By Mike Blackburn*

Like so many industries, the residential construction sector is subject to external market influences (things that happen and effect your business that you have no control over).

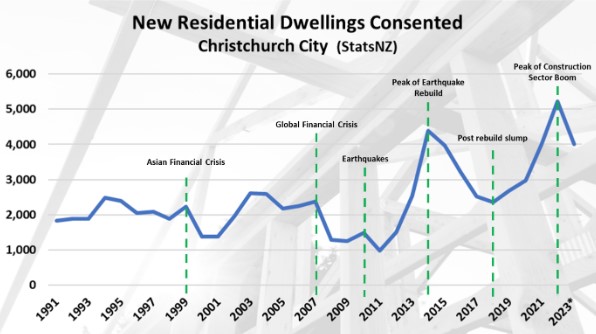

Over the past 30 years, the residential construction market here in Canterbury has seen several boom, then bust, then boom cycles. Almost all which have been driven by factors outside the control of individual builders or the wider industry.

Since 2018 (bottom of the post-earthquake rebuild slump), residential construction across the region has seen exponential growth in building consent numbers through to the end of 2022. This has culminated in the highest number of new residential dwellings consented, ever.

This is despite the “supply-chain crisis”, post COVID in 2021 and increasing interest rates in 2022.

However, it’s pretty obvious (if you have been paying attention) that the overall New Zealand economy has slowed significantly, and all indicators point to a recession.

So, what happens to residential construction during a recession?

The end result is that the number of new residential construction activity will fall.

Probably no surprises there, but lets unpack this a little and look at specifically what is happening and the direct impact that this will have on the residential construction sector.

Interest rates go up. The reserve bank puts up interest rates in an effort to make money more expensive (and essentially to slow the economy). This means that the cost of borrowing money goes up, and getting a mortgage or developer finance is harder to get.

High Inflation. Inflation is the measure of how much stuff costs to buy. There are two impacts on the construction sector here. 1. As the cost of stuff goes up (mortgages, groceries, petrol etc), people have less money to spend. 2. The cost of building materials goes up, which makes new houses more expensive to build…at a time when people can’t afford to buy stuff.

Low Consumer Confidence. The above two factors lead to the third. People have less money to spend and as a result buy less…this includes new houses.

There are a whole bunch of other factors and influences…but I reckon that these three reasons are enough to get you to understand that 2023 will see a downturn in residential construction activity.

Of course, you probably already know this. If you are in, or associated with the building sector, ask yourself what 2022 was like?

Most everyone that I have talked to over the past 12 months have said that sales were down, costs were up and money was harder to get…pretty much everything I have talked about above…right?

So, in fact, the residential building sector is already in a recession and probably has been for most of the past year.

Remember, pretty much all current construction was sold 12 to 18 months ago. As these projects start to come to an end, many builders are telling me that they have no forward work (or very little) to carry on with.

If you have been around for a while, then you will have seen all this before. That doesn’t make the current downturn any easier to navigate, but (hopefully) it will make you a little more aware of the impacts a downturn will have on a construction business.

Make no mistake, we are in for a tough 12 months (most likely longer), and there will be plenty of casualties along the way. However this too will pass.

Mike Blackburn is the principal of Blackburn Management. You can contact him here.

9 Comments

"Remember, pretty much all current construction was sold 12 to 18 months ago. As these projects start to come to an end, many builders are telling me that they have no forward work (or very little) to carry on with."

Not that I agree with them, but KO projects are continuing

KO builds only represent about 5% of the total. So very little potential to buffer the big slump that’s started.

Is that right?

Finally an article on this. Not an insightful one though. In fact very shallow.

Offer your insightful insights to interest.co then. A few other commenters have written articles, but it takes guts

I'm currently see builders posting on local social media community pages. Looking for work.

Great. I have a couple of building and landscaping projects that will keep a few tradies gainfully employed - I'm just waiting until they stop price gouging and are desperate enough for work that they will do it for reasonable $$$. But when I see people talking about getting $7000 per sqm quotes for building a basic 130 sqm house, I don't think we are there yet.

100% K.W.

In the same position and with build costs around $7000 per sqm - the total build cost + land cost + unforeseen build costs your looking well over any potential resale value....even at peak market 2021. The math does not work out yet.

There is a lot playing out domestically, in an election year.

Both from a cultural and an economic perspective.

If the Left win it's a mandate for the Left to push ahead under a leader who will not waste the mandate.

If the Right win, they will see it as a clear rejection of Left policies and a mandate to lurch Right.

Confidence to do things tend to get put on hold during such wondering....... which way things will swing.

The latest surprise 50bps may also cause a few to reconsider if this is the bottom of a light cycle

or actually just the very start of a major correction.

I wonder how interconnected residential construction is now and how fast the fire will spread.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.