Credit Unions

All licensed non-bank deposit takers will be able to call themselves banks under the Deposit Takers Act, but fintechs will have to opt into the new regime

1st Oct 25, 8:30am

All licensed non-bank deposit takers will be able to call themselves banks under the Deposit Takers Act, but fintechs will have to opt into the new regime

What is and and isn’t covered under the deposit insurance scheme launching in July

11th Apr 25, 11:10am

8

What is and and isn’t covered under the deposit insurance scheme launching in July

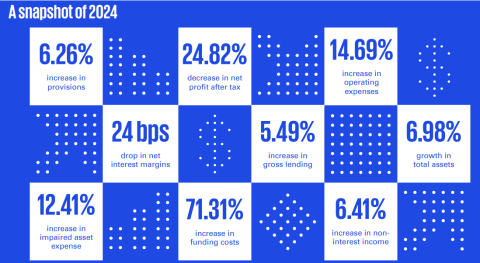

Profit tumbles across non-bank lending sector for second consecutive year, KPMG FIPS shows, as funding costs surge

11th Dec 24, 5:00am

Profit tumbles across non-bank lending sector for second consecutive year, KPMG FIPS shows, as funding costs surge

Disruption lies in empowering non-bank lenders to compete, not just making four major banks five, Lyn McMorran argues

24th Aug 24, 8:45am

11

Disruption lies in empowering non-bank lenders to compete, not just making four major banks five, Lyn McMorran argues

RBNZ expects some deposit rate convergence across different types of deposit takers once compensation scheme launches

12th Mar 24, 3:02pm

35

RBNZ expects some deposit rate convergence across different types of deposit takers once compensation scheme launches

Banks may have profited by $2b on customer call accounts through RBNZ using settlement accounts for its LSAP programme, consultant tells Commerce Commission

17th Feb 24, 9:40am

13

Banks may have profited by $2b on customer call accounts through RBNZ using settlement accounts for its LSAP programme, consultant tells Commerce Commission

KPMG's annual survey of non-bank lenders shows the impact of rising funding costs

13th Dec 23, 7:42am

KPMG's annual survey of non-bank lenders shows the impact of rising funding costs

Gaya Herrington explains how the Global Financial Crisis led to her leaving central banking, going back to university to study sustainability & revisiting The Limits to Growth

28th Jun 23, 12:22pm

102

Gaya Herrington explains how the Global Financial Crisis led to her leaving central banking, going back to university to study sustainability & revisiting The Limits to Growth

Retirement Commission 'de-jargoning money' guide suggests use of 'debt' instead of 'credit' & 'end date' instead of 'maturity'

1st Jun 23, 11:46am

8

Retirement Commission 'de-jargoning money' guide suggests use of 'debt' instead of 'credit' & 'end date' instead of 'maturity'

Parliament committee proposes making the Deposit Takers Bill more friendly to smaller non-bank financial institutions

12th Apr 23, 4:13pm

7

Parliament committee proposes making the Deposit Takers Bill more friendly to smaller non-bank financial institutions

RBNZ points non-bank deposit takers grumpy about a lack of liquidity access to its settlement account access review

10th Mar 23, 1:08pm

RBNZ points non-bank deposit takers grumpy about a lack of liquidity access to its settlement account access review

Against the backdrop of a possible Commerce Commission probe into banking competition, Gareth Vaughan looks at how the actions & inactions of NZ authorities have helped maintain the dominance of the big four banks

8th Mar 23, 11:59am

45

Against the backdrop of a possible Commerce Commission probe into banking competition, Gareth Vaughan looks at how the actions & inactions of NZ authorities have helped maintain the dominance of the big four banks

Huge year for non-bank financial institution sector but clouds may be gathering

14th Dec 22, 7:51am

3

Huge year for non-bank financial institution sector but clouds may be gathering

Reserve Bank may apply macro-prudential tools to non-bank deposit takers but isn't concerned about the growth of non-deposit taking lenders

16th Nov 22, 9:44am

Reserve Bank may apply macro-prudential tools to non-bank deposit takers but isn't concerned about the growth of non-deposit taking lenders

Financial Services Federation unimpressed with National Party proposal to favour banks over its finance company, building society & credit union members

26th Sep 22, 10:12am

6

Financial Services Federation unimpressed with National Party proposal to favour banks over its finance company, building society & credit union members