As part of our summer series on the household term deposit market, we now want to take a look at the 'term' structure of the market.

We have previously posted an RBNZ analysis, and also a review of which banks offered the best rates consistently. Now it is a look at the length of time depositors are prepared to lock up their funds.

Households have $261 bln in deposits at banks (S42). Given there are 1,995,500 households, that is a rather remarkable $130,830 in the average household bank deposit. Clearly, this is not evenly distributed, so some households have very large combined bank account balances.

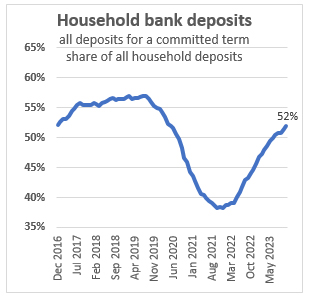

A bit more than half of these overall bank balances are in a term-committed deposit. As you can see households shifted their holdings to at-call (transaction or savings) accounts aggressively during the pandemic, but haven't yet shifted back to TDs at the pre-pandemic level yet.

When they do get back to the 56% level, that means another $10.5 bln will shift across. This last bit might take some time given the lessons of the pandemic. But good interest rate offers will help and are behind the fast recovery.

Savers might be attracted to the interest rates in term offers, but they are still choosing short terms.

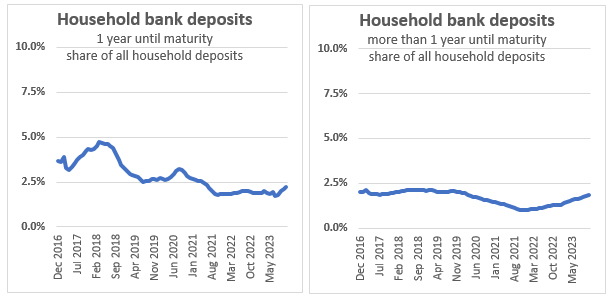

Less than 5% of all household deposits are for terms of 1 year or longer,

and there is clearly no rush currently to increase holdings for these longer terms.

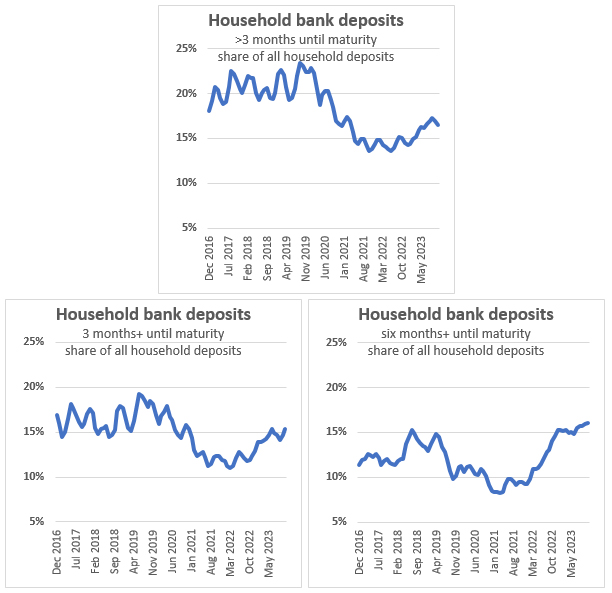

The real weight of TD's are in the less-than-a-year terms.

However, the six to 12 month terms have become increasingly popular, no doubt induced by the relatively high interest rates on offer. "6%" rates are doing the trick, drawing in a record share for these slightly longer terms. Pre-pandemic, when rates were low, it was the less-than-3-month category that dominated. That is shifting longer post-pandemic with the new high offer rates.

Solid, above-inflation interest rate offers do move saver behaviour.

To have balances this large, households with them are obviously not young, or 'starting out'. It is safe to say they are 'old' and corralling their resources into cash as they approach or are in retirement. It is a natural transition, and helps explain why the age cohort has economic power and is vocal expressing themselves when they feel challenged. Boomers confirming and reinforcing the stereotype that the rest of society has concluded.

48 Comments

Where do bank deposits come from? Bank deposits are created by the banks themselves through their lending and the government also creates additional new bank deposits when it runs budget deficits but only those deposits created by the government can add to our net savings as deposits minus our bank debt.

Where do bank deposits come from? Bank deposits are created....

Yes. Thats obvious from our favorite RBNZ money in NZ document.

My question is why NZ banks need to compete for more term-deposit ?

More term depoists means they should increase the liquidity and core-funding ratio ?

A bank like ANZ with a very heavy mortgage book can chose to be less interested in term-deposits ,right ? just concentrate on 'showing' some 30% Risk Weighted Asset (capital??) to match their riskless mortgages ?

I guess people still stick with ANZ deposits because its a reliable banks and thinking their deposit safe there. A term-deposit guarantee by RBNZ or govt across all regulated banks will change the picture , I suppose.

All interbank payments are made by using the currency reserves held in their exchange settlement accounts and these will be lost to the other banks if they don't maintain their deposit holdings. Reserves then need to be borrowed back at interest from other banks or from the central bank. There is also a loss of reserves due to our current account deficits. Banks have specific departments to manage their reserve holdings I believe.

There is also a loss of reserves due to our current account deficits

Don't this this is right. Current Account deficit will result in the ownership of deposits being transferred to a foreigner ( the importer) with the reserves transferred to their bank in NZ.

Or are you talking about them converting those reserves into bonds ?

Not sure exactly how it works but not all NZ Dollar bank deposits will be held in a NZ bank but the reserves always remain in the central bank. If a NZ bank lends a dollar which ends up in a foreign bank then it will also have lost a dollar of reserves and must regain it by borrowing back that dollar deposit. Hence why our banks borrow overseas I suppose. Foreign central banks and the Bank of International Settlements must enter the picture somewhere as they must have an account at the RBNZ to complete the payments.

treadlightly,

let's say I sell a property on which there was no mortgage and place the proceeds in TDs, how does that fit the picture you paint? I am well aware that most money is created by the banks when they make loans, but that's not the case here.

You're missing the other side of the ledger. What if that property was purchased by a First Home Buyer with a 5% deposit? In a round about way, your proceeds now in the form of a TD are derived from a mortgage.

You said you're aware that "most money is created by the banks when they make loans" but why is it not the case in your property sale? Did you specifically seek out a cash buyer? Again, in a round about way, you denied another seller access to a cash buyer.....

Not sure TD rates are attractive after inflation and after tax, which might explain why there is a relative lack of demand.

Lower risk is always lower reward, looking at the Milford and Fisher managed funds etc, if you have a 10y plus horizon then there higher risk funds have 8-11% annual performance before tax. the Aussie performance fund even higher.

Those returns are not that great, despite what people may think. And no guarantee that they will perform heading into the future. Those fund managers have their work cut out for themselves.

A 3% difference between now & pre pandemic TD savings is "relatively" minor.

Current TD rate's will perform at least as well as most balanced investment funds & outperform most >50% mortgaged property investments.

I suspect that the TDs short 1yr horizon is because many people have been holding back to see where the peak is (probably we're there now), before committing to 2+ yrs

It is minor when inflation is 3% higher too (and you get taxed on nominal returns not real ones).

I personally would like to see cash-rich boomers forget about term deposits and spend like drunken sailors. It would be a way of giving back after their age demographic has been handed everything on a plate.

Term deposits are largely meaningless for the younger avocado munchers. They need to find better options.

The reason we don't "spend like drunken sailors" is because most of us had nothing ever "handed to us on a plate".

Well if you're suggesting that the boomers have not proportionately and substantially benefited more from suppression of the price of money and monetary largesse, I think you're missing an important piece of the puzzle. Remember, team of 5 million, right? You can't have your cake and eat it too.

JC most are asset rich and cash income poor

its why they are rich but ....

because most of us had nothing ever "handed to us on a plate".

Actually this is what they are unaware of. They (most of them) should realize how much have been handed on their plate because of the banking money expansion through credit creation. The credit creation should have ideally used for real world activity but gone into financial assets mostly ( in NZ mainly housing). So its upon the asset rich people to spend and enjoy; so that money goes into the actual economy. Anyway they can't take their assets when they leave this world :-)

For some odd reason, what you describe is not taught or debated in high school / tertiary economics classes. Makes you wonder about the quality of education in our country.

If everybody knew how the banking system really worked, there would be riots. The real casualty is that nobody is taught how to learn, how to research these things for themselves. The lesson is to accept the mild unease and gradual decline in living standards, then go to sleep quietly.

Hopefully boomers will spend their hard earned cash before the whining generations get their hands on it. Oh wait, when boomers spend the whiners do get it, obviously just not fast enough?

What boomers generally spend is income derived from houses predominantly built by the two generations before boomers, which are conveniently set up as passive income generators to extract from the two - three generations after them. That and a government benefit - superannuation. Oh and a government subsidised rental market. Who's getting what from who now? What you're describing is a manipulation of economic power via asset hoarding, except the asset is just some house dad built in the 50s. Nice 👍

What percentage of ‘boomers’ own residential property for rental purposes? A clear minority. But keep perpetuating the myth.

My generation knows how to save, work 2 jobs and avoid the waste on alcohol, SKY, eating out, coffee, designer clothes and sun glasses (as some examples). Oh, vaping, concerts, latest smart phones. Maybe a designer tattoo to finish up.

Congrats Kiwikids on your position. Enjoy your retirement.

Thank you.

My generation knows how to save, work 2 jobs and avoid the waste on alcohol, SKY, eating out, coffee, designer clothes and sun glasses (as some examples). Oh, vaping, concerts, latest smart phones. Maybe a designer tattoo to finish up.

Sounds like a bit of the ol' "back in my day."

But it misses the point. The avocado generations now have to trade off more of their labor for the lowest rung on the hierarchy of needs. And it doesn't make sense. In developed economies, the cost of shelter and food should be getting more affordable. The boomers have gone through a period where h'hold debt to GDP has increased from <20% prior to the 90s to close to 100% today. That debt ratio has not occurred because of the emergence of the iPhone.

That debt ratio has grown for a multitude of reasons. One is the desire to keep up with ones neighbors. Another is a change in fiscal discipline. Sadly, another is a reduction in income vs living expenses. The latter has a multitude of reasons, not the least of which is recent .govs flooding the economy with cheap money which resulted in unintended consequences to be polite. Annoyingly, productivity improvement is still important and is rather ignored by .gov...

An example of fiscal discipline. My wife and I bought our first television around five years ago. The last time we had a TV in our house, M*A*S*H was still live (and that TV was a hand-me-down from parents and had tubes in it). We both are (were) engineers that had rather good earnings. We also planned to save for our retirement (our abode was NOT considered an investment). We aggressively saved, and got more than a few comments about how silly we were in terms of our fiscal conservatism. I was rather dismayed in my early years watching my peers buy new cars a few years after getting a good job. We had done the maths 40+ years ago, buying a new car when young adds around a year to when you can retire. This metric is still accurate. You want to become wealthy, spend well beneath your means. Best to do that in the early years, where it makes the largest difference in later years.

The challenge we have now, is to learn how to spend our accumulated savings. Either you have money, or money has you. Choose carefully.

I am gobsmacked as to how few kiwis save for their retirement. Super is at best, a garnish for an appropriate retirement.

We could be siblings with our attitude to finance. My key questions in my late 20’s were ‘how can I retire early, be financially independent and healthy?’ It meant disconnecting from a social group who drank, drugged and clubbed. It meant sacrificing evenings to help in a family business despite having a very good income from my primary job.

Despite my $1500 car I’m relishing my retirement at 58 later this year. Running, riding and reading are essentially free activities and will help fill my leisure time. It was definitely worth the effort and the laughing/comments from peers about my thriftiness. Irony is some are older than me with identical income streams yet are still servicing mortgages and acknowledge they need to work past 65. Your life, your choice.

Life expectancy isn't backed by any guarantee. I'm 50/50 planning for rainy days and enjoying the moment. I'll definitely not be able to retire before 65, if I ever reach that age (note that I'm fit, don't smoke or drink but hey, life is unfair).

Congrats Cheetah! Well done.

My wife and I started our retirement planning while still in university. We set a goal of retiring at the age of 50. We over-achieved and left our jobs in US at the age of 45 and shifted to NZ at that point and considered ourselves retired. Turned out that I enjoy working on challenging engineering stuff, and have been doing consulting work if the work is interesting. Now 63, and still doing consulting work at a part-time level (at what I consider to be outrageous rates). When I look back on our fiscal estimates from 15 years ago, our current status is more than twice what we had estimated it would be. Hence the comment that we need to learn how to spend. Our current annual expenditure is about half of what we can afford to expend. We are in an extremely fortunate position in that regard.

An aside, after we sold our house in US back in 2006, we rented for a decade as it was cheaper to rent than own for the locations that we lived in. We finally bought a home in Hawkes Bay at the end of 2015 as it was clear that it was an appropriate time to once again own a home. Despite the spruikers claims, for several decades it has been better to be in the share market than to own a home, excepting some short periods of time. Nowadays, we have maybe 20% of our money in the sharemarket and the rest in term deposits. Return of capitol is now considerably more important than return on capitol for us.

The tricky conundrum you see is that many of your demographic have followed this mantra their whole lives and ended up wealthy by mid-50's only to have them or their spouse fall ill and either be incapacitated which will either drain the wealth or sadly they won;t be around to enjoy said wealth, leaving them wishing they had enjoyed their lives more and been a little less conservative. It is a hard one, as nobody knows when their time is up. Hard to see those who struggle on the pension only and hard to see those who planned so well and never got to enjoy their prudence. I'm of the 50/50 myself. I frequent recycling centres and tip shops, cook at home for the most part, make my own alcohol, cycle a reasonable amount, grow veggies and fruit at home, buy second hand and get many things at a cutthroat price from china online, and my wife and I rarely do birthday gifts which affords spare cashflow for when we wish to spend on anything significant and call it a gift so to speak. We don't need a lot to be happy, and often the more we have the shallower life can be in some respects. Good food, good drink, good company and shared experiences are my go-to's.

As someone that had my father die when I was 29, and then my mother when I was 43, I understand the dilemma in regards to enjoyment vs savings. Very sadly, my parents planned for my father to live a bit longer, and when he died, my mother quickly depleted her funds. We took her in and cared for her in the final years. We vowed that this would never happen to us.

Both wife and I have had some health issues in the last couple of decades. We happily went to the front of the queue via paying out of pocket to get timely care (the public health system has decayed horribly in the last decade, and in particular, the latter half despite the mantra of "nine years of neglect" that we heard six plus years ago).

Well said Cheetahlegs.

I happily put my hand up as a 'Boomer' but my early approach to personal finances and life plans was much the same as yours. I avoided debt as much as possible by buying only what I could afford and if it required a loan (as a residential house always does), then pay those debts off as quickly as possible. The post-80's "keeping up with the Jones' " and "it has to be European, not cheap Asian" attitude didn't interest me to the extent that it seems for many of the whining generations (JC is the classic), so being debt-free has also served me well. Never owned more than the one home and that was initially done during the high interest era of the 80's. Still, we are now what would be described as quite comfortable and are the supporters, not receivers within the family.

Despite all the B-S spouted on by the likes of JC, it was still relatively costly to go through Uni in the 70's but the discipline of doing it without any access to a Student Loan was in itself a good financial learning-exercise. Costly education systems with high course fees and the need for student loans have been brought about by the now firmly entrenched attitude that almost everyone should have a degree. Having a vast multitude of tertiary courses (many of which are completely farcical) requires a vast government funding of which less can be subsidised. The necessity for a tertiary education should be profession-focused (as it was for myself), rather than degrees becoming desirable accessories.

Pointless making these comments though, as you can never convince the blinkered visionaries.

Well said. Congratulations on your wise choices. Just ignore the financially illiterate who are trying to make you feel guilty for your success.

Inflation gave many houses. Yes there were high interest rates for a period but wages increased significantly. Even those who just owned their own home. My father purchased a house in the late 70’s for about $12k. When he retired in 1990 his income was about 3 times the purchase price. When I purchased my first house in 2010 it was about 4 times my gross income. My income would need to be $1m a year in 11 years time. Assets increases massively in value and inflation took care of the debt

Assets increases massively in value and inflation took care of the debt

Huh? Global debt to GDP has increased massively over the past 30 years - largely through derivatives. It's nonsense to say "inflation destroys debt". If it did, debt to GDP would be falling.

The great thing about high interest rates is it kept a lid on principal amounts. Increased mortgage repayments from pay rises go straight off the principal amount.

- 25 year $10k loan @ 22% = $43 per week. Pay increases by 5%, mortgage +5% to $45 per week. It's now a 13 year mortgage.

- 25 year $500k loan @ 6% = $743 per week. Mortgage +5% to $780 per week. It's now a 23 year mortgage.

@Cheetahlegs66

well said.

Most boomers don't own rental property. Asset-rich, maybe, through owning their own home via hard work and prudent spending but not necessarily income-rich.It was always the Kiwi aspiration to own your own home. They didn't create the exponential growth in property values over the years. Clown government policy mostly did that.

Boomers are easy targets for the insta-gratification generations

If your argument is that boomers as a generation have not had the greatest exponential economic run in history of any generation that has been or potentially will be, then boy have I got some news for you. Life's hard, even when it's easy. Boomers worked hard, but there is an expectation that the hard work will pay back 10 fold while no longer producing anything of use to society. The same expectation is that younger generations will continue to pay boomers rent on a plate, and continue to neglect the economic, health, infrastructure, environmental and social crisis that we seem to be in.

btw hows the house price? and the second house price? How about the rent? How about super? and accommodation supplement and the gold card and free public transport and the inherited plate it all comes on?

Many boomers love to tell us how hard they worked. The truth is they worked no harder than many do today. They did have the opportunity to buy assets vastly cheaper than one can today. That’s where they won the accumulation of assets race.

Assets? You mean houses. Computers, clothing, whiteware and cars are examples of goods which are cheaper today (inflation adjusted) than 20 years ago. Oh, computers, air travel…..Young punks are the blessed consumer generation.

Always makes me chuckle, boomers i started work on 6 pounds a week think we had two weeks paid holiday back then. I managed to build a business by working 80/90 hour weeks for 30 years. Still working aged 69 but not as hard as i used to.

ditto

Other than eating advocados😉

If anyone has a better investment idea than a 6%+ term deposit in a pi structure I’d love to hear your thoughts.

talk to Jardens I have several good friends in the wealth section its what they do make and preserve wealth...

They like fly fishing as well.....

Do ut your yourself (don't pay jarden or anyone else). Diversify.

JamesM,

The stockmarket. If you have enough capital, but limited knowledge as your question suggests, then perhaps spend some time talking to a broker like Craigs and put a toein the water through them. Alternatively, consider low-cost index funds.

I think you might be surprised by the long-term record of the market-and don't neglect the value of dividends. I have been involved professionally and personally for some 50 years and have done well from a disciplined, low-risk approach. Good luck.

JC sure the investment guys have work cut out but TD rates cannot outperform growth for long before they plumment as well... its called finance, when things get that bad everything falls BIG TIME recession becomes depression

Us boomers have had the best financial times. Good jobs, cheap assets to buy and access to reasonable finance to buy them. Those who follow us will never have it as easy as we had it. My home bought for $490k now worth $3m. And that is just one of my assets. You cannot do that today.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.