Residential property investors are taking a bigger share of the property market this year compared to 2024, but are paying less for the properties they are buying.

The latest Property Pulse report from property data company Cotality says mortgaged investors accounted for 23.5% of residential property purchases so far this year, up from 22.0% last year but still well below the 27.1% market share they enjoyed back in 2015.

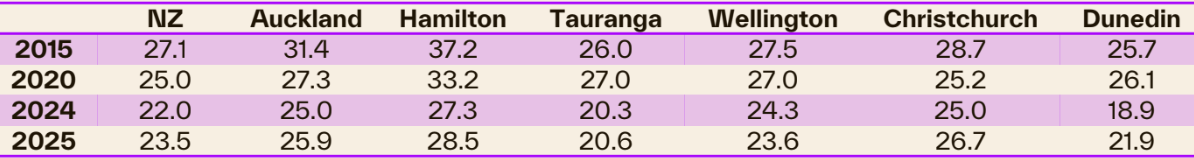

Around the main centres they are the most active in Hamilton where they have a 28.5% market share so far this year, and least active in Tauranga with a 20.6% market share - see the table below for the full main centre figures.

Wellington is the only main centre where investors' market share so far this year has declined compared to last year.

Investors are also making a strong showing in several regional centres where prices tend to be lower, including Gisborne with a market share of 30%, up from 23% last year, followed by Rotorua 28%, Invercargill 27% and Hastings 25%.

While investors have mostly been increasing their share of the market this year, they are paying less for the properties they are buying.

The median price paid by mortgaged investors so far this year is $759,000, down from $770,000 (-1.4%) last year.

At the national level they tend to prefer stand alone houses to multi-unit developments, with stand alone properties making up exactly two thirds of the properties purchased by investors this year, according to the Cotality report.

The comment stream on this article is now closed.

Investors' Share of Residential Property Purchases in the Main Centres

5 Comments

Standalone houses equals tax avoiding capital gain chasers. Making speculation and inflation great again....bought to you by the letters RBN and Z.

Are there any stats on the percentage of sellers that are investors? i.e. if investors accounted for 25% of sellers, and 23.5% of buyers then the number of property investors would be shrinking. Might be an interesting look into the makeup of the market

The latest Property Pulse report from property data company Cotality says mortgaged investors accounted for 23.5% of residential property purchases so far this year.

Couple of remarks:

1) I find this number very high, at a time when numbers don't add up neither cashflow wise, nor capital gain wise. Sure, the astute investors will be able to create value, but still, almost one in 4 houses is being bought by investors in these tough times...

2) I don't fully understand the wording "mortgaged investors accounted for 23.5%". Does this mean that there are even more investors in the market who are not mortgaged ? Or perhaps Cotality's way to figure out the amount of investors is via mortgages.

Can you please clarify, thank you.

In answer to your second point:

Information on whether a property is purchased for investment purposes comes when the bank supplies mortgage data to RBNZ. As you know, the RBNZ collects data on the purpose of purchase including whether it is FHB, OO, investor or business purposes (and LVR information) and this data is made freely and publicly available; Cotality is referring to that data. If a property is purchased without a mortgage, then a bank and RBNZ have no way of knowing why the property was purchased and hence why Cotality qualify their statement. (The only government or other entity who will have knowledge on investors purchasing a property for cash are IRD and the Bond Centre - neither who are involved in producing relevant dat.)

Thanks P8

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.