• Recent housing policy announcements have been met with mixed responses.

• Rents probably won’t rise sharply, the bright line tax extension will make little difference, but interest deductibility will slow house price growth.

• Developers who have recently purchased land may pause to re-evaluate the feasibility of their development, but established developers are likely to push ahead.

Tax deductibility of interest costs

By far the most impactful of the announcements was removing interest deductibility from investment property tax liabilities. The law was to be applied almost immediately to new property purchases, thwarting any sudden surge in investor buying. Existing investment properties will be phased into this tax treatment over four years.

By way of example, an $800,000 property secured by a 60% mortgage, interest-only at 2.5% a year has interest costs of around $12,000 a year. As a result, the investor will pay up to $4,680 extra in tax (39% tax rate). Some will not have the cashflow to continue being landlords and will have to sell.

In the context of strong house price growth, we expect the policy to reduce house price growth through 2021. In early 2022, assuming borders to our main migrant sources (China, India, the Philippines, South Africa) remain largely closed, annual house price growth will likely turn briefly negative as the rules bite and interest rates lift. But given the level of house prices, even small capital gains will easily offset any tax implications. Those who can find the extra $4,680 in cashflow will try to hold on to their properties.

Mythbusters

Every time a policy change occurs that pushes up the costs for landlords, some argue that (1) this will push rents up, and that (2) rental housing will disappear. There is little evidence for either of these claims.

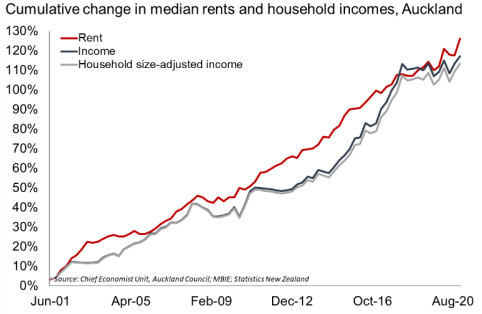

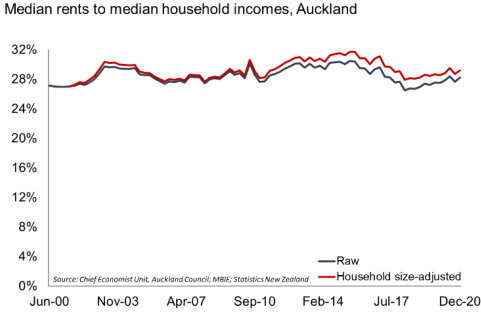

Every business wants to pass on higher costs, but landlords are already charging prices set by what renters can pay. Over the last 20 years, rents in Auckland have risen at almost the identical rate as household incomes, despite increased costs such as the removal of the Loss Attributing Qualifying Company (LAQC) loophole in 2011 or healthy homes standards requiring better heating and insulation.

Even adjusting for growing household sizes (arguably because rents rose), annual household incomes rose at a rate similar to rents. Over time, rent to income ratios have moved in a narrow band as a share of income. Bearing in mind also that income inequality (rather than wealth inequality, which has worsened) has been largely unchanged in New Zealand for 25 years, even at lower points than the median income, this relationship has likely held.

In relation to the second claim, some investors will sell their properties for a lower price than would be the case if this policy did not get introduced. Some of these offloaded properties will be bought by other investors at the lower sale price. Others will be bought by owner-occupiers who can afford the lower house price. These houses don’t disappear when they stop being rentals; they become owneroccupied homes.

Distortions

As a policy to slow house price growth, the deductibility rule will be effective. However, it introduces other distortions. Some asset classes have capital gains that are comprehensively taxed (like shares), and others do not (investment properties). Other business loans have interest deductibility, but investment properties do not. The more distortions we introduce, the more likely we get perverse outcomes.

There has been talk of a further distortion – controlling rents – if rent increases materialise. We don’t think rents will rise more than they would have anyway, but introducing another distortion (rent controls being literally the textbook example of a policy that does not deliver more affordable housing, for instance) would simply compound the perverse outcomes.

The capital gains tax that couldn’t

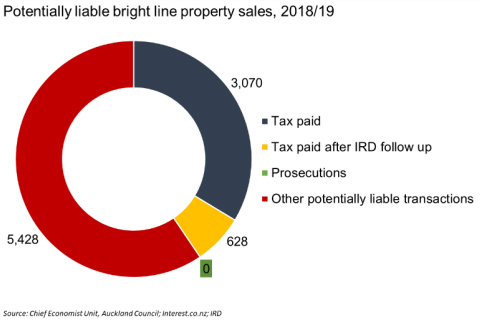

The bright line has also been extended to 10 years from five. The test could be useful if vigorously enforced (the evidence from the latest available year suggesting it is not), but is the poor cousin to a comprehensive capital gains tax. In 2018/19, a total of zero prosecutions occurred for bright line test tax obligations.

We suspect the lengthening of the holding period will have little impact on prices or equalising asset classes without more enforcement.

$3.8 billion in housing acceleration funding

The government announced that it will contribute a further $3.8bn toward the nation’s infrastructure shortfall to boost housing supply, following $12 billion announced in the NZ Upgrade programme and $3 billion in shovelready funding for COVID recovery announced in the last 15 months.

More money for infrastructure is very welcome, but some of the detail remains unclear. Will this be a loan, or cash-in-the-hand? Cabinet is yet to decide on criteria; that only happens in June, before projects can be considered for funding. How long until we see shovels in the ground? How will value be determined across the myriad of projects it could fund? Will Auckland get a share broadly commensurate with its share of growth and contribution to the tax take?

Some have suggested much of the funding will be used to fund Kainga Ora programmes. From a Council Group perspective, what gets funded may have consequences for additional or out-of-sequence spending it might trigger that may not have been budgeted for, so again, the detail will matter.

First Home Loan Grant will boost lower quartile house prices

The final part of the housing policy announcement was an increase to the maximum dwelling price and the maximum income thresholds below which applicants can receive a grant to help purchase their first home.

The impact of a policy that makes money available to a bigger pool of people in a limited price range is likely to be house prices in that range lifting toward the top of that range. The result can be much the same as increasing accommodation supplements, which in times of housing shortages, flow through to landlords, as they can be used for no other purpose. While median house price growth may moderate due to the interest deductibility rules, we may well see prices in the lower quartile of housing rise.

Where does this leave development?

Ironically, strong growth in house prices gets more housing built. The impact of the interest deductibility change will be increased uncertainty in the housing market. This is already being observed in auction results over the last three weeks. We suspect house prices over the next while will still be up strongly over the same month last year, but annual growth rates will fall from the dizzy heights of 19% in March and 24% in February 2021.

Developers who have recently bought land will query whether their completed developments will fetch the prices they need to return a profit. Construction costs continue to rise, so slower house price growth means slower land price growth. Developers who have owned land for some time, however, will still likely progress.

Further certainty on where and when extra infrastructure will be funded would be useful for councils and developers, and could accelerate development, but clarity and timing are fundamentally important.

* David Norman is chief economist at the Auckland Council. This article was first published here. It is here with permission.

21 Comments

"Some asset classes have capital gains that are comprehensively taxed (like shares), and others do not (investment properties)."

And this was written by the chief economist for Auckland Council????

When did incompetence become part of the job description for chief economist??? Share sales could be taxed for capital gains, just as investment property sales could be taxed for capital gains. There is zero essential difference between how capital gains from investment property or shares are handled. (disparaging expletive deleted here)...

If you own shares from other jurisdictions, ASX, NYSE, etc most are taxed on capital gains or by the 5% dividend rule. There are exemptions but not many and you'd have to constrain your portfolio to those exempt in order not to succumb the capital gains or the 5% div rule. Affects diversification. This is irrespective of your intent. If investing, no capital gains on the exempt shares. What NZ has is an unequal investment playing field with housing being the standout choice because it's mainly not taxed by central govt.. Quite a few on this website tout CGT to curb housing demand and bubbles. It's been shown worldwide it doesn't.

'The more distortions we introduce, the more likely we get perverse outcomes.'

Yes, they are distortions and will result in perverse outcomes.

And knowing this, we will do it anyway, rather than remove distortions and get non-perverse outcomes.

Friedrich Hayek's The road to serfdom comes to mind.

The biggest distortions by far are caused by QE and over a decade of choking interest rate suppression.

And yet in jurisdictions with proper land-use policies, QE and low-interest rates have not caused price distortions. Go figure.

If zero prosecutions occurs for tax avoidance, this doesn't automatically mean that the government didn't pursue anyone that defaulted. It could mean that 100% of the people caught by the tax implications actually paid their tax. No-one left to chase.

As far as I am aware capital gains from shares are tax free, unless you are in the business of buying and selling shares. This exactly the same as housing if you ignore the bright line test.

Not foreign shares. In this case you are taxed annually on a deemed 5% rate of return, or the gain.

Is the following statement a Mythbuster?

"Every time a policy change occurs that pushes up the costs for landlords, some argue that (1) this will push rents up, and that (2) rental housing will disappear. There is little evidence for either of these claims."

The evidence provided was based on the last 20 years of rents versus household income.

The government has introduced a raft of changes which has resulted in unprecedented growth in house prices & an unprecedented increase in costs to owners of rental properties. Historical rents will provide little guidance to this unprecedented situation. Basic economics indicates there is going to be an increasing shortage of rental properties & a corresponding increase in rents.

Covid-19 resulted in a rent freeze for 6 months. Many landlords will have put up rent at the end of 2020 so will not be able to increase rent until end of 2021. Other landlords have not put up rent but will be worried that further rent freezes or rent caps will be introduced. The cumulative impact of this will be unprecedented increases in rent unless the government tinkers with rent controls.

I cannot find any good examples of where rent controls have worked over the medium to long term.

In Tony Alexander's latest survey he states "A special survey I conducted of 4,000 investors showed over 70% planning to raise their rents more than they had previously been thinking. Over 30% said they will pull back from buying a property, and about 25% said they would sell."

70% sounds like warning bells to me.

Surveys of affected parties are a waste of time.

Basic economics says the income from the asset helps determine the value, not the other way around.

How does basic economics suggest that there will be an increasing shortage of rental properties? Outside of altering the population/amount of houses, how is this shortage created?

According to his graph in 2013 rent growth was 80% whilst income was 50% ? That seems like a big difference ( rent growth was 1.6x income growth ). At present it looks like income growth is at 115% and rent growth is at 125%. Current rent growth is only 1.1x income growth since June 2001 in a market where we know 1.6x is achievable!

Also rental price growth at the lower end of the market is much higher than income growth for the bottom quintile of income earners.

There are substantial headwinds for builders now anyway, lumber and other building materials are being substantially inflated in price. We had a window post-GFC where there was a lot of slack in materials and labor within construction but that excess capacity has evaporated.

Yeah, I visited a mate of mine who is a builder last week, and asked him how is business. He said, how should business be when we can't get materials?

Economists are like belly-buttons: every council or bank has got one. They have a vast array of often contradictory opinions and the media are tripping over themselves to report every utterance.

Yes and No

Well, the market is certainly crazy if you are looking for houses for sale in Wanganui. Or even renting for that matter. I would recommend https://whanganuimansions.co.nz which is a free online real estate magazine featuring houses for sale in Wanganui, Waverley, Marton & Bulls, New Zealand. All the local real estate agent & private listings. All price ranges. All in the one place for your convenience. All properties listed for free.

Well economists rarely get things right. And here we have an economist who works for a council... so you know, like any normal economist, only worse.

Bloke in our Town has been given a Free Council House by Council. He is now living in a disused Bus Shelter as nowhere else to rest his weary head.

The Council did build several new Large Bus Shelters at different Bus Stops.......But then again, Councils have different priorities...these days...

Will this make subdividing more attractive? I see a lot of huge properties around Auckland with a small old villa or ex state house sitting on them. I'm assuming new builds will be exempt? The Auckland subdivision process is a bit convoluted though, which could put first time "mum & dad" developers off.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.