Prospective home buyers should have more to choose from this summer with a big jump in new listings and a sharp rise in the total number of homes available for sale.

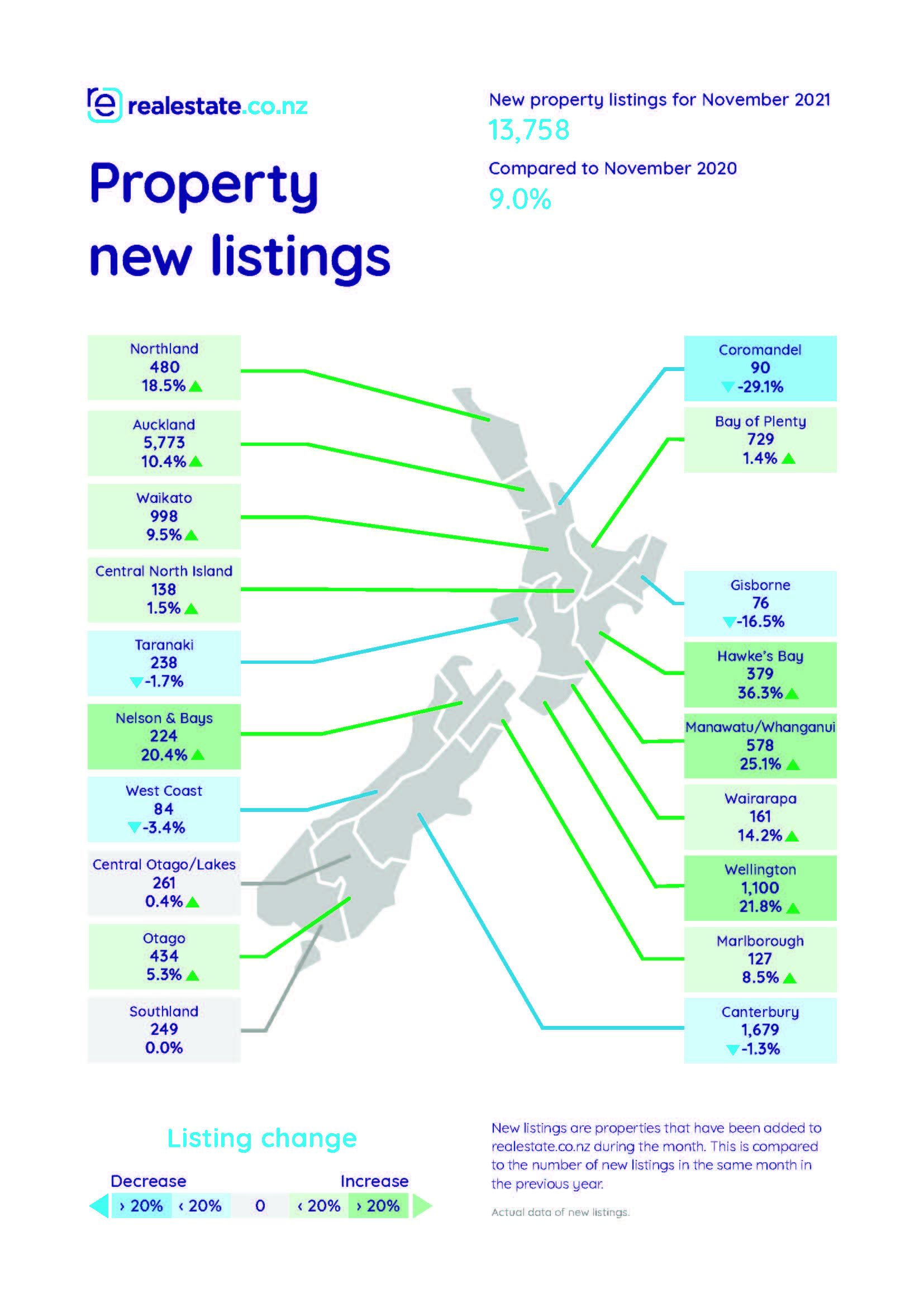

Property website Realestate.co.nz received 13,758 new listings in November, up 24% compared to October and up 9% compared to November last year.

That is the highest number of new listings the website has received in any month of the year since October 2014.

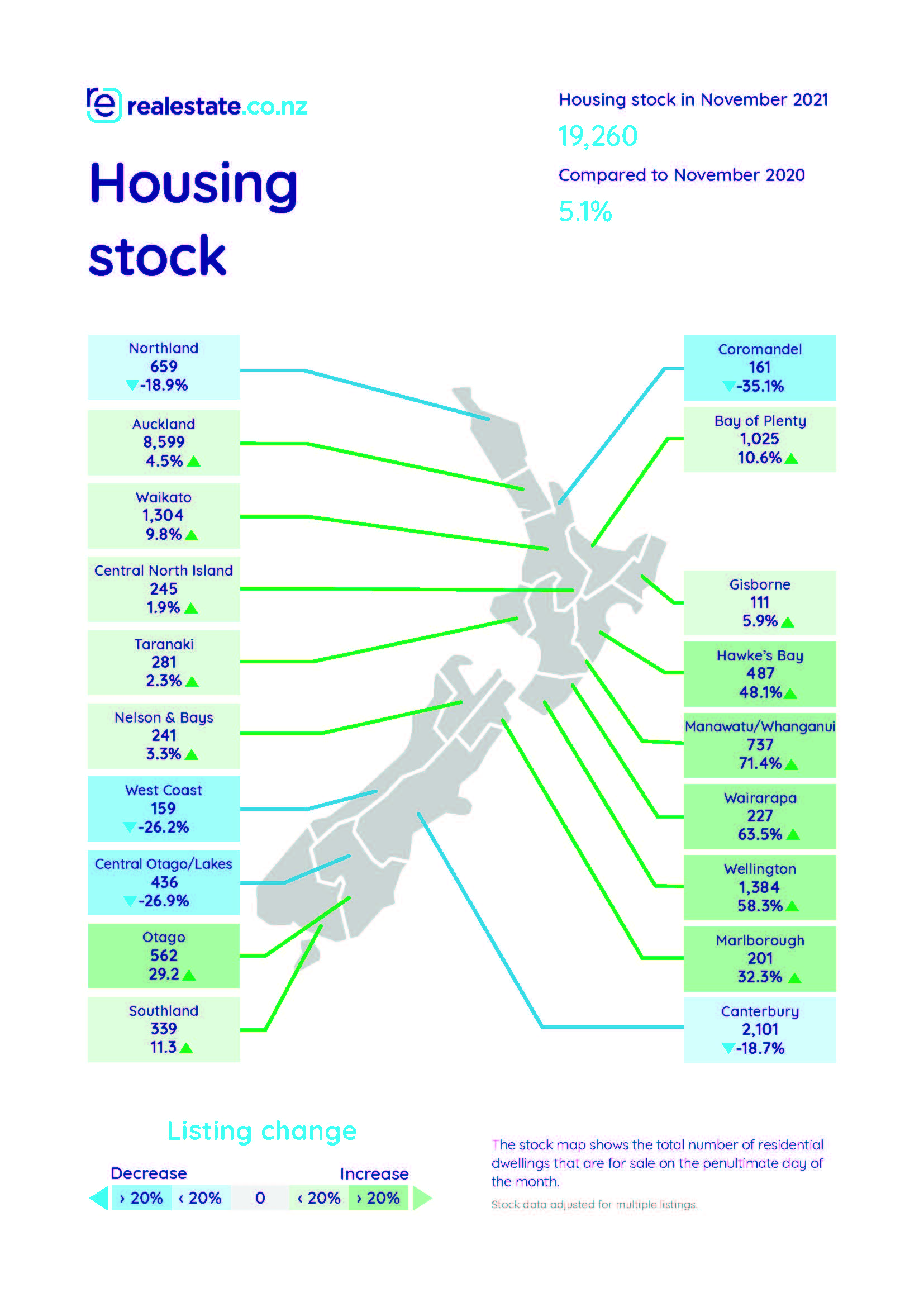

That in turn helped to push the total number of homes available for sale on the website up to 19,260, up 5.1% compared to November last year and almost equalling the stock levels of March this year, which is usually the busiest month the year for real estate sales.

Those figures suggest the supply pressures in the market which have left prospective buyers competing for a limited number of homes available for sale, may be starting to ease.

In its November report Realestate.co.nz said the figures suggested the market was at a "turning point."

"The new Zealand property market is taking an encouraging turn," Realestate.co.nz chief executive Sarah Wood said.

"It looks like buyers will have more homes to choose from this summer."

Pricing data from Realestate.co.nz was more mixed in November.

The national average asking price of properties listed for sale on the website pushed past the one million dollar mark for the first time at $1,003,413*, up by $23,282 compared to October.

However, there was no clear trend around the country, with November asking prices down in eight regions compared to October and up in 11.

However, it may be significant that the regions which showed a decline in asking price in November - Waikato, Bay of Plenty, Hawke's Bay, Central North Island, Wairarapa, Central Otago/Lakes and Southland, included several where price gains had previously been among some of the strongest in the country.

*Note: Realestate.co.nz produces both seasonally adjusted and non-seasonally adjusted asking price data. The numbers interest.co.nz refers to in this article are non-seasonally adjusted.

The comment stream on this story is now closed.

53 Comments

The crowd is beginning to rush for the exits.

Be quick.

Indeed.. Real Estate Agents will be pleased.

I wonder if Luxon's properties are setting empty ??

If Luxon sells will he try to evict his tenants first.. ?? I bet his houses are sitting empty lol

Can someone ask if his houses are empty.. ?? Is someone rushing around as we speak, trying to save face.. trying to tenant his properties ??

I think you will find most people that have has his work career will own a bunch of realestate. Lets face it the tax rinsing aspect, and security of it, it just made sense.

I agree, I voted for TOP knowing Gareth Morgan had a bunch houses setting vacant.

Mr Morgan said; 'it wasn't worth the trouble tenanting them and that tenants muddied the carpet'.

Mr Morgan pointed out such a situation was ridiculous and laws/taxation needed to change.

Luxon on the other hand wants to be Prime Minister and dose NOT want large falls in house prices - BIG DIFFERENCE. :)

What a dumb comment Zack.

He's got more money than you, does it matter where he invests? Get over it.

lt will be interesting to see whether the REINZ figures tell a similar story. October's national inventory was down 16% compared with the same time a year ago according to them, so if it looks anything like the realestate.co.nz figures suggest it does now, that would suggest a huge flood of property hitting the market.

Hi Greg, could you also add the map for the asking price please? Many thanks

Do it yourself if it's important you. You are not Greg's boss.

No I'm not his boss but I'm a paying subscriber, so I'm allowed to ask politely

The housing marketing is heading the same way as your Goldfish did when you screwed up the pH.

...belly up.

Spoken like a true ex-goldfish owner.

Next stop the flusher...will the banks flush some of the extreme speuvestors...

Not to worry - the RBNZ will inject more "liquidity" to keep the gold fish right way up for just that bit longer...

When I was 6, mine died when I kept feeding it non stop (true story)

I just wonder how many "mom n' pop" investors out there are saying "let's get out while the going is good" ...... but they'll have to find a "buyer" for the price they are expecting ??? ........ don't forget that NZ has the highest house prices in the western world compared to income.

Smart money already cashed up in the last six months, or is on the sidelines continuing to build a vulture fund. Kaaaarrrkkkkk.

Was that your vulture sound? LOL

Markets gone up another 20% in 6 months, you missed out.

20% is chump change compared to the gains possible when the market tanks

Crazyhorse

No doubt some Mum and Dad investors will be getting out but there is no evidence (e.g. the many Tony Alexander’s surveys across a variety of RE sectors) to suggest that is currently happening in significant numbers.

However the important thing is knowing when to walk away and a lot of boomers experienced the 87 share market crash so will be well aware that hot markets don’t continue indefinitely - and assuring those CG will be tempting

Bottom line is that many of the Mum and Dad investors will have purchased investment properties for retirement so are looking at the long term and cash flow. For many of these they will be weighing up the very good yields on their initial investment and that recent falling interest rates have wiped their mortgage so cash flow will be both earlier than expected and excellent. While they may have unrealised capital gains, there a few low risk alternatives if they do sell.

Many mums and dads have also guaranteed their children's housing loans.... they won't like the call from the bank when the kids can't pay and they bugger off to Australia for a fresh start

The "intention" may well have been to hold long term granted, however rising interest rates, rising cost of living, living beyond their means etc may well take that option off them? Yes all such things should have been factored in prior to purchase but I bet there are a heap that didn't in the feeding frenzy that is the NZ Property market.

He said the smart ones. That is a low percentage of the total lol.

Agents and vendors though, are defiantly still trying to push the envelope as far as they still can. Not to mention that headlines like this, only draw even more buyers out of the woodwork.

its the descriptions that get me....

I wont be surprised if i see some blurb on the next house i look at saying "New Lynn Beauty At Its Best" "10 supermodels held together with concrete, gib board and laminate flooring, this one might get you so excited we'll honestly be surprised if you dont whip your old lad out during the viewing and start pleasuring yourself on the spot" Vendors saying Must Sell !

Act now! Be quick! Beat the rush! bargain buying! won't last long! don't miss out! and the best of all, Affordable! lol. Just more Real Estate agent gibber.

Good. Some signs of balance & sanity returning to the market. It's the buyers turn next year.

Be quick...https://www.u-buy.co.nz/brand/pepto-bismol

Keep buying from each other guys and push the prices to be high.

The politicians you choose are all big time investors, so they won't bring in policies to help the poor and needy. All politicians are rich and they will only help themselves and the rich who owns properties.

So get on the band Wagon and buy at any price. Become a land lord and enjoy the fruits. Don't wait. Keep buying the same house multiple times from below kiwis and make it reach new heights with no real value added to the society or the economy.

Just keep doing it, you don't need good university education but need a hammer and shovel to keep doing the hard labor. Keep importing the educated people who buy your houses and make you rich.

So let's just do what we have been doing for last few decades and let's all be millionaires.

I hear property prices double every ten years or so, average price in Auckland 2 mill easy money, everyone has 2 mill and 400K for deposit.

Maybe banks could offer mortgages for deposit.

No joke, Squirrel Money (P2P lender) lends you the deposit under their Launchpad product. You borrow a huge chunk of the deposit then you borrow the 80% LVR from their property loans. The loan servicing for the $2m loan will be a hurdle for most though although at the mid price range of $1m, it is doable.

Yeah I'll believe it when I see it. Every week stories are coming out like this dangling hope that the market might start to even out, only for prices to charge ahead.

I hear you. I think the big difference now is the increasingly difficult access to debt. Talked to a couple of contacts in the banks yesterday and the worm has definitely executed a 180 degree u turn in their practices. Hesitate to say those that loaded up on debt on commercial recently stand to loose big as yields rise.

My mortgage broker said the same this week.

Would be good to understand what proportion of this increased inventory relates to medium/high density as opposed to stand alone housing.

How many additional long term arrivals will be generated next year by the new Covid Visa rules phase 2?

This will kick in. Just as our borders are opening up to overseas arrivals.

It depends. There could be a bunch of Indians and Chinese with NZ residency would be fleeing their countries if their economies implode over there and due to their large population size, NZ won't be too bad an option. It's really hard to tell and a wildcard. For many average Indians, they wanted to come back to NZ yesterday.

Chinese border closed all of 2022

but go on

Interesting. This is new news to me. I'll check it out.

I can tell you all from distant memories what could be resurrected; it was very common in the 1960s to 1990s when the banks were a lot more reluctant to lend on mortgages than they are now. The following could occur especially if the banks keep upping the mortgage interest rates:

Say the banks won't loan money on a mortgage to a couple of young buyers because they don't meet the bank's de facto debt-to-income ratio. An investor with a few houses might want to sell one or two of them. The investor can sell a house to the young couple by 'leaving in a mortgage' assuming the couple have a reasonable deposit even though the deposit isn't large enough to satisfy the bank. This would give the investor a tidy income for a term of say 3 or 5 years by which time the couple would save more to be in a position to obtain a bank loan. The interest rate for that 3 or 5 year term would be less than the current bank rate but higher than the current measly bank term deposit rates. So this would be a win-win situation where the buyers would pay a lesser interest rate for say 5 years, enabling them to save more of their income, enough to eventually take on a bank loan; the vendor (mortgagee) would get a higher return than a bank deposit and have the security of real property. This would particularly be attractive to those who are becoming worried that the banks are carrying too much housing debt and might themselves become shaky if the market implodes.

And, more importantly for the vendor, he would probably be able to sell his property for a higher price than he otherwise would.

Wouldn't it be just as likely that prices have to correct down closer to DTI levels?

The difference between new listings and inventory in wellington and wairarapa is interesting. That would seem to imply that properties are piling up faster than they are selling, are is that a statistical mistake on my part?

Yes Wellington one of the regions had a massive jump in number of listings in the last month. Average 1M whatdyou expect.

So listings are up 9% year on year (yoy) for November; however, the housing inventory remains the same at 10 weeks year on year.

It seems to me that demand has also moved a 9% upwards- in congruence with supply.

This may be the golden ticket out of poverty driven misery- when everyone thinks it's going to tank, BUY!

There isn't many lifetimes to lose due to indecisiveness.

Be quick!

But the guru T Alexander has preached that the top is past, and that no more gains are here. All the banks have called a price retreat and are pricing debt on that basis. The specuvest sheep are following that call. What to do...

That said if the house you need comes up and you can afford it, then do it. I suspect all the people in that category have already pulled the trigger. Those that cannot afford the stupid pricing of today are being pushed further back by the banks. So we have here is a big standoff no longer based on want and life support rates. The tide retreating daily on the pull of DTI and higher rates, and many a beached whale of debt is about to get a blistering suntan. What to do indeed.

Kaaaarrrrkkkkkkk

I really like your posts Averageman. I was like you.

The challenge is that when you're a rational investor in an irrational world, chances are you'll be proven wrong time and time again and I was like that. Logic and analysis told me that the COVID lockdown would mean the end of the economic world also however, amazingly, after it all, markets are now even HIGHER than before. Stocks and real estate like WWTTFF? I had to admit I was wrong and it is an inherently challenge for the smarts to admit their intrinsic analyses are flawed and even let go of the arrogance of thinking one was right. If you had bought a property after COVID and say on it, you've made a boatload of equity.

You think things make sense because logic dictates (which you and I are absolutely correct) however, the sheep operate different to us and will borrow even more money through money lenders/ payday advances to survive and thrive. Never underestimate the will for humanity to survive, they will steal, cheat and rob to pay their mortgage and put food on their tables and when you multiple this by all the millions mortgagors in this country. They can keep the Ponzi going albeit being extremely fragile is where the govt comes in with fiscal support.

In fact, it's the masses and herd determine markets not you or I in our analyses. We are the 5-10% that use our intellect to predict price direction, when masses and society that control prices and there's nothing to say that prices may not go up, stabilise or go down.

What a load of nonsense.

Looks like ol' clown world managed to look up "congruence" in the dictionary, but hasn't mastered singular and pluralised verbs yet.

Looking at Trademe figures.

Nationally the number of properties advertised for sale between 1 November and 1 December increased by 24%.to 24604 properties.

the number advertised to let increased by 10%

In Auckland over the same time the for sale increased by 27% to a total of 10031 properties.

The number advertised to let increased by 12%

So as usual Auckland leads the charge. Of course not all agents list all of their properties on Trademe so there will be more than this number.

Kaaarkkkkkk!!!!

A lot assuming that 'Mum n' Dad' require home loans. Do folks assume Luxon and the likes are servicing mortgage debt?

I don't imagine so.

Of course they have mortgages - you don't use your own money to buy houses ... it's all about leverage

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.