By Amanda Morrall

1) Boiler room operators

The most vulnerable group of investors? This article from Vanguard may surprise you. It's not the first time investor or the gullible housewife. It's the 50 plus, educated, should know better alpha male investor with more money than sense.

Robin Bowerman, Principal, Corporate Affairs & Market Development at Vanguard Investments Australia, warns this cohort group could be susceptible in greater numbers with the proliferation of self managed superannuation funds in Australia and so called boiler-room operators sprouting up to prey on their fear and greed.

Bowerman said the situation underscores just how irrational investors are, regardless of intelligence.

Why do intelligent, reasonable and successful people get caught remains the question. The explanation at least in part to how investors make decisions and what influences us.

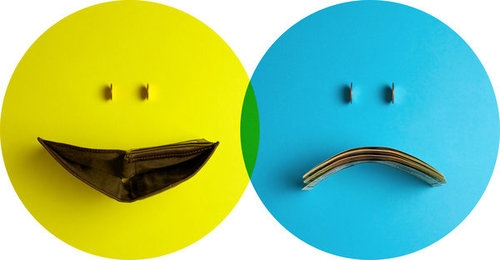

Two base motives for investors are fear and greed. In these cases the greed appeal is obvious - the chance for quick money and outsized returns. The fear perhaps comes in two flavours - after having sampled success with an initial investment there is the fear of missing out on the next episode multiplied by an X factor.

Then comes the particularly vicious double sting - some victims get called by ‘recovery room’ operators. These calls come after you fear you have been conned, offering to mount legal action to recover some or all of it. Again a fictitious offer and the ultimate definition of throwing good money after bad.

On top of that you can add overconfidence. A particularly powerful influence, some might argue, in the case of 50+ successful men. At that time of life there is a good chance that they have taken entrepreneurial risk at some stage of their business lives - perhaps starting or running their own business - which can foster overconfidence in their ability to assess the risk in what is an unfamiliar world for most people.

The best defence is a good offence which includes two simple but important steps, says Bowerman:: 1) checking to see if the individual is registered. To search the New Zealand Financial Services Provider Registry click here here:

2) Consulting with a professional financial advisor; authorised financial advisor.

2) How fees erode returns

According to Gareth Morgan's characterisation of investors, I fall into the camp best described as greedy. Why? Because I'm in a "growth fund" in KiwiSaver and what's worse, I have an active fund manager. I'm not disappointed with my fund manager, but I understand the argument against them. The majority can't beat the index taking into account their higher than average fees.

Index fund tracker Vanguard sheds some light on this topical issue by looking at fund manager performance for the past year as applied to the S&P/ASX200.

The NXZ50 has fared relatively better and the investment landscape here is unique from Australia's but take note of the differences on fees paid on the index funds versus actively managed funds. You can then look up what you pay in fees on your KiwiSaver and compare it to other such funds by going to our KiwiSaver section, entering your fund in the Find your Fund, then hit "see other funds like this."

3) Under-indulgence

Is too much of a good thing a bad thing? In short, yes, generally because an unlimited supply of x,y,z will ultimately undermine your appreciation of it. Just as too much chocolate, too often will dull its deliciousness, too much money will tend to distort its relative value. Research cited in this Forbes Money article suggests that beyond US$75K, happiness levels begin to plateau, putting lie to the notion that high net worth is the ultimate nirvana. That's because once you reach a comfortable standard of living, additional income won't necessarily make you happier.

Spending less on material goods, and more on experiences or helping others,will lead to greater levels of happiness than more money in the bank, writes Robert Glatter, echoing the conclusions of money researchers Elizabeth Dunn and Michael Norton published in this column in the New York Times recently. Time to book that next vacation. That you've saved for in advance of course.

4) Personal finance is hip

Time Magazine's money section reports on how schools in Chicago are working to switch students onto personal finance at a young age. Kids in 3rd grade there are using their library sessions to learn about the four pillars of personal finance; saving, spending, donating and investing. I was pleased to see donating formally acknowledged as one of the pillars. At the end of the sessions, kids are issued with a piggy bank that has slots for all four. Brilliant idea; four in one.

5) Investing as couple

There's good reason to maintain separate finances but for solid couples with staying power and a common vision of the future, investing together can be fruitful.

Here's Foxbusiness.com with some strategies and tips for financial soulmates out there.

To read other Take Fives by Amanda Morrall click here. You can also follow Amanda on Twitter @amandamorrall

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.