2024 will bring deposit insurance to New Zealand on a formal non-emergency basis. Most other Western countries have a scheme like this.

The arrival here has the possibility of some transition distortions. Banks will be charged a fee for the coverage, and when insured by the Government, those deposits covered become "risk-free" and are likely to offer lower interest rates (or where no interest is paid, new or sticky fees). Banks don't see themselves as charities and will find ways to pass on costs - just as they do in other jurisdictions who have similar coverage.

And we should all understand, this is not real insurance. No private insurer anywhere in the world will provide this coverage. This is a taxpayer benefit for savers. And savers tend to be well healed and politically connected. It is a middle-class welfare benefit. To mitigate the obvious moral hazard, a modest upper limit will be imposed applying to all balances at an institution.

One of the ways the Reserve Bank is preparing for this introduction is by providing increased transparency for banking system deposits and savings. They have released a series of new disclosures on a system-wide basis. The following explainer describes the new data and analysis. At this time, this transparency does not extend to their Dashboard resource (Key Bank Metrics). But it should. After all, taxpayers will be backing up banks with the "guarantee" and depositors should get this type of transparency by individual bank. In the meantime, here is the Stats Insight released Christmas Eve. We will be following subsequent developments in this data monthly.

The original is here.

STATS INSIGHT

Bank Deposits – November 2023

• Term deposit growth has been strong since the beginning of 2022, with just over half of all household deposits currently locked in on term deposits.

• Most household term deposits are due to reprice within a year, however there has been a growing proportion of deposits locked in on rates longer than 4 years.

• There are over 17 million deposit accounts held by registered banks in NZ, with 15.7 million of these held by resident or non-resident households.

• The average household transaction balance at end Nov-23 was $4,875, while the average savings and term deposit balance was $13,150 and $88,817 respectively.

Note that there are slight differences in the totals for on call (transaction & savings) & term deposits with the breakdown published in our S40 table. Also please note that deposits by size data only reflects deposits held in NZD. Please refer to our technical note for more information.

21 December 2023

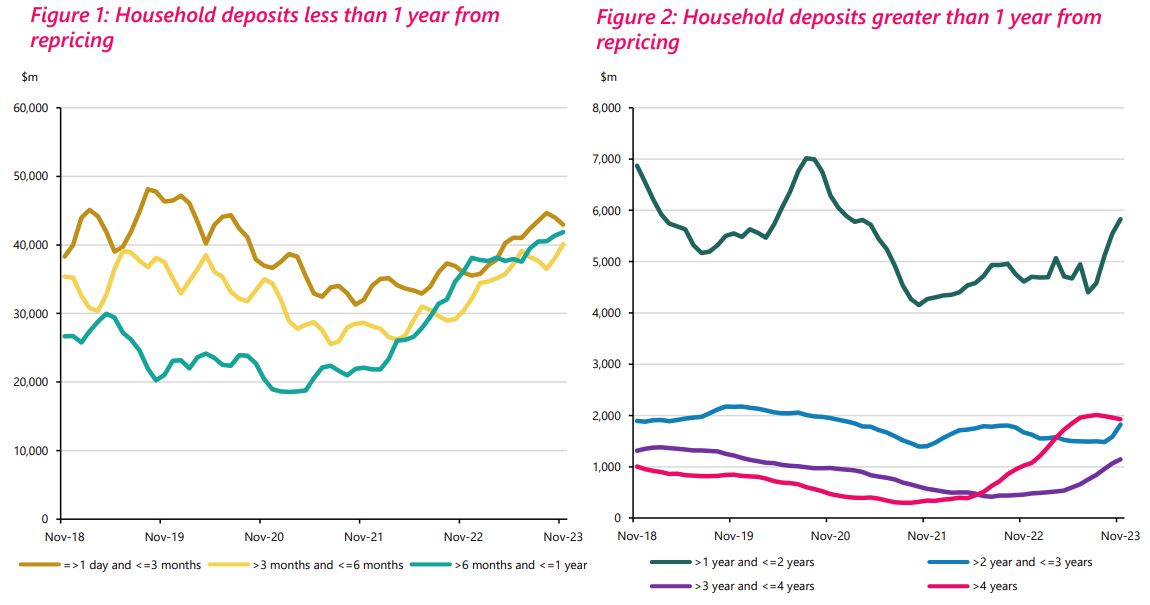

Deposits by repricing

As at end Nov-23, about 54% of all deposits held by registered banks were on call. For household deposits only, this proportion was about 48%, down from a peak of 62% at end 2021. Deposits have been shifting from on call into term deposits since the beginning of 2022, when interest rates began to rise from historic low levels. Household term deposits traditionally are set for less than a year, however there was a visible shift into longer term rates between mid 2022 and mid 2023. The level of deposits more than 4 years from repricing reached a historically high level of $2b in Aug-23, making up 0.8% of all household deposits.

Business deposits have seen a similar trend, with the >4 years term deposit bucket also reaching historically high levels in Sep-23, although only forming 0.2% of total business deposits. Business deposits largely remain on call, with 68% on call at end Nov-23. This is down from 78% on call at the beginning of 2022.

Deposits by size

As at end Nov-23, there were over 17 million deposit accounts held by registered banks in NZ. Of these accounts, approx. 15.7 million were from resident or non-resident households. Nearly half of these household accounts (7.4m) were transaction balances with a balance of less than $10,000. These balances equated to $7.8b, or about 3% of the total value of NZD household deposits.

There were 6m household savings accounts and 1.6m household term deposit accounts at end Nov-23. The number of term deposit accounts has risen 49% since the start of 2022, up from 1m.

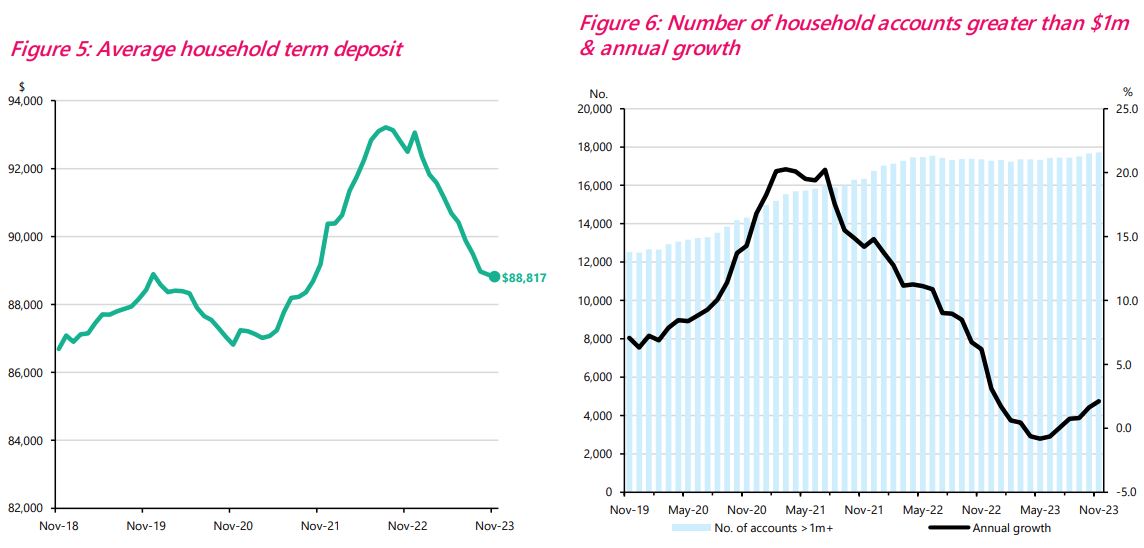

The average household transaction account balance was $4,875 at end Nov-23, which was down from a peak of $7,246 in Dec-21. Meanwhile the average savings and term deposit balances were $13,150 and $88,817 respectively. Most household term deposits are between $10,001 - $100,000 in size, but there has been strong growth in the number of term deposits less than $10,000 since the beginning of 2022, with growth in this bucket outpacing other bucket sizes. This reflects the number of balances less than $10,000 that sit in transaction and savings balances. This has also helped drive the average term deposit size down from a peak of $91,810.

The number of household deposit accounts with a balance greater than $1m across all deposit types saw strong growth post covid, with annual growth peaking at 20.3% in Mar-21. However annual growth has since fallen to 2.1% at end Nov-23. There are currently 17.7k accounts with a balance greater than $1m (note that this number does not represent the number of millionaires in New Zealand).

Depositor Compensation Scheme vs Deposits by size data

The implementation of the Deposit Takers Act 2023 introduces a new Depositor Compensation Scheme (DCS), which in the event of a deposit taker failure, will ensure depositors are eligible for compensation of up to $100,000 per depositor, per institution.

In our new S45 web table, we break down the total value of NZD deposits into three different deposit types (transaction, savings and term), and then by the total value of deposits which fit into bands based on the size of each deposit.

The total value of deposits covered under the scheme cannot be calculated from this table, as compensation under the scheme will be based on a single customer view as opposed to a single account view. The S46 web table displays the total number of accounts held by registered banks.

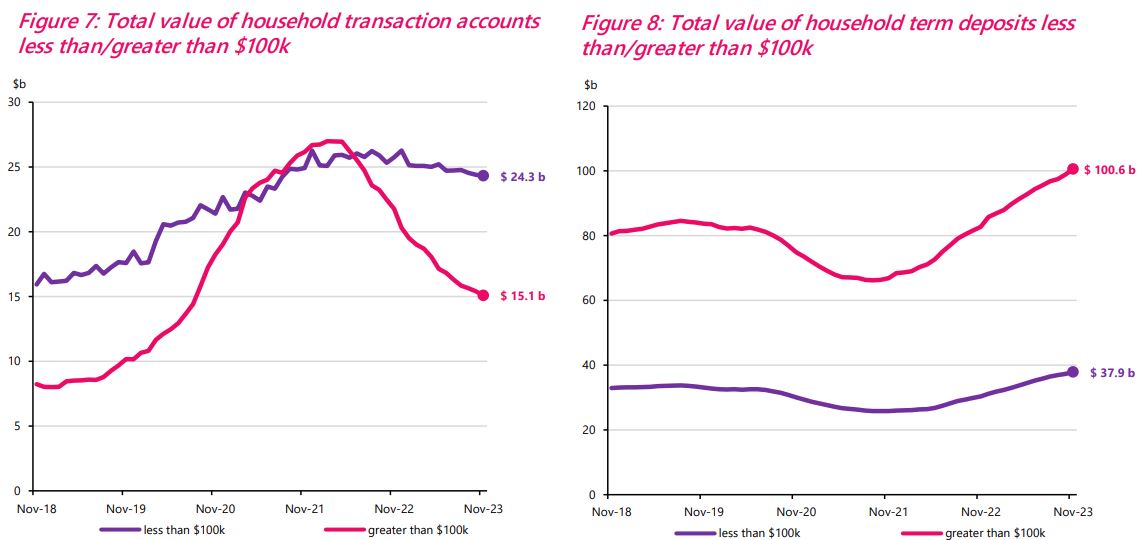

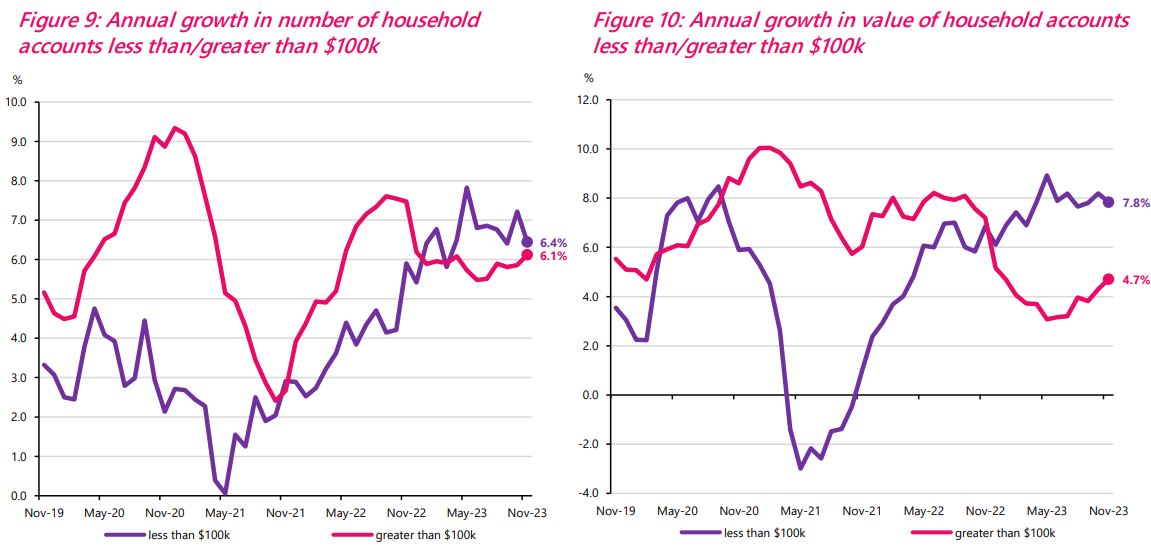

When looking at the value of household deposits less than/greater than $100k, we can see transaction balances greater than $100k have been declining sharply since Apr-22, after seeing strong growth between covid and this period. A lot of these balances likely shifted into term deposits, which have seen strong growth over this period.

Annual growth in both the total number and value of deposits greater than $100k started to decline at the beginning of 2023, however still remains quite strong.

About the Stats Insight

The data used in this insight is sourced from the Reserve Bank’s Bank Balance Sheet Survey. All New Zealand registered banks are included in the survey. Data is collected monthly and published on the last working day of every month.

Transaction balances include balances where the purpose of the account is primarily for making transactions or everyday banking by customers. Savings balances include balances where the purpose of the account is primarily for saving. For some balances disincentives may apply if used for transaction purposes; that is, a penalty may apply such as loss of bonus interest. Term deposits are customer time or term deposits with a maturity of greater than one day. Deposits on call include all deposits with balances which are either readily available to be withdrawn or can be withdrawn at short notice. All deposits not bearing interest are also grouped together with on call balances. Deposits on call does not equal the sum of transaction and savings balances due to some savings account products being reported as term deposits separately within the bank balance sheet return. Data on household deposits includes both resident and non-resident households. Deposits by size data includes NZD deposits only.

Deposits data is published in the following tables:

• S40 Banks: Liabilities – Deposits by sector

• S41 Banks: Liabilities – Deposits by industry

• S42 Banks: Liabilities – Deposits by repricing

• S45 Banks: Liabilities – Deposits by size (value)

• S46 Banks: Liabilities – Deposits by size (number)

For more information, please contact: stats-info@rbnz.govt.nz

44 Comments

With a measly $100k cap its unlikely to do anything to encourage people to bank outside of the Big 4. And the banks know that, so they can charge what they like in terms of insurance fees. Just another source of income for them.

That doesn't make sense to me. I would have thought that those with large amounts in bank deposits would choose multiple banks to get wider guarantee coverage. Potentially pushing the very well off into much more than the four biggest.

"Potentially pushing the very well off into much more than the four biggest."

During the GFC, there were many reports of depositors spreading their deposits among as many banks that were insured, to get their individual bank exposure below depositor guarantee thresholds. I heard one report of an individual who had deposits at 20 banks.

Those bank depositors with the biggest challenges are:

1) large companies with large transaction account balances that are required to meet large operating expenses - e.g payroll, purchases, rent, operating expenses. (Examples that come to mind in NZ - Air NZ, Fonterra, and other large publicly listed companies as well as large privately owned companies, trusts, and government entities such as Inland Revenue, WINZ, Kainga Ora, etc). This was a problem that came to light earlier in 2023 during the bank run on Silicon Valley Bank and tech companies that had large transaction account balances.

2) money market and other investment funds with large balances at banks - if there are concerns about counter party risk, investment funds are quick to pull out their funds due to their responsibilities to their clients.

All government spending is financed by the issuing of its own currency into the reserve accounts of the banks and which is retained within the central bank. The banks then create the deposits for the government departments to spend and as such any losses would be to the bank and not to the government. Taxation deletes both bank deposits and reserves again after payment and excess reserves can be retained as government bonds.

"All government spending is financed by the issuing of its own currency into the reserve accounts of the banks and which is retained within the central bank"

It differs among countries based on their laws.

1) Some countries have central banks that are independent of the central government.

2) Some do not.

One example of 2) above is Zimbabwe. The result is hyperinflation.

Our Reserve Bank belongs to our Treasury Department and is in no way independent except in the control of monetary policy and we are discussing NZ banking here anyway and which is what I am referring to. Zimbabwe had a loss of productive output when its farms were taken off the white farmers and it then became a net importer of food along with being a dictatorship and being without an efficient taxation system.

Just trying to understand your earlier comment.

A) "the issuing of its own currency"

Who issues the currency?

1) the central government

2) the central bank

3) other?

B) "All government spending is financed by the issuing of its own currency"

This is due to ownership of the central bank by the central government (via the treasury department within government)?

What does the IRD do after taxpayers pay their taxes into their bank account? Does the IRD take the funds out of their bank account and deposit it at the RBNZ? This is to repay the RBNZ for the money that they advanced to the government via issuing more currency? Or is the money put on deposit at the RBNZ? Just trying to understand what you are saying.

For example - the IRD's bank account for receiving tax payment is 03-0049-0001100-27 - this is an account at Westpac - https://www.ird.govt.nz/managing-my-tax/make-a-payment/ways-of-paying/p…

The Reserve Bank shows the operation here.

Figure 3: Stylised base money system, https://www.rbnz.govt.nz/-/media/518b0156a77949d08cfee13723f98974.ashx

Thank you very much for sharing this. Good explanation.

The RBNZ document pointed to by treadlightly is a good start.

Who issues the currency?

1) the central government

2) the central bank

I guess for the ease-of-explanation, we can consider central-govt and central bank as the single entity ( along with treasury ) as the currency issuer.

People talk about 'independence of central bank' ; that is as simple as saying my Excel spreadsheet is independent ; in a way it works following all the rules and formulae set by the user. The same way centralbank is independent - but its mandate and its members are all appointed by government and it works to fulfill the mandate .

Agree, I'm currently with 7 banks, about to be 8, a year ago it was 3.

Yeah. Currently I'd be relatively safe with a single bank, but there's an extra digit expected in the not too distant future.

My plan is to spread it wide, including the smaller banks, plus...

I expect the banks are going to use IRD numbers as their metric as to who owns accounts, so placing money into a trust account will also likely see it protected under the trust IRD number (so 100K in personal account, 100K in trust account), plus 100K in business account, and business then using additional banks as necessary.

So I expect maybe a surge in deposits to minor banks, a surge in trusts, and a surge in businesses that don't really do much business beyond holding cash.

If you had $1M in Australia that would mean maintaining accounts across 4 banks , while in NZ you would need to bank with 10 different banks. We dont even have that many banks to choose from.

Not to mention having to jump through AML hoops trying to open accounts with 10 different banks. And lower sums incur lower interest rates, so it would cost you to split it across 10 banks. Most people will be just like me, and just leave the amount over and above the deposit guarantee with the "safest" bank. People with a couple of hundred thousand on deposit as their home deposit savings, will still be incentivised to keep it with the same Big 4 bank rather than transfer it to multiple smaller banks chasing a higher interest. And no competition for deposits makes it harder for small banks to compete in lending. The very wealthy would be unlikely to have money on bank deposit anyway - they would be making use of money market funds where the entire amount is guaranteed.

If you have shared ownership with your wife, then by having accounts with 10 NZ banks you would be able to cover 2 mil. We do have 10 banks to choose from. To open accounts with NZ banks is very easy indeed - I have accounts with 10 NZ banks and I never had any issues with opening any of them.

Then, assuming that most people would have around 50% of their total holdings as shares and bonds (as a conservative-balanced portfolio seeking a cautious compromise between capital preservation and growth), this would mean that you could have up to 4 mil total in savings, out of which 2 mil in term deposits, fully guaranteed.

Whilst not as good as similar deposit guarantees in many other countries, it is still not that bad after all, and it is something that in many cases can reasonably be worked with, with a bit of effort.

I'm a believer in the principle of if you are going to do something, do it properly. Otherwise its just an additional cost on consumers for very little benefit. It should at least be aligned with Australia, and be a $250k cap, which is the deposit on an average Auckland house. $100k is not very much at all, especially after several years of high inflation. In a few more years, it will be peanuts.

"especially after several years of high inflation. In a few more years, it will be peanuts.

and so why would you - TD's do not do well over long term with inflation

Tried to open a company account with ANZ. Company is owned by a Trust. Wife is an ANZ customer.

With the anti money laundering bureaucracy, and an afternoon wandering getting copy of doc certified etc etc and bloody etc simply gave up.

The mantra of the day was "Oh, there is just one more thing". Heard that multiple times.

You think that is hard enought, they do an annual review and gotta go through that all over again and again at Withdrawal

Banks have steadily eroded their social licence by continuously protecting their own and shareholders interest at the expense of depositers and it is not impossible to regulate to associate Banking hypocrisy with financial consequences eg - Should morgage rates be increased in response to market changes then deposit rates should adjust in the same timescal and & % change, RBNS should increase Banks deposit requirements when they fail any regulation, such deposits should be specifically held against failure and be available to depositors as a priority charge. Director and Senior Managers benefiting from share allocations and large bonuses not directly relating to the profit improvement resulting from their implemented decisions be required to hold shares for a increasing % of their remuneration suitabley staged over years and these shares be immediately forfeited in the event of Bank failure or significant loss. Questions need to be asked as to what level of profit is acceptable to Banks and other monopolies and duopololies taking into account actual risk and delivery performance, taxation be adjusted for excess profits or under performance that negatively affects their stakeholders. Whilst shareholder are already first in line for losses, similar responsibilities should apply to Directors so they understand their personla assets are at risk, Mainzeal are the only example I am aware of where this is actually being persued. I can hear the screams and protests so treat these ideas as a discussion document.

Will be interesting to see what happens to the TD rates. In Oz they are lower because of the deposit guarantee. The 100k per bank will favour the likes of Kiwibank, Rabo, TSB, SBS, and Heartland as depositors spread their deposits in 100k chunks. I believe RBNZ should make the banks hold more deposits for 3 to 5 years, NZ has a huge proportion of borrowing and lending at the short end. Will be an interesting year, along with the DTIs in April?

In Oz, rates are lower not just because of that, but especially because of their lower OCR and because international investors require less of a premium than what they would require in a smaller and more marginal economy like NZ, which rightly or wrongly is perceived as "riskier" than Oz.

With the deposit guarantee, there will definitely be a drop, but by looking at the kind of fees that the RBNZ is planning to introduce, such decrease will be quite small indeed - I would be extremely surprised if it was more than just 20 bps for the bigger institutions.

We can almost calculate it based on Australias numbers and compare NZs OCR with Australias lower OCR. But I suspect that it will be a way to increase their margin. But hope that will not be permitted

I was referring purely to the TD rates vs OCR, whtaever that may be. The TD rates are definitely lower relative to OCR in Oz, during Covid they were significantly lower than NZ, when the guarantee was highly desirable. From memory their TD rates were about 30% lower than ours relative to OCR, it was quite a lot.

Pperhaps a new RBNZ Governor with big balls would remind Banks of public concern at their anti public policies and strongly hint tha additional no bearing deposts at RBNZ would be required to deter such policies.

But the DG is going to apply to small banks too, so you get the same protection whether you are with a 1st or 2nd tier bank. So the big banks have to stay competitive with their rates, otherwise why wouldn't people go to a 2nd tier bank with higher interest rates, if they get the same protection? Waht you are describing is the current situation.

They only get protection for $100k. Any amount over that is uninsured. So nobody is going to put funds in excess of $100k into a second tier bank. Nobody really wants to be dealing with 10 different banks and trying to make payments for things from multiple banks. Second tier banks have zero chance of attracting higher deposit amounts, so we will still be stuck with the current situation where the majority of funds continue to be held with the Big 4 banks.

The guarantee is fine for protecting the savings of people who don't have much cash but it will be useless in attracting larger amounts of funds to second tier banks, which is necessary for them to be competitive in the lending market. It could have served both purposes but it won't.

I suspect protection for smaller depositors was the rationale.

As deposit rates rose so I put more into term deposits. It hardly seems to be worth analytic data?

As deposit rates drop I shall transfer more of my funds somewhere else. QED.

"Banks will be charged a fee for the coverage, and when insured by the Government"

Do you know the name of the company / institution / entity collecting the insurance premiums paid by the banks and insuring bank depositors?

In the US, the company is named Federal Deposit Insurance Corporation (aka "FDIC") - https://www.fdic.gov/

Taxpayers are not currency issuers and as such cannot cover the loss of anything and they certainly cannot cover the loss of their own savings as this would be illogical. Only the government has the financial means to cover losses and should do so by nationalising the banks concerned as happened overseas.

I disagree that this is a middle class welfare benefit, and the fact that NZ is one of it only OECD countries without a deposit guarantee would indicate this too. Even low income people have savings and if they were to also lose their money due to a bank failure it would also be catastrophic, and also for the economy as a whole without it being bailed out. Depositors don't know what banks invest in and how risky that could be

Absolutely agree with this. Wealthy people are unlikely to have much of their funds in cash on bank deposits, it would be deployed into money market funds, fixed income funds, superannuation accounts, property, shares, and other assets. Its those at the bottom whose sole asset will consist of cash in the bank, and thus they benefit the most from the deposit guarantee. If my bank went belly up, I would lose maybe less than 3% of my net worth. For someone who rents and has $10k in savings, that's a 100% loss.

Many over 65s have all their savings in the bank.

Don't worry about that, rest homes will whittle that down to sod-all in a flash.

If all your savings is cash in the bank, you are probably not very wealthy.

Suggest you check the graphs and do some research

The boomers who have wealth, but are conservation and got burnt by share markets in 87, .com. 2000 fin crisis etc etc now retired and want to protect their wealth rather than throw it in the hype mix are choosing TD's as a means to protect wealth rather than generate it

Relax the banks are making billions.. We all know this

I think that any downside to TD rates because of this guarantee is limited. The (already guaranteed) gov't kiwi bonds are currently at 5.25% for 6 mths and 5.5% for 1 yr.

Considering how much the banks make.. Why bother?.. All banks in this country are doing well

So a different bank required for each 100k, and banks charging for the privilege to pay the govt. A very small wow factor indeed.

Key question, where is a safe place to park ones money if the banking system ends up with only the lies of FIAT, aka backed by nothing substantial - vapor...?

After the GFC this is why bitcoin and such exist. Let's face it is the banks ever overreach and "crash the system", like in GFC and 1987, the price of the major coins will soar thru the roof as people fight to escape the FIAT system. Accordingly having the skills to leverage crypto could be more than worthwhile. It bypasses the control of any Govt or State and the banks. Look at how depositors leveraged crypto in Cyprus to escape the proposed grab by the EU several years back.

Averageman ...you and I know "FIAT" munny has had its day ever since Nixon took the USD off the Gold Standard ...it is backed by ZIP NADA NOTHING and can be issued to banks on a key stroke !

While you don't hear much about "money printing" at the moment, it definitely happened this year, when banks found themselves holding bonds for 5/10 years @ 2.5% ....the FED took back those bonds at 100 cents in the dollar .....totally inflationary and banks bailed out again.

INFLATION is the biggest wealth stealer for all, except the world's elite .....while people just don't get it, that money in the bank, at even 6% interest is still not keeping up with inflation.

How will this DEBT (now approaching 34 Trillion) EVER GET PAID OFF IT ??? - It won't.

Have 20% of my investments in Crypto (60% BTC) and so far it has more that kept up with inflation - and returned way more than that ! Just HODL'ing ATM waiting to see how Mr Larry Fink and the Blackrocks et al will play their hand with these ETF's. While the halving in April.... :)

The NZ banks will always do alright, as they will be bailed out by the Government if the S ever HTF .......while the NZD would tumble and NZ Inc. will face even more inflation and the economy will be even more "up sh*t creek without a paddle"

Nah, I'll leave the banks to themselves - they've got enough people slaving away for them already ! , while only a small handful indulge in the spoils.

Yes ! this is the year for CRYPTO especially BTC ....onwards and upwards ....and leave the banks completely out of it !

And before you "scared of Crypto brigade, because you see it as an actual threat" start screaming ......"Yes, I pay and have paid ALL taxes on my trades and sales"

Always remember it there are only 21,000,000 BTC .......how much cash is out there looking for a better return ???

This explanation of without basis has always befuddled me. Earlier this year, I asked ChatGPT, which said:

Fiat currency is backed by the government that issued it and the trust and confidence of the people who use it as a medium of exchange. The value of fiat currency is supported by the government's ability to maintain its economic and political stability, control inflation, and honor its debts. Additionally, central banks can use tools such as monetary policy to regulate the money supply and stabilize the economy, which can further support the value of fiat currency.

I had previously believed fiat currency is backed by the underlying strength of the nation's society and economy as well as confidence that strength would be sustained, with traded currencies also being vulnerable to political judgement of the government and society as a whole.

We are required to pay our taxes in the governments unit of account namely the NZ Dollar and this is what will always create a demand for it and banks can only extend loans made in NZ Dollars if we wish to buy a home. Economic growth and savings require an ever expanding money supply and not a fixed one.

In some countries folk don't trust the system so store wealth in jewellery and gold. Quite wise. It's portable so you can grab it and run to the border.

In New Zealand we feel quite secure, but is this wise? Maybe we should look more to the basics.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.