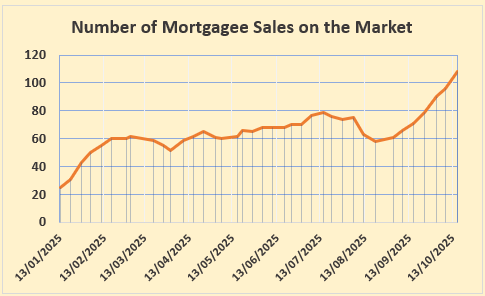

A sharp increase in the number of mortgagee sale properties has emerged over the last few weeks.

Interest.co.nz has been tracking the number of mortgagee sales on the market each week since November 2022. For the most part their numbers have remained relatively low.

Up until early October 2023 there were less than 50 mortgagee sale properties on the market at any time. In mid-October 2023 they pushed past 50, and passed 60 in April last year.

They hovered between 50 and 60 for most of last year, then began rising again this year.

The increase in mortgagee sales has been particularly strong since late September this year. At the beginning of October it went past 90 for the first time since interest.co.nz began collating the numbers. By mid-October, the numbers had surged to 109. (See the graph below for the trend so far this year).

The timing of the increase is surprising because it comes as mortgage interest rates have been falling. However, Reserve Bank data shows the total value of impaired loans held by banks increased by $15 million in August to $563 million.

There are several things banks can do to prevent a mortgagee sale when a customer strikes financial difficulties including; extending the term of a loan, converting it to interest-only payments for a period of time and, even payment deferral while the customer tries to restructure their finances.

However, the fact the number of mortgagee sales has been rising even as interest rates fall suggests the most likely reason is borrowers have faced an unexpected drop in income, usually due to job loss or business failure.

In such situations, no amount of mortgage restructure can make up for the fact the borrower simply has no money coming in.

The borrowers who will be most vulnerable in such a situation will be those who bought during the 2021/22 housing boom, particularly those who purchased their property with a low equity loan at the maximum term available, and then suffered a loss of income.

As well as losing their ability to make their mortgage payments, these people may also have faced the indignity of being tipped into negative equity, as the value of their home declined in the face of a weaker housing market, leaving them with little wriggle room to restructure the loan.

In such situations, a mortgagee sale becomes almost inevitable. And the borrower may still owe the bank money even after the property is sold, if the sale didn't raise enough money to fully repay the mortgage and any additional bank charges plus the real estate agent's commission on the sale.

That could see the borrower not only losing their home, but potentially facing bankruptcy as well.

The comment stream on this article is now closed.

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

30 Comments

The timing of the increase is surprising because it comes as mortgage interest rates have been falling

This shows the typical lack of understanding of the lag between interest rate rises/falls, and their actual effect on the market.

I disagree, it shows a total lack of confidence in the NZ economy and those running it. I've never seen it so bad, not in 40 years. I also don't see it improving, and I'm an eternal optimist.

You are both right. The RBNZ single-handedly ruined the economy due to a total lack of competence. They should have known about the lag, they shouldn't have gone so high, they should have cut sooner and faster, and they will no doubt cut too far and cause the opposite problem.

Their job is to keep the economy running smoothly, but they have been doing the exact opposite, yanking the OCR wildly in each direction. They are paid the big bucks to make small proactive changes, any idiot could make big reactive changes.

Single-handedly?

You gotta be jocking. This has been a huge collective effort by the ruling parties and the idiot voters that put them in power. Effectively they all gone hard out to rid us of the ability to produce anything worth selling and hence where we find our economy.

Correct RC, our current malaise has many fathers. We are lazy, self-indulgent, entitled and not that smart.

Disagree. The ruling parties and the idiot voters didn't help, but when it comes to the economy, the RBNZ has caused most of the problem.

Labour's big borrow up at Covid didn't help, same with National's spending cuts, but without the OCR swinging wildly around the economy wouldn't be in this position. We still have much lower government debt than many countries, we should be in growth mode.

I would agree that both parties have caused this by giving the RBNZ stupid mandates. Unemployment should be a part of the mandate, but clearly made a secondary role for when inflation is under control.

Growing what exactly?

GDP, jobs, confidence, spending, etc. It will happen now that they have lowered the OCR, but much later than it could have, and at the expense of many people who have lost their job, house, business, or just moved to Aus.

Incidentally the Aussie economy is still doing OK. Are you saying their governments have been significantly better? Or is it just that their central bank isn't so insane?

The OCR is not nearly the culprit you think it is, in fact it being too low was the problem. Many borrowers were on fixed rates as the cash rate spiked and not really that impacted.

I'm much more of the view that being a geographically isolated primary producer with some of the highest power and petrol prices in the world has finally taken its toll. We want the benefits of first world infrastructure and standard of living, a large welfare state and to cut our carbon emissions to those agreed at the Paris Accord.

Guess what, it's not possible. Something has to give, we need to grow the economy, find new exports and export markets and increase productivity. Even then we will just be stopping the deterioration. At this point our best strategy is to become a state of Australia.

Well said. Te Kooti gets it. A country as isolated as ours with the backbone of our economy made up from agriculture and tourism shouldn’t be as wealthy as we are. Add to that no minerals. We’ve done well to hang on so long. The slide in living standards is inevitable

Exactly. I don't see the slide as inevitable, but we are definitely a turnaround situation to use corporate lingo. Things are going to get worse but at least house prices falling is a step in the right direction.

Absolutely.

We may have had less of a peak in prices if the RBNZ started ticking the OCR up in 2020 when they somehow removed LVR ratios and implemented the FLP (insanity) and LSAP so to dampen expectations on the future cost of debt, but they didn't and we saw they greatest transfer of wealth in the history of NZ as well as the greatest increase in private debt.

Now we are left with the mental health implications of mass homelessness from such exponential rises in asset prices, lockdowns, vaccine mandates polarising family and friends/society, and finally, a lack of trust in central government which is the one and only thing they need in order to hold power and have society abide by the rule of law...which we have seen deteriorate.

I have faith we will improvement but not until the core view of housing is for a place for shelter vs an investment asset for yield, capital gains, and ultimately a non-emotive numerical game for retirement wealth, and we as a nation strop trying to have all the infrastructure and technology of much larger nations with greater populations by an order of magnitude.

"GDP, jobs, confidence, spending, etc."

What does that even mean. In the past 40 years it's mostly been based on increasing the total mortgage lending to increase the money in circulation. That's a money grows on trees thinking. I believe we are at it's limits and there's a need to shrink realestates shre of gdp drastically but that's going to mean lots of jobs disappearing. And the crucial part is we have killed off anything productive that those people could have done.

What did we kill off?

What could these people have been doing that is now not there for them to do?

This is a serious question, I’d love to hear your opinion on this.

Fair cop. Killing off is probably not correct. What we did was maintain the same level of export manufacturing and servicing as we had but increased our population by 60%. Killing our productivity would probably be more accurate. The fact that non primary exports by percentage account for less than half the amount they used to and the biggest chunk of that is tourism.

Oddly it's not the low wage immigrants who are unproductive, most of them work at the productive end. But it's allowed a heap of others to move into completely non productive areas such as the real estate industry.

It is a great question and I think its a complex answer.

Many used to work in the big factory in town, whatever it was. In Waipukurau there was a TipTop, in Waihi there was a TV plant, we built cars in the hutt. There where a lot more sheep so a lot more freezing works.

Each factory had their own electricians etc for maintenance and used local sparkies for large projects. In many cases there where cassing product plants associated etc.

But any form of primary procesing is cheaper in countries with lower wages. White gold went up, sheep wool down. Unless you where niche you where undercut by asia on price or Germany on quality. Around 2002 housing went NUTs, many who used to make things started things for houses, ie making kitchen cabinets etc etc. We moved our small manufacturing to support what was going to become the Ponzi, not thinking we would have nothing if the boom turned to bust. Who plans for a bust? you deny it ie all through 2021.... Every saturday Herald had a HOUSING Section. We WHERE ALL MILLIONARES rodney.

Even people with more solid businesses outside the Ponzi realised you could make 30% tax free buying houses vs the risk of expanding there viable factories/service companies, so they did the smart capitalist thing, they jumped in.

If you have lived here with your eyes open you have seen small guys import housing materials and make a fortune, but sadly that fortune has gone into Omaha bachs not more niche business that employ PEOPLE.

Now we find ourselves in a hole they we will have to climb out of if older, or move away from if younger.

There is no miracle to fix a bust as National are finding

Appreciate the replies RC & ITG, I'm early 40s and very vaguely remember local manufacturing, as a cricket fan I was always a bit sad to have missed out on the cricket factory that was just up the road at one time, I googled it as this triggered the memory, this comment from John Morrison in a 2013 interview was interesting...

"We set up a sports goods company there - the Australasian franchise for Duncan Fearnley. We had a really good two or three years. There were a lot of incentives under the Muldoon Government - tariff protection, job creation, export incentives, capital loans. Then Roger Douglas changed it all overnight. Suddenly it wasn't a good idea any more."

I also remember twenty plus years ago being in a local woolshed listening to a rep speak and when he was given a**holes by the crowd about not looking after the sheep farmers and their wool prices he simply asked "please put up your hand if you're wearing any polyfleece", 90% of the room put their hand up and he follows with "well, if you can't support your own industry what do you expect me to do"

I look around my house now, nothing is made here (well, apart from the house itself!), I don't know what the fix is...but as consumers we've been all very eager to pay less for imported goods...even if we rewound the clock and implemented the incentive Mystery mentions above would we be able to have prices competitive enough for punters to buy them?

I lean towards thinking maybe a good mix of grunty govt spending on infrastructure, some incentives for business (not this investment boost)...and as much as folks hate it some more private debt slushing around on property investment, but new builds not re-selling old sh*t to each other to try and give construction (and therefore pie shops) a rev up

No country has found an answer to an over priced property bubble, the best has been a lost decade or two.

We are all turning Japanese.

Before they crashed we all studied and wanted our business to be just like them, not realizing it was a house of cards.

We did post 1987. The banks just need to be honest and exit the defaulters. Yes there will be some losses but the money shouldn't have been lent in the first place.

NZ found a way to unwind post 1987. The banks just need to be honest and wind up the defaulters. Yes there will be some losses but that money shouldn't have been lent in the first place.

Banks have been suppressing the truth. Perhaps this is part of the decision of reducing LVRs again to keep the banks from acting...

That's my speculative take too. Banks will have been extending and pretending with non-performing loans because they didn't want to pile mortgagee sales into an already crashing market. With lower interest rates now putting something of a floor under the crash it's a little safer to release supply.

Given the RBNZs ongoing dysfunctional failures from 2020 on & the major Australian banks disproportionate enthusiasm for NZ residential mortgage lending, surely its time for mandatory no recourse mortgage loans as eg USA. There seems little likelihood of any other market mechanism being as effective in promoting sensible constraint as demanding the banks having their own skin in the game.

Why it will never happen in NZ is a good question.

Because banks control house prices by setting what they will loan on it. Up the risk to them and they will loan a lot less. Turkeys won't vote for Christmas.( Though with reference to my comment above they did vote in our government).

I realized this after the GFC, but then IMHO they lost control, their masters wanted more. Retail lending swelled to 70% of book. Insto divisions became the poor cousins to retail. I think they are safe, but they will not see book growth for a long long time, and they are not setup to access credit lending to SME.

Heartland may be well placed here with reverse etc

The data in the articale needs a longer tiem scale to be insightful. I think this is a bit of a "the sky si falling" story. According to AI;

Mortgagee sales in NZ have been rising since a 2017-2021 low point, influenced by factors like job losses and the economic climate, though they remain much lower than the 2009-2012 period following the Global Financial Crisis (GFC)

For example, while overall sales are increasing, they are still significantly lower than the GFC peak of 768 in the July 2009 quarter.

Numbers decreased significantly between 2012 and 2021, reaching a 17-year low in early 2022.

I'm sceptical and want to see who is being sold up.

1. First home buyers.

2. Investors. Lured by the bubble.

??. Are there many long term owners or are they mostly new owners. Etc.

KH

You are possibly missing the most significant group being sold up - that is those who have mortgages on their homes for business purposes.

Numerous small business owners finance their business using their home as collateral. Due to the high failure rate of small business, interest on a home loan is usually less than half when the business is used as collateral. RBNZ mortgage data indicates slightly over 10% of mortgages are for businesses purposes and in reality it may actually be higher.

With the high current number of businesses (especially hospitality) going into liquidation the likelihood of business owners having been liquidated, and now with no income, being able to negotiate an arrangement successfully with their bank is likely to be minimal.

Of the 109 current mortgagee sales, fourty or ffifty initiated through small business failures would not be unrealistic.

wow who could have seen this coming

Please add the 25,000 people who have converted from principal and interest to interest only.....

expect some of these to fall over in the coming 12-24 months as well

its just banks have extended the runway, the plane still has to get off the ground before it hits the end of ... the road.

Where does ones find the interest only mortgage info? Lazily didn't search...

The extend and pretend only goes on for so long until reality bites

"October, the numbers had surged to 109" That's a drop in the ocean. There must one or two thousand that are hovering just before a mortgagee sale. How many mortgagee sales are there that aren't advertised? I suspect the advertised ones are there to drum up a large number of interested buyers.

And there will be many thousands more who voluntarily sell up because they either panic and don't realise there are ways to get back on their financial feet, or they can't swallow their pride and ask for help.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.