A huge surge in the number of homes on the market comes at the same time sales have plummeted.

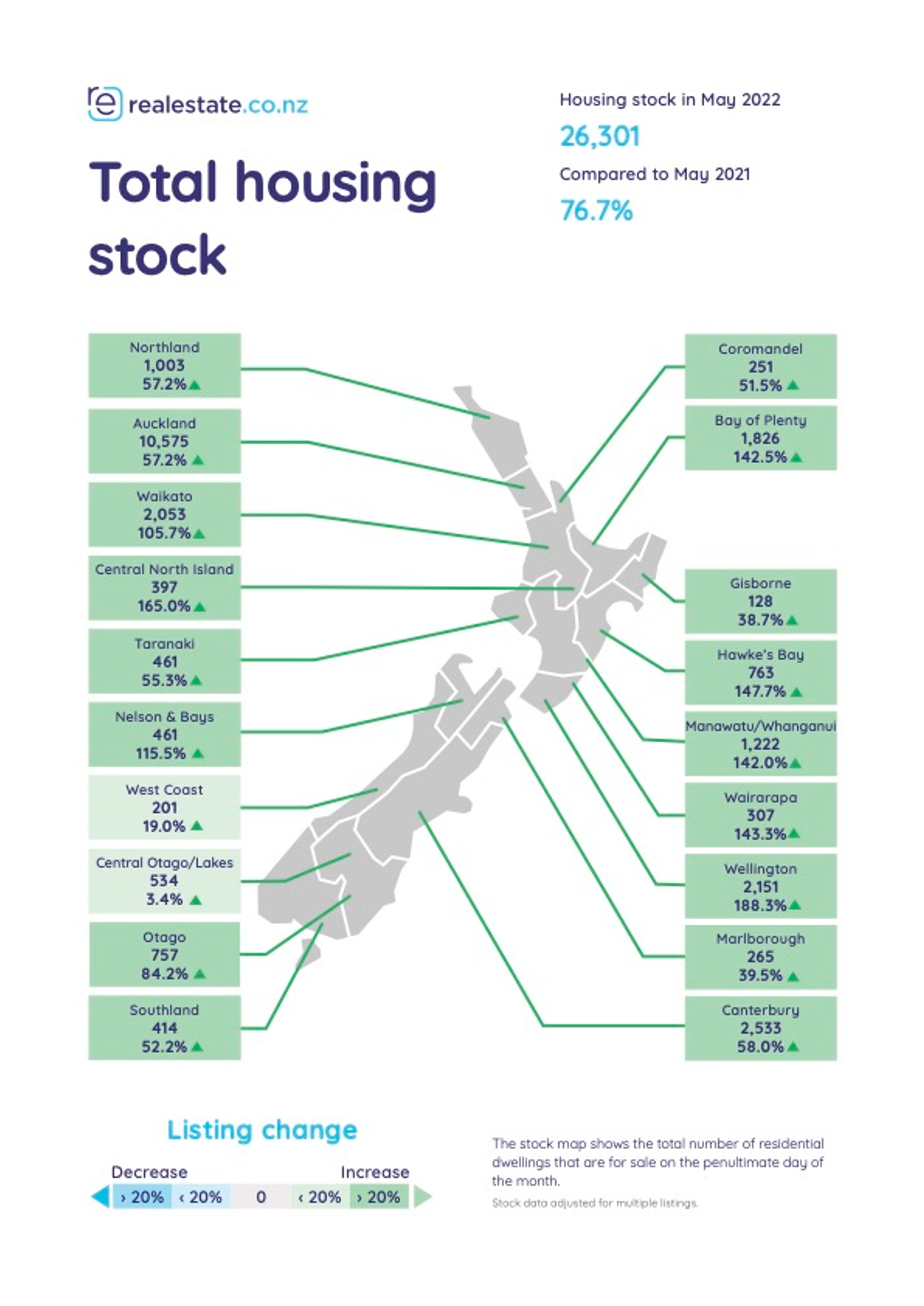

Property website Realestate.co.nz had 26,301 residential dwellings available for sale at the end of May, up a whopping 76.7% compared to the end of May last year.

The number of homes available for sale was more than double what it was a year ago in many regions, with the biggest increases occurring in the Wellington region where stock levels were up by 188% compared to May last year, followed by the central North Island +165%, Hawke's Bay +148%, Wairarapa +143%, Bay of Plenty +143%, Manawatu/Whanganui +142%, Nelson & Bays +116% and Waikato +106%.

The chart below shows the number of homes available for sale in all regions at the end of May compared to the end of May last year.

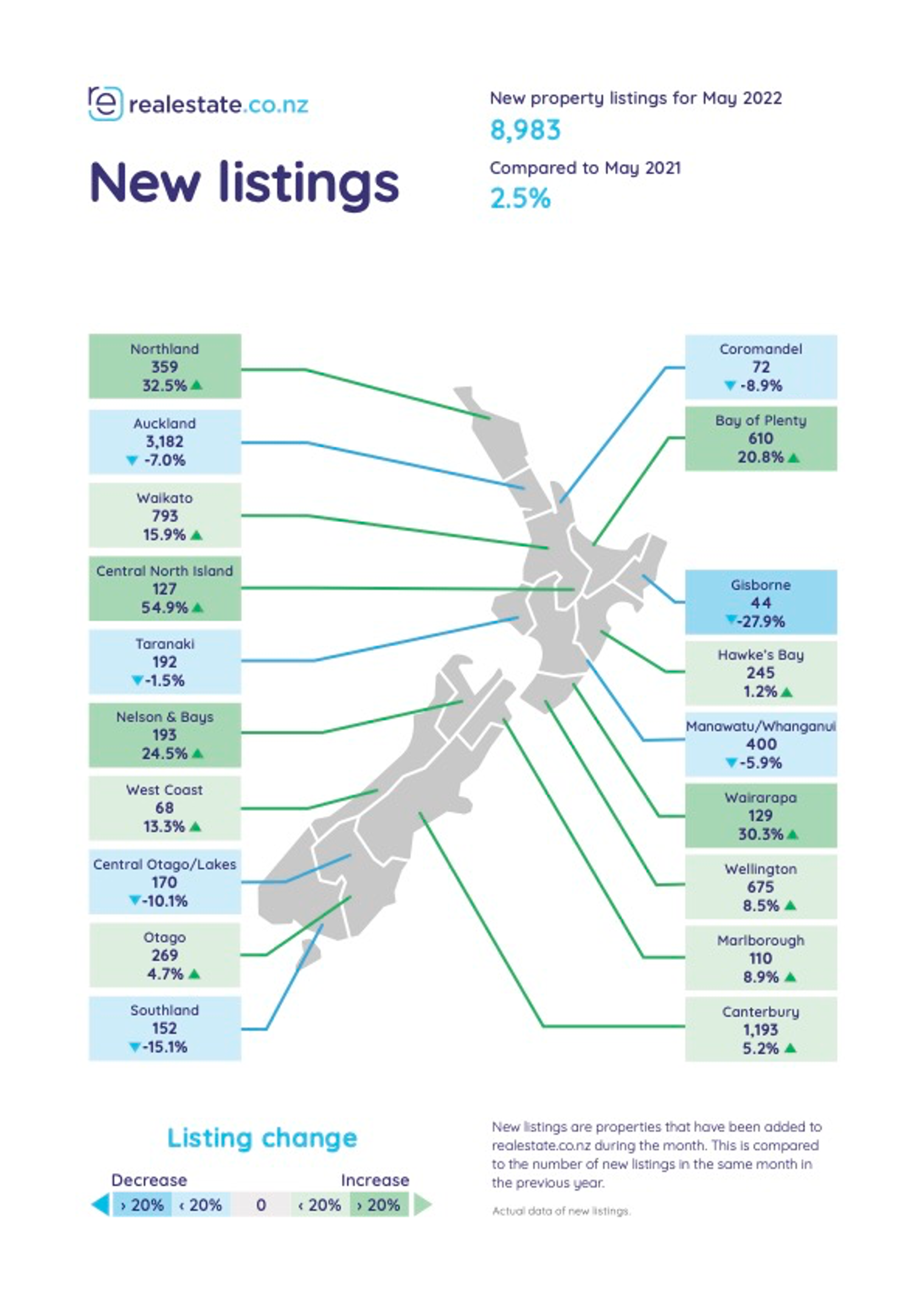

Significantly, new listings across the entire country in May were up only 2.5% compared to May 2021, the second chart below shows new listings by region.

So the increase in stock levels is due almost entirely to a slowdown in sales.

According to the Real Estate Institute of New Zealand, there were 4860 residential properties sold in April this year, down 35% compared to April last year.

There are signs that the high number of properties on the market and low level of sales is starting to affect asking prices.

Average asking prices were lower in May than they were in April in 11 of Realestate.co.nz's 18 sales districts.

The biggest declines in average asking prices were in Waikato where they were down 15.5% in May compared to April, followed by Gisborne -9.2%, Hawke's Bay -5.9% and Southland -5.8%.

For potential buyers, the increase in stock levels and easing in asking prices is obviously good news.

And with so much stock to choose from they can afford to take their time and negotiate hard to get a good deal.

For vendors the market has become more difficult and they will need to pay particular attention to having their properties well presented and realistically priced to ensure a sale over the coming months.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

65 Comments

Wow, some of the numbers coming out in recent times are staggering! I commented a while ago that I didn't believe there was a "shortage" of housing, just a shortage of houses for sale after hearing people in the game comment "House prices will always go up as there is always a shortage of houses".

Looking around my neck of the woods lately there are a ton of houses on the market and many are not selling having been on the market in excess of 6 weeks. You could say we have an 'excess' of houses!

Some penthouse apartments in Palmy North are still on the market after 9 months, even with $100K+ price drops.

Is there really a penthouse in Palmy, is that a thing? I'd consider that a red flag.

... probably fat fingered the button , meant to be a " tenthouse " in Palmy ... Warehouse special , camping out for the winter in a discount tent ...

'Is there really a penthouse in Palmy?'

Yes it's pages are stuck together and it's in Tim's wardrobe

AP (Ad Punctum)

There's 2 on Rangitikei Street I believe. Other than that one above the pub on Princess street.

I've been suspicious about the so called housing shortage for a couple of years, particularly when borders closed and house prices rocketed up. This 'shortage' would be correctly described as an 'allocation issue'. With falling house prices I think we may see this allocation issue resolve itself.

Looking around my neck of the woods lately there are a ton of houses on the market and many are not selling having been on the market in excess of 6 weeks. You could say we have an 'excess' of houses!

Yes. Everyone's running for the exits. Question is: where are they going?

Strange the way some people think. Most of the sellers will buy something else, there is no "Excess" of houses. Numbers on the market are being compared to the market during Covid so not a fair comparison. I have been tracking the numbers for sale in Tauranga for about 3 years now, numbers for sale are only now back to what they were pre-Covid. A whole load of people now want to move because it was just a nightmare to do so during Covid. I'm sure a few speculators and the overleveraged are pulling the plug but the percentage would be small.

If there was an excess of houses there wouldn't be lines queuing up at rental open homes and prospective renters in tears.

I get the schadenfreude, but your average renter is going to get belted just as hard as a property owner, harder in most cases.

Is that still the case? Wellington shows an excess of rentals currently

I've been loosely following, regional listings up from 1350 to 1450 in four weeks - 25 listings per week (I said 10 - 20p/w in a comment on here a few days ago, but checking the data, 25p/w). Many price drops, many past their availability date. Seems as though the jig is up in Wellington in particular. House prices and rentals are both dropping.

Every part of the country is different, but the stories are coming out now.

Inventory building in Auckland too.

I've been tracking Christchurch listings for about 6 years. Listings are nowhere close to where they used to be 5 years ago. Listings are even less than in April 2020 when we were in lockdown!

What is more interesting is the nature of those listings. Most of them are for those crappy new build townhouses. There are hardly any unsold stand alone houses, or older units with garages and decent backyards. This is likely to get worse as the townhouse completions add to the stock on market due to all those who purchased them off the plan with the intention of profiting from an immediate resale (and no intention of occupying them), those buyers that can no longer get approved for finance, investors who can no longer afford a cashflow negative property due to higher interest rates, and those over leveraged developers who scaled up volumes dramatically thinking that the gravy train would continue forever.

I would be interested to see if its the same in other towns - are the unsold listings established or new build properties?

My guess on people moving to Christchurch over the past 2 years is that 2021 they realised they were officially "locked out" of the Auckland/Wellington property market and saw Christchurch as 1/2 to 2/3 the price whilst still being around a city and without moving country. Have you found similar views on people moving there?

The thing is that some these sorts of high intensive housing struggled to sell in the good times. They seemed to be more of a vehicle to sell a loan package

House price rise was not because of supply as our polticians and rbnz keeps repeating, it is an excuse just like TRANSITORY INFLATION based on ehat they goofed up in a Big way.

Ashley Church used to roll out that ridiculous argument that if there's houses for sale there cannot be a shortage ....

... never could tell if he was deliberately bull sh*tting us , or if he actually believed it ... either way , you gotta larf at the sheer insanity of it ...

I've seen that argument put forward on here, too, apparently unironically.

Sadly some people's brains are only just sharp enough to scratch around on the very surface of logical thinking and they don't realise there's a sub-soil they aren't troubling.

'If there's houses for sale there cannot be a shortage" is one of the best of Ashley's numbers in one of his best musicals.

Up there with 'Prices Double Every Ten Years (Baby)"

Houses for sale almost doubled, credit halved.

The laws of universal gravitation now applies to the NZ housing market.

When two objects interact, they apply forces to each other of equal magnitude and opposite direction or in other words what goes up must come down.

Wow the feeling of impending Doom has increased by 11% since yesterday!

Probably we need an 'impending doom feeling-onometer'

Sharron Zollner's time has come!

Just been listening to Real Estate mogal and Shart investor Barbara Corcoran.

The US market must be heading in another to ours based on what she said.

Demand is out stripping supply.

She advised people to not approach your buying a home as an investor but as a home buyer for your family.

She then said to trade up,trade up trade up.

She said that most middle class people have their wealth in their house and that helps in retirement.

Get in the game she said.

Thats my interpretation of what she said.

She owns a real estate company so its in her interest to say that.... The facts are that you can get 30 year mortgages over there and they were going for 2.5% last year and now they are up around 5.3%, while the demand is still there, credit is being restricted which is a good thing... also houses are far cheaper in the US than here aside from the expensive cities.

those 30 year 2.5% were a sweet deal, 30 years is a long time

US is just starting to turn, much like our housing commentators, sounds like she is looking back not forward.

The real estate data rolling in for April and May shows that the U.S. housing market is softening. New home sales fell 19% to their lowest level since April 2020. Redfin reports 19% of home listings cut their price over the past month. Inventory is rising fast, while mortgage applications and existing home sales are also falling.

Source here.

When she said most of their wealth is tied up in housing, she might be correct n some states, or one type of asset compared to the many other types, But the average American has only 35% of their wealth in property, whereas NZ has approx. 65%.

Maybe that's because the Americans have something other than houses to invest in, and their houses aren't priced as high as NZ's

The "Pump" is finished, and now the "Dump" begins.

Houses will continue transact for less as credit continue to tighten and become more expensive, leading to a spiral of negative leverage. The regional markets have not felt the shift yet as being proclaimed by the property companies in those locations. It is important to remember they are always approx six months behind Akl and Welly "trends".

That trend is "freefall".

It's time in the market not timing the market....... ( WARNING joining the market right now may involve a long ... wait... until breakeven.....)

This is not a pause in the market like 2005 no this is FREEFALL

It's time in the market not timing the market....... ( WARNING joining the market right now may involve a long ... wait... until breakeven.....)

NZ is the new Japan?

Princes of the Yen.

What's playing out is a direct result of the excess QE the govt chose to do to cover the covid ''crisis.'' As most people are beginning to realise, covid was sensationalised by the media, over played our communist govt & well supported by their tertiary ''experts'' all at a huge expense. The cost of a home increased 40% over an 18 month period - madness on steroids.

To today: The artificial ''boom'' has to be lowered, somewhere near to reality (for wages etc) would be nice. It's never pleasant drifting out to sea when the 2-stroke wont start, but we need some balance to return to the country & the markets. The best bet in my opinion would be to remove the people who created it, but sadly, that option is not available this year. The second best bet is to sit tight & work hard (remember working?) & tough if out over the following 18 month period, of which we are already 6 months into. Life will go on. There is always hope. And the biggest hope of all is the JA & GR & co are banished to the wilderness where they can carry on achieving nothing at their own expense.

Perhaps the government needs study a little about risk management and diversity of investments..... much as i love our strategy of having an entire economy resting on one large export customer (ruled by a dictator) and the worlds most over-inflated housing market.

Just wish there was an alternative to these guys and 7-houses luxon.

Old 7-houses Luxon will be losing [paper] money hand over fist once the crash really gets going.

It will be interesting to see whether or not that changes voter's perception of him as a successful, savvy, businessman.

Luxon ran a big corporate, he has put his money in housing and wants to protect his investment (and those of his mates) by getting into power and reinstating a housing boom.

(Also i note he wants to raise the higher tax bracket so he gets more take home pay even though he apparently doesnt know what he will spend the extra money)

He has no skin in the game - lives in a different world to his voters and is hoping to get in just because Labour fails badly enough.

Whereas NZ needs a leader and visionary - Rebalance the economy, drive efficiencies in public sector, proper climate policies, sort health and kids out.

...gotta play his part in young Max Key's business plan too of course

Buying and selling on the same market doesn’t seem to equate to any serious level of doom for the majority of homeowners?

It does for builders tho....... they have a long build cycle , prices could fall 20% while inflation and supply issues cause the cost to build to rise by 20% or more, do the maths

And the numerous jobs and trades hanging off construction....

..a declining market is the best market to trade up in.

I love the term, 'profitless boom'

https://www.vice.com/en/article/dypaev/rich-bankers-say-your-life-is-ab…

The lowest number of houses for sale across the country on trademe last year that I saw was 17,000....it's been sitting above 32,000 for the past 4 months, it won't actually show any more than that number, also down the side it used to show recent home sales now it throws out random sales from random months from last year, unknown if intentional but an observation nonetheless.

I track the TradeMe listings. In April 2020 there were 30,500 houses for sale NZ wide. Auckland is currently about 20% higher (12,434) than in April 2020 (10,165) when we were all in lockdown. Christchurch is still lower (2800) than April 2020 (3200), and in the areas I follow still about half the number of listings from 5 years ago (which is why property prices began falling 2017-2019).

What I find annoying about TradeMe listings is there's no way to filter out "House for Removal" in the property search.

That 12,436 in Auckland today, for example, includes pages upon pages of house removed from developer sites.

How I do it is set a minimum price level like 100k or 150k. At that price you will still get the factory new-builds though

When did. realestate.co.nz start up in competition with Trademe? That will have affected the Aussie companies figures as realestate.co.nz picked up it's numbers. I check both, and I have to, because they both have heaps the other one doesn't.

"For vendors the market has become more difficult and they will need to pay particular attention to having their properties well presented and realistically priced to ensure a sale over the coming months."

Gone are the days when an old tired house sold within days of being listed, and at a good price too. As far as I can gather, its in the lowest quartile that a price decline is evident.

Winners of yesteryear are the losers this year. Or are they, just hunker down for a couple of years and see what happens.

Just another reminder of the laws of market dynamics.

Sales volumes up, prices up = bubble.

Sales volumes up , prices down = stable market

Sales volumes down, prices up = stable market

Sales volumes down, prices down = crash

Is this article referring to a news article/report on the realestate.co.nz website? If so, could you please link to it? Or has interest.co.nz just completed its own analysis of info obtained from re.co.nz?

House buyers have choice, correct but house prices are still holding for now.

10% fall after 50% to 100% is no good as lot to fall compare to rise.

Remember that mortgage has gone up by 60% compare to last year and is not the end.

The houses that manage to sell are down 10%, the ones that fetched an offer favorable to the vendor.

Mortgage pre-approval statistics would be a measure of market potential. Houses can only sell for what people are capable of paying. The crop of pre-approvals could be for amounts 30% lower than last year. Properties that fail to sell could be receiving offers much lower than the vendor's expectations, but these aren't measured in house price stats.

The Trademe Bot is busy today with

Method of sale change - Notification

Price Reduction Notification

Deadline sales in Turangi are well.... Dead.

Now listed with a double RV price by negotiation, oh the pain to come

https://www.trademe.co.nz/a/property/residential/sale/listing/356594797…

For 630k you can get a 3 bedroom house 30 mins to Melbourne CBD, 20 mins to Brisbane CBD, 10 mins to Perth CBD... cities with 2 million, 5 million odd people...

Or you can live 5 hours from any city in the middle of the country and get locked in during winter snowstorms and buy a house like that which in reality is worth about 150k max.

Would have sold for that about 2014, been a great buy ever since......

Another 2-3 seasons of fly fishing and things will have righted themselves......

You don’t need to be Sherlock to see housing market is crashing. Some people are still in denial any good investors would of jumped out end of last year, seems like the slow ones are starting to wake up.

Its hardly a crash. Tauranga is 0% change for the last 3 months and still up 21.7% YoY so my pick of single digit gains for the year is still a possibility. Places like Auckland that is just way over priced will get hit hard, I'm not expecting the regions to get slammed, people are bailing out of Auckland and moving North and South.

The regions always get slammed, read history of past corrections.... people cant move out of akl now, they are locked into a falling market

Carlos this is just the start house price’s downturn, housing crash is a slow motion crash just takes longer but same result. Some clues for you to watch, rates raising inflation high building companies going insolvent, average house price’s getting lower more stock coming on market.

"Places like Auckland that is just way over priced will get hit hard"

... Last I checked Tauranga wasn't far behind Auckland in the overpriced category. Similarly, it's price drops won't be far behind.

Acting like to today's prices are an indication of the near future standing still is just that, an act. Nobody is that stupid...

Tauranga's time will come just like all "the regions", that's glaringly obvious.

It's the final throes of the "denial" stage.

"Other people's houses may fall in price, but not mine"

Agreed Chebbo!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.