Evidence is mounting that 2025 is shaping up as the mother of all buyer's markets for the housing market.

There was a flood of properties on to the market in January, with new residential listings on property website Realestate.co.nz hitting a 10-year high for the month,and the total residential stock available for sale on the website at a nine year high.

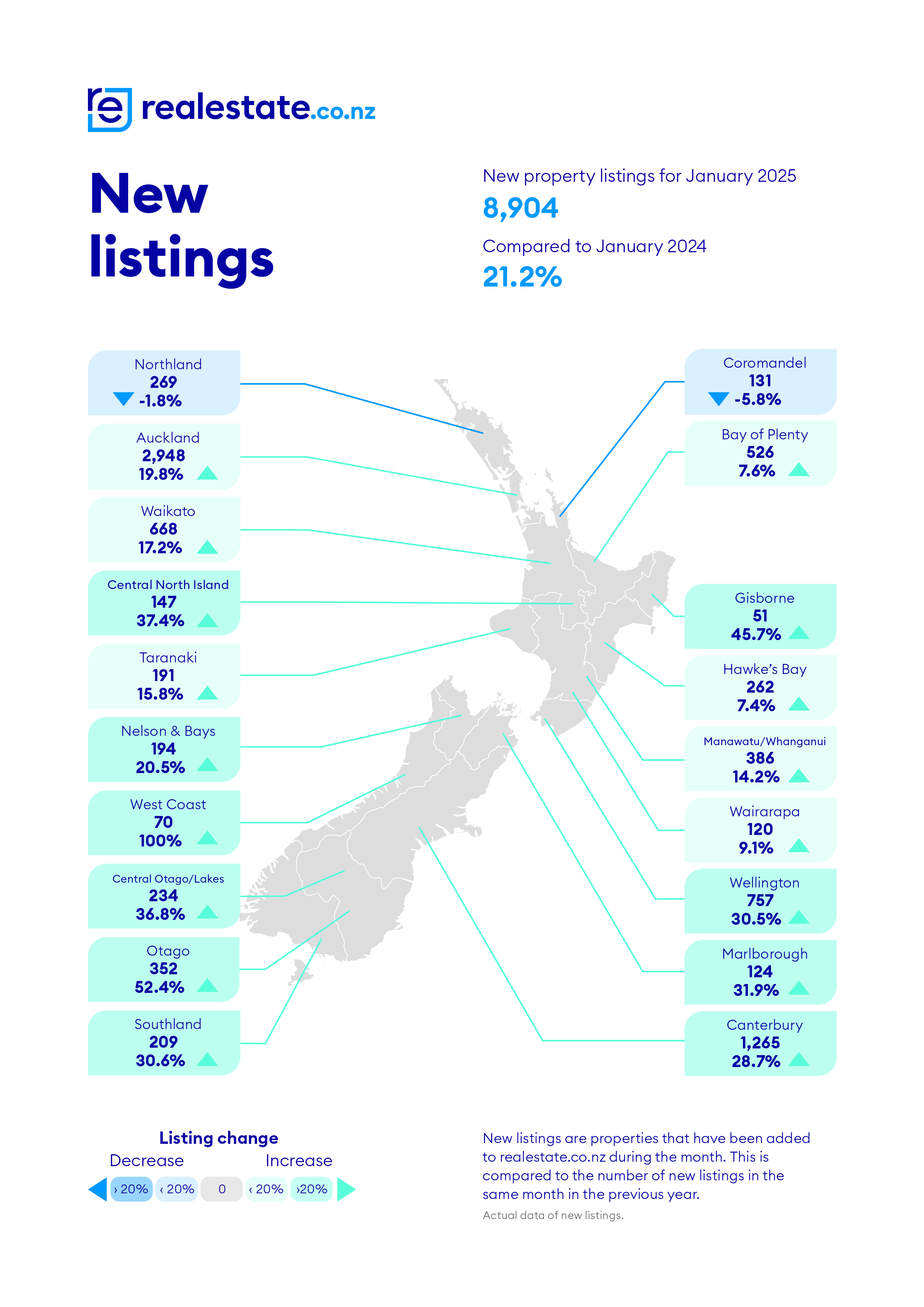

Realestate.co.nz received 8904 new listings from across the country in January, up 21% compared to January last year, and the highest number of new listings received in the month of January since 2015.

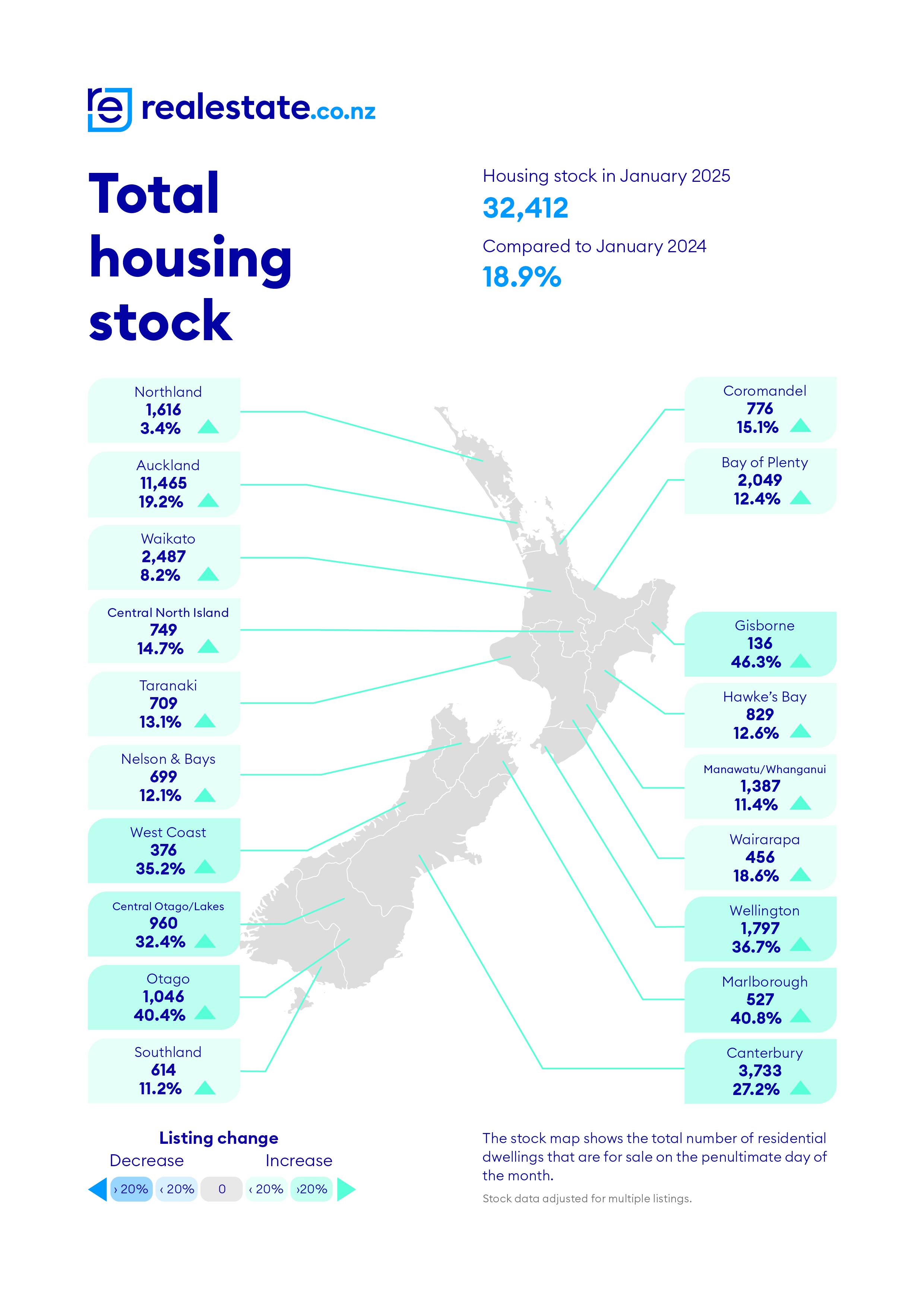

That pushed the total amount residential stock available for sale on the website to 32,412 at the end of January, up 19% compared to January last year.

That is the most homes for sale on the website at the end of January since 2015.

With so much to choose from, it's likely buyers will continue to have the whip hand in negotiations with vendors, who will have little choice but to meet the market if they are wanting achieve a sale.

Prospective buyers will be particularly spoiled for choice in the critical Auckland market, with stock for sale in the region hitting a 13-year high at the end of January, when 11,465 properties were available for sale, up 19% on the same time last year.

Other regions where stock levels were particularly high compared to a year earlier were; Gisborne +46%, Wellington Region +37%, Marlborough +41%, West Coast +35%, Canterbury +27%, Otago +40% and Central Otago-Lakes +32%.

The only regions were the total stock for sale at the end of January was less than 10% higher than the same time last year were Northland +3% and Waikato +8%.

Realestate.co.nz said the average asking price of properties for sale on the website continued to hold steady in January.

"The national average asking price has hovered between $840,000 and $890,000 for two years, offering the stability buyers crave and the predictability sellers need," Realestate.co.nz said in its January report.

"The start of 2025 saw this trend continue, with January's national average asking price at $868,969, down a modest 1.3% year-on-year," the report said.

"Lots of choice, combined with relative price stability, offers certainty for both buyers and sellers, and as interest rates decline, the market may become more appealing for those in the sidelines," Realestate.co.nz Chief Executive Sarah Wood said.

"When things will change is anyone's guess, and right now we still have high stock levels to cycle through, so it is unlikely we will see a frantic rebound," she said.

The comment stream on this story is now closed.

137 Comments

“House prices are stabilising, interest rates are declining and stock is plentiful.”

Omen for a boost in market activity?

TTP

It would be interesting if they could do a summary of who is selling like is it investors selling or people upgrading or people leaving the country.

Boomers selling up in our area. The 4 and 5 bedroom homes around 1 to1.2 mil. Most of them are selling in less than 3 months.

Omen for a boost in market activity?

No this isn’t a sign of a market boost - it’s a slowdown, plain and simple.

- Too many homes, not enough buyers – Listings are piling up, and sales are taking longer.

- Buyers have the upper hand – More choice means they can negotiate harder and take their time.

- Prices under pressure – Sellers will need to lower expectations or risk sitting on unsold homes.

Unless demand picks up or interest rates drop significantly the market is heading for a cool-down not a surge.

One would be an absolute fool to dismiss a scenario of increased market activity alongside a continuation of falling house prices over winter months....

Now even "Damian" is awake all night flicking through his book of Omens.

And zero surprise to some of us eh RP. The market is on a precipice of severe declines - if you do really need to sell then cut hard know and get a sale while you can, otherwise prepare to be slaughtered.

Yeah - the global trade war has just kicked in, together with a Ai/tech/manufacturing/salary/climate/resource wars to come - its really china vs the west now. And the west has created such a monster of a mess - that turning it around will take decades. Likely trying to accelerate a response will result in societal collapse. Though its kinda funny how after years of the west pushing globalisation we are now all backpedalling at speed and insisting on buying local to survive.... which is totally suicidal economically as the west is falling behind in tech and thus will not catch up again without importing or stealing tech from china which tariffs and cold wars will prevent from happening

i plan to diversify and plan for skills/asset acquisitions that suit the changes and minimise reliance on the state and the local economy, infrastructure etc. Its too unpredictable.

As I have been forecasting for the last 6 months, the tsunami of listings may well reach and breach all previous records.

All the while potential buyers continue to move to the west island.

The market has a long way to go before median prices line up with median household incomes at an affordable level (i.e no more than 40% of take-home pay to service the mortgage. Which leaves 10% for insurance/rates and maintenance). And those numbers are still not sustainably affordable for a family with a couple of kids.

Dreams are free.

Trumps Trade Wars risk causing another surge of inflation globally depending on how they play out. US bond markets are starting to price in higher interest rates.

You should work for Oneroof

Well, I guess “market activity” doesn’t imply direction.

Stock UP

Listings Up

Unemployment Up

Departures Up

Job ads DOWN

Demand DOWN

House prices DOWN

You forgot the biggest factor for house prices:

Interest rates DOWN

Overall I’m picking another flat year.

Interest rates are down but still in a restrictive range. They'd still be in this restrictive range after a 50bp cut this month.

Its looking more and more like a hold by the minute. Banks already dropped rates a fraction so any drop is already priced in anyway.

There is a risk that interest rates could start rising later this year due to the trade wars and other factors

Biggest factor is what will banks lend on a given property, if at all. Also not included, up or down.

Flat decade

You forgot the biggest factor for house prices:

Interest rates DOWN

Were property promoters saying the same thing in the 1990's in Japan?

Property promoters in Australia repeating the same line of reasoning (and interest rates by the RBA haven't even started falling yet)

https://youtu.be/Pg3fIFT7VqY?t=66

Here's another interesting statistic:

60% of first home buyers are getting assistance from the bank of mum and dad (and even the bank of grandma and grandad in some cases)

Donald Trump isn’t doing vendors any favours. This could get ugly.

I think you have to know Trump personally to get favours from him, otherwise no one is getting any favours from that guy.

Ok brains trust of Interest.co.nz, help a brother out here.

I’ve only ever bought one property before (and it was effectively purchased from a ‘friend of a friend’ with minimal negotiation due to securing the seller a very quick sale before even formally listing).

However, the clan is expanding. In fact, we’ve just discovered we are getting the ‘Buy 1 Get 1 Free’ special on our next child … lucky us, I guess?

We love our little place in central Chch but for 3 kids, 2 adults (one of whom permanently WFH) and a dog it just isn’t going to be big enough.

We’ve found a couple of suitable properties around the $1.1-$1.2m mark (ours being worth about $800k according to the valuation sites). One in particular is very appealing to our needs and tastes.

I want to get the best deal possible for us but don’t necessarily have the time up my sleeve to hold out for a once-in-a-lifetime property market collapse (life goes on, basically, and there’s a value to us in having a home suitable for this massive and totally unexpected circumstance change).

So to anyone buying/selling recently in greater Chch (especially out Selwyn way - we are looking at a big lifestyle change) what is realistically happening in terms of sale prices versus asking prices etc? I want to negotiate a decent deal but don’t have the time or inclination to spend the next 6 months viewing hundreds of open homes and low balling the crap out of everything. Because of my work there is a strong element of “time is money”.

All I want is a “fair” buy. Any advice appreciated. I’ve never really negotiated on property before. Negotiated plenty of commercial contracts, even lots of car buys/sells but property scares me a bit!!

Congrats on the new additions.

Obviously the result of too many dumbthoughts. ;)

Increasing your mortgage by up to $400k will mean a significant lifestyle change in its own right. If there are complications with either of the new packages (congrats btw) it will add further lifestyle changes.

Be prepared to walk away. Someone who is selling something no longer wants it, or wants something else more than what they're selling.

Look for a private sale where you can engage directly with the vendor. From what I've seen, RE agents don't actually negotiate - they're a go between, and sometimes advisor. Remember that.

Learn every clause you can put on an offer.... use these to your advantage.

Helpful commentary, thanks. Definitely seems to be better buying on private sales. And I'm not interest whatsoever in going to auctions.

It won't be $400k extra borrowing for us (as I've got some additional cash I'd introduce to minimise the borrowing - I've kept my powder dry a bit for a rainy day and have a genuine need to use it now as circumstances dictate it). Maybe more like $250k extra borrowing. We have been paying down the current place very aggressively so would just need to "get over" the fact that we would be paying the new place back at a slower rate because of this unexpected development. On a 20 year term, for example, which would have us paid off by early 50s the monthly payment would be noticeably less than what I'm currently paying off anyway. Obviously pay more interest and have more debt, but the financial aspect stacks up fine enough from a cashflow perspective (and I'd still have a good 12 month emergency fund in place) I simply don't want to wind up paying $1.1m for a $950k property if that makes sense.

Appreciate the other comments too (I won't clog up the thread by responding to each one).

Why not go to Auctions? I doubt very much there is any arbitrage between auction and private sales.

The best buying I ever did was at an auction, they can work both ways depending on the market. The winners curse in a hot market but if the auction flops you are in a very strong position. I sat on my hands at the auction, it fizzed and then I had two agents begging with me to improve bid, I walked out and they hit the bid later that night.

The one purchasing method I would avoid is tender, that's where you can overpay.

100% agree with Te Kooti. Just don't bid against yourself. If you get taken into a negotiating room, stay there. Do not go back out onto the floor. Do not let the auction re-start. Be brave. It's a great way to buy if you can hold your nerve.

If you can walk away, you are in a strong position. It helps to have some negotiation training, BATNA for example.

I second that. Counter-intuitively you get the best deals from a skilled vendor (or their agent) because it is their job to judge how much they can get out of you. All you need to do then is have in your mind your set in concrete walk away point. They will read your body language and tone of voice etc, and if that price is at all possible a deal will be done.

My brother in law is crazy good, his motto is neither party should like the deal much but they still sign.

Website estimation is famously over buoyant. Contact a local agent, with "Im thinking about listing" type language, and request a sales report for the last three months of similar properties in your existing local. Visit some open homes in your are and see how many punters are actually looking, ask a few what they think houses are worth. This will give you a realistic feel for your likely sell price, and thus, your options.

Interest.co commentator The Man 3 is based in Christchurch and provides some very good commentary on the state of the market down there. He'll be on here at some point to provide further insight.

Sell first, get a rental and then go shopping. Doing both puts pressure on you to sell too low and buy too high. But I understand that may not be practical.

That's not a bad suggestion Rastus. I had friends who bought a new place before selling their old one and then due to the pressure to sell the old place had to settle for an offer they were not happy with. Selling then renting while looking for a new place makes a lot of sense (if you are ok with the hassle of moving twice, etc.)

I've been renting for 9 months or more since selling. Really gives you some time out to consider what your next move is, getting finances clearer, seeing market clearer and working out real needs. One big change is the rental is tiny (we came from 4 bedder/office/two lounges/pool) but now when we view modest size homes they seem huge.

We are still undecided on what we really should be going for next. But have zero pressure. It's a nice spot to be in.

It's a nice spot to be in. [rastus]

...... until housing market recovery starts gaining momentum - and you realise how much you've spent on rent. And the cramped living quarters and insecurity of renting are hacking you off. And it isn't as easy as you thought finding/purchasing the right house in the right location .....

TTP

He could be retired by then....

Ooohhh, fear mongering. I see where you’re going there. Are you trying to suggest the market will flip around with such speed silly rastus will not be able to react quickly enough and he/she will be reduced to renters hell for all eternity? writhing and burning in eternal agony? TTP you are not very credible.

Or you could build some more rooms on? Done well, with cunning design that focusses on KISS, this can be worthwhile. But I guess that comes down to whether you want to stay in the area.

Have considered that but our section is small and ultimately what you could do with the house is limited (it's a large townhouse). If we had a bit more land I'd probably look more closely at that option.

Why is it not big enough

As the father of twins I can safely say that the next few years will be some of the most challenging years of your life and will make negotiating on a property seem like a walk in the park!

Thanks, I feel even better about it now lol.

Actually that's a lie, I've never been more nervous about anything in my entire life.

The best part is I wasn't even that keen on another (was coming around to the whole 'one and done' way of thinking). Nek minute I'm researching larger houses and cars with adequate space for 3 across infant seating.

You'll be fine. It sounds like you are pretty financially secure (which helps a lot) and hopefully have Grandparents nearby. It is tough, but will be worth it one day when you are sitting on the deck with a beer and the three of them playing together nicely and having a great time.

Cheers. I haven't actually told anyone in real life yet (only my wife and I know). I'd be completely lying if I said I was excited or happy - I actually feel pretty guilty about that as we've got so many friends who can't seem to have kids or have struggled greatly - and here we are getting mistakenly landed with the human equivalent of a whole litter and feeling pretty down about it.

I know we can do it, and we are fortunate to have a close support network. I'll do everything in my power to give these kids a great life, it just still feels very surreal.

At least it wasn't triplets I guess!

Great attitude. From what I have read I reckon you will be just fine.

Just wait until you realise that you will also have to buy a seven seater SUV or people mover in order to fit 3 car seats.

Good job I love buying and selling cars. I'm much more excited about getting my wife a new 'family wagon' than I am about buying a new house.

However, to your point, there do appear to be a number of options now for 3 across infant/child seats that fit in "normal" cars (we have an Outback, and supposedly that will fit fine).

I might trade my old truck in on a people mover though, as I don't massively care what I'm seen driving as long as the AC is ice cold and it is safe enough. Then we can take out mum, dad, 3 kids and the grandparents who will be finding out soon their retirement won't be as chill as they had hoped.

I had a colleague who was in the same situation and approached it backwards. He wanted a Nissan Leaf, had 3 kids, and went looking for ultra narrow carseats that could bring his dream to reality.

But you'll need the soccer mom van to go on holidays with the grandparents anyway.

Also at some point you'll be transporting your kids friends as well.

Just check that the 3 across car seats manage the stage where some kids are still rear facing, while the older one is forward facing, and that it transitions to a booster seat for the older child. Many of those 3 across are more designed for triplets of the same age.

Also check the strain on one's back lifting a child in and out of the middle seat. Its not as easy as doing it while standing at the car door.

Some men see their vehicle as an expression/extension on their manhood, but that's just insecurity. If you're driving an MPV you're doing it because it's loaded with proof of your virility.

The newer ones aren't the penalty boxes they used to be, and they can also be modified like any other vehicle. Just go easy on the suspension for the first few years.

If you can bear the risk, sell first perhaps with a long settlement because negotiating subject to sale is a weak negotiating position. If you want a fair deal there really is no substitute for getting out to see houses and see how much they sell for. Try and attend auctions, in person is ideal but online is a good substitute. Talking to the agents at open homes gives insight but not as much as talking to the punters. Congrats on the family additions!

Congrats DT, wow can only imagine that would’ve put me in overdrive.

Im nervous for number 2 as it is, haven’t even contemplated the twofer scenario!

I would sell and then rent for a while and take your time.

While renting put your time into researching the market and locations. Knowing the market and being cashed up puts you in a great position.

You dont know any pregnant women do you?

Start looking now, but sell your own house First, request a long settlement date, which will give you time to find your new house and move into it directly. Revisit your view that you're not prepared to spend time looking at lots of houses, this is really a big mistake. The more houses you view, the better idea you will get about value, the more likely you will find a great house for you, and you will also be less likely to get too attached to a new house "you just have to have", and end up over paying. You say "time is money", you are very likely to make/save much more money through taking time looking at lots of houses than through your job, especially after tax.

While I am not familiar with the Selwyn towns specifically, I can telll you that the Christchurch market for family homes is still highly competitive. Good homes sell fast, and they usually sell for more than current CVs. Where the excess stock is coming from is all the new (and used) townhouses that have flooded the market over the last few years and which are really struggling to sell. So be aware that you will have a much harder time selling your townhouse in central Christchurch, than you will buying a home in Selwyn. You may need to get an updated (and realistic) valuation on your townhouse so you can move ahead, you dont want to be caught out signing a contract for a new house only to find that you are short $100k on the townhouse sale because prices have fallen so much.

What I suggest is -

- look at what homes have sold in that area (from the map provided on homes.co.nz), what they sold for, and how long they took to sell. You can get that information from homes.co.nz, propertyvalue.co.nz and realestate.co.nz. Take this one as an example - https://www.realestate.co.nz/property/16-barnsley-crescent-west-melton-…. You can see it sold at the low end of the estimated price range, slightly below CV, and was on the market for 24 days.

- consider how much new building is going on in the area. Older homes that are competing with new builds may have a more difficult time selling, or may sell for less. As such you may be able to make a lower offer.

- dont write off auctions. The best houses go to auction, because the agents know they have the best chance of selling, and its less work for them dealing with all the buyers. So if you avoid auctions you are just limiting yourself to lower quality homes that don't have much interest. While this might be a good tactic if buying an investment property, its not the best idea when looking for a long term family home in which to raise your children. Just go in with bridging finance approved, and a set limit so you dont overbid. And apply that limit if you are the one in the back room negotiating. Be prepared to walk away. Dont bid against an Asian buyer - you won't win and all you'll do is help them push up property values in the area.

- make a realistic offer and if its not accepted, insist that the agent come back with a counter offer so you know where they are at. Then come up and try to meet somewhere that you are comfortable with.

And congratulations and good luck! House hunting with a wife is one thing, househunting with a pregnant hormonal wife expecting twins is quite another :-)

Hi there - thought I'd drop some general advice, also had the 2 for 1 but am 10 years down the road of you (12, 10 and 10) ! By the way congrats, first couple years are chaos maybe but it works out very nice, we are in the sweet spot now with an awesome crew ;). I think it's normal to freak out on the logistical front (I did - e.g. will we need bigger car, bigger house? etc answer was no to both!). My advice would be to consider letting things settle in the first few years after they arrive, you don't need to add another bedroom right away, and you never know what's around the corner, you certainly could make it work for another 10 years. Our house set up (AKL) is similar to yours by the sounds... randomly we now live in a decent sized floor area 3 bedroom apartment in Singapore, and our kids are happily all still sleeping in the same bedroom (and no car as not needed!), so we even have a spare room still - they love it! (by the way I also had similar set up when I was a kid). House back home is rented out, might eventually need to upsize as planning to move back for high school years, but you have options - e.g we could also rent another house in the right school zone in that scenario, or live in a different city which we are considering for that phase too. In summary - I'd recommend you can consider not to dive in now on the upsize and see how things pan out next 5 or so years as the kids get bigger, in mean time pay off your remaining mortgage and save additional so you can later pay cash for upsize if needed, worked out well that way for us... and also remember it goes real fast, fast forward a few years and sadly you'll be stressing about how sad it will be when you're empty nesting haha. Hope that helps the decision process

DOUBLE YOLKER! Congrats mate

Some dodgy advice listed above.

Never get bridging finance for a home purchase in a flat or falling market! You could end up paying $8-10k a month extra in interest for a very long time (maybe until the bank forces you to sell at a big loss) with no additional income as you won't want to rent anything out as you will be desperate to sell!

If you've got a near new townhouse in a complex it may be harder than heck to offload. If it's an older traditional standalone townhouse or separated by garages only on 350 to 450m2 it may be a different story and easier to sell but no guarantees.

Anyway always sell first or if the timing isn't quite perfect, consider putting in conditional offers subject to getting finance "with terms and conditions suitable to the purchasers own requirements in his/her own discretion" - get a lawyer to approve any conditions!! Always make sure you can exit a contract safely. No point with offers conditional on your house selling as vendors will run a mile - best just to have a very good out clause (a carefully written finance or due diligence clause) and only put an offer in only if you have a pending sale (say own home already under contract or multi offer deadline with an acceptable offer already on the table).

If you're buying in Selwyn, there's always plenty of houses coming to the market. If you are very picky about what you want, just be prepared to rent if need be, or have a very long settlement on your own home.

Never bridge to buy at auction. Ever!

dp

The youngest baby boomer, born in 1964, will turn 65 by 2030. For boomers relying on their home for retirement, is now a good time to sell or a bad time?

Oct of 2021 was a better time. If I was 65 and needed that cash out of my home I would have it listed now. Its not going to rise but might fall, test the market see what's offered.

Its never really a great time to sell unless you are getting straight back into the same market. A few people would have made off like bandits at the 2021 market peak but it was probably unintentional. I watched one property I was looking at buying that resold at the peak but unless they rented and waited there were no gains, its more likely it was a split up or they just sold and bought a different place.

BS. I sold and i wait. Why would I sell and buy into a declining market?

You must remember Rastus, there is absolutely no declining market in The Mount and environs - Zwifter has already proclaimed this many times on this site.....and locals know best :)

And many houses that have been listed and remain unsold for years...some as many as five years plus.

> Its never really a great time to sell unless you are getting straight back into the same market.

Nothing screams "good investment" and "not a bubble" like an investment you can't realise unless you are wanting to immediately buy back the exact same type of investment....

Withdrawals are temporarily suspended on the NZ REIT

From my sample size of 2 - it may be too late.

Most retirement villages require you to be 70 in order to enter, so the wave of selling may be skewed to that rather than 65. Also a lot of people now work beyond 65, so I would think that people have plenty of time to wait before selling up.

Commentators may recall a month ago that I mentioned that my Wgtn home had dropped 30% since the 2021 rateable valuation (from $1.3M to $920k).

Wgtn rateable valuations are provided by QV, these are now due out this month, nearly 6m overdue.

In the last 2 weeks, for no obvious reason, my homes QV has increased 13%, to $1.04M. This is despite the Wgtn property market being very depressed according to all published reports.

I am a bit suspicious that this months increase is a coincidental good news story as new rateable valuations are published in advance of the indicated 15% rates increase....

I doubt everyone is breathlessly watching their estimate on QV's site, so there's no PR to be had. I just happen to have checked mine months ago, and I checked it now, and it hasn't moved. What this means is the value of your property has increased relative to mine, so your rates will go up more than mine. Yay me!

Bearing in mind, of course, one's rates do not go up and down in lockstep with valuations, it only dictates one's slice of the citywide rates haul.

WCC cannot afford the values to drop by 30% as then they cannot claim higher rates. They seem to have spent their money based on 2021 values and associated level of rates thinking house prices only ever go up! Fools really. Given the optics they really need to stop with the nice-to-haves things and focus on the essentials

That's not how it works. They can and will claim a higher total rates haul regardless of your property value, unless the council can cut its overall expenditure.

Each valuation year the council determines how much money they will require to function for the forthcoming period, and announces what the increase will be - this is the headline figure everyone screams about.

However, some will pay a smaller increase and some a bigger increase, because the slice of the pie you're required to pay depends on the increase/decrease in value of your property relative to everyone else's over that period.

- If the overall market values increase 20% but your individual property only increases 10% you'll be up for a smaller rates increase that someone whose value increases by 30%. This is because your slice of the overall market value pie is smaller. But conversely...

- If the overall market values drop 20% but your individual property only drops 10% you'll be up for a larger rates increase than someone whose value drops 30%. This is because your slice of the overall market value pie is bigger.

Councils only care about the value of your property in relation to everyone else's in the catchment. Your property could be worth $1 and they'd still have bills to pay to service it.

As an example, our Hawkes Bay rates went down a couple of years ago even though our valuation went up an alarming amount - the land value increase was well below the council catchment increase overall in percentage terms, and that is what is (or was) used as the basis for apportioning rates.

Trumps Trade Wars risk causing another surge of inflation globally depending on how they play out.

isolating the USA and dropping out as the global lawmakers/role-models and smashing national alliances (alliances that the US took decades or centuries to build) actually means inflation is the least of our worries (though still a big immediate threat). The reality is that the USA is acting this way because it is scared of china and their increasing inability to match them in any field... auto manufacturing, tech, military, gdp growth, debt, salaries, standard of living, science, space... u name it.

this time china was ready for trump do do the obvious - and china is already stepping into the void the US has left. China is trying to be seen to work in alignment with the global rulemakers that trump is leaving or trashing so they will quickly replace the us/west as the global leaders and rulemakers and largest economic and military power.

I reckon we may be only months away from the biggest global powershift we have seen for a couple hundred years.

Understanding exactly how it plays out, whether trump(US) really has any aces up his sleeve and how this will affect NZ economy and way of life is very tricky. but i certainly wouldnt be putting all eggs into the RE market right now

My worry with that eventuality is the US is a warmongering bully.

Much much more listing, prices still flat to dropping, renters exiting west, immigration no longer gangbusters, US interest rate decline on stop, trade war starting up, recession still going. Does all this add up to the specu herd starting to charge the exit...?

Buyers as a class don’t want to buy. They are broke, at the margin. Sellers, esp in Auckland don’t meet the market which is 15% roughly on average below CV. This can be seen on REINZ by taking a property and comparing the stuff sold v stuff for sale. This mantra of buyers market is now v tired and inaccurate

Yep. Banks now have less ponzi finance to throw around to boot. People can only afford what they can afford.

Its a dysfunctional market, there is bugger all liquidity due to the mismatch in price expectations.

These situations always work themselves out, unlike stocks there are not constant incoming flows to invest in housing.

Its actually worse then that, not only are there big spreads between ask and offer, there are way more sellers then there are buyers for anything but first homes.

And now add back inflation and rising rates curtesy of the orange man.

The fat lady is priming to sing.

Meanwhile in Aussie

Housing affordability could get a boost in coming months, with the Brisbane and possibly Perth markets likely to join Sydney, Melbourne and Canberra in a downturn that is expected to receive only a modest lift from interest rate cuts this year, economists say.

The pressures from nearly three years of high interest rates and soaring costs of living have prompted more home owners to sell, resulting in a substantial rise in available stock in Sydney and Melbourne, and also in Perth and Brisbane.

1150 properties currently listed for sale on TM in Tauranga, that's pretty much the average. I have seen anything from 1000 to 1300. Been tracking it since Covid.

By mid March it will be over 1300.

Are there more or less buyers around? what do sales trends look like? I assume you track these given your financial interest in the area.

All weights not enough speed work.

Wanaka got down to 100 listings in August 2021 and it's now at 372 and rising every week.

But Wanaka prices remain sky high compared to 2021, especially vacant section prices.

They are probably around the late 2021 prices still. That doesn't invalidate my point at all though. Each market always perform differently to others.

A moment of silence for the idiots that bought at the peak of the market.

"Tāmaki Makaurau" prices, in particular, are likely to continue to plummet until they reflect the true desirability of the dystopian experiment.

sellers remorse?

Define plummet? down 1.9% yoy i'd call 'easing'.

Prices in Auckland have crashed (by any definition you want of what a 'crash' is) since the peak and continue to crash. Las year the crash slowed but there is little indication it will stop crashing at this stage.

So in your books, when does a crash end? Are tulip bulb prices still crashing? To me a crash is sudden and sharp. Down 10% in a couple of months for housing, or a couple of days for stocks. Whereas the auckland market has been flat for 48 months, and flat for 48 months i could never describe as "continuing to plummet".

We will see what comes... could be another crash for sure. I'd love them to crash, to me they are way too high still and a curse on our economy, but i'll settle for pro-longed easing. Probably better in the long run than making half the population bankrupt.

A crash ends when prices stop falling and start rising again.

Some people measure crashes from when they recover to their previous highs.

In the last ten years the Tokyo stock market has trippled in value, but in your books it was still 'crashing' during that time? And was crashing for about 34 years in total? I'll have to agree to disagree on that one. Likewise Tulips...

.

So if you slowly lose your leg via gangrene vs get it amputated in one swoop, does that mean you still have a leg to stand on?

RNZ reported an interesting point - number of secondary homes listed for sale has increased in popular holiday spots. Pauanui was given as an example with 65 houses for sale, at the peak of the market the number listed for sale was 10-15.

Watch the Taupo bays along to Turangi...

At market peak Whangarei had 260 properties for sale, now there is 960. Probably the same everywhere.

Went to Pauanui for the first time over the holidays. Really the most boring characterless town on the Corromandel. It's like you're in Remuera but worse, as there's nothing to do. There isnt even a dairy to get an icecream without driving somewhere.

Sounds like NZ's Florida?

I work with one person who lives there. She is constantly telling people she lives there. It's weird.

Did you turn up in a Toyota Camry or something?

Would be really out place with those 6 figures euro cars.

Lucky they thought you are a Doordash delivery guy and didn't call the cop on you.

To put into perspective, according to MBIE website, the median household income for Wellington is 149600, with the DTI rule, this median household can borrow up to $897,600.

translate into house price this median household can afford:

10% down payment: $997,333.33,

20% down payment: $1,122,000.00

$1.1 million debt on $149 k income in a particularly volatile world ....doesn't seem 'affordable' to me, sounds like a giant millstone with lots of risk attached.

perhaps I didn't use the correct word. I was merely checking where it the limits lie when it comes to DTI rules.

of course, those numbers means the household borrows to the absolute limit, which is risky to most of us.

Especially if you work in the Public Service

I think they meant the debt is still $897k but with a $200k deposit they could buy a $1.1m home

Assuming two salaries split equally, they will make $9,692 after tax each month.

A 30-year mortgage on that $897,600 at 5.5% would be $5,096/month or 53% of their take home pay. Add in insurance, rates and maintenance them you are looking at 60% of income just for the house. Affordable is 30-40%

We’ve afforded 50% or more for over 10 years now (paying more than the 30 year repayment).

Definitely depends on the household income and lifestyle creep. A basic grocery bill is generally the same whether your household brings home $150k or $250k. Same with a lot of other living costs.

Therefore the repayment %'s can be higher on a higher income without being at risk of eating into basic living needs.

Looks good if you know the cost of debt will be cheaper in the future than it is when you take out the loan - but I personally think the cost of debt could be higher in 5-10 years time than it is now meaning the cost of serving the debt rises and could mean very little to no capital appreciation on the investment. It isn’t that appealing at all purely from an investment perspective.

Not investment advice but you’d be better parking your cash in gold for a few years and going fishing (which a few years ago was laughed at as being a stupid ‘gold bug’ strategy…. but if somebody did that a few years back they are up significantly and in a better place to buy now - and that pattern could continue yet for a few more years yet - I personally purchased some gold in 2019 when yield curves initially inverted as a risk hedge and it’s been one of my best investments of recent times).

I agree with you on both counts. The main problem with buying gold though is the marginal tax rate you need to pay on liquidation. Makes a serious dent in the returns.

As other people say we need a significant re-write of tax policy so everyone doesn’t pile into housing and we diversity ourselves in a less concentrated fashion (into housing).

Can't you buy an overseas ETF holding gold and pay the annual FIF tax instead?

More listings? Yes. More prices in line with the finance buyers can get? No.

Yep

More people - fewer land

In the long term, house price is a one way ticket, UP!

🤡

Land does not equal house.

"That is the most homes for sale on the website at the end of January since 2015."

That's an interesting stat. NZ has built a lot more homes since 2015, so the fact that we had the same amount of houses (or more even?) listed for sale in 2015 makes one ponder whether the situation in the RE market back in 2015 was worse than it is now. Does this mean that the situation in the RE market today is not as "gloom&doom"y as we think? I mean - look at what happened to house prices post 2015 despite the high number of listings back then.

Lots of stale "re"listings of tiny overpriced near new townhouses flooding the market with very little supply of what the market actually wants, which is tidy normal homes at a reasonable price!

Market is supremely overpriced in the regions versus historical levels. Low yields are unsustainable and will lead to a stagnant or falling market for the next decade barring catastrophe or mass immigration both of which are highly undesirable!

Blah Blah Blah has been updated from deadline sale to price by negotiation.....

the new Real Estate tagline of the year

FFS if its for sale put a price on it and stop wasting everyone's time.

I know right, my trademe notifications are spammed with it, that plus "property X asking price has decreased by X amount"

Yep. Price by speculation is just lazy and has just been delaying reality while price free fall. Owners will in many cases turned down offers they would jump at now.

Greed....burn.

Where I live is probably not that different to everywhere else in NZ. Lots of new listings every week day. All price brackets. Entry level to multi million. I believe many vendors are dreaming especially with the expensive homes. Another tough year coming up. Trump is going to cause some of that trouble we are facing economy wise.

Much of the profits from the banking sector go overseas and the debt created in the housing market including investors is now around 90% of GDP or $360 billion. Quite how we can continue to pay the interest and repay seems to be overlooked. It appears to be a pension Ponzi scheme of sorts. If someone wants to point out how this can be resolved I would like to know. It seems that there is no limit to how much the banks will lend and no consideration that this debt maybe unrepayable and will burden nz into a future of an impoverished nation

Yes, housing loans are now at $369 bln while GDP is at $421 bln. But mixing a long term liability with the nation's annual economic activity is a distorted thing to do. You should also consider that residential housing assets (including investors) exceed $1.62 tln. So the mortgages of $360 bln are 'only' 22% of the asset values that underpin them.

Further, no bank would lend in a situation where a borrower could not reasonably be expected to pay the loan back. And their lending practices have resulted in very low loan losses over a very long time. So they have substantial credibility in 'responsible lending'

Even total household debt is lower now as a percentage of household income than it was in 2008 - and recent trends do not show it rising.

Yes, bank profits do flow to overseas owners. And yes interest amounts on home loans are high. That is the cost of running a current account deficit for a very long time - we need overseas investment to afford the infrastructure we run (and that includes a safe banking system). Voters would not tolerate the policies necessary to force a current account surplus situation because that would necessarily involve locking our country down with import quotas, high tariffs, and embedded inefficiencies (that in turn require high taxes, and the resulting crony capitalism of favoured importers). Been there, done that, and it was a huge failure that broke the country quickly.

You may like to consider why (thousands of) overseas investors invest here long term. They would hardly do it if they anticipated a collapse that risked their capital. They do it because they see a positive future.

Finally, it is quite wrong to say "there is no limit to how much the banks will lend and no consideration that this debt maybe unrepayable". This is all regulated by the RBNZ with a very broad set of rules and regulations. These help make the lending safe and sustainable, in addition to all banks wanting to stay in business. There is no profit for them if their clients all go broke. Loan losses are currently running at record lows. A bank making irresponsible loans would soon find depositors abandoning them, resulting in a run on that bank, and their shareholders losing everything. There is no current risk of anything like that happening.

Listings are at their highest in years. I found an article that breaks down some key stats on what's happening across the NZ property market. It paints an interesting picture of where things are headed. https://www.opespartners.co.nz/property-markets

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.