The housing market slump deepened in August as values continued to decline, according to the latest figures from QV.

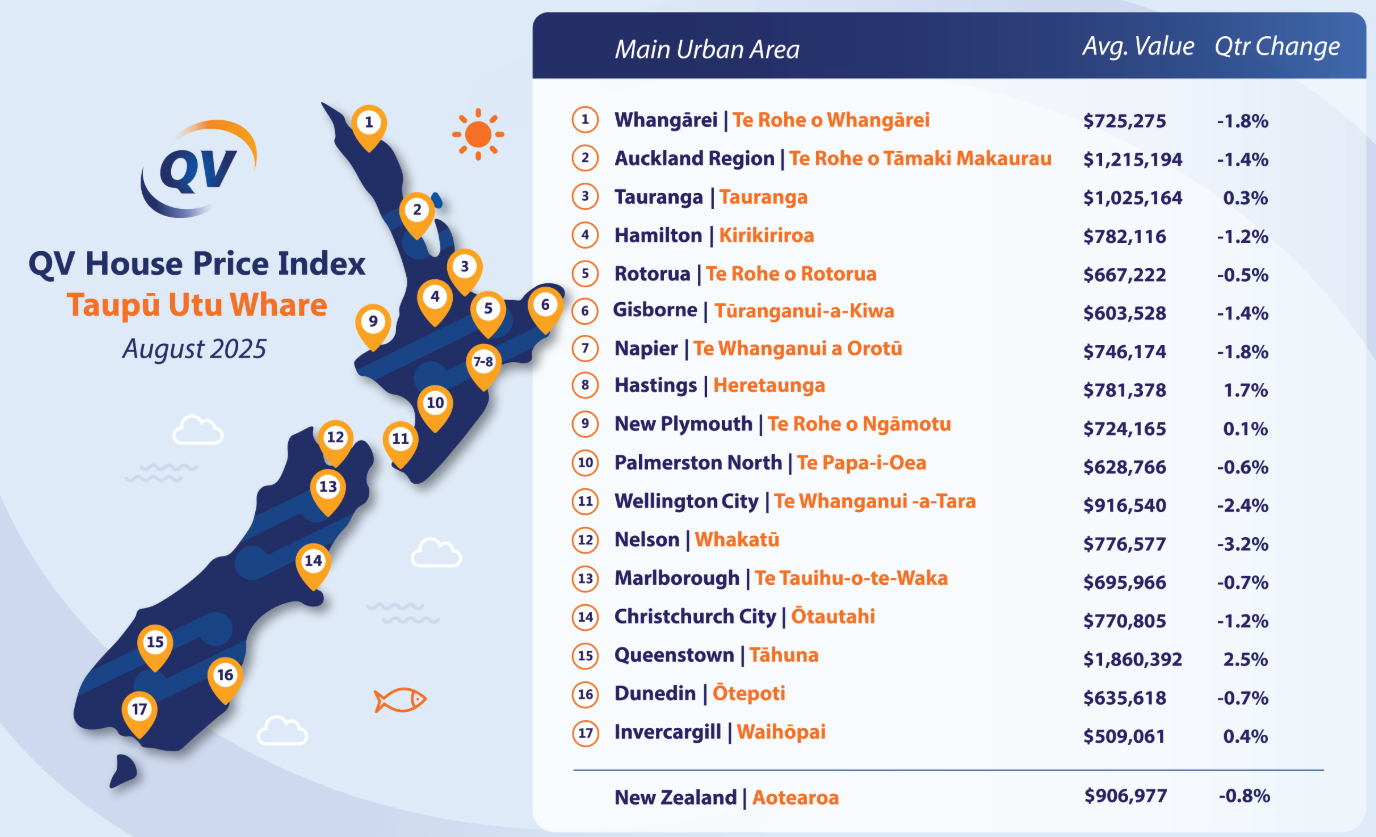

New Zealand's average dwelling value declined by 0.8% over the three months to the end of August, according to the QV House Price Index. It's now 13.4% lower than the January 2022 peak in market values.

The biggest decline in the three months to August was in was in Nelson -3.2%, followed by Wellington City -2.4%, Whangarei -1.8%, Napier -1.8%, Auckland -1.4%, Hamilton -1.2%, Christchurch -1.2%, Dunedin -0.7% and Palmerston North -0.6%.

Going against the trend, value gains were recorded in Queenstown up 2.5%, Hastings up 1.7%, Invercargill up 0.4%, Tauranga up 0.3% and New Plymouth up 0.1%.

"As we head into spring, the housing market remains subdued, with values continuing to decrease in most parts of the country," QV national spokesperson Andrea Rush said.

"The slump is most pronounced in Wellington, where values are now close to 30% below their peak, and in Auckland which is down around 20% - underscoring the scale of the correction since early 2022," she said.

However, the slump could be good news for first home buyers.

"With home values coming down and interest rates beginning to ease, affordability is slowly improving for buyers in many areas, however higher living costs, rising unemployment, the broader economic downturn and stretched household budgets continue to restrict demand, " Rush said.

"A steady flow of new townhouse and apartment completions are giving buyers greater choice and helping to limit upward pressure on prices," she said.

"Buyers are taking longer to commit and sellers are increasingly having to meet the market - agents report some home owners are struggling to sell in time to secure their next property, leading to more deals falling through," she said.

The comment stream on this article is now closed..

22 Comments

Specuburning...how's that sun tan going?

Oh dear, not selling like hot cakes

It was inevitable these days would come. From early 2022, those who heeded the advise to save and wait have not only saved a load in interest, they've got a bigger deposit that earned good interest meantime. Having healthier finances, the opportunity to own a healthier portion of their first home up front is very real. Those Bag Holders who spouted "you can't time the market" have been proven wrong. Patience and discipline were and are key qualities not irrational emotion filled FOMO that often ends in tears.

Houses are for living in. I am personally pleased to see real house prices fall over time.

Uh oh spaghetti o

The Market is slow if we are resorting to chains of sales... FHB you are cash offer... offer low

Buyers have all the power and the GriftySpecuLot have none.

FHB Buyers should only offer in the old valuation ranges of 2012 and 2015 and this will just bring forward the bottom of the market crash and the great asset price reset to good, justifiable yields, will be done.

I see prices now regularly hitting the 2017 to 2019 sales prices, so great things are happening out there! Keep hope alive and stay positive!

Mike Hosco is spiting tacks, that his underwater rentals, continue to drift forever lower. Even his powerful oratory/voice, cannot lift the crashing NZ housing market tide.....

Our first house is now worth about 900k (if in original condition), we bought it for about 400k 19 years ago. 400k in today’s money is 630k now, so there is a real gain but not a crazy amount. In that time the NZX has gone from around 4K to around 13k, had we invested 400k then it would be worth $1300k.

Basically the last few years of declines has changed housing from an amazing investment to a pretty average one. For those that bought in the last decade, probably lucky if you haven’t gone backwards in real terms.

In that time the NZX has gone from around 4K to around 13k, had we invested 400k then it would be worth $1300k.

You can't invest in the NZX. For investment purposes, the most direct proxy is Smartshares S&P/NZX 50 ETF. From 2006, the index has appreciated roughly 289%, and with reinvested dividends, the gross total return reaches about 415%. CAGR about 8.7%. Gold has appreciated 467% (in Kiwi pesos) over same time period.

Question is has NZX really done anything or is it just a product of money supply.

What we do know is that real h'hold income growth will not have matched asset price inflation. People need to factor that in to how to manage the Ponzi going forward.

Good point about the reinvested dividends. On the flip side I also ignored the fact that buying a house means you don't have to pay rent, so that makes the house investment a lot better too. And the tax advantages.

Property investors did very well. Borrow the money from the bank with a 10% deposit, the renter pays the mortgage. They effectively turned 40k into 900k tax free, a very good return. Of course it is much higher risk, you can lose much more than your investment, as some recent property investors now know.

Sure. But as I pointed out about the NZX being a product of money supply, you can also say that the Ponzi is just a product of monetary expansion as well. While it's been a great game to play, we have to think about what it all means. Because if the game continues, we have to get used to the idea that credit creation is going to to take the money supply to the moon. To what end? It seems to me that we're terrified of creating credit to actually do things beyond the Ponzi. In more ways than one, that is troubling and unsustainable. IMO.

Has it been money supply expansion, or just demographics? The boomers were saving for their retirement, we could see the opposite happen when they spend for their retirement.

Has it been money supply expansion, or just demographics?

The aggregate value (measured in fiat currency) of the housing stock cannot increase without monetary expansion. “Money creation in the modern economy,” from the Bank of England Quarterly Bulletin in 2014 is a recommended read - https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/20…

The paper indicates that money supply is created when banks make loans, including but not limited to mortgage lending. However, across the Anglosphere, mortgage lending is the largest single component of bank lending. So the Ponzi relies on this credit creation expanding forever and a day.

Remember, lending for the Ponzi as a proportion of total bank lending is substantially higher in New Zealand and Australia compared to most other countries, including much of Europe, North America, and the OECD average.

It's amazing how little money supply is talked about in the mainstream. It's usually a better indicator of actual inflation than the cherry picked basket of goods that they use

New Zealand M2 Growth, 1989 – 2025 | CEIC Data https://www.ceicdata.com/en/indicator/new-zealand/m2-growth#:~:text=Key…

That's much better comment JJ, as exemplified by the "0" upticks, vs your original comment of "12" upticks.

So $270k gain in 19 years on an asset that is has suffered 19 years of depreciation. That's a monstrous return.

if you bought the house with 70-100k down the returns look more like the property apprentice numbers, then buy another 10...... the idea is to use leverage here... on the way up anyways....

You should have bought the shares, however 19 years of paying rent instead could have take a big chunk

"In that time the NZX has gone from around 4K to around 13k, had we invested 400k then it would be worth $1300k"

But you didn't have $400k to your name back then, did you ? You may have had a 20% deposit so $80, so your $80k would have theoretically become $260k, still less than what you made by buying your house. Plus you got the enjoyment of a roof over your head rather than a share certificate in a folder and paying rent. You may want to factor this in too.

Mean reversion in slow-correcting asset takes years. We're still far from the bottom.

Prepare for the Immigration flood gates to open as the government begins to panic as we move ever closer to the election. Don't want to upset the all-in-property constituents do we.

Does not work if there are no jobs to come to though............

and everyone is trying to get to Aussie not NZ

and those immigrants need healthcare and schools etc

The immigration can is up against the wall, and cannot be kicked further down the road

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.