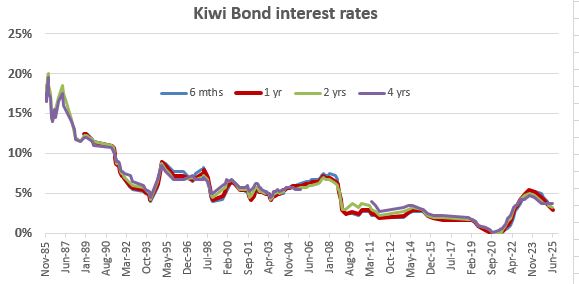

Savers who use the Treasury's Kiwi Bond offers will want to know they cut the interest rate on them on Thursday (today), the third reduction in 2025. The previous reduction was in February.

The interest rate 'curve' has now steepened rather sharply as it has fallen. In fact, the one-four year difference at +75 bps is the steepest since June 2022.

Treasury (or more precisely, the Debt Management Office of Treasury) last set these rates on February 27, 2025.

For subscriptions of $1,000 - $500,000 they are now at:

| Maturity | change | Rate |

| 6 months | -50 bps | 3.00 percent per annum |

| 12 months | -50 bps | 3.00 percent per annum |

| 2 years | -25 bps | 3.25 percent per annum |

| 4 years | none | 3.75 percent per annum |

The official announcement is here.

Savers who value these direct government-guaranteed term deposits now have to put up with after-tax rates that are no better than Consumers Price Index inflation and in most cases worse. Inflation was running at 2.5% in the March 2025 quarter. The new lower 3.00% Kiwi Bond one year offer translates to 2.48% for taxpayers on a 17.5% marginal tax rate, to 2.1% for taxpayers on the 30% tax rate, to 2.01% on the 33% tax rate, and just 1.83% for those on the top 39% tax rate. Basically there is now no 'real' tax-paid return when you save via Kiwi Bonds.

With the Depositor Compensation Scheme now in place, banks and other authorised deposit-taking institutions are where you have to look to to get a positive 'real' return. However, those still wanting risk-free returns for amounts above $100,000, Kiwi Bonds will remain an option, for gilt-edged protection at least.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.