Treasury has announced increases to the Kiwi Bond interest rates they offer. The previous increase was four months ago.

Kiwi Bonds effectively set the risk-free benchmark for New Zealand retail savers.

The new rates are:

| Maturity | Rate | change |

|---|---|---|

| 6 months | 5.25 percent per annum | +50 bps |

| 1 year | 5.50 percent per annum | +50 bps |

| 2 years | 5.00 percent per annum | +25 bps |

| 4 years | 4.75 percent per annum | +50 bps |

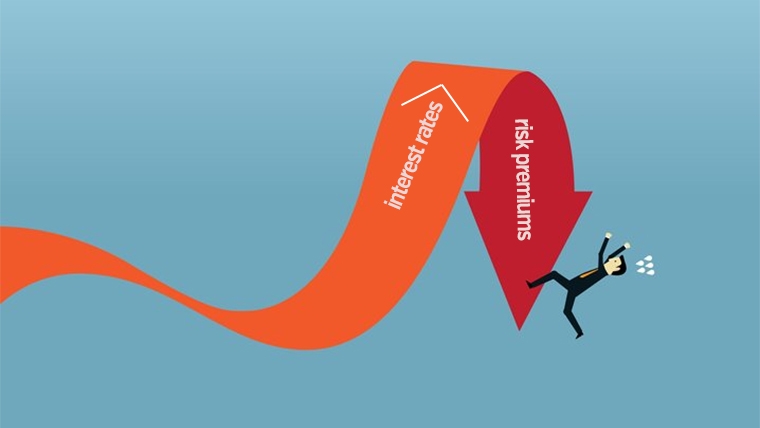

Rates offered by banks for their term deposit products are almost always higher than these, and that difference is the risk premium for holding your funds in a private bank.

After this latest rise in Kiwi Bond interest rates, the risk premium for holding money in a trading bank remains near the lowest we have seen it, especially for terms of one year and more. Here is a summary of the Kiwi Bond offer rates, compared to the average bank offer rates of all retail banks in New Zealand.

| Term | 6 mths | 1 yr | 2 yrs | 4 yrs |

| p.a. | % | % | % | % |

| Kiwi Bonds | ||||

| 31-Dec-18 | 2.25 | 2.25 | 2.25 | 2.50 |

| 31-Dec-19 | 1.00 | 1.00 | 1.00 | 1.00 |

| 31-Dec-20 | 0.10 | 0.10 | 0.20 | 0.20 |

| 31-Dec-21 | 0.70 | 1.10 | 1.50 | 1.90 |

| 2-Jun-22 | 2.00 | 2.50 | 3.00 | 3.25 |

| 28-Jun-22 | 3.00 | 3.25 | 3.50 | 3.50 |

| 8-Dec-22 | 3.75 | 4.25 | 4.25 | 4.25 |

| 27-Apr-23 | 4.75 | 5.00 | 4.75 | 4.25 |

| 28-Aug-23 | 5.25 | 5.50 | 5.00 | 4.75 |

| Bank averages | ||||

| 31-Dec-18 | 3.20 | 3.36 | 3.51 | 3.76 |

| 31-Dec-19 | 2.63 | 2.59 | 2.55 | 2.55 |

| 31-Dec-20 | 0.85 | 0.89 | 0.91 | 0.95 |

| 31-Dec-21 | 1.53 | 2.13 | 2.48 | 2.95 |

| 2-Jun-22 | 2.42 | 3.12 | 3.54 | 3.87 |

| 28-Jun-22 | 3.04 | 3.93 | 4.13 | 4.38 |

| 8-Dec-22 | 4.38 | 5.11 | 5.14 | 5.16 |

| 27-Apr-23 | 4.28 | 5.73 | 5.29 | 5.19 |

| 28-Aug-23 | 5.75 | 5.98 | 5.60 | 5.33 |

| Risk premium | ||||

| 31-Dec-18 | 0.95 | 1.11 | 1.26 | 1.26 |

| 31-Dec-19 | 1.63 | 1.59 | 1.55 | 1.55 |

| 31-Dec-20 | 0.75 | 0.79 | 0.71 | 0.75 |

| 31-Dec-20 | 0.83 | 1.03 | 0.98 | 1.05 |

| 2-Jun-22 | 0.42 | 0.62 | 0.54 | 0.62 |

| 28-Jun-22 | -0.04 | 0.68 | 0.63 | 0.88 |

| 8-Dec-22 | 0.63 | 0.86 | 0.89 | 0.91 |

| 27-Apr-23 | -0.47 | 0.73 | 0.54 | 0.94 |

| 28-Aug-23 | 0.50 | 0.48 | 0.60 | 0.58 |

At these new levels, the premium bank term deposits offer has been squeezed across most terms. They are now at their skinniest in at least five years.

The above table is only a summary at the points in time stated. The premiums will vary in between the dates listed above. Bank term deposit offers vary regularly based on a range of competitive, market demand and cost of funds issues. They don't depend on what Kiwi Bond rates are. But depositors should be aware of these and ask themselves whether the premium offered is enough for the risks involved.

When taxpayer-backed deposit insurance is effective in late 2024, risk premiums are likely to fall again. In fact, there may be no case for there to be any risk premium of bank term deposits when they are backed by the State.

11 Comments

I have a $100k TD maturing in 3 weeks, hopefully the major banks also read Interest.co.nz or it might be time to take up my first Govt Bond...

Hi David, the Kiwi Bond application form states its 5.50% for one Year not 5% :)

https://debtmanagement.treasury.govt.nz/sites/default/files/2023-08/app…

Thanks

At 5.25% for 6 months, kiwi bonds are looking mighty attractive compared to my Kiwibank 90 day notice saver account at 5.35%. With several 100k deposited, I think I would rather have more security.

Yes surely Kiwibank will have to lift their offer on the 90 day.

Only if they need the money ...

Yikes, it always suprises me poeple in your position don't have a chunky allocation to NZGBs. When kaka hits the fan, money in a retail bank is a risk.

All banks need to up their game urgently. IMO the only reason I have my money in shorter oncall type accounts, is so I can't remove it if things start to look bad. But with Kiwibonds I can afford to lock it in for longer. If banks don't act fast I will just put it in kiwibonds.

So these rates set by Treasury is just starting point ? The actual rates are determined by the market during it's auction. Isn't it?

No, these are Kiwi Bonds - a product offered by Treasury to retail investors. There is no auction, you just fill out the form and send them your money.

Oh.. cool. Thanks

So no secondary market concept to sell them and no value appreciation or depreciation for kiwibonds?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.