A reader asked if our new home loan comparison calculator can account for the cost of a break fee.

It can.

When you set up the data for the calculator inputs, you will have to know an estimate for your break fee.

First, you need to remember than mortgage contracts are real contracts at law. You have signed up for specified conditions, including incentive clawback provisions. (Typically, cash incentives currently come with an obligation to remain with lender for three years and if the contract is ended early, some of that incentive will need to be refunded (clawed back).

New Zealand law requires banks to allow a mortgage fixed rate contract to be broken. And it also limits them to only recovering costs, and not 'profiting' from the transaction. This is the basis of our break fee calculator that can estimate the amounts involved.

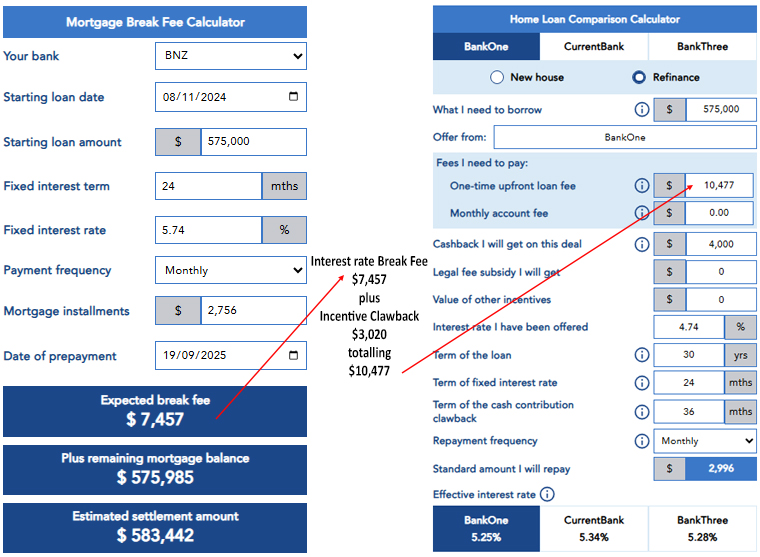

Here is an example we can work through.

George borrowed $575,000 from his CurrentBank on Friday, November 8, 2024, fixing the interest rate at 5.74% for two years. He also received a $4,250 cashback incentive on the normal terms.

Now George is concerned he has locked in a rate that is too high and would like to take advantage of the 4.75% one year rates currently in the market. He has an offer of 4.74% from BankOne who will also give him a cashback incentive of $4000 on the standard basis.

His current bank will let him shift to a current one year rate at 4.75% provided he pays the break fee of $7,457. If he stays, he wont have to repay any of the original incentive.

And he has a third offer from another bank (BankThree) of 4.75% with a $3750 cash incentive.

Processing these numbers is only a first step, and there may well be other considerations before making any final decision. Those other matters may be important. But here are the initial steps George could take.

Step One: work out the likely break fee from CurrentBank.

StepTwo: work out the likely cash incentive clawback from CurrentBank.

Step Three: compare the three offers.

The cost of breaking up with CurrentBank become costs that need to be applied to the BankOne and BankThree offers.

To break his existing contract, George will first need to pay $7,457.

Then he will need to repay some of the incentive he received originally because he is leaving his current bank well before the three year promise he made to get that incentive. There could be a range of factors involved here, but if we just use a straight time-based proportion; he could be required to return $3,020 in the bank's clawback of the cash incentive.

The original three year incentive clawback promise was for 1095 days and he now wants to do that 778 days early. So the incentive clawback could be $3,020 (being $4250 times 778/1095). This is another cost for this transaction on top of the break fee.

Here is one way you can apply these details to our calculators to get an "effective interest rate" estimate. Calculating an "effective rate" gives a consistent basis to compare the effect of the three offers.

Remember, it is only an estimate. Only the banks involved can give you the actual numbers.

In this case, the question then becomes, is the expected benefit enough to go through the hassle of making the switch?

If you struggle to follow or absorb these calculations, especially if you have specifics that are different to the example above, you should seek advice from a qualified professional. An experienced accountant or mortgage broker should be able to help you work through your particular case. Mortgage brokers who are members of Financial Advice New Zealand have committed themselves to full professionalism.

Here is the break fee calculator estimator. These working tools below are not preset with the example above. They are preset with their original default values and you will need to change them to fit your circumstances.

Mortgage Break Fee Calculator

And here is the home loan comparison calculator.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.