Inland Revenue (IRD) says it has uncovered more than $150 million in undeclared taxes from property developers and investors as a result of a crackdown on their behaviour.

The taxes were mostly undeclared income tax and GST which were discovered after the Government gave IRD more money in last year's budget to beef up its compliance work.

"Inland Revenue has been taking a closer look at the tax affairs of developers, people with rental properties and those people covered by the bright-line test," IRD said in a statement.

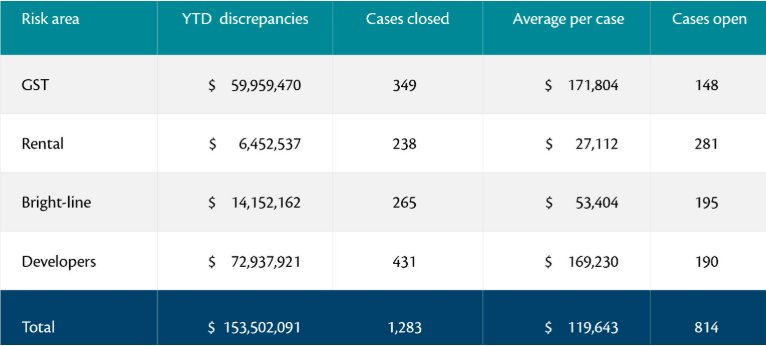

That work uncovered $153.5 million in additional tax in the first nine months of the current financial year, only slightly less than the $156.8 million uncovered in the whole of the 2023/24 financial year.

A major focus has been on property developers to make sure they met their GST and income tax obligations.

"While some of the errors [by developers] will be accidental, we're also seeing a pattern of property developers claiming significant refunds as they incur costs up front, but then failing to file and pay once properties sell," IRD said.

In the financial year to date, IRD has found $72.9 million of discrepancies in returns from developers, up by almost 50% compared to the same period of last year.

IRD has also found many cases involving companies or individuals making multiple land transactions where GST was not correctly accounted for.

"Sometimes they are changing the intended use of the land, or frequently transferring ownership between entities with or without GST registrations," IRD said.

"These actions appear to be attempts to circumvent their GST obligations."

IRD investigations in this area have uncovered almost $60 million in discrepancies so far this financial year, up 39% compared to the same period a year earlier.

IRD is also looking closely at people's obligations under the bright-line test, which have uncovered $14.2 million in tax discrepancies so far this financial year.

The comment stream on this story is now closed.

The table below comes from IRD.

5 Comments

Wow, colour me surprised! (not)

"These actions appear to be attempts to circumvent their GST obligations."

No surprise. The specu flipper model is to avoid paying tax. Find them. Tax them. If they can't pay throw the book at em.

Time to use data ai mapping to look back over the last ten years and add interest to the fines and recovery.

Except they simply liquidate the company and walk away.

It's not that simple if IRD chooses to use its powers

https://www.deloitte.com/nz/en/services/tax/perspectives/asset-strippin…

Good job!

IRD need to seriously investigate and look at all sales of second, third, etc, extra house buyers, and company purchases, especially any sales made within 5 years of buying.

I know some who believe the first flip is tax free.......

Get into it IRD! SHOULD BE A BILLION OR TWO IN HIDDEN TAX!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.