The last two and a half years have been a wild ride for investors. Markets in everything from equities and bonds to residential property and cryptocurrencies have been volatile and unpredictable.

The reasons are obvious – a global pandemic, a dramatic rise in interest rates and inflation, and the bloodiest conflict in Europe since the Second World War.

For many Australians, shares constitute a major component of their investment portfolio. According to the most recent Australian Investor Study, undertaken by the Australian Securities Exchange (ASX) in 2020, more than six and a half million Australians hold listed investments directly.

The ASX is a significant securities exchange with an equity market capitalisation of around $2.5 trillion. 2,000 domestic companies are listed on the ASX and 160 foreign companies. The most recent financial year ended 30 June 2022 saw 217 new listings, the highest number since 2008, including 19 foreign listings – seven from the US, five from Canada, and four from New Zealand. The quoted market capitalisation of new listings was $59 billion, a record for the ASX.

But how did investors in the Australian share market fare in the year to 30 June 2022? Depends what you compare it with.

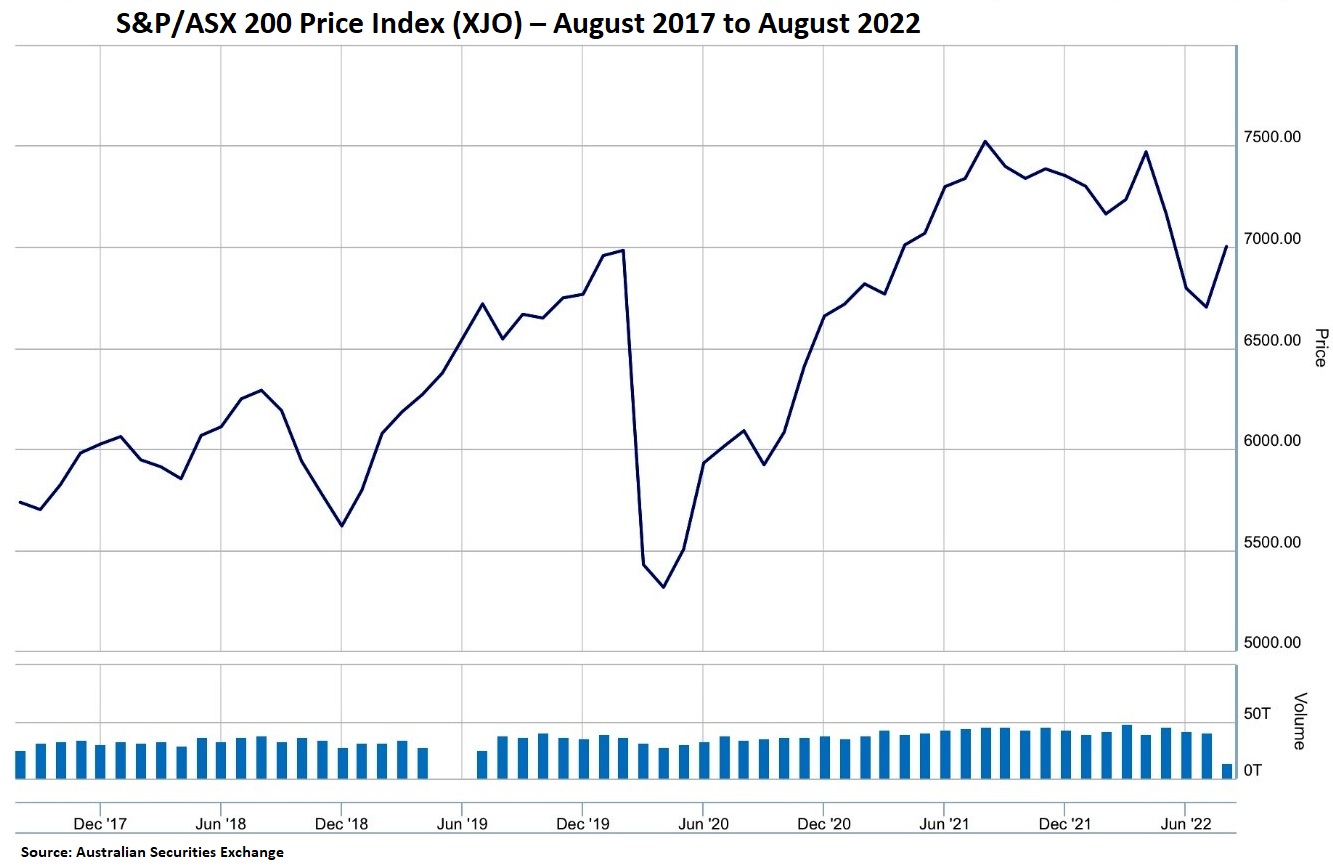

The S&P/ASX 200 is a market-capitalisation weighted index based on the 200 largest stocks listed on the ASX. In the June year, it dropped 10.2%. That equates to a negative return of about 6% after accounting for dividends received.

That’s an ugly outcome, although better than the performance of many foreign equity markets. In the same period, the S&P 500 index in the US was down about 12% and it carries a dividend yield less than half that of the ASX 200. (Of course, to international investors currency movements also matter. The Australian dollar fell about 5% against the greenback in the relevant period.)

Usually when equity markets fall, they are outperformed by the more stable bond markets. However, there has been nothing ‘usual’ about markets in recent times. In the latest financial year, Australian bonds returned a dire -10.5%. International bonds were not much better producing a return of -9.3%.

The performance of commercial property is more difficult to assess. The best proxy, listed property stocks, returned -11.2% in Australia and -10.5% globally in the year to 30 June.

By comparison, Australian residential property was a star performer. Most areas of Australia experienced an increase in house prices, often a dramatic increase.

For many Australians, their largest investment (outside their home) is superannuation. That reflects the country’s compulsory superannuation system. Collectively, Australians now hold more than $3.5 trillion in superannuation funds.

It appears that most Australian superannuation funds significantly outperformed the equity markets in the latest financial year. According to SuperGuide, the median result for ‘conservative’ funds was -2.2%, for ‘balanced’ funds -2.6%, and for ‘growth’ funds -3.3%.

These relatively modest losses may seem surprising given that Australia’s superannuation funds invest in the same equity, bond, and commercial property markets that suffered double digit losses. The explanation is that superannuation funds also invest in other asset classes such as infrastructure, credit, and private equity, and that those asset classes performed better in the period to June 2022. A part of the explanation may also be that some of those asset classes are not exposed to the rigours of continuous valuation by listed markets.

Fortunately, the Australian and global share markets have experienced a substantial bounce in the six weeks since the end of the financial year. The ASX 200 has now (as at the time of writing) recovered over 7% and currently sits just 5% below its all-time peak recorded this time last year.

At the current level, the market is almost exactly where it was back in February 2020, immediately before the arrival of Covid-19 triggered a 20% crash.

The trillion-dollar question is where to from here. The answer will be determined by a combination of domestic and international factors.

The ASX 200 is dominated by banks and mining companies. The former benefit from the current environment of rising interest rates but they are also exposed to greater borrowers defaults if economic conditions deteriorate too much. This week CBA, Australia’s largest bank, announced a full-year profit of $9.6 billion, up 11% on the previous year. CEO Matt Comyn acknowledged the risks to the economy but said that he expects Australia to avoid recession.

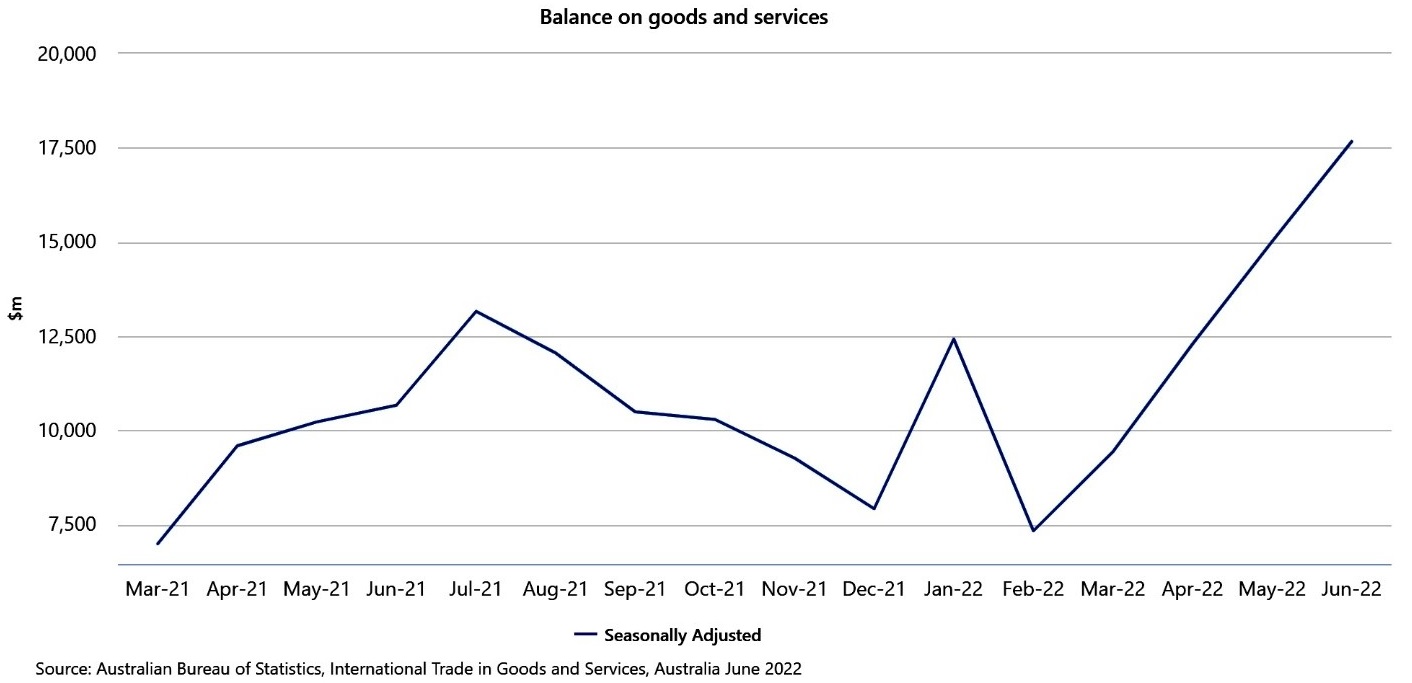

That view is consistent with the recent drop in unemployment to a fifty-year low and the return of large-scale immigration post-Covid. As a major exporter of food, energy, and resources, Australia also continues to profit from the ongoing conflict in Ukraine. June saw another massive trade surplus.

Australia’s mining companies are big winners from this development. They also benefit from the view that resources offer a hedge against inflation. However, they are exposed to any further deterioration in the international economy and particularly to a slowdown in China.

Takeover activity will continue to provide support for Australian shares. Global investment company Blackstone recently completed a $9 billion takeover of Australian casino company Crown Resorts. KKR, another global investment giant, is currently undertaking a $30 billion takeover of Australian-based international healthcare operator Ramsay Health Care. Last week BHP launched a $8.4 billion bid for fellow Aussie miner Oz Minerals.

Of course, none of this will matter if the US share market falls over. And there is no shortage of ‘bears’ predicting precisely that outcome. A return to the market pessimism that saw the S&P 500 drop more than 20% in the first half of 2022 would quickly flow throw to Australian equities.

The primary threat is further interest rate rises by the Federal Reserve to bring inflation under control. There appears to be a glimmer of hope in that regard with the latest figures suggesting that US inflation may already have peaked.

But if the last few years have taught us anything, it is to expect the unexpected. The next Covid-19 or Ukraine invasion could be just around the corner.

Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

2 Comments

Australia differs from NZ in that it actively develops its natural resources. It is lucky that it has the space to do so, outside the main population groupings, which is what we suffer from here in NZ to a degree, a lack of space. Australia's mindset also differs from NZers in that they see their natural resources as exactly that, their natural resources whilst in NZ we see our natural resources as potential pollutants, if we see them at all.

Most nations that have any sort of wealth use their natural resources. If they don't, others will use them for them, whether that nation benefits or not. The rich will just buy them while the poorer nations cannot usually refuse the big sums of money offered.

The issue we face in NZ & in other developed nations, is that we are increasingly being taught that these natural resources should not be developed & should be left for future generations. To do what? You guessed it, to develop them of course.

So why shouldn't we use them? Because they pollute the Earth is often the answer.

But just around the corner are technologies that will capture the wastes of these developments, developing other products as they do so. Why aren't we jumping on this band wagon you ask? Well, we're trying to. These new products are being developed as we speak. If we could only develop our mindsets to keep up with these new developments (instead of being stuck in the past) then we will/could have a better future for all of us.

When we were created, we were given an abundance. It is ours by right. We also have created a blindness & a deafness that has not served us well in the past, nor will it tomorrow either. We might have another 1,000 years to go! We have to keep developing. Smarter of course.

Nice choice of words…develop… I’d call it ‘consume’.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.