By Amanda Morrall

I've been on the hunt for sometime for the perfect app. My specifications are as follows: must be intelligent, intuitive, low maintenance, mobile friendly and affordable, and most importantly, savings conscious.

With that in mind, I decided to test drive Xero. Xero is well known and loved by SMEs (small and medium enterprises) who use it to effectively remove the need for an accountant, or at least its made them less dependent on one. Its lesser known personal finance software was the one I was interested in and will be reviewing now.

I have to declare up front that Xero has kindly agreed to waive my subscription fees so I can assess its offerings. I'm hoping that hasn't affected my objectivity and also that my honesty won't sabotage the offer, but I guess I'll have to take my chances.

Because I'm thrifty I was initially attracted to Xero because of its 30-day free trial offering. I'm not normally one to take up these free offers as I always live to regret the freebies that invariably come in exchange for the endless solicitation. Had I been able to fully evaluate Xero in the allocated 30-day trial period, I would have done so. I don't think you can fairly assess the worth of any personal finance tool for at least three months.The programme costs $59 a year, so just under $5 a month.

My initial impression was good, then bad, then good again. Allow me to explain.

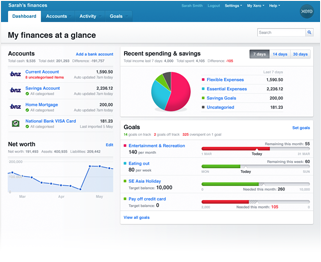

Like other personal finance software and apps on the market, Xero is designed to help you keep better track of your money; how much is coming in, where it's going, spending allocations by category and savings goals. So far so good. Signing up was pretty easy but when it came to uploading information from my bank, into their software, I ran into trouble.

Xero suggests you upload three months worth of bank statements in order to establish and analyse spending patterns. You do this by downloading monthly statements from your bank onto your computer, then uploading them onto Xero on-line.

As I'm a bit of a Luddite (and this is hardly Xero's fault) I lost two days of my initial free subscription trying to find out where the data went. When you download it from your on-line bank account to a computer it sort of disappears. Eventually, I realised the statements went into the downloads file on my computer so I eventually managed to import them into Xero. After each monthly statement gets uploaded, you are prompted to start tagging and categorising information. The early stage categorisation was so confusing, to me, that I abandoned it halfway, then ended up losing all my data.

It was the accountant speak that threw me; payee, amount, dates, options, references. I wasn't sure what I was being prompted to do and why then all the data disappeared.

Personalised email

Just as I was about to abort the whole thing, because I couldn't find a phone number on their Website to call, a personalised email arrived inquiring how I was making out. It was a well timed email as otherwise, like I said, I'd have packed it in. This one came with a real person's name and phone number attached.

A phone call later, I was walked through the primary coding system. I ended up having to re-up load everything and follow the prompts on the first coding stage to get to the second phase where you code each and every transaction from your monthly statement.

Lucky me, I chose December through February and given how busy December was financially (it being Christmas, summer holidays and me having visitors) it was a long, and arduous process tagging my electronic spending for that month. I couldn't curse Xero for the number of my transactions, but it did take me approximately three hours to comb through three months worth of statements coding and categorising each and every item. I never carry cash so all my spending is traceable through EFTPOS.

By the third month, it seemed to get easier and faster. I've done this exercise before, when I did a similar thing with sorted.org.nz's budgeting and money tracking software, but not with the same degree of precision. Although I was silently cursing the whole time, I appreciate now how valuable this part of the set-up is.

By doing the hard yards you are forced to examine your spending at close range.You can't escape from it or gloss over the numbers, at least not when you are cross reference the inputs with original statements, which is what I did.

Once I was finally through the thick of it, I began to get excited and the prospect of what the software might be able to achieve in terms of financial profiling. However, it was quickly apparent that the 30 days would be insufficient to let the software work its magic.

I'm pretty good with my budget, but the software has features that allow you to try to narrow your targeted spending bands down in certain categories (for example food or clothing or entertainment)and it charts your spending with graphs and pie charts. All of this helps to give you a big picture overview of your financial behaviour.

'Show me the automation'

I was starting to fall in love with Xero until I found out this: that while business users have their accounts updated daily through an automated "bank feed" systems, the same facility doesn't exist for personal finance users.

What this means is that every month you have to manually download and upload bank information onto your account. Although this isn't quite as labour intensive as at the early stages (because the system recognises most of the coding from your initial inputs) it's still an inconvenience as far as I'm concerned. And after speaking to a very helpful person at Xero, I discovered this is going to be the case with pretty much any personal finance software in New Zealand at present, save BNZ which has a special arrangement with Xero to allow daily uploads.

ASB has its own money tracking software as well for its customers. (Bernard will review this at a later date). Kiwibank has one too with its 'Heaps' product. The banks have been reluctant to open up their automated data fees with personal finance software providers such as Xero and Dunedin's Pocketsmith.

Given that you can effectively get the same information as you can with Xero, for free through Sorted.org.nz, I'm not sure (given the impairment of the one feature that would make this a stand-out product) the $5 a month is worthwhile.

The other disadvantage at present is that the personal finance version of Xero isn't available on mobile, which for me is a convenience that would definitely justify the costs.

I think the real effectiveness of technology applied to personal finance is in not only in tracking and tagging your spending but also waving it in your face. And seeing as most of us are more engaged with our mobile phones these days then bank tellers or paper statements, this interface would seem to be the most important and effective if it serves to improve financial behaviour through awareness.

However, given that I had yet to discover Xero's full functionality (in its present form), and also the fact that I'm getting it for free for now, I'm willing to persist and will update in three months to give you my two cents worth.

With any luck, they'll have addressed the bank feed issue and mobile problem before my complementary subscription runs out.

I'd welcome any comments below from other Xero Personal users about the pros and the cons. We'd also love to hear from any Heaps or Pocketsmith users out there. Also, see Emma Geraghty's March 2010 article on the personal finance software scene in New Zealand, which includes a call from Bernard Hickey for the banks to open up their data to independent providers.

And here is Bernard's March 2010 opinion piece below:

Wouldn't it be great for New Zealand's financial literacy if people were able to monitor their spending and saving through various bank accounts and credit cards in one place so they could forecast their overall financial situation at any time of the day from their computer or phone?

It might make New Zealanders think again before borrowing to buy that second coffee or the new car or the 54th investment property. If only New Zealanders had been more informed about their own financial health over the last decade we might have been able to avoid the finance company debacle, the foreign debt blowout and the surge in credit defaults. Such an integrated real-time financial picture might even drive more competition between banks and credit card companies, helping to reduce fees and improve service.

There are many powerful new online tools being developed around the world that allow consumers to create just that real-time picture. They're called Personal Financial Management (PFM) tools and they're now big in the United States and parts of Europe. The biggest and best known ones are called "Mint" and "Wesabe". They allow someone to collate together exactly how much they owe or what they have saved from a variety of sources. They can work out how much they spent and on what. More importantly, they can use this information to predict their future financial position.

The biggest barrier in the past has been bringing all the information together and then finding the tools to analyse the information in a way a regular consumer could understand. In days gone by, the only people able to do this have been whizzes with Excel spreadsheets and a degree in computer science who could download the data from their online bank accounts and then reprocess it. There's been a few software tools such as quicken but they haven't been as 'real-time' or user friendly as the new tools.

This trend towards online PFMs is much more advanced in America where aggregators or middlemen such as "Yodlee" have cut out all the hard work of liaising with hundreds of banks and other financial information providers to ensure online services such as Mint and Wesabe can allow customers to easily pull the information together at the click of the mouse. New Zealand's own Xero, which is the local online accounting software services business founded by Rod Drury, has just done its own deal with Yodlee to help its offshore small business clients integrate their financial details into one place.

New Zealand's banks have been remarkably quick and adept in the past at adopting new technology. New Zealand's adoption of EFTPOS is a shining example. So why haven't our banks picked up and run with the PFM trend faster?

There's a couple of reasons, but one big reason is a lack of innovation and openness so far. Our banks have started down the track, but they want to keep the customers within their own four walls. So Kiwibank has launched its own tool called "Heaps" and BNZ is just about to launch a tool in conjunction with Xero, while ASB has launched its own tool called MyMoney. This means customers can analyse their spending and saving, but only if they have all their accounts with the one bank. Westpac, ANZ and National have yet to launch their own tools.

Only BNZ's MoneyMap tool, which is set to be launched soon, allows customers to import data from other banks or credit card firms. But it's still a cumbersome process and not automated or real-time like the Yodlee/Mint model in the United States.

Why won't our banks allow customers to choose to integrate data from other banks onto independent PFMs? Right now, they simply won't allow it. There are plenty of local PFMs trying to open their doors. Xero is planning to launch its own XeroPersonal tool in the next couple of months and Dunedin's own "Pocketsmith" has also asked the banks here for access. Both Xero and Pocketsmith are having to plough ahead in overseas markets without much joy at home. The banks are simply refusing to open up. It turns out New Zealand's banks even want to charge the likes of Xero or Pocketsmith to download the data.

It's time the Retirement Commission , the Commerce Commission and possibly even the Reserve Bank encouraged the banks to open up their systems to allow New Zealanders to use both independent PFMs and their own banks' tools for all their account information, regardless of which bank it's with. It would encourage competition and innovation. It may even make it easier for customers to switch between banks. It would also help improve our currently woeful financial literacy.

11 Comments

I use Xero business for two businesses of my own, and also for a client's business that I help manage. I have investigated Xero Personal but chosen not to proceed. Not having automated bank feeds is a deal breakter for me on this. Tried to get my two student aged children (20 and 21) to use it - even offered to pay the annual subscription for them both - but having to manually download transaction files from the bank then manually upload to Xero wasn't goint to be a happening thing for them.

Bernard's call for all banks to open up on this, rather than follow the proprietary route, is great - as is your suggestion, Amanda, that it has to be mobile phone friendly. If bank feeds were automated, and the results turned up on my kids mobile phones, I'd have another go at persuading them of the benefits.

Just one other comment re Xero Personal. It seemed to me when I played with it that it was stronger on helping understand spending with a view to containing it, but seemed to me less capable at helping with the saving/investing side of things. Others views?

I agree - spending was fine on Xero personal, though it's not as intuitive as Kiwibank's offering (in terms of automatically coding). The saving part of Xero personal is useless, there doesn't seem to be a category for lump sum savings.

ANZ/National do have a similar offering called "ANZ MoneyManager" it can be used for ANZ/National customers and non-customers. I use it with my ANZ and NB accounts and it pulls my transaction info automatically. From what I can tell it can pull other bank info automatically but havent tried. Works pretty good.

smw007

Thanks for that. One of the problems with the bank-only personal finance tools is that they stop you from integrating all your accounts and finances across different banks etc.

I wish they'd open up, with the appropriate safeguards.

cheers

Bernard

MoneyManager looks as if it links KiwiBank and Westpac going by the in-app 'add account' thing, but I don't have accounts with them so no idea how it works, but it looks like it is added the same as my ANZ/National accounts, but aside from that not sure how it will work when added, will be interesting to find out!

I started trying out Heaps the Kiwibank personal finance application yesterday. I am both a Westpac and Kiwibank customer. But most financial transactions take place through my Westpac accounts. You can manually download from any of the 5 major Australian banks to Heaps. Heaps is free, and there is support,one working day turn around, and the frequently asked questions list. It appears that you don't have to be a Kiwibank customer to get this support.

So, one of the first steps for me was to download accounts and transactions from Westpac to Heaps. Heaps helpfully tells me to use a MYOB format to download a Westpac account when I enter a new account into Heaps. In the Westpac site I then directly download and save the Westpac account in the "MYOB cashbook" format. The saved Westpac account goes to the downloads folder on my computer. It is easily picked up from there, as Heaps indicates to browse to the downloaded Westpac account file. There was a Luddite moment doing the first download but after a coffee break everything went very well. Once you have downloaded one account to Heaps it is easy to download other accounts, including a credit card account, and it doesn't take long.

The next step is to categorise all transactions that have been downloaded into Heaps. After that many future transactions that are downloaded should be automatically categorised. I have started the categorising. There are major categories that you can further subdivide for extra detail about your spending etc. Heaps seems fairly intuitive to use.

Security: You can get into Heaps either through a log in to Kiwibank, or by going into the Heaps site and logging in there. After completing any downloads,don't forget to delete any account details you have downloaded to the download folder on your computer.

That's it for now. I need to see how it goes after a few more monthly downloads.

Thanks kiwi, sounds very similar to xero. Please do let us know how you go. You can email me directly: Amanda.Morrall@interest.co.nz

For people that have no idea or love to dwell on detail this may be fine but all the information in the world will not in itself make a dam difference. It comes down to attitude , awareness and discipline

I would argue unless your files download quickly and seem less why waste your limited energy. Just focus on the obvious.

1. Focus on income first and foremost, where you can increase you income is always more advantage than focusing on expenditure. Expenditure is harder to tackle as it reflects habits

2. Then look at expenditure from the largest item down. It doesn't take long to do. You can get close on the typical line items without having to precise.

Loans, taxation, insurance , working downward

Determine which element that you can control, have options or is largely fixed.

Research each and work out the most cost effective option, change if appropriate.

Most people find it is the discretionary items are the only material controllable items at this point and then it comes down to day to day awareness , choice and discipline.

If you want to be accounts clerk ok, if you want to act and make a difference just do it.

Sound advice speckles. Thanks.

I just visited the sorted website and it looks like it has had a design upgrade. Looks great and is easy to use, I have just finished using the money planner. Took a 6 month snapshot of my online bank account (insuring to include December holidays & Christmas shopping).

Took the average of my weekly/monthly expenses – food, rent, petrol, entertainment etc and tracked my ‘one off’ expenses like vets, ipad, Christmas presents as yearly expenses. I found the money planner picked out a few expense categories that I would have missed.

Now I know my spending trends vs. my income and I have an awareness of where I can let costs like groceries go up and down by ‘x’ amount and still be ok, likewise how long it will take to save for one off purchases with un allocated income/savings.

I have also identified a few areas where if I can cut back it makes a big difference over a year to my savings i.e. buying lunches.

I don’t really see the point in tracking your actual monthly costs if in most cases people’s spending habits are pretty consistent and only need to be reassessed if your situation changes, like buying a house, change of job, children, relationships etc.

I will stick with the 80/20 rule, I am 80% aware of my spending patterns which took 20% of my time and am not interested in spending 80% more time to track the last 20%!

Personal accounting systems like Zero are for people who are most likely already very capable with finances and probably are pretty good at being on top of their spending. If easy to access sites like sorted can get the finically illiterate and most likely indebt individuals more aware of their spending habits and how to dig themselves out of a hole, that is where the real success in personal budgeting lies.

Thanks Magic.

Have to say I'm impressed with all these practical and sensible comments here too. I like your 80/20 rule. It's balanced and realistic. I'm also impressed with sorted.org's makeover although my budgets over the years were somehow shuffled and date stamped to yesterday which threw me as I could find the most recent one initially. Probably user error.

Given it is free, I think you'd be better off using their resources instead of paying for them. But I'm still waiting for the magical mobile app that barks, jumps and shows me the money.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.