The average asking price of residential properties advertised for sale on Trade Me Property declined for the fifth consecutive month in August.

Trade Me Property's national average asking price was $820,800 in August, down from $861,900 in March.

March is usually the busiest month of the year for the residential property market and marks the official end of the summer selling season, while August marks the end of winter.

That means the average asking price on Trade Me Property has declined by $41,100 (-4.8%) over the autumn/winter period this year.

This suggests vendors looking to sell a property are becoming more realistic in their price expectations, especially when stock levels remain high and buyers have plenty of choice.

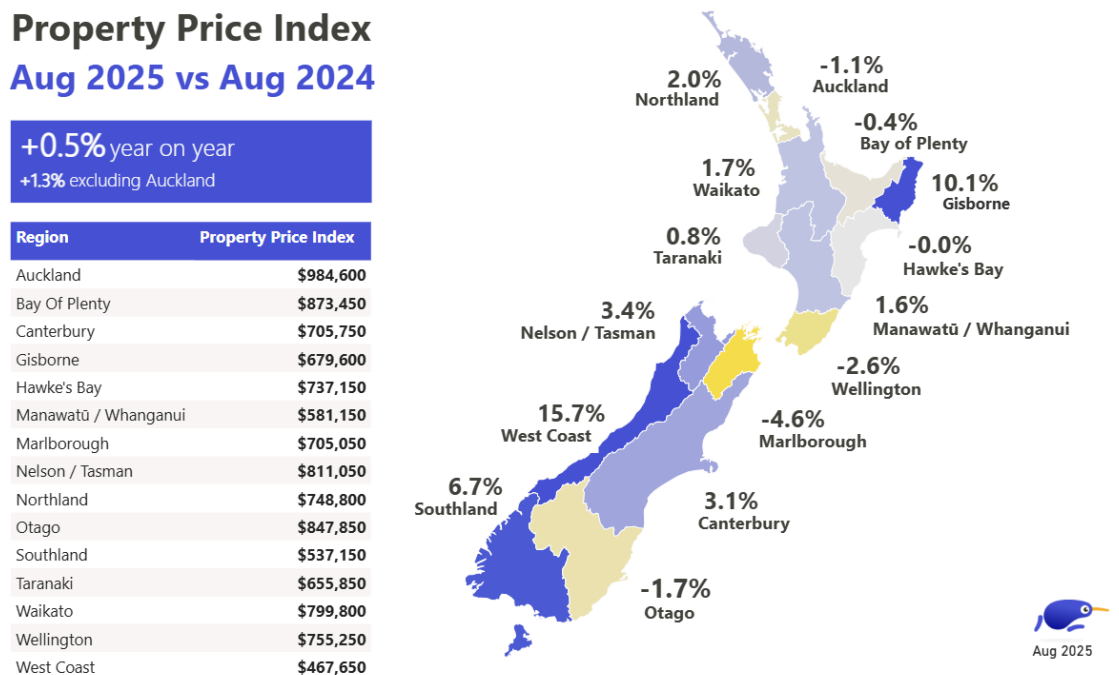

The decline in average asking prices has been particularly steep in Auckland and Wellington, with both centres also experiencing five consecutive months of price falls since March.

In Auckland, Trade Me Property's average asking price was $984,600 in August, down by $72,700 (-6.9%) since March.

August was the second month in a row that the average asking price in Auckland has been under $1 million.

In the Wellington Region the average asking price was $755,250 in August, down by $66,350 (-8.1%) since March.

The comment stream on this article is now closed.

15 Comments

Westcoast is the place to be. Sandfly paradise.

$680k for Gisborne. Madness considering the little amount on offer there. Lovely beaches, but not so great for jobs / health / crime / accessibility / etc.

There seems to be a movement away from the big cities, with many areas approaching Auckland price levels. I wonder if that is temporary or will become a long term trend. Possibly just the two speed economy with rural doing well.

Boomer exiting Auckland. When many Akl'er sold up at peak stupidity in 2021 thereabouts, there was a notable surge in buying in Northland, Coromandel, Taupo, Hawkes Bay and Otago lakes. As you do.

Moving away from your kids as you age is a bad idea.

And healthcare. Maybe the kids have already moved on.

Could be any or all of these:

- People moving to Aus more likely to be recent immigrants so more likely to be from Auckland

- Rural economy doing well

- Regions building less houses than Auckland and still have a supply issue

- Boomer's exiting - either to other cities or exiting their investment portfolio

Or families moving back to the region they grew up in, bringing the warped notion of house value with them. I'm sure REA's are encouraging them to use up all of those capital gains as well as taking out another big mortgage too.

Hamilton/Tauranga have been flying since the ~2015 Auckland spillover

Asking prices are up on the same month last year, but shhhh, let's compare the best month of the year, March, with the last month of winter, August. This makes for a much better clickbait headline of prices being down.

Annual is quite old data. Both comparisons are useful

Looking at both the annual and the quarterly, it certainly appears lower interest rates are not having much upward effect at all, and in fact prices may have started falling again.

Yes, up 0.5% for the year - let the good times roll!

I'm hoping for another few years, maybe a decade, of flat prices to let incomes catch up and finally snuff out the Kiwi obsession with property investment over all else. We can't get wealthier and more productive if house trading continues to overshadow investing in productive businesses.

It’s a difficult turd to polish.

Prices going down when interest rates were increasing was expected. But stagnant / decreasing when interest rates are falling will be a real worry to many.

You might be hoping for an own goal, the building industry will struggle without some price inflation and we’ll end up with another shortage. I think current prices are getting close to affordable.

I agree.

Doom and gloom gets the clicks.

Home prices falling is a great big positive, rejoice.

Only Specuvestor is crying. Less than 14% of the population.

Most are smiling at this epic reset, to 3 to 5xDTI.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.