The last three weeks has witnessed very little movement in auction activity.

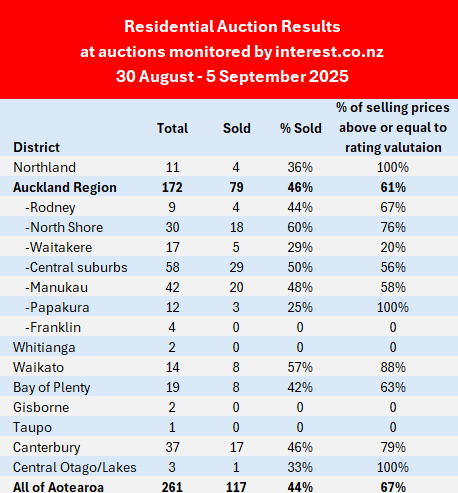

Interest.co.nz monitored the auctions of 261 residential properties around the country over the week of 30 August to 5 September. That was down slightly from 277 in each of the two previous weeks.

Of the 261 properties on offer at the latest auctions, 117 sold under the hammer, giving an overall sales rate of 44%. That compares to 43% the previous week, and 49% the week before that.

Basically the market is still sitting on its winter lows. Although we are now officially in spring, the green shoots are still in the trees rather than the auction rooms for the time being.

Details of all of the individual properties offered at the auctions monitored by interest.co.nz, including the prices of those that sold, are available on our Residential Auction Results page.

The comment stream on this article is now closed.

36 Comments

Its a cold wind blowing through NZ Property markets

Alot of hot air coming from your way though...

https://www.oneroof.co.nz/news/120-000-plunge-house-prices-fall-hard-in…

Keep blowing shifty

They are selling like hot cakes.

That's because there have been very few $3m - $4m houses go on the market, while lots of townhouses in the $1.2 - $1.3m range have sold, which has skewed the average value lower.

But the HPI is ment to correct for this by using quartiles?

I simply do not believe we have 20 suburbs losing 5% in THREE MONTHS because suddenly 1.2-1.3 mill hot cakes are selling. What we are seeing is middle class house price capitulation as clearance comes to town, its simply the start of the next leg down after a bit of a rest.

$120 k is eye watering and there are another 20 suburbs 5% down in 3 months !!!!!!!!!!!!!

Barfoots said -2.8% in a Q but wider sale numbers across all agencies paint a much worse situation.

120k is $1,318 per week for the entire Q !!!!!!

It seems that you're clutching for negatives here IT. It's simple mathematics - when a whole bunch of $1.25m properties sell & very few $3m+ homes sell, the average is going to be closer to the lower figure. To conclude that house prices have suddenly dropped by $120k is a bit of a stretch. A more accurate headline would be "$1.25m Townhouses in Meadowbank selling like hotcakes".

Plenty in this range and over. Just harder to spot when sitting endlessly on "Price by Speculation"... I mean "Negotation".

If I was a FHB, I'd be getting in now, as it's not going to be this affordable again for quite some time.

You sound like a somewhat desperado seller ??

FHBs are certainly best to save and wait for the crash to bottom in 2027 or 2028 (renting is way cheaper than mortgages) and buy at 3 to 4xDTI.

Alternatively, get a "bottoming price" today by offering in the 2012 to 2015 price range, or walk away!

Easy peasy, lemon squeezy!

Renting is cheaper than owning? Based on what metric?

You don't have to look far to find very nice (new) 2-bdrm townhouses in Christchurch for around $575k. With a 20% deposit, you're looking at around $550/wk to service a 30 year mortgage. You can't rent much for $550/wk in chch.

Yes that is Christchurch, but there are plenty of places still around NZ where it is cheaper to rent than pay mortgage, insurance (ever-increasing), rates (increasing greatly and due to continue doing so for years to come), maintenance, and pray you keep your job or it all goes tits-up.

2bedroom townhouses will not gain in value over time unless the area is likely to prosper significantly, therefore why spend 575k on a 2bedroom squishbox where if you decide to have more than one child, or get twins, you have to sell and either make a loss or be lucky to get back what you paid, and thanks to inflation, that figure doesn't have the purchasing power as when you paid it.

Many can rent, save extra, invest some, have 0 responsibility for any of the above costs and move out if the rent goes up by too much or they wish to relocate suburb, city etc.

Why? How?

The bleeding has stopped but this patient’s still in ICU.... until the underlying disease is addressed - affordability. More octane ie interest rate cuts needed fast

Lower prices will fix affordability

Housing-related sentiment has turned. Our ‘time to buy a dwelling’ index surged a further 10% in August, buoyed by a third 25bp interest rate cut

https://www.interest.com.au/economy/239/westpac-sees-tight-supply-lifti…

You're referencing Australian housing market data

Yes, yes I am! Because it's New Zealands favourite destination for travel and relocation

So it was intentional. A little Aussie hype smuggled into an NZ property thread to mislead

Of course its an intentional link, not an intentional mislead as you seem so keen to paint it as... you should stop taking yourself so seriously, as a time lord you'd already know what is happening in aus without me mentioning it. So move along please.

🤥🤡

Haha that'd be right. Don't get your long nose out of joint mate

The only thing Aussie banks want in NZ is to keep the ponzi growing so they strip as much profit from NZ as possible.

To share an anecdote, I broke a lifelong policy yesterday and bid on my first property auction (by telephone). North Canterbury.

There was 1 other bidder (in the room). I reached my happy to walk away price at $865k & it still hadn't met reserve which would have been ~$900k. The other bidder eventually negotiated agreed price at $880k.

The agency had listed the property searchable at $750-800k. RV was $860k: 5 other properties had sold in the same street this year, all for less than RV. It seems that the practice is to advertise low to get the punters in & set the reserve higher than market to make genuine buyers think the sellers actually made concessions in negotiations.

Buyers are the most important people in the room, can withhold agreement and walk... Until market dynamics (buyers/sellers market) change

Ah the good old days were the fliperati laughed as people climbed all over each other to bid. Tax free fluffy unicorn left and right. Pass the bollie darling.

That was then. This is now.

🍿

Another strange one. A bare section on Clifton Hill sold this week at auction for $1.22 mill. Wonderful city, mountain and sea views. But this land was categorised as red after the EQs and eventually passed into Christchurch City Council ownership. The property was well publicised in the media after the Feb 2011 event, a shattered old villa and a deep diagonal chasm running down the length of the section, the reserve land in front, and across the road. This land had in fact been classified as of potential danger to human life in a futures similar event. Captioned as ”Life threatening hazards. “ Wonder whether the buyers have been informed about this history as they surely should be given the Council’s great penchant for slapping anything negative it can on any LIM.

Its a scarey drive up and around there, one wrong move and you're gone 💀

As crashflow continues downwards for spec town they are trying to offload. Govt pitching in with lowering interest rates but don't be fooled. Lower prices...

The MASSIVE 6-7% falls in Auckland good suburbs in the last 3 months are eye watering..... its not a flat market at all

It's not all D&G...

https://www.thepress.co.nz/nz-news/360804135/christchurch-home-values-r…

Exactly, its worse than DnG.

Who in their right mind would move to CHCH region, when their hospital is stuffed tighter than sardines and tents outside are now required.

Sounds third world.

Avoid it like the plague!!!

Christchurch is doing well right now, even the uni has a buzz to it, many Aucklanders going there.

I went to CHCH and loved it, kayaking, skiing and great outdoors tramping.

I think it has many characteristics appealing to young people and young families

And prices never went as nuts as Auckland/Wellington

Yes hard to find cons on CHCH, when it has many pros.

Hospital capacity is the one con, as it is in many places. They are veeery slow to add capacity, when the population gains.

We should give the rent extracting, rental collecting Speculeach a break, they have been trained by previous Govts tax givaways and forever lower interest rates for the last 40 years ( FOREVER RIP ended in 2021) ....... they know nothing other, than buy/hold/flip rentals.

They still deny the memo, that the world sent them in 2021, that the jig is up and the house collecting "roads to riches" party, is over.

Oh well, if they all go down with the Rentals Ship, as she crashes from one jagged reef to the next, it will be justice served on ole Specky.

Good see the "crash narrative" now permeating within the Oneroof/property investor group crowd- it is a good job and lessons learned.

Therein lies the lesson, burnt fungers, hands and arms of Specky (3rd degree) and now no hope of burnt investors returning to the rental rort, anytime soon.

So the 3 to 4xDTI now in sight, as the crash is set to bottom somewhere in 2027 or 2028.

King of bullion by day, prince of ridicule by night - you’re smashing it in the bullish gold and silver markets while still finding time to torch the pooperty leeches with surgical precision. Education is wasted on those mean mutts… but I get it, even royalty needs a hobby.

Surely as a wise Boomer, you have slipped out of the Rentals Collecting Epoc (1980 to 2021) and now well diversified out of that now defective investment rort?

Yes I own a home, that's enough of that sectors risk for me.

So a little Silver and Gold, has indeed added some shimmering lustre to the investment futures of those who saw and knew, the status quo shifted a full 180, post 2021.

Surely Boomers are not forever blind to what has been believed as a store of value, exchange and currency for 5000 years?

It's not too late, as most are still asleep on the resurgent Silver/Gold paradygm, as $48/$4000 plus, is still to occur.

As with all investments, DYOR and accept the risks.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.