By Amanda Morrall

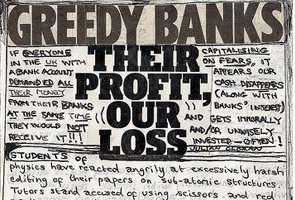

New Zealand credit unions, the shrinking rural violet of the banking sector, have taken an uncharacteristically bold move to steal customers from the "greedy banks" by positioning themselves as the "easy" more trustworthy alternative.

A group of seven credit unions, including Baywide (one of the country's largest credit unions) last week launched a campaign called Easy Banking aimed at educating the masses about credit unions and drumming up a stronger customer base outside of the provinces.

The campaign, which consists of television ads and a website, presents credit unions as a worthy suitor for Kiwis "worn down by the weight of greedy banks.''

Baywide's chief executive Gavin Earle said credit unions want to market themselves as an financial outfit that "works alongside" customers instead of "on the backs" of them.

As one of those disenchanted mainstreamers the credit unions are hoping to woo, I'll be watching their movements with interest.

I have long regarded this underdog of the banking sector as a exclusive club for farmers - or else socialists; an impression based on false assumptions and pure ignorance.

Superficially, credit unions might have a rural persona and a pinkish hew but the reasons have less to do with agriculture and politics than a sense of community. At least that's what I am told.

Democracies

Unlike the conventional shareholder structure of a regular bank, credit unions are locally owned and "democratically" controlled by members. As such, members get a say (that's a vote) in how to run and govern these small scale banking outfits.

In reading their materials, one gets the overwhelming sense that they are more about people than profits. Earnings are poured back into operations to finance better products and services for members, instead of pad the pockets of overpaid CEOs.

Fees as a result are relatively low, and there is an overriding philosophy is to push education over products.

Jonathan Lee, business development manager for the New Zealand Credit Union Association, says while financial literacy has always been an implicit part of credit union operations, it has come to play a growing role since the Global Financial Crisis.

Both here and abroad, that has manifested in collaborations with schools, employers and non-government organisations who see value and merit in trying to achieve better financial outcomes for average folks just trying to get ahead.

Lee says it's not uncommon for credit union members to advocate on behalf of another member, for instance if they're negotiating a car purchase, or working through debt problems or a budgeting crisis.

This spirit of cooperation and sense of community (devoid of the usual profit-driven motives underlying the corporate banking system) is resonating with a public increasingly wary of the mainstream.

In Australia, where four million citizens have opted to go with credit unions over conventional banks, the "Big Four" are now flanked by a "fifth pillar."

New Zealand, with only 214,000 members, may be small by comparison but the numbers are growing.

Among the 21 credit unions that belong to the New Zealand Credit Union Association, there are about 95 branches serving some 177,000 members with combined assets worth NZ$625 million.

3 Comments

How safe are they compared to a bank? I understand that all deposits at a bank are unsecured (i.e. there is absolutely no gurantee), however If a bank defaults, the Govt will most likely step in and rescue.

What about a credit union? Can Credit units lend more $$ than they have as deposits like a bank?

I very much like the idea of not making the banks richer, and keeping profits in the community. The world would be a better place if this always happened.

I wonder how the banks that support the credit unions feel about this

Amanda, you have made an error in this article. There is no such entity as the New Zealand Credit Union Association or NZCUA - rather they are called the New Zealand Association of Credit Unions or NZACU.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.