Interest rates seem to have stopped falling.

Global pressures are behind a sentiment shift that sees more chance of official rate hikes in New Zealand in 2026. In fact, financial markets are pricing in a September or October rate hike,

But the next rate hike will likely come much earlier in Australia.

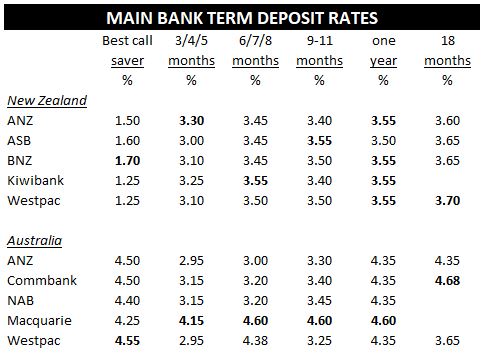

So with that in mind about how the central drivers of official rates might play out in 2026, this is how the term deposit and some key call accounts currently sit - on both sides of the Tasman.

In Australia, Macquarie Bank are making a big play for household deposits, offering outsized rates for savings accounts and term deposits. And it is very successful, raking in huge shifts and raising market shares.

In pursuing this high-rate strategy, they have some key advantages. First, the other big banks can't really follow as comprehensively because their embedded book sizes are so much larger to start with and following Macquarie just raises costs for them at scale.

And secondly, Macquarie doesn't have the same social banking obligations the big four have. They don't need to support branches, they aren't required to provide country banking networks, and they don't have to provide broad services; they just target the profitable middle. And it is also an advantage that the Macquarie team is relatively new, hired in raids on key people in the big four, so they now know where the vulnerabilities are in their target rivals, and where the real opportunities are.

All the same, the big banks have to respond, and they are, with selective and targeted 'specials'. Commbank is defending its position well. ANZ is the weakest of the big four, as APRA data shows.

This fierce Aussie fight means that offer rates in New Zealand are now relatively low, especially for at-call deposits, and for one year or 18 month deposits.

Holding bank deposits at interest in Australia can bring a 1% to 2% advantage if you are selective.

This table emphasises the the big bank differences. But in both markets there are challenger banks where better rates can by had. In Australia, those challenger banks, especially the community-based versions, are suffering market share losses under the Macquarie onslaught. Even banks like HSBC, ING, and Suncorp are having to fight very hard with elevated rates, and despite outbidding Macquarie sometimes, they still suffer market share losses. It is fierce.

Given the fact that New Zealand has a 2.25% policy rate, and Australia now has a 3.85% policy rate, our main-line bank offers don't look too bad for term deposits. But that is not what savers look at - it's "what's in it for me, now" that drives decisions, especially institution shifting decisions.

And it is probably worth noting in the NZ section of the table above, ANZ, ASB and Westpac are bonus saver rates, whereas BNZ and Kiwibank are straight savings accounts where you don't have the conditions and restriction of a bonus saver.

And for the Australian at-call savers, we excluded the 'welcome' rates that only apply for a short time when you first sign up. The rates in the table are the ones that apply after that.

The look ahead at the wholesale pricing shows New Zealand is facing three rate hikes over the next year or so. But Australia is facing only one (soon) and half a chance on only one more.

The Macquarie factor is very influential in Australia. Our big main-bank challenger - Kiwibank - isn't having the same market-shifting impact here, and while its commercial returns remain quite low and it can't really raise significant capital, it is very unlikely to play the role here that Macquarie does in Australia.

You can find comprehensive coverage of of Australian retail rate offers at interest.com.au in a very similar fashion to our New Zealand coverage.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.