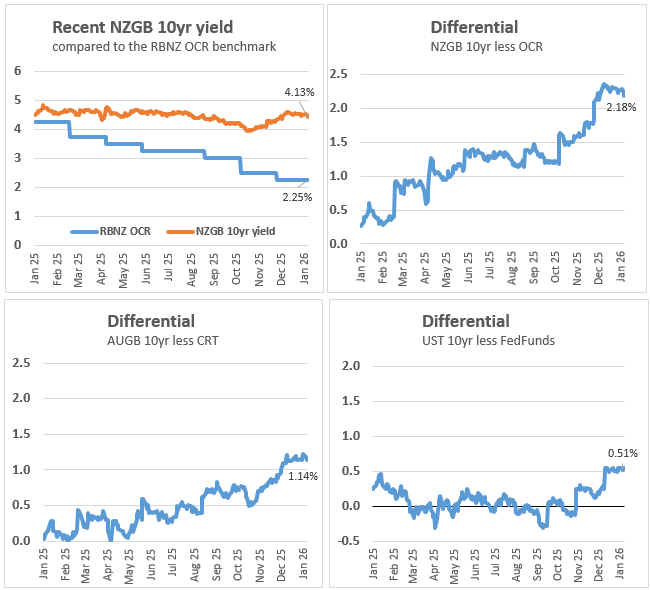

Regular readers will have noticed that while central banks cut their policy rates in 2024 and 2025, long term benchmark bond rates have started to rise recently.

The effect is stronger in New Zealand than in many other developed economies.

It is a global trend. Even in Japan, while they have raised their policy rate recently (from 0% to 0.5%), the Japanese Government 10 year bond rate has risen much more sharply (from 0.7% at the start of 2024 to 2.09% today).

First let's review what financial markets are signaling with this differential.

Bond investors may be anticipating some combination of stronger future economic growth, higher inflation, or increased government debt, and are demanding greater returns for lending long-term despite those short-term rate cuts. Factors like inflation expectations, fiscal deficits, and central bank credibility are playing significant roles in these decisions.

Long term investors (like the fund managers of the massive global retirement funds) are particularly sensitive to inflation outlooks. They risk losing their mandates if the returns on the funds they manage don't yield better-than-benchmark returns, after inflation. There are huge sums at stake. Global retirement savings are massive and probably exceeded US$150 tln at the end of 2025. That is far more than five times the US GDP. Sovereign wealth funds likely add another US$15 tln to that. Global equity capitalisation likely exceeded US$130 tln.

The influence of Scott Bessent/Donad Trump, or even Jerome Powell, and their debt-constrained firepower is dwarfed by these markets. The smell of rising future inflation will be the key drivers.

What is 2026 going to bring? Growth or inflation? or both?

It is very unlikely to be growth without inflation. But it could well be inflation without growth. Markets are pricing for either inflation-with-growth or inflation-without-growth, but not growth-without-inflation.

2026 is likely to end with long term interest rates pushing higher because the two primary outcomes predict higher inflation.

Bond markets price future likelihoods. They probably see continuing rises in inflation expectations, growing more than the 2025 increases. They likely see much higher government borrowing, especially in the US as fiscal management turns sharply irresponsible.

They also likely see continuing moves by populist politicians to weaken central bank independence. It is clear that is the drive in the US. But even here in New Zealand, politicians frustrated that their fiscal policies aren't working have turned to blame monetary policies for 'undermining' them. The evidence for that is scant, but it is an easy stick to beat in an election campaign.

All these influences require price premiums. They are likely to get larger.

Higher interest rates do have positive impacts. They raise the hurdle rates for investment decisions. Only 'good' projects get approved. Marginal projects don't. That has the positive impact of improving productivity. When growth is low and governments think they need to support their economy, many projects get approved that will never generate a return (think Auckland's central rail link, light rail to the airport, some 'roads of national significance' projects). They require more cost than can possibly ever be recovered. The net result is that we all get poorer.

It is hard to look ahead at the start of 2026 to see these issues fading. Bond investors will require higher interest rates.

This will be good for some, but there will be losers too.

"Investors" in residential real estate should be re-thinking their commitment. Rents are falling, mainly because the demographic trends are going against them. That same trend means there are far more houses for sale than buyers who need them. Prices will languish. Certainly local body rates will be rising, and compliance costs will rise even faster as imposed rates caps push greater rises on to user pays fees.

The chances of rising mortgage interest rates in 2026 should not be under-estimated. The cost of 'leverage' is likely to go up, squeezing out any gross gains from rental income.

3 Comments

While return may be an issue for decisions how will that play out with necessity? This suggests a greater move to increasing public ownership and greater potential for nationalisation which may well drive private default and subsequent deflationary spiral...weve been there before and it dosnt bode well, especially when we have nukes this time around.

They also likely see continuing moves by populist politicians to weaken central bank independence

Timely. Hot off the press, federal prosecutors have opened a criminal investigation into Fed Chair Jerome Powell focused on the multibillion‑dollar renovation of the Federal Reserve’s Washington headquarters and his related testimony to Congress.

Jerome Powell says the DOJ is threatening the Fed with criminal charges for refusing to follow President Trump's interest rate demands.

https://www.reuters.com/world/us/us-federal-prosecutors-open-inquiry-in…

Timely warnings to New Zealanders. Thanks for your directness and clarity Mr Chaston.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.