First home buyers have been taking advantage of lower mortgage interest rates to get into a home of their own but it appears that the willingness of banks to provide them with low equity mortgages may be just as important in determining whether or not they can afford to make a purchase.

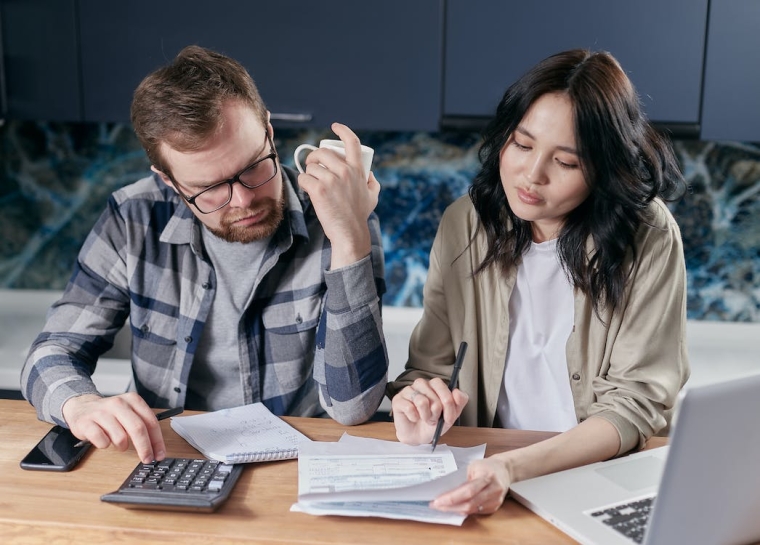

Latest mortgage approval figures from the Reserve Bank show approvals to first home buyers have been rising slowly but steadily since the beginning 2023. (Note: Mortgage approval figures will always be higher than the actual number of mortgages put in place, because borrowers may get several quotes from different banks to get the best deal, all of which are included in the RBNZ's mortgage approval figures, but only one of those is actually converted into a mortgage. You can read more about this here).

Mortgage approvals to first home buyers have risen from 2299 in August last year to 2549 in August this year - the first graph below shows the monthly trend.

Over the same period, the average two year fixed mortgage rate has declined from 6.00% to 4.77%, which has had a significant impact on housing affordability for first home buyers - you can read more about this here.

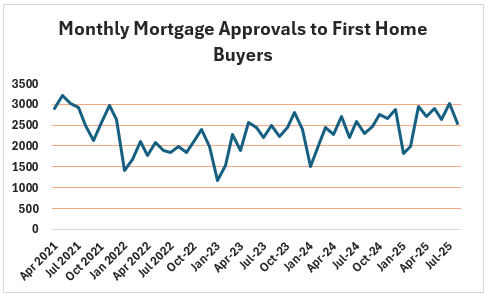

But lower mortgage rates appear to have had only a modest impact on the prices first home buyers are paying.

Interest.co.nz estimates that the average price first home buyers paid for their home was $681,000 in August this year, up by just 3.6% compared to a year earlier in spite of the substantial drop in mortgage interest rates - see the second table below for the monthly price trends.

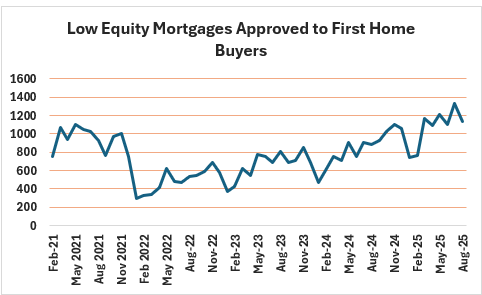

However the figure which has shown a substantial increase is the number of low equity loans being approved to first home buyers.

Over the last three years low equity loan approvals have been steadily increasing in both the total number of such loans being approved to first home buyers, which has risen from 531 in August 2022 to 1140 in August this year (see the third graph below for the monthly trend), while the percentage of mortgage approvals to first home buyers that were low equity loans has increased from 26.9% in August 2022 to 44.7% in August this year.

Perhaps that is not surprising, because as interest.co.nz's Home Loan Affordability Report shows, while interest rates remain low, mortgage payments should generally be affordable for most first home buyers on average incomes, but scraping together a deposit remains a significant challenge - hence the popularity of low equity mortgages.

Low equity mortgages are those where the borrower has less than a 20% deposit and carry a greater level of risk for both the borrower and the lender, which is why low equity borrowers pay a significant premium for their mortgages compared to borrowers with a 20% deposit.

However the latest figures suggest that the ongoing ability and willingness of banks to provide low equity mortgages will be one of the biggest factors in determining whether aspiring first home buyers will be able to realise their dreams of home ownership.

The comment stream on this article is now closed.

8 Comments

The male looks like Guy from NZ Today, he might not need a low equity loan

Which implies to me homes are still over-priced relative to incomes ...

Yes. When your marginal buyer is characterized as "low equity", it suggests that the Ponzi is creaking like a ship and not representative of a healthy market.

How do you know they are "marginal" buyers? Are you privy to bank data on these buyers? It would seem that you're somehow unhappy that young families are getting into their first homes, which is sad. The younger you are, the more likely you will be to be in a low equity position. Everyone has to start somewhere.

How do you know they are "marginal" buyers? Are you privy to bank data on these buyers? It would seem that you're somehow unhappy that young families are getting into their first homes, which is sad.

You're responsible for your own education. If you think any property market can function properly without the marginal buyer, then you shouldn't really be commenting on market dynamics. Let me give you a primer:

The marginal buyer is the agent whose willingness to pay determines the market price, especially in asset markets like property where transactions clear at the price offered by the most aggressive bidder. Without this buyer, sellers must adjust expectations downward, leading to lower sale prices or longer time on market.

Just an observation....

Under traditional auction system used in NZ, the most aggressive bidder is never identified - only the second most aggressive bidder (the under bidder) is identified when they reach the limit of willingness to pay. The limit of what the buyer is willing to pay, is unknown because bidding stops when the under bidder drops out.

Now, in a Dutch auction, the buyers willingness to pay is identified. Because the price starts high, then teduces until someone hits buy. Can't figure why NZ wool isn't sold under a Dutch auction system.

Surely price is the determinant .

But I guess that thinking is a big win for the financialisation of a basic human need. Well done banks. You lose Aotearoa.

There are also debt to income rules in place now?

Curious, the deposit guarantee scheme has contributed to banks carrying lower risk liability to investors and consequently TD rates declined.

What % of bank home mortgage lending is backed by cash deposits? If significant, then I hope the low equity risk premium interest rate margin has also reduced (compared with pred deposit guarantee commencement) otherwise the banks are clipping the ticket both ways. While big value risk lies with NZ taxpayer.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.