th May 25, 2:17pm

When sentiment slumps and bond vigilantes return, is the only way for gold 'up'? especially when equity valuations seem unreasonably high

A significantly weaker US dollar and overall heightened risk pushed gold higher during April. US policy and structural risks will drive gold investment. Profit taking could bring pause but may also encourage consumers

10th May 25, 8:31am

A significantly weaker US dollar and overall heightened risk pushed gold higher during April. US policy and structural risks will drive gold investment. Profit taking could bring pause but may also encourage consumers