This content was supplied by CoreLogic.

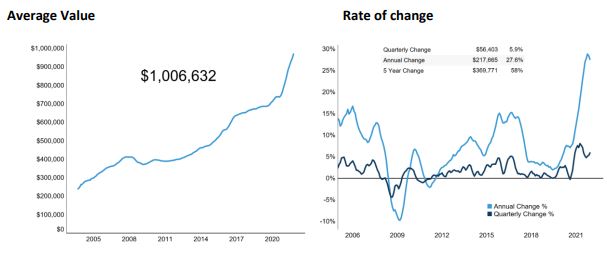

CoreLogic’s House Price Index (HPI), ... showed some heat remains in the property market, though the signs of an upcoming cool-down linger. Nationally, property values rose 1.9% over December, a slight lift on November’s rate of growth (1.8%).

The December reading closes out a record year for the Aotearoa property market, with 27.6% growth over the full calendar year exceeding the previous record of 24.4% growth witnessed in 2003. The average value of a New Zealand home now exceeds $1m for the first time, sitting at $1,006,632.

CoreLogic NZ Head of Research Nick Goodall said “2021 has truly been a remarkable year in the property market, with low interest rates and the continued ability for most borrowers to secure finance both key contributors to persistently strong demand for residential property. It must be acknowledged though that both these factors are changing.

“Since the changes to the Credit Contract and Consumer Finance Act (CCCFA) on 1 December 2021, which brings greater scrutiny of a potential borrower’s expenses and ability to repay their loan, feedback from mortgage advisors has been very strong that the tightening has gone too far.

“While the changes clearly haven’t impacted all borrowers immediately, with values still rising at above average rates, they are likely to be felt more widely throughout 2022 as rising interest rates and diminishing affordability combine to reduce borrowing capacity,” said Mr Goodall.

CoreLogic House Price Index - National

Mr Goodall said despite persistently strong monthly value increases, the annual rate of growth dropped for the second month in a row after peaking at 28.8% at the end of October 2021, illustrating nothing can grow forever.

The big question now is whether the conditions turn so much that values actually start to drop. High inflation is leading to forecasts of continued upward movement in the Official Cash Rate (OCR). The Westpac economics team, for example, forecast the OCR to hit 2.00% by September 2022. But with responsible lending practices ensuring both equity (through loan-to-value ratio restrictions) and servicing of mortgages (through assessment interest rates) can handle market change, alongside a strong labour market, the likelihood of forced sales or even motivated vendors remains low.

From a supply perspective, listings have swung to the positive which will improve choice for buyers and subsequently reduce some vendor power over pricing, but unless the vendor is an investor looking to divest their portfolio due to reduced profitability, their willingness to accept less than its perceived value will also be low – at least for the early part of 2022.

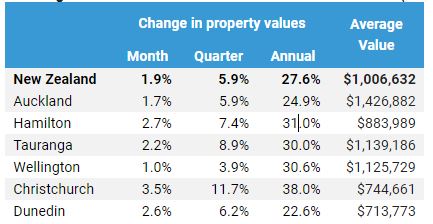

CoreLogic House Price Index - National and Main Centres

Looking into the index results for the main centres, momentum has been sustained in the final month of the year, however there have been some dramatic shifts in the annual rates of growth in both Tauranga and Wellington.

In Tauranga the annual rate of growth slowed from 35.8% at the end of November to 30.0% at the end of December, while in Wellington it dropped from 33.5% to 30.6% over the same period.

Christchurch continues to experience very strong monthly growth, at 3.5% over December, which takes the annual rate of growth to 38.0% extending the record breaking figure achieved last month.

Meanwhile the annual rate of growth in Auckland slightly dipped to 24.9% (from 25.7% in November).

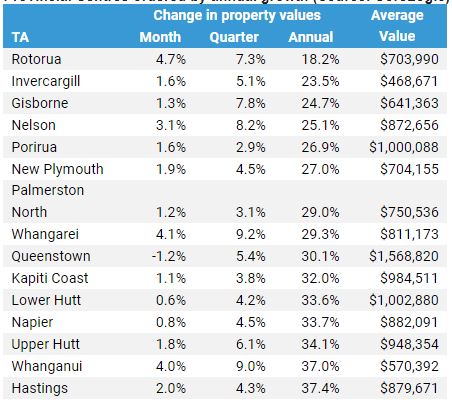

Provincial Centres ordered by annual growth (Source: CoreLogic)

The overarching trend across the provincial centres is that of a reducing rate of annual growth, though similar to the nationwide results momentum has remained in many of them.

The recent acceleration in property value growth in Queenstown has hit a speed bump, with values seeing a -1.2% drop in December, taking values back below the $1.6m mark they exceeded at the end of November. Previous optimism from the proposed border opening may have been scuppered by the arrival of the Omicron variant of Covid-19.

Further growth in both Lower Hutt (0.6% in December) and Porirua (1.6%) has seen the average property value in both cities tick over $1m. Nearby Kapiti Coast is also approaching this figure (currently $985k) after 1.1% growth in December.

Recent growth hasn’t been quite as strong as other provincial centres in both the Rotorua (18.2% p/a) and Nelson (25.1%) markets in 2021, however they have both finished the year with solid momentum, seeing a lift across all three growth periods.

Similarly Whangārei and Whanganui finished the year strongly, with 9.2% and 9.0% growth respectively over the final three months of 2021.

| Territorial authority | Average current value |

12 month change% |

3 month change % |

| Far North | 660,918 | 28.2% | 8.0% |

| Whangarei | 811,173 | 29.3% | 9.2% |

| Kaipara | 862,096 | 36.9% | 7.9% |

| Auckland - Rodney | 1,326,244 | 27.5% | 7.4% |

| Rodney - Hibiscus Coast | 1,268,459 | 25.6% | 6.5% |

| Rodney - North | 1,378,445 | 28.9% | 8.3% |

| Auckland - North Shore | 1,593,625 | 21.5% | 5.6% |

| North Shore - Coastal | 1,838,185 | 22.4% | 6.1% |

| North Shore - North Harbour | 1,497,050 | 19.6% | 2.7% |

| North Shore - Onewa | 1,308,881 | 22.1% | 7.2% |

| Auckland - Waitakere | 1,146,195 | 25.7% | 4.7% |

| Auckland - City | 1,646,026 | 22.6% | 3.5% |

| Auckland City - Central | 1,348,543 | 15.8% | 0.5% |

| Auckland City - Islands | 1,553,231 | 27.2% | -3.9% |

| Auckland City - South | 1,508,755 | 23.9% | 5.3% |

| Auckland_City - East | 2,109,969 | 25.9% | 5.0% |

| Auckland - Manukau | 1,296,302 | 28.9% | 9.7% |

| Manukau - Central | 1,037,400 | 32.7% | 10.2% |

| Manukau - East | 1,630,298 | 26.6% | 7.4% |

| Manukau - North West | 1,108,595 | 26.6% | 8.8% |

| Auckland - Papakura | 1,022,126 | 32.5% | 9.9% |

| Auckland - Franklin | 994,779 | 34.4% | 11.3% |

| Thames Coromandel | 1,122,613 | 29.7% | 0.3% |

| Hauraki | 630,253 | 25.9% | -1.4% |

| Waikato | 759,435 | 36.0% | 14.0% |

| Matamata Piako | 705,105 | 30.5% | 7.7% |

| Hamilton | 883,989 | 31.0% | 7.4% |

| Hamilton - Central & North West | 825,298 | 33.5% | 7.8% |

| Hamilton - North East | 1,105,660 | 32.3% | 9.8% |

| Hamilton - South East | 807,825 | 29.7% | 5.2% |

| Hamilton - South West | 774,185 | 26.3% | 5.0% |

| Waipa | 879,558 | 30.1% | 6.3% |

| Otorohanga | |||

| South Waikato | 458,051 | 41.1% | 12.1% |

| Waitomo | 377,574 | 36.8% | 23.8% |

| Taupo | 821,844 | 32.9% | 2.2% |

| Western BOP | 995,631 | 31.5% | 8.7% |

| Tauranga | 1,139,186 | 30.0% | 8.9% |

| Rotorua | 703,990 | 18.2% | 7.3% |

| Whakatane | 721,234 | 35.7% | 6.8% |

| Kawerau | 409,890 | 26.9% | 5.4% |

| Opotiki | 505,706 | 38.3% | 6.4% |

| Gisborne | 641,363 | 24.7% | 7.8% |

| Wairoa | |||

| Hastings | 879,671 | 37.4% | 4.3% |

| Napier | 882,091 | 33.7% | 4.5% |

| Central Hawkes Bay | 618,755 | 41.6% | 9.4% |

| New Plymouth | 704,155 | 27.0% | 4.5% |

| Stratford | 474,019 | 30.9% | 2.0% |

| South Taranaki | 434,696 | 38.0% | 9.1% |

| Ruapehu | 415,767 | 38.2% | 13.5% |

| Whanganui | 570,392 | 37.0% | 9.0% |

| Rangitikei | 492,650 | 40.2% | 9.6% |

| Manawatu | 677,733 | 29.5% | 6.8% |

| Palmerston North | 750,536 | 29.0% | 3.1% |

| Tararua | 467,674 | 55.4% | 3.2% |

| Horowhenua | 663,844 | 37.0% | 5.0% |

| Kapiti Coast | 984,511 | 32.0% | 3.8% |

| Porirua | 1,000,088 | 26.9% | 2.9% |

| Upper Hutt | 948,354 | 34.1% | 6.1% |

| Hutt | 1,002,880 | 33.6% | 4.2% |

| Wellington | 1,258,410 | 29.6% | 3.7% |

| Wellington - Central & South | 1,177,794 | 24.5% | 4.0% |

| Wellington - East | 1,383,669 | 32.3% | 5.2% |

| Wellington - North | 1,204,657 | 34.1% | 4.2% |

| Wellington - West | 1,450,639 | 29.9% | 3.4% |

| Masterton | 671,501 | 29.3% | 4.0% |

| Carterton | 742,010 | 39.0% | 3.2% |

| South Wairarapa | 904,924 | 30.3% | 11.5% |

| Tasman | 843,523 | 23.3% | 4.1% |

| Nelson | 872,656 | 25.1% | 8.2% |

| Marlborough | 715,719 | 24.4% | 4.6% |

| Kaikoura | 612,131 | 24.0% | 1.1% |

| Buller | 298,934 | 31.6% | 8.8% |

| Grey | 350,402 | 42.3% | 11.2% |

| Westland | 358,039 | 24.5% | -4.2% |

| Hurunui | 551,183 | 26.5% | 10.5% |

| Waimakariri | 665,395 | 34.4% | 8.5% |

| Christchurch | 744,661 | 38.0% | 11.7% |

| Christchurch - Banks Peninsula | 780,893 | 35.5% | 9.6% |

| Christchurch - Central & North | 855,602 | 35.8% | 10.8% |

| Christchurch - East | 569,620 | 38.8% | 11.1% |

| Christchurch - Hills | 1,005,920 | 34.0% | 10.9% |

| Christchurch - Southwest | 722,050 | 41.5% | 13.9% |

| Selwyn | 842,780 | 42.7% | 13.4% |

| Ashburton | 501,167 | 27.8% | 11.2% |

| Timaru | 479,328 | 17.8% | 2.8% |

| MacKenzie | 682,089 | 19.1% | 3.4% |

| Waimate | 377,552 | 30.0% | 10.8% |

| Waitaki | 476,298 | 24.0% | 6.6% |

| Central Otago | 730,867 | 23.4% | 1.8% |

| Queenstown Lakes | 1,568,820 | 30.1% | 5.4% |

| Dunedin | 713,773 | 22.6% | 6.2% |

| Dunedin - Central & North | 729,802 | 22.4% | 5.6% |

| Dunedin - Peninsular & Coastal | 652,281 | 24.2% | 4.4% |

| Dunedin - South | 687,791 | 21.6% | 9.5% |

| Dunedin - Taieri | 746,003 | 23.8% | 5.1% |

| Clutha | 392,716 | 24.7% | 1.8% |

| Southland | 469,029 | 30.8% | 11.5% |

| Gore | 375,601 | 29.8% | 2.2% |

| Invercargill | 468,671 | 23.5% | 5.1% |

| Auckland Area | 1,426,882 | 24.9% | 5.9% |

| Main Urban Areas | 1,142,295 | 26.8% | 5.9% |

| Wellington Area | 1,125,729 | 30.6% | 3.9% |

| Total NZ | 1,006,632 | 27.6% | 5.9% |

Note: The CoreLogic HPI uses a rolling three month collection of sales data. This has always been the case and ensures a large sample of sales data is used to measure value change over time. This does mean the measure can be less reactive to recent market movements but offers a smooth trend over time. However, due to having agent and non-agent sales included, the index provides the most comprehensive measure of property value change over the longer term.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and you can select any of our free email newsletters.

65 Comments

Interesting choice of photo for the headline

Extreme cyclists Hans Rey and Steve Peat snuck into the Cliffs of Moher site in the wee hours of the morning..

- their actions were widely condemned and criticised as "foolhardy" and "idiotic".

Apparently that ledge has since fallen 200 odd metres down into the sea. Video of the cycling shenanigans here:

If they wobble a couple of feet to the right they will be killed....not much different to cycling along the road here.

I honestly thought it must have been photoshopped. Good to see they are wearing their cycle helmets that will help.

Time for a DTI… surely??

The new consumer credit loan rules are probably covering that in a perverse way right now.

Not long now until Hamilton house prices surpass those of London.

Ignore the "doom and gloom merchants", this is just because Kirikiriroa/Hamilton is a hugely desirable place to live and it has absolutely nothing to do at all with the Tree-Taniwha in Te Whanganui-a-Tara/Wellington spraying it's koha across the motu with reckless abandon.

Incredible really that house prices keep marching upwards despite rising interest rates, draconian CCCFA laws with banks extreme vetting borrowers, removal of interest tax benefits for investors, LVR reinstated, brightline an effective capital gains tax, constant negative media and government and RB talking down the market.

Property is still instinctively the most favoured option for home dwellers, investors and developers.

I can’t figure it out. The only explanation I’ve got left is that people aren’t planning on paying these mortgages off before they retire let alone saving for that retirement.

Er no need to worry. Say it with more omph Existing Residential Asset EQUITY. Most buyers already have the magic numbers floating behind them. It is what drives the investors to be in a better position to buy than FHB and second home buyers also to be in a better position than FHBs. they don't need to even save a cent in deposit unlike FHB to get the mortgage. Now that is a hugely unfair playing field but it does explain why the banks credit crunch affects those at the lower end of the market & FHB much more than those with large portfolios (even though they are reporting low income and paying smaller amounts of tax than the average person).

I recently upgraded to a bigger house, was told that I would have no issue keeping our existing house as a rental and buying another place through equity leverage. No thanks, would rather sink that equity into our dream home even if it does mean foregoing additional income. Plus it's nice to be able to give another FHB a shot at home ownership.

Nzdan ......that's exactly what I did in 2017 and it was the best move I have ever made ...now out of all this property investor "madness" and watching from the sidelines......as to be "maxing out" on debt right now, as a property investor in Auckland you would have to have "rocks in your head" .....it's the first home buyers I feel for and if I had a young family, a trade or profession and contacts in Aussie, I would be buying a one way ticket across the Tasman ASAP ! .....and I can back that up, as have lived over there twice - Sydney and Perth, but now I would prefer Melbourne, as have family there.

REA's seem to be leveraging recent-past, astronomical price increase rates to capture new business (we can get you more than the others / property 'x' over the road is listed for 'y' moonbeams and there's interest at that price) and / or perceived market momentum with a smattering of high-value sales is persuading vendors to keep reaching for the stars. If you are desperate to buy, watching your deposit waste away by the hour, what choice does one have? How long does one wait? Will the music stop (as it has in the past), or will it keep playing?

If you are desperate to buy, watching your deposit waste away by the hour, what choice does one have? How long does one wait? Will the music stop (as it has in the past), or will it keep playing?"

Is it your experience Befuddled, if so commiserations

The average value is strong, will remain astonishing till 2023 because labor will not take any action.

Govt has kept their promise of keep ticking the price until they are in power.

Happy buying for those who want to be indebted for there life..

Adrian Orr drops his mic, flicks his hair back and swaggers off stage to the imaginary cheers from the crowd.

So much inequality has been created in NZ.

Those that own property have got much richer. Those that do not own property have got much poorer. The government has failed their base supporters.

Interest rates have been set far too low. There has been too much “printing of money”.

Renters in the provinces will be the worst affected over the next decade as private rental supply decreases & rents keep climbing. There is now no easy fix.

Labour has indeed abandoned its core voting block. Will indeed be an election on interest in a couple of years.

Report in PI mag. On rotorua ...

"A couple of years ago Rotorua Rentals would have 25 properties advertised on any given day whereas that number has now dipped to an average of eight"

"Many landlords threw their hands up in the air and said 'I'm done'. They have left the industry and sold leading to good tenants being displaced and rising homelessness"

I am not sure but did anyone predict this outcome? I know that no one in the govt did when Little and Nashi told landlords about 3 years ago on the national news "sell up!" The chickens are at home roosting now.

Where did the houses go then because they certainly did not stay empty and are indeed still housing a family now in a much stable position then where they would have been poor tenants before. Or did the new landlords just builddoze and build more properties on the same section (housing even more poor families than before). Either way you look at it the sales are a benefit if an owner occupier or developer buys but a drain on society and harmful act when it is a landlord without the means to maintain their assets to ensure basic habitation standards (i.e. do not severely harm & disable those in them) but decides to strip the families of huge amounts of their income leading them to sacrifice health, stability and wellbeing. NZ has known problems with its housing stock leading to disabling and deadly health outcomes and are severely unaffordable in rental rates. Don't try to paint it that it was charity to rent the properties when getting the benefits of your mortgage paid by someone else so you can have a steadily increasing financial asset with little risk of loss or duty of care.

The ghost home princess Jacinda denies are a problem for some strange reason? https://www.nzherald.co.nz/nz/ghost-houses-increasing-why-are-40000-hom…

Yes you dont get it as sand is covering your face etc. You have the quote from PI magazine I suggest you get a copy and study the full article. It was always said it would happen .... now there is evidence.

Ar article in an industry magazine is not evidence.

You seem to miss the fact that (all other things being equal) it's better for a home to be owner occupied than rented.

I dont care if you want to be obstinate.... I took a quote that gives a fact (was 25 now 8). You can keep denying and making out it is a conspiracy until it is too obvious to ignore then find another scape goat

Anecdotally on the ground I have seen no evidence of landlords selling up in significant numbers in Rotorua.

Déjà vu anyone?

When was that?

What an unmitigated disaster.

Mr Goodall said despite persistently strong monthly value increases, the annual rate of growth dropped for the second month in a row after peaking at 28.8% at the end of October 2021, illustrating nothing can grow forever.

...housing prices are worth whatever a bank will lend to buy a house.[my emphasis] Link

..it can be plainly seen today that the most important macroeconomic variable cannot be the price of money. Instead, it is its quantity. Is the quantity of money rationed by the demand or supply side? Asked differently, what is larger – the demand for money or its supply? Since money – and this includes bank money – is so useful, there is always some demand for it by someone. As a result, the short side is always the supply of money and credit. Banks ration credit even at the best of times in order to ensure that borrowers with sensible investment projects stay among the loan applicants – if rates are raised to equilibrate demand and supply, the resulting interest rate would be so high that only speculative projects would remain and banks’ loan portfolios would be too risky. - Link - section II-3

Or put another way, what ever they will lend to refinance a house.

Looking at the NZD it looks like Orr is now in the process of destroying that too.

Nah. Rising US

It does now take a pile of a million New Zealand dollars to buy the very same houses in New Zealand, if that's not a loss of the value I don't know what is.

Whangarei is always the first to collapse. Been looking at for sale prices up there and they are dropping.

https://www.trademe.co.nz/a/property/residential/sale/northland/whangar…

https://homes.co.nz/address/whangarei/maunu/74-puriri-park-road/AxLML

For sale, enquiries over $799k. Good luck with that.

40% profit in 3 years / $225k tax-free - not bad. Why bother working? And hardly a 'drop'.

I'm noticing a lot more prices being specified in Havelock North, which is known as an area where a lot of people are running on the ragged edge trying to appear wealthy.

Meanwhile, this...

https://www.trademe.co.nz/a/property/new-homes/house-land/hawkes-bay/ha…

...was on the market as a house and land package about 3 years ago, around the $1.5M mark, and never sold. I suspect the developer has been emboldened by the property next door selling for $1.7M in 2019 and homes.co.nz now valuing it at $2.81M. Ripper of a pay day if he pulls it off.

So the average property in NZ is now 1mil. The average salary is 56k. That gives us a DTI ratio of about x18.. (that’s nuts!!)

How has this been allowed to happen? When the government and the RB sensed trouble, they lit up the housing market to support the economy. The fact that they lost control of the numbers on the way up gives me hope that they will lose control on the way down. Jacinda has stated she doesn’t want to crash the market… given her track record, I’d bet on it.

gives me hope that they will lose control on the way down

Tom, I understand your wish for house prices to go down if you want to buy a house but I don't think you fully understand what "losing control of the housing market on the way down" would mean. You would certainly not be able to buy that coveted house, nobody would lend you money anymore to buy it.

Absolute drivel.

They may not be willing to lend to let you catch a falling knife as the bubble implodes, but once prices bottom out and stabilize it is business as usual for the money lenders.

I already have a house. Hard to believe huh.

I’d like to change that last statement. The bank own the majority of the house. My name (and my partner’s ) is against the debt. I always have had some admiration for the freedom that renting gives you. Having a mortgage is great for security but renting allows you to move around and live without the commitment of maintaining a place. There is a social stigma about not owning the roof over your head that I feel is misplaced. Everyone should have the choice though, and I can’t wait till the day we return to that. Too much emphasis is placed on home ownership in NZ and it’s locked a lot of people out of the market. Would I go into negative equity if it meant an even playing field for non homeowners?? In a heart beat. All the gloaters and rub it in your face commentators on here really are the pits. They for me are the low end of society.

That’s good for you.

The property owner also has the choice to rent their property and rent something else if they so desire to have the choice of flexibility.

Having rented all my life there is no comparison to owning. Your mental health is much better as a result.

Good banter Tom thumb

I already have a house. Hard to believe huh

Yes, very.

It is bad when you have to describe a slowdown in the annual rate of growth that is still miles better than any balanced managed fund performance as a drop in the market. If that is a drop then the next lotto & superball winners are experiencing a worsening of fortunes (quite apt though considering the winnings have not kept pace with housing inflation).

Sure, New Zealand property has bulldozed all prior predictions of decline but "this time it's different". Rates are low, inflation is high and there are plenty of greedy little kiwis looking to jump aboard the magical money machine that is residential housing.

None of the tea leaf sifters have any credibility left now. High prices have historically begot higher prices which is classic reflexivity. Let's not pretend to be any cleverer than we are, eventually a crash will come but how to make money or avoid losses is probably more important than a causal analysis or exact timing.

Try reading the article again but replace the word growth with the word inflation it might make a lot more sense.

I stood out the back of my house a couple of nights ago with my wife, looking out over our modest rural acreage. We felt truly blessed to have been able to purchase the property a couple of years ago, for more than we would have preferred to pay, but it was a once in a lifetime opportunity.

But we were also sad, because we had hoped our children would one day be able to buy us out and continue the work we're doing on the land. Looking at the prices around us now I cannot see that ever happening without them becoming blindingly successful in their chosen professions, whatever they may be.

I note Kainga Ora splashed out $6.5M on just under 9Ha of land (RV $1.61M) on the outskirts of Napier a few months ago to build state housing (note: this is the term used in the government gazette). Perhaps one day that's the fate for our land, and our children/grandchildren can take those proceeds and buy a 2-bed ex-state do-up in Hastings.

we had hoped our children would one day be able to buy us out and continue the work we're doing on the land. Looking at the prices around us now I cannot see that ever happening

You can sell or gift or part gift your house to your offspring at whatever price you choose, especially if you'd like them to "continue your work". I find your post very weird

It sounds like a humble brag.

If that's what you took from it, sure. I was tired. I'll try again, with less poetic licence and more Facebook..

We bought a place. Then people around us bought too. They paid more. Now our place is "worth" more even though it's still a run-down, barely-habitable dump on a big patch of dirt (#humblebrag). Unless they become Instafamous our (NZ's, not just ours) kids will struggle to afford even that because the current power generations are pushing it out of their reach. This makes me sad. :(

The government are buying lots of land at even higher prices that make don't even attempt to resemble market value. This pushes prices even higher. This is even worse for our (again, NZ's) kids, because it's also concentrating socially vulnerable families in small areas where, from experience (#humblebrag), it becomes survival of the most violent. This also makes me sad. :(

Million bucks for a 3 bedy in AKL near multiple beaches, all the playgrounds you ever want (hunting fishing etc etc, beautiful views good climate no animals that want to kill you only a few hrs flight to the most beautiful islands such as raro fiji. Yea ill pay that and some.

The Economist - Three fundamental forces mean the global house price boom may endure for some time yet:

https://www.economist.com/finance-and-economics/how-long-can-the-global…

^ paywall, but republished on stuff: https://www.stuff.co.nz/business/300490617/how-long-can-the-global-hous…

Kiwis would love access to long term fixed rates like the US & now Europe.

I live at the Mount and have a rental property here. I have owned these properties for 18 and 21 years respectively. From the figures I have seen, they rose in value by some 30% last year. Lucky me. My share portfolio fared much less well, so why would i say that I much prefer the stockmarket to the property market?

Well, these property values are simply estimates, while I know precisely how my shares performed. In fact my best performing 7 holdings rose by 33.60% while my largest holding rose by 76%.

If I had to choose one word to differentiate the 2 markets it would be flexibility. To cash in on the estimated gain on my rental, I would have to put it on the market. That would probably mean the tenant leaving-who has been there for over 11 years- and thus losing the income. the whole process would take months, be costly in fees and commissions and might or might not result in me achieving the est. value.

Contrast that with the stockmarket. Last year, I unexpectedly found myself needing to find a six figure sum to fund cancer drugs that are not funded by Pharmac. I was able to quickly, easily and cheaply pull money from my holdings for that purpose.

I am happy to have a foot in both camps for diversification, but much prefer the stockmarket as an investment and over many years, it has indeed outperformed the property market.

If you bought your house 20 years ago for say $250k, you would have invested $50'000 deposit into it (20%). That house would now be worth about $1 million so you made a gain of $950'000 or 1'900% in 20 years. I doubt you got 1'900% return on your shares

So, lovely if you were born early enough to be able to do that.

And that's the problem Yvil - home ownership and wealth has increasingly become a matter of timing and luck.

It's an awful situation for our country's collective future, but nice for certain individuals who were able to do that.

If you believe in the law of the jungle, then I guess you think it is a great thing.

HouseMouse,

"If you believe in the law of the jungle, then I guess you think it is a great thing". I know that I am one of the lucky ones and though it's easy for me to say so, I really don't think it is a great thing. I have always invested for income, not growth, so the est. value of these properties has never concerned me. As regards my home, should i wish to move in this area, then the price of anything I want to buy will also have risen and I would be no better off.

I would have much preferred to see house values on a much lower trajectory, giving young people the same opportunities that my generation had. When i bought my first home, I could only borrow 3 times my income, with no allowance for my wife's income.

Interesting that you could only borrow 3 times your income, given that 3 times ones income today is just the deposit.

I wonder why people in your generation didn't just save cash and buy the house outright, term deposit rates were significantly higher back then along with mortgage rates so it's a no brainer. But instead we incessantly hear about 2nd and 3rd mortgages and 20+% interest rates, and how the youngin's have it easy today.

Yvil,

Disappointing. I expect better from you. You have just made up figures to prove a point. In fact, both properties were bought outright. The rental has given me a return of approx. 600% excluding net rent and that's fine. That is based on an est. value. I can't make a direct comparison with my shares as I started buying them in 2004 and gradually became fully invested over the next 8 or so years.

Since March 2003, the NZX50 has produced a return of 582% though it is of course a gross index-dividends included. My portfolio has significantly outperformed the NZX50. I spent most of my career in the financial world.

So far short of the property investment return of 1'900% if you'd done it properly, disappointing, I expected better of you...

Yvil,

I don't think you can be well, so it's best to draw a line under this unenlightening exchange.

The markets still pumping. When you start talking "Drops" you need to take a step back, the gains are still crazy at 2% a month, it needs to drop to a fraction of that, even 2% a year now would still be high on top of the recent gains.

Fed just announced a 2-3 year plan for steady increases in rates. US markets acting like crack babies being told to stop their medication. Cant have any further impact here surely...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.