House prices took a tumble in December, finishing the year on a soft note, according to the latest data from the Real Estate Institute of NZ.

The REINZ House Price Index declined -1.1% overall in December compared to November, led by lower prices in the Auckland market, where prices were down -2.3% for the month.

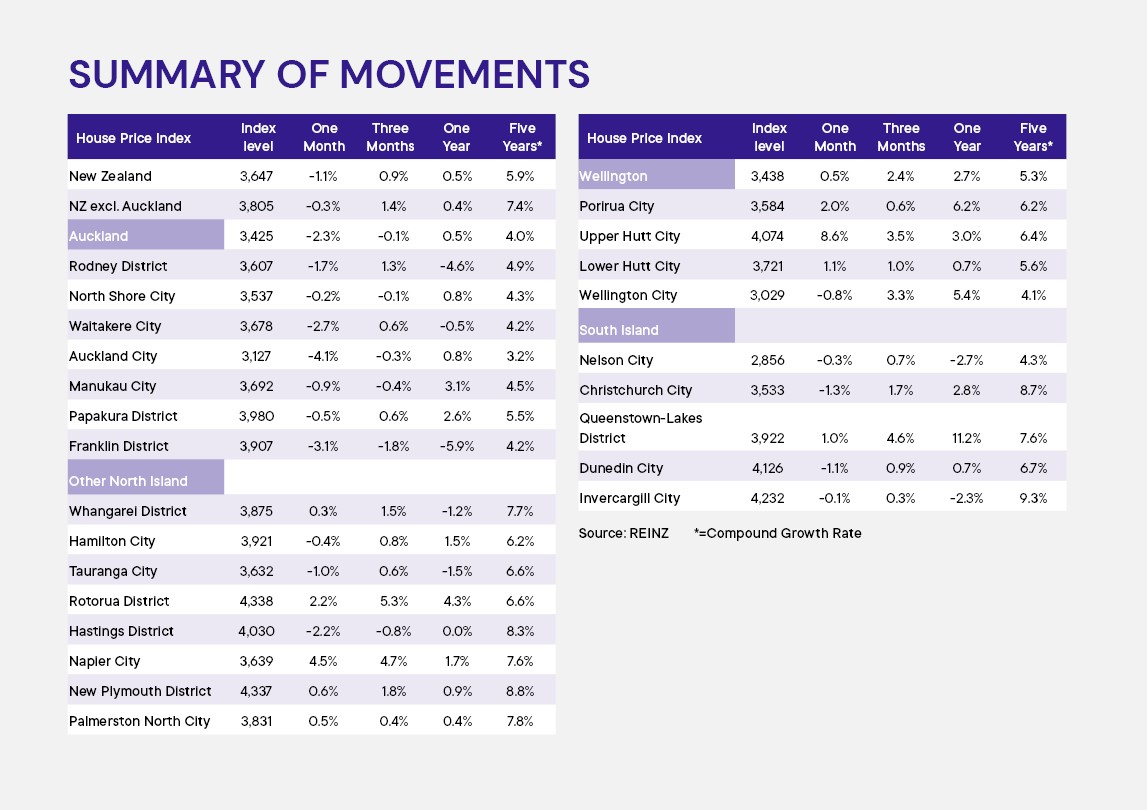

The HPI posted declines for December in most major centres, falling -0.4% in Hamilton, -1.0% in Tauranga, -2.2% in Hastings, -0.8% in Wellington City, -0.3% in Nelson City, -1.1% in Christchurch and -0.1% in Invercargill.

Within the Auckland region, the biggest price decline was in Central Auckland which includes many of the city's most expensive suburbs, where the HPI declined by -4.1% in December, followed by Franklin on the city's southern boundary where the HPI declined by -3.1% for the month. See the table below for the full main centre figures.

The REINZ HPI was developed in conjunction with Reserve Bank as is considered the most reliable indicator of current price movements in the housing market.

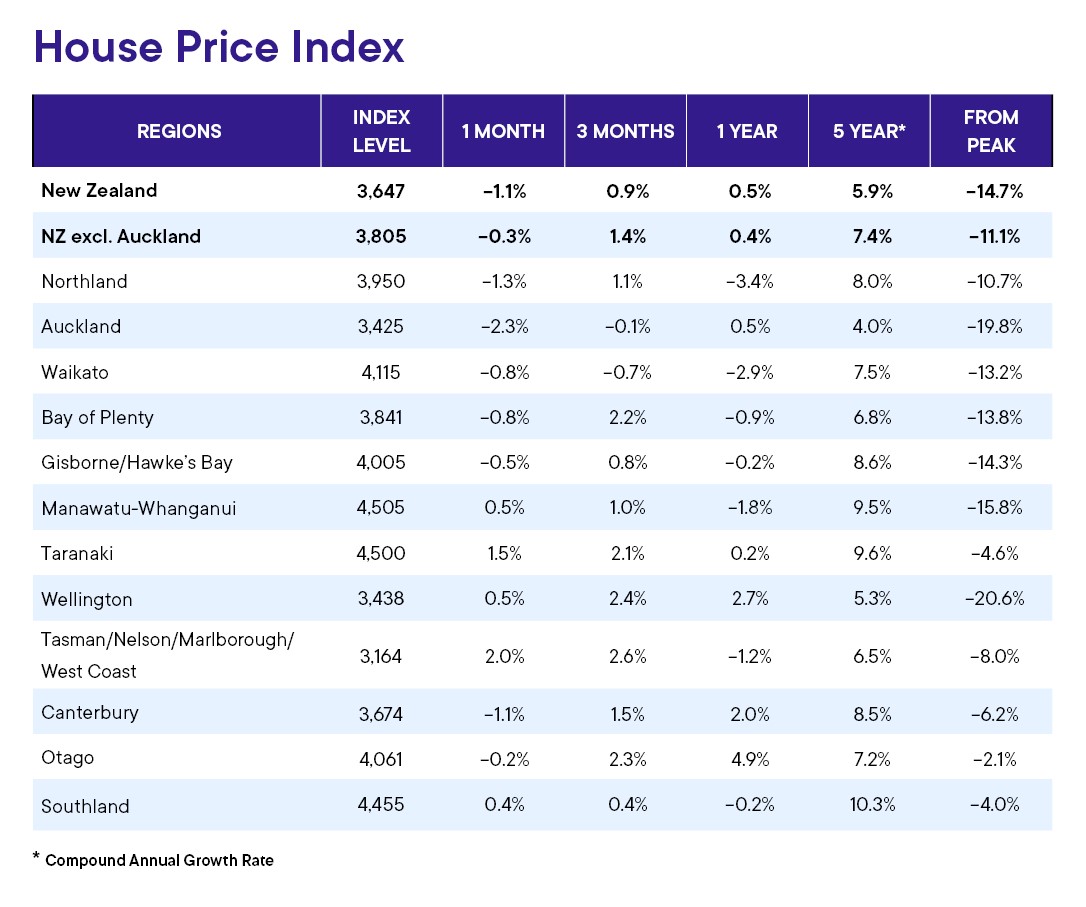

On a regional basis, the HPI showed declines in eight regions last month, with four regions posting an increase in prices - see second table below.

The national median selling price was $779,830 in December, down -1.9% compared to November.

Market activity levels also remain soft, with the REINZ recording 5145 residential sales across the country in December.

Although that was up +14% compared to December last year, it was down by -27% compared to December 2021, down by -46% compared to December 2020 and down by -21% compared to pre-Covid levels in December 2019.

However, December is always one of the quieter months for the real estate industry with the market coming to a standstill over the Christmas/New Year break.

The next few weeks should give a better a idea of where things are sitting as activity starts to wind up again, with March usually being the busiest month of the year for sales activity.

The comment stream on this story is now closed.

REINZ House Price Index - December 2023

REINZ Regional House Price Index - December 2023

Median price - REINZ

Select chart tabs

Volumes sold - REINZ

Select chart tabs

•You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

134 Comments

Would love to hear Yvil's spin

Thanks, here you go: Prices (HPI) are definitely down in December.

compare to when?

Just a blip, prices are rising🙂

Harvey, you're the poster child for the wealth effect.

It's just a flesh wound!

That’s a great start. Keep it coming! 👍👍

Oh dear Harvey... you and Tony A should put away the crystal ball. It's not working.

You mean meth ball?

Back down we goooo

Game of snakes and ladders, but this time it's only one way, as you said..

That's a strong change, particularly Auckland. 2024 is going to be an interesting year.

There is no middle ground, just way down..

I have a feeling it might be "Interesting" in the Chinese Proverb/Curse sense of the word

😂😂😂😂😂

Usual problem here surfaces yet again....... DGM reject intelligent/balanced discussion and resort to cliche, innuendo and slurs in demonstrating support for their twin pillars of arrogance and ignorance.

TTP

Works both ways. You'd have been more correct to say ...

"Fools reject intelligent/balanced discussion and resort to cliche, innuendo and slurs in demonstrating their support for the twin pillars of arrogance and ignorance."

But even people who aren't fools lower their standards from time to time. ;-)

Stop slurring.. not an intellectual act..and bordering stupidity and arrogance

As opposed to the vested interests/ticket clippers quoting endless "Im so great statements. Here's one of yours from yesterday "Neither will the DGM get their much yearned for crash in house prices 💥 and ensuing economic havoc. 🤯". People disagree with you, as you do.

Summary, if you are happy to dish out the stuff you did yesterday, suck it up today.

And a fraud like Tim is hardly entitled to take the higher moral ground

Wouldn't deal with anyone at the so called "Property Brokers"....... (aka.......what did the Court call it?)

erm... didnt the article yesterday headline that 'prices were firmer towards the end of the year'

CoreLogic (yesterday's article data source) uses settlements if I recall correctly, so it's basically delayed ~1 month. REINZ HPI (today's article data source) uses unconditional sales, which are more recent and up-to-date. CoreLogic's next report will also show a drop in price, as the settlements come in for December's unconditional sales.

Is ~1 month still the norm?

I ask because longer settlement periods aren't unusual when the people in a chain are struggling to sell, when developers are involved, etc.

The average is probably higher, but I wouldn't know for sure. I'd guess 20 business days is the standard/minimum, but someone in the industry would know better than I.

No. The minimum is about 1 second. If you get the ducks all lined the whole process, from offer to settlement, can be over in less than 60 minutes. I suspect fewer if it's really needed.

It's way longer than 1 month - can be 2-3 once a sale is settled, is notified from the lawyer to the council to QV to Corelogic.

Thats why they have to run a three month average because there will be very few sales for the most recent month

Different measure and different source. This measure is superior

Yeah the REINZ HPI was always touted as the "Gold Standard" of house price statistics on the way up.

I know. It is hard to keep up sometimes. The articles earlier in the week were for indexed house values from qv. This is trailing data, as it seeks to determine the value of every house based on the sales data of the last three months. The REINZ index is based more on monthly house sale averages across different regions rather than extrapolated differences between houses. What this means is that there is more noise in the REINZ data. Also, the discrepancy indicates that there might have been more houses sold in the lower quartile of properties, skewing the REINZ HPI. A big jump in the sale of Auckland CBD apartments prior to the academic year beginning could account for that.

I have found the Corelogic HPI to be the most helpful in determining trends.

Happy to be corrected if anyone knows better.

The REINZ data is a true index and adjusts for differences in the mix of properties sold of properties sold each month.

It is indeed. Thanks Greg.

One point worth noticing with this index ... If you live in an area where lots of new apartment buildings and/or terraced houses are being built then expect the average price in that area to decline just because the terraced houses / apartments are priced at less than the average.

Nothing to worry about if you sit on chunk of land with a single house - or better - a cross-lease on a big chunk of land. The land will have become more valuable but the poor house's life expectancy may have dropped to only another 20-30 years ;-) (Subject to zoning of course.)

And because Auckland always sells a bunch of apartments in the summer ahead of the academic year, there is always a REINZ HPI drop for Auckland Central in Dec/Jan.

Both REINZ and Corelogic effectively revalue all properties in their analysis - as both take the sales data and compare with effectively rateable values.

The Corelogic is based on three month rolling prices where as REEINZ is latest month. And as you say, REINZ often uses contract dates rather than settlement dates so is far more up to date.

REINZ is more volatile - but I think the market can bounce around a lot too. It is excluding the seasonal factors as well. For instance, end of the year always seems to have lower median values as I think a lot of young families (and therefore cheaper homes) buy and sell around year end so they are moving over christmas so as not disrupt kids' school year.

I suspected as much to be honest. No amount of spruiking by vested interests saying housing is back to being a great investment can make basic maths make sense, even with interest deductability coming back. During the major increases a few years back, a lot of it was fueled by people leveraging their equity to buy investment properties. However, say you bought a $800,000 house and rented it for $750 a week, on interest only - at 6.9% pa you're paying $55,200 to the bank and collecting $39,000 in rent. You're $16,000 out of pocket, without accounting for any maintenence, rates, insurance, property manager fees... And that's assuming it's always tenanted and they're always paying rent... You're gonna need a lot of capital gains to make that an actually good investment, assuming you do have the free cashflow to make it work.

I don't see prices rising until we've seen significant interest rate decreases.

And checking the history of the OCR since implementation in '99 at https://www.interest.co.nz/charts/interest-rates/ocr the average appears to be around 5-5.5% so it's not certain if they will ever go much lower than this granted the level of debt in the world currently. Perhaps one day they will realise that this isn't the best tool for controlling the supply of money like it was in the 90;s when the majority had mortgages, and the country and demographic has changed.

North Shore staying strong - "What a great place to live"

Except for all the nimbies, pearl clutchers, and dyed-in-blue national party supporters.

Nothing to steal keeps the others away?

Ask HouseMouse... he can't stop going on about the North Shore...

?

😂

I have asked you a couple of times why YOU seem to be obsessed with it, that’s all

Never got an explanation

Probably an inverted dead cat bounce

Looky at all the doom goblins going frothy at the mouth over one months figures, and a quiet month at that. I suspect they'll not be so frothy when it turns out things are going sideways in the next few months when there is a bit more data.

So the Dead Cat will be stuck on a rusty nail, on a ledge then?

The next storm that comes in a month or two will knock it loose!

Lol

I have always thought prices will pretty much go sideways, perhaps nudging upwards later in the year

it’s the nonsense around prices rising 10% or more, from several bank economists and commenters here, that is so laughable

Yeah, I don't see house prices going to the moon anytime soon, but nor are they going to fall off a cliff anytime soon.

Interest rates need to go down for prices to go up in any meaningful way. And even then it could be due to recession in which case prices still wont go up.

I don’t think a mild / moderate recession would prevent prices rising (a bit), if interest rates fell a decent amount.

A severe recession would.

Its hard to know if falling interest rates will help at all. I think current prices are already baking in some amount of future interest rate drop. I doubt we will get back to 2.5% home loans, probably more like 5%, and at 5% interest payments would still be higher than at the peak. I guess wages are also higher than the peak too though.

Keep wiping your tears..

No tears here, we're doing just fine, most of the mortgage is fixed for another 2.5years and we aren't struggling.

Just relaaax every body .....TTP & Yvil et al will be along shortly to calm your furrowed brows, with their words of encouragement and reassurance, that this is just a very minor blip, at one of the lowest sales months of the year.

Be grateful you have their wise words and intelligent views, based on decades of experience, in not only residential property investing, but just about everything.

Anyway. what would any DGM know, with their warped views, mainly bought to them by those alternative media channels and not listening to the MSM media and their "shaggy dog" stories, as national news.

As Bob Marley said "......every little thing gonna be alright"

Happy Daze one and all ..... peace ....out.

Looking at the REINZ HPI graph, there is always a sizeable drop in December. This drop is relatively small one in comparison.

In volumes, yes. But not really for prices

.Huge crash on homes.co.nz there must be a glitch in the Matrix

There was recently a huge increase, in some places +10-20% in a few months. I think their modelling has had a bug - should not be taken seriously.

Their estimate of my property has gone up 300k in the last four months. If Homes was reliable I would be a rich rich man.

I noticed this over a few houses I watch, I put a comment on another site but my comment was booted off.

Hilarious given the fact the over leveraged were here yesterday attempting to FOMO FHBs into early purchases off the back of QV data.

Be Quick!

They have all congregated at a pub and consoling each other..

To add to the anecdotes. We’re listing a 2 bed shared title house in Ponsonby area and yesterday were provided latest sales data from Barfoot along with our sale proposal.

All but 1 of the 12 sales referenced (late Nov/Dec/Jan) for 2-3 bed houses in Ponsonby and Grey Lynn suburbs sold for below 2021 CV.

Two of them more than 25% below CV.

We’ve been suggested to take 5-10% off CV as an expectation.

Interesting times

Mates just listed his house. They asked the agent to adjust homes.co.nz down cos it was bordering on fraud and they actually want to sell.

He’s crazy. I’d keep it high and let people think they got a bargain when they paid top dollar.

I’d think the opposite and not even approach the vendor as the price would seem out of reach/unrealistic.

Just put it in the add - "motivated vendor selling 20% under market value".

Says it all really right there.

Homes.co is not market price. I am really surprised that someone like the Valuer General doesn’t put a stop to them…. It is all over the place and usually does not compare well to QV estimates or Corelogic estimates that use standard statistical methodology. Homes used to publish data that showed how accurate their estimates were ( homes estimate compared to sale price), but seems to have been pulled off the site.

There's a 30% difference in my Homes.co midrange valuation vs my bank's Valocity valuation. 15% higher than what we paid in late 2021.

This is in Wairarapa.

The 3rd consecutive month that the average house price has gone down. Its been fairly flat line ~780k for all of 2023. Its hard to see why people are saying house prices are on their way up again.

It’s easy to see why - huge vested interests, essentially an economy that is ‘Houses and Cows’.

The likes of Granny Herald rely hugely on RE advertising.

And the bank economists are most certainly not independent and objective.

And with so many different data sets, you can just report on the ones that went up that month and not on the ones that didn’t.

The REINZ is the only data worth looking at.

It has become the way of the world now hasn't it? Where you have to read more into what isn't being said than what is in order to gleam any insight.

Hope and prayers are here if anyone needs any..

I still think current mortgage rates are no where near priced in yet. That is, if rates don't go down the market will fall further and or crash. Quarterly or at least semi annual 0.5% rate decreases along with WFF increases will help keep prices stagnant.

The recent raises in prices were just some of best buyers panicking because of the election and overpaying a little. This is tenuous argument but see the drop in LVR at the same time prices increased.

This is all moot as something overseas is going to break before this has a chance to play out.

More DGM on the property ponzi. Similar negativity over in Aussie. And the ponzi is fighting back. NSW tax lawyers are suggesting that property taxes on foreign buyers may be illegal as they contravene tax treaties. The NSW govt has already being offering tax refunds to foreigners (given that NSW relies heavily on property taxes for its operating revenue, this suggests that they're terrified that absent foreign buyers threatens their cash cow).

The more I try to rationalize this article, the more I think you couldn't make this sh*t up. We are way passed the too big to fail stage now.

https://www.afr.com/property/residential/property-taxes-on-foreign-buye…

It is not 'negative' over in Australia. In most cities house prices have been escalating quite rapidly.

Price in retreat from the weight of capital. Was always going to happen. Those holding the parcel of debt increasingly look like the last sucker. No one can qualify to bail them out, and those that can are waiting for reality to really sink in.

But will anything happen if banks continue to ignore defaults, and dont wind up those that are failing to pay...?

I'm a lawyer. In the last few months I have become aware of two different situations where couples who are going through acrimonious separations have not made any mortgage repayments in over two years and the bank has simply ignored it. There has not even been any formal hardship application, repayment holiday, interest only period... They just have been unable/unwilling to pay and the banks have just looked the other way. Amazing.

Win win win for the bank. They get more interest, don’t have to be the baddies forcing a mortgagee sale, and assuming they have lots of equity, they will still get their money back one day.

Win win win for the bank. They get more interest, don’t have to be the baddies forcing a mortgagee sale, and assuming they have lots of equity, they will still get their money back one day.

What money? Most of the "money" in mortgages is created by keystroke. You're suggesting that the banks have lent out deposits. But that is not really the case.

Its still a negative on the bank's balance sheet though isn't it?

Sure. But the asset is primarily the debt obligation. The capital as a liability is somewhat rubbery.

"In the last few months I have become aware of two different situations where couples who are going through acrimonious separations have not made any mortgage repayments in over two years and the bank has simply ignored it. There has not even been any formal hardship application, repayment holiday, interest only period... They just have been unable/unwilling to pay and the banks have just looked the other way."

Interesting. Can you tell us the LVR on the mortgages for each of the couples involved?

The LVR may be sufficiently low and given the circumstances, the lenders are willing to add the unpaid interest to the mortgage - so their mortgage loan is increasing until

1) the mortgage breaches an upper limit of the LVR - e.g 80 - 90% OR

2) financial arrangements for the separation are finalised.

This kind of stuff is insane to me. If we have this level of soft fraud with mortgages we will never see the collapse coming. Can lower level mortgage managers hide this from their superiors (to meet targets) or something? There is no way this is small scale otherwise they would deal with this properly. (Could they be protecting the moral of the FHB and they get away with because they are of particular demographic???)

This kind of stuff is important, if true, not just an interesting story. If banks have been doing this for 2 years then what are they doing now? The property markets even more of a ponzi that we know. are our banks solvent if when they will have to eventually forced deal with this?(they may not control this moment)

It reads as either incompetence, arrogance that the banks feel they're too big to fail, or potentially overconfidence that the govt will save the day for housing price gains. Either way, they don;t want any increase in mortgagee sales lest it start panic setting in and the 'house' of cards come tumbling down

They have "ignored" a non preforming loan for two years when in theory the mortgage holder would have taken all the loss!!! and a single person has two separate customers in this situation!! (I guess it theoretically be an IT fault but it's just not) I have also seen other comment with other stories (so I don't think it's decision made in panic that they are in the process of tiding up).

This read as if the banks know its going down and they are effectively insolvent if this plays and hoping we go back to ZIRP or just extracting profits for shareholders until it collapses. I'm guessing however this works it's using legal and regulatory loopholes so it's not technically fraud but it could just be illegal but the easiest way to keep everyone quite.

If you want govt help you make the feedback signal work that recent FHB are struggling, not hide it. I would guess the RBNZ and govt know this is happening and are enabling this and they have no answers except to hope it goes away.

Someone please make a good argument that this is <1% of the banks mortgage books by value. Otherwise NZ ends up with a third world economy for a couple of decades.

"In the last few months I have become aware of two different situations where couples who are going through acrimonious separations have not made any mortgage repayments in over two years and the bank has simply ignored it. There has not even been any formal hardship application, repayment holiday, interest only period... They just have been unable/unwilling to pay and the banks have just looked the other way."

Which banks or non bank lenders are their mortgages with?

I'm going to say it again ...

Look at the Auckland flatline between 2016 and 2020 (madness due to RBNZ foolishness). What caused that?

My conclusion is that it was the much higher densities allowed under the new Auckland Unitary Plan that came into force in 2016. (Feel free to prove me wrong. No one has yet. And almost all housing pundits ignore it.)

If you take the flatline price, adjust a tad for inflation what price do you get? (go on. Do the maths!) That could become the new normal. Scary, huh.

Average dwelling prices in Auckland ain't going anywhere fast as the amount of land that can still be developed is huge - staggeringly so.

But what we will see is movement at the top end. The trophy house sector will still continue upwards. As will those sitting on 'prime land' (big, easily developable sections in prime locations) which are scarcer than you'd think.

All good points. Agree majority of the easy sections subdivision was done in the 80s and 90s. New plans has reset that though. Intensification potential definitely effects your rates.

At the time I remember part of the Auckland flatline was attributed to the clampdown on capital outflows from China by the CCP.

I looked at that reason. It was pure speculation from the usual sources.

While there was a very small number of chinese squirreling monies out of china, the numbers & values were so small there was no way they could have been driving prices prior to 2016. Prior to 2016 - in my view - it was a steady clime due to low'ish interest rates which fell in fits and starts since the GFC. Post 2016, supply increased and the flatline started. (On a side note - I see no reason, once inflation is under control, why those pre-covid level of interest rates wouldn't return, i.e. US prime mortgage rates with a smallish risk premium.)

“much higher densities allowed” - I prefer “less lower density enforced”. The council aren’t some nice organisation allowing you to develop, they are an evil organisation forcing you not to to win NIMBY votes.

There's a couple of Australian economists here who think that supply wasn't increased by the Unitary Plan: https://www.fresheconomicthinking.com/p/the-auckland-myth-there-is-no-e…

Might require a subscription to view. If supply wasn't increased then I'm not sure why it would decrease house prices. There's also a follow-up post too: https://www.fresheconomicthinking.com/p/the-auckland-upzoning-myth-resp…

I think it helped limit house price inflation but I also think it is overstated. My opinion is that the unaffordability created by the house price boom from 2014-2016 was probably more influential. Prices, by 2016, had got too high and there wasn’t interest rate relief until 2020 to re-stimulate the market.

Sorry. I can't read that. And won't pay for economic opinion hidden behind a paywall from economist I've seldom heard of.

But I will say, prices are affected by future constraints, or the perception thereof.

And post 2016 - those constraints are dead, buried, and hopefully, never to return!

From 2016, for most people, the perception is that 'bargains' will pop up more frequently. And they have.

The vast majority of buyers are looking for the basics. i.e. good locations with short commutes, good schools, public transport, close to entertainment and health services, walking distance, etc. The UAP of 2016 is enabling much, much more of these types of dwellings. And there is still much more available. Much, much more!

Only the very, very rich will be able to afford the same amenities with a 700-1000 sqm section and a single house. The younger (and smarter) will pull their horns in, pay way less, but get the same amenities but at a fraction of the cost ... and be debt free way, way earlier.

How about paying for Interest, since you're a prolific reader and commenter ? Don't you think David and his team are worth it?

Yes, they are correct, and this is something I have pointed out myself numerous times over the years, especially supply as in enough to make housing more affordable.

It's simple maths, and the 'first principle' principle understanding of land use policies and the greater market.

The RUB is a restriction, the MUL a further restriction, and the Unitary plan an even further restriction. Yes that land may have been available quicker but it did three things. 1) it made that land fewer in number compared to casting the net wider, and 2) put the owners in a more advantageous monopoly position, 3) plus at the same time, like the 'Eye of Saron,' all developers' gaze was diverted onto that land as the only land council would consider allowing to be developed so created further demand relative to supply, even though the supply had increased..

The net result was it exasperated the supply and demand difference between landowners and developers, irrespective of any imbalance that might have existed already between developers and purchasers.

Thus the price of future development land was going up irrespective of what was playing out in the immediate market with existing and stuff already in the system.

Good points Chris which you have made before. Two points to counter:

- The cost of building a new house now is horrendous ($4000/m2 for a pretty basic quality). As much as the unitary plan encourages development, if the discrepancy between a new build and an existing is that much, it is unlikely to influence the price of existing stock. except maybe upwards pressure.

- You say that the unitary plan effect has only just begun and there is far more intensification to come. I work in land development and I dont think that is true. Most of the low hanging fruit has already been picked, subdivided, developed. The remaining lots require expensive inputs like new SW lines, retaining walls, ground stabilisation, boundary adjustments, house demolitions, etc etc. With the margins so tight for developers this simply wont happen. While the unitary plan may in principle allow further intensification, the economic feasibility isn't there. Lowering real house prices wont help that cause either.

As a land development consultant I'd say that it is the quietest it has been in about 8 years.

My builder charged me $110 + gst p/h for a recent job, approx $250k per annum. That's $1m alone in labour for 2 builders working for 2 years - before council fee's, architects, sub-contractors, building materials etc etc. How do you build anything but a kitset for under $3m?

The quality of our housing stock will continue to deteriorate.

Why are builders worth $250,000 pa? Why are they being valued way above a GP, a nurse, an accountant or policeman or any other professional group who have spent years training. Just reinforces that we do need a crash to correct this sort of anomaly in the economy.

Why not ? Its a skill like anything else. Peoples idea on what is required was a particular problem like for an Electronic Technician which is still seen as someone at the very bottom of the skills list and the pay is a joke. Good on them I say, unless they are still building leaky homes that is......

For the same reason a CEO is paid 50 x the average worker's income in NZ, up from somewhere around 10 - 15 x a couple of decades ago.

Do CEO's today add much more value to a company than they did back then?

Hi 1689, I think we're talking about different types of developments.

My view is looking specifically THAB and MHU zones (i.e. brown field). I.e. bowling (or transplanting) the existing house (or houses) and rebuilding to apartments and terraced houses. (My hobby area.)

Whereas you seem to be talking about taking bare land (i.e. green field), subdividing and either selling empty sections and/or building stand alone houses (or MacMansions). And I'd agree. Councils and central government policy is not in favour of further 'spread'. Hence quiet times for you folk.

Would I be right?

Re cost of building - please note I usually include 'in real terms' qualifier. And, as you'll know, building in existing areas does cost more due to the points you've highlighted. But not as much as you'd think once the costs are spread over multiple dwellings.

Methinks the RBNZ (and the retail banks) will be getting a tad nervous with these falls.

What will they do? ... (No. I'm not going to say it again. ;-) )

If current swaps are correct, there is going to be some support provided by slightly decreasing interest rates. This, combined by continued significant immigration, should cause house prices to go sideways for the whole year. There might well be some up and downs, but I just don't see any more significant decreases happening this year.

Yes, the NZ housing market is wildly overpriced, but for the abovementioned reasons I can't see 2024 as the year when house prices get finally realigned with economic fundamentals.

House prices have been re-aligning with economic fundamentals since the RNBZ signaled higher interest rates and a possible recession way back in October 2021.

I make that 2 and a quarter years ago.

I expect that re-alignment in real terms to continue for 24 and 25 and 26 - and quite possibly longer.

You make Oct21 three and a quarter years ago?

LOL. I struggle with simple / quick maths. I'll correct. But it's great to see you considered my point in sufficient detail. Thanks.

All time highs for property won't be reached again until the 2040's. Surges in inflation bought on by continued geopolitical issues, will ensure interest rates remain elevated for a very long time.

You might be right, but I’d say that’s still unlikely. Maybe a 10-15% chance.

I’d say they will be reached again around 2027-2028

Including inflation? Today they would need to go up to $1,033,000 to match the $925,000 peak according to the RBNZ inflation calculator.

I mean nominal.

Real prices, sure it’s a different story

They may never get back to that level in real prices. It would probably require 2.5% mortgage rates again, another pandemic or something.

Simply a blip in the upward cycle that has been in place since mid 2023, caused by election tremors and a spate of Nov interest rate rises which are already being unwound.

Median price has gone down in two of the last 3 months and is now back to where it was 6 months ago, hardly a blip.

The blip was in September when it went up a lot, but it has trended back down since.

HPI up in 6 of the last 7 months.

Auckland still ahead 4.2% from the low point.

Small reality check. Elections unsettle people, then they get on with it.

Yes Auckland is a bit different. But if all NZ is flat and Auckland is up, that implies non-Auckland has gone down.

‘Tis but a scratch

Well one thing is a certainty, NZME won't be publicising this data on their media channels.

Interestingly, but unsurprisingly, REINZ gave it a positive spin

Almost like they're bought and paid for.

Haven't seen any mention of this news on mainstream media or tvnz

REINZ are lying through their teeth in their write up of this data. Jen Baird the CEO leads the report with ‘Clear signs of momentum building in the market’. It’s actually dishonest at this point.

At a national level prices are

-1.1% in the past one month

+0.9% in the past three months

+0.5% in the last year

Auckland figures paint an even more pessimistic picture

Exactly what ‘momentum’ is she referring to? Anecdotes from her RE mates?

The ability to spin negative figures and paint a positive picture truly defies belief and at a minimum is stupid and in reality is dangerous.

They could argue that +0.9% in the past three months is 4% annualised.

Or you could argue that +0.5% in the last 12 months is a more accurate annualised figure.

You could, but 4% is much more aligned to what they want you to hear.

Now that we can agree on!

But hadn't the property experts previously said that house prices had begun increasing again? Totally contradicts this story from a few months ago https://www.stuff.co.nz/business/property/301007747/it-feels-like-the-s…

Two more months like this in Auckland and we will be back to 2019 price’s add in inflation and NZD tumbling people who purchased at highs will be in a huge financial hole, I expect the housing price crash to continue throughout this year maybe stopping when average wage families can afford to purchase a home. For the many on here who are over leveraged sell what you can before it’s out of your hands definitely see a good financial advisor.

If you look at the median price graph in the article, I expect this price to retrace upwards through the second half of this year to reach two-thirds of the previous peak around the end of the year, somewhere around 850,000 by the look of it.

This is based purely on overseas liquidity + a lag. Overseas liquidity trumps everything else. The RBNZ will have to follow overseas reserve banks leads.

Speculation does not follow the same rules as the real economy, speculation is governed by worldwide liquidity in my opinion. Speculation is always and everywhere a monetary phenomenon.

re ... "The RBNZ will have to follow overseas reserve banks leads."

They didn't when they started raising.

The RBNZ was - if memory serves - the second central bank in the world to start tightening. Other central banks were months behind. Many were saying they'd look through inflation as it was supply constraint driven not demand driven. (Golly - perhaps they were right! Why Yes! They were. What they didn't figure on was greedflation and just how bad it would be. Central government could have stopped this by making it widely known that they'd use windfall taxes liberally and without consideration should suppliers gouge the market to line their pockets.)

Much of it depends on the area and the quality of the property.

Good quality will always command a premium price, particularly if it's made of superior materials, has a view, off the ground is always a good start, can't flood, no through traffic, quiet, handy to shopping and retail, garage, good car parking...that is not many recent developments with no car parking and the streets turn into one way traffic.

People will pay a premium for a quality house. Not rubbish.

Thanks. Without you telling us water is wet, we'd have had no idea. ;-)

"Beauty is in the eye of the beholder - but only the rich can buy real beauty."

It ain't brain surgery.....check out some the developments around Auck.

The smart people people will be buying a property with potential and needing a makeover, not a box with no car parking and streets reduced to one-way because of all the cars parked outside.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.