Patchy spring weather conditions were reflected in the housing market in September, with mixed results around the country.

The Real Estate Institute of New Zealand recorded 6346 residential property sales in September, up 3.1% compared to September 2024.

However, the news wasn't so good in Auckland, where 1925 residential properties were sold. That was down 5.6% year-on-year.

Around the rest of the country, excluding Auckland, sales were up 7.5% compared to a year ago.

Sales also looked a bit grim on a seasonally adjusted basis, dropping 2.5% nationally, down 8.4% in Auckland and 2.9% lower across the rest of the country.

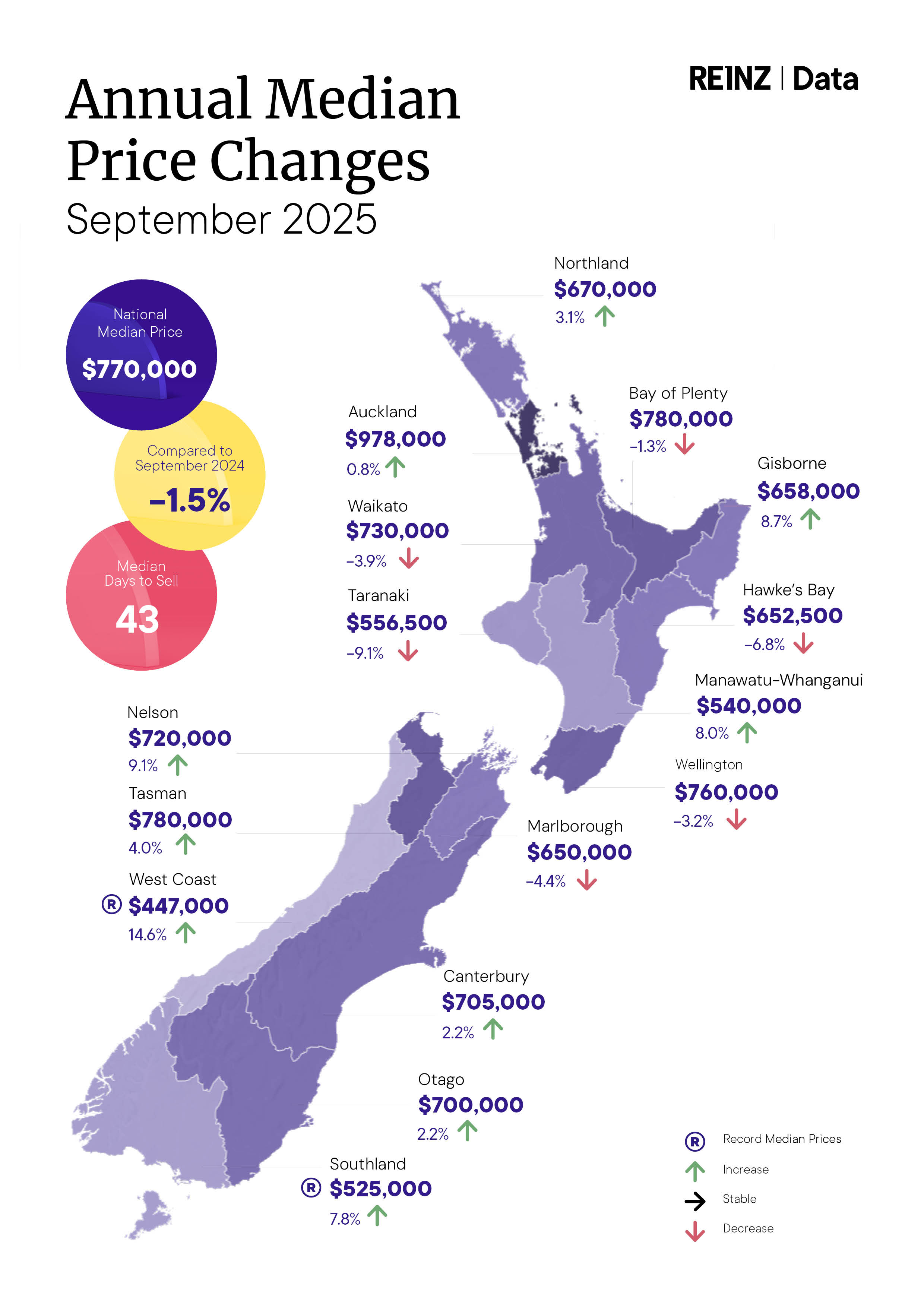

Price movements were generally up for the month, with the national median selling price increasing to $770,000 in September from $761,000 in August (+1.2%), but still down 1.5% compared to September last year.

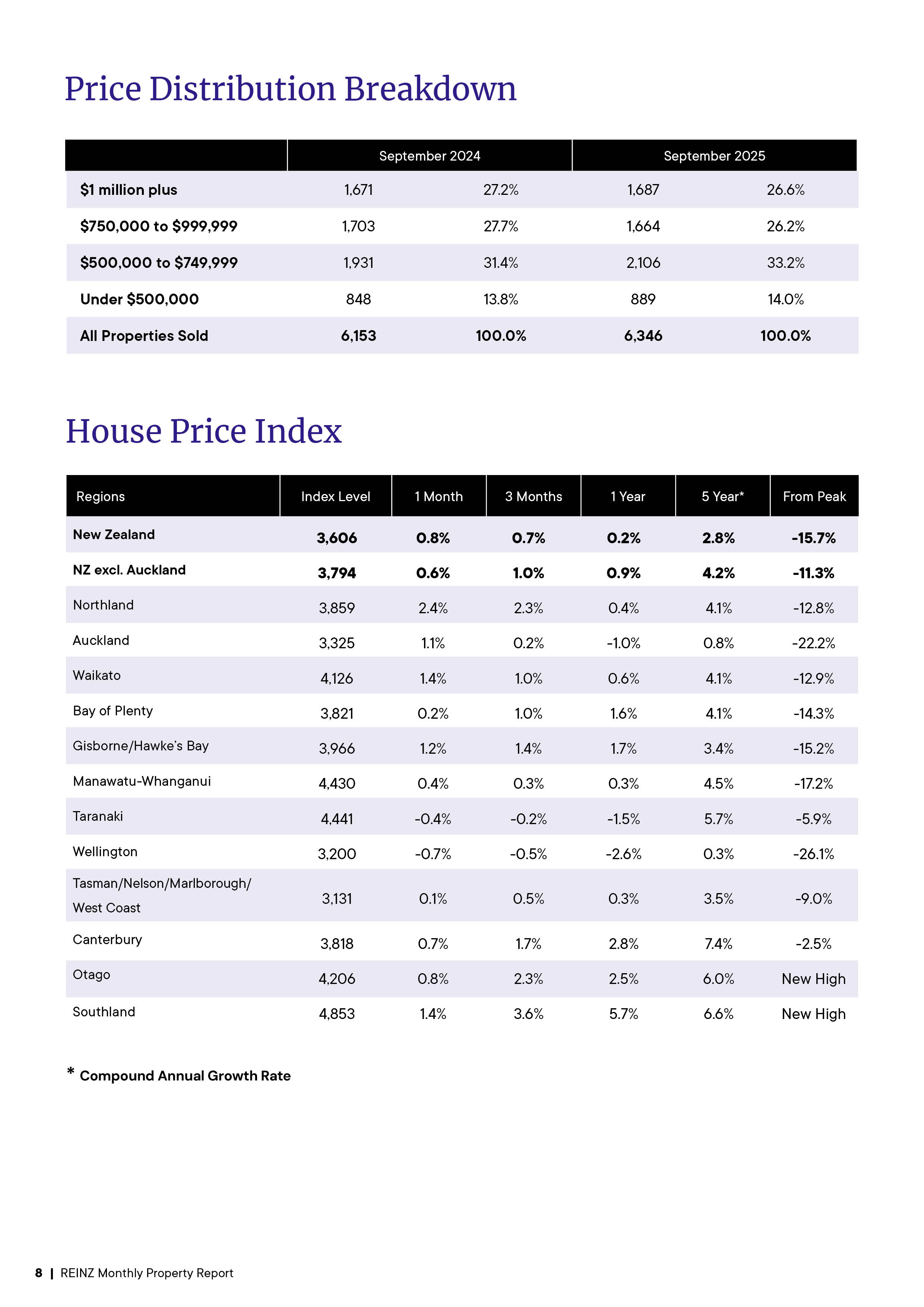

The REINZ House Price Index (HPI), considered the most reliable measure of house price movements because it adjusts for movements in the mix of properties sold each month, was up 0.8% for the month.

The HPI recorded increases in September compared to August in all regions except Taranaki and Wellington. See the table below for the full regional HPI figures.

"Some local salespeople are reporting a noticeable lift in activity across the market, with first home buyers and owner-occupiers still the most active," REINZ Chief Executive Lizzy Ryley said.

"With the recent OCR drop of 50 basis points likely to influence further interest rate reductions, combined with the usual spring rush, salespeople are cautiously optimistic that activity will strengthen further through spring and summer," she said.

The comment stream on this article is now closed.

Volumes sold - REINZ

Select chart tabs

Median price - REINZ

Select chart tabs

21 Comments

The race is on - can prices rise fast enough to stop the 5-year CAGR turning negative? Looks like Wellington is going to lose the race in the next month or two, Auckland maybe in the new year. Can the country as a whole escape?

What's the upshot, DON'T buy because It’s low vs buy Because It’s Cheap?

I assumed perhaps wrongly that having houses come back in price and being affordable is what most people want

I think I'm at the point where if someone told me they were buying a rental property, I wouldn't necessarily think they are crazy to do so. Yields are no longer as terrible as they were, and the chance of prices rising is reasonable. Depending on location, of course.

But I'm not at the point where a rental property looks like a good idea to me, compared to the other investment options that are out there. The hassle/return/risk ratios don't look good to me. Besides, the house I live in is already worth more than my share portfolio so I still consider myself pretty NZ real estate heavy.

Edit to reply to your edit: Yes, I think most people benefit from cheaper house prices. The exception being those who own more than 1 property, who are seriously overrepresented in politics and media - hence the narrative that rising prices is a good thing.

You mean Mike Hosking? He is very underwater on his property buyups, over the last few years. He CHEERS every glimmer of property hopium.

Don't listen to The Hosk and you won't be triggered. Switch to Pigeon Post on YouTube if that's your style

It seems to me your approach is more middle of the road average than fast lane driving ones own success. I'm not criticizing that it's fine if that's your risk tolerance

Like I say, it's risk/reward. I know leverage is easier for real estate than shares so you can amplify gains pretty easily, but I simply don't see there being dramatic returns in the next 5-10 years. Could be wrong. Full disclosure - I've owned a rental property overseas before so I'm familiar with the experience.

Happy to stick mostly with shares, including small caps and unlisted shares where I think the risk/reward checks out. And in fact, I essentially have invested in leveraged property through REITs which as I've mentioned have had a great run on the NZX this year. Beats a residential property investment that would have likely been cash flow negative, needed attention and maintenance, and not delivered any capital gains.

In the New Zealand context, you can't get much more middle-of-the-road in investing terms than buying a rental property with a chunky bank loan.

Above you referred the 5 year performance, looking at the NZ REITs I thought that Kiwi would be the worst performer. I was wrong KPG negative 7.63 percent, the sharemkt darling Goodman lost over 10 percent and Stride is negative 35 percent. At that point I gave up

My point about driving ones own success is no more evident than an industrial property bought by stride for 97 million. The seller made 6 times their money in a few short years by gaining the consents, bought for 13 million around 2016. If the seller didnt pay tax on the capital gain thats up to IRD to work out.

Above you referred the 5 year performance, looking at the NZ REITs I thought that Kiwi would be the worst performer. I was wrong KPG negative 7.63 percent, the sharemkt darling Goodman lost over 10 percent and Stride is negative 35 percent. At that point I gave up

I wouldn't be surprised at a CRE apocalypse in Aotearoa. I have indirect exposure to Aotearoa REITs. Not by choice. Wouldn't touch them with a barge pole. Unless it were something related to renting property used by bureaucrats.

Yeah, they would have been terrible to hold in the post-Covid bust and presented quite a nice buying opportunity afterwards. Sharesight tells me KPG has given me 8% CAGR since I bought (I started buying a little earlier than would have been optimal, in 2022), similar for ARG. Beats what residential property has offered over the last few years - obviously not my best investment but decent return for a solid, relatively low risk stock.

Pick and choose any time period that will justify your case. The last 5 year performance of Auckland and Wellington, that you brought up, is actually still positive. Not like your REITs

I'm not quite sure what case you're trying to argue here. The time period I chose is the time period I owned the shares, I just grabbed the number from Sharesight which tracks all my investments. The 5 year return is irrelevant to me as I wasn't interested in buying when they were expensive.

I know the 5 year CAGR is still positive - please re-read my original post. Then, if you like, re-read the second post where I acknowledge that residential property may also be approaching a reasonable buying point.

Of course you don't want to understand... You’re allergic to inconvenient facts I see.

I am quite confused. Clearly something has upset you, but I'm not sure what. Hope you get over it and enjoy your day too.

Again, edit to reply to your edit: I didn't question your stats, just their relevance. I'm not clear on what point you are trying to make.

Not upset at all, you clearly are. Am just setting the record straight. If that’s too much, we can always put together a list of superlatives to keep your ego company.

Glad you're doing OK. Still confused on what sparked the attack - I just find the stats interesting, looked back over the last couple of REINZ reports and extrapolated what's going to happen to the 5-year CAGR. You bought up my risk tolerance for some reason, so I thought I'd share a little. I didn't realise my investments would be triggering.

In general I like to remind Kiwis that there are investments beyond residential property as I think the single-minded standard protocol of borrowing big to buy as many houses as you can has made the country a worse place.

😫😫😆😆😆😆

I know leverage is easier for real estate than shares so you can amplify gains pretty easily

The Ponzi relies on monetary debasement through credit creation for non-productive purposes. It's the life and blood of its existence. Until the boffins accept and the sheeple understand that, things will only continue to get worse. At the moment, it seems it will take a Minsky Moment for that the happen - which would likely be something akin to a depression (which is kind of reality for many younger people already).

I'm betting on more credit expansion and liquidity.

My calculation is that the HPI in December 2020 was:

- NZ overall 3434

- Auckland 3442

- Wellington 3610

So the five year measure will be negative by the end of the year.

on our way to property halves ever 10 years?

Greg Ninness: Perhaps change the language. "Pessimism" for New Zealanders results from potential house price rises.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.