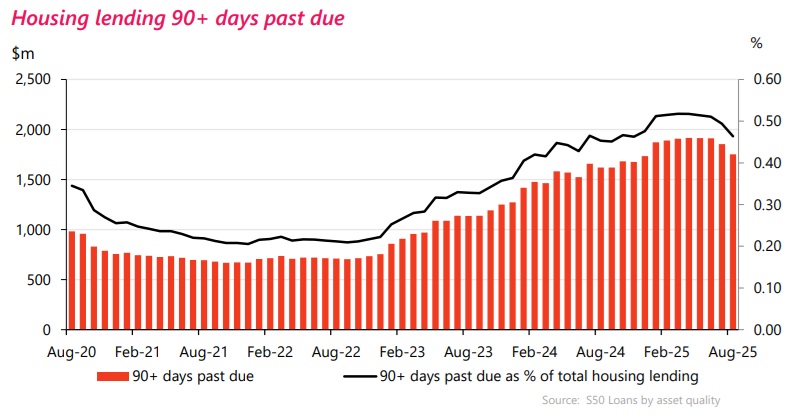

It's dangerous to draw conclusions too quickly - but the worst may now be over in terms of mortgage distress.

Latest monthly loans by asset quality figures from the Reserve Bank (RBNZ) show that the amount of mortgage money classified by the banks as non-performing fell by $88 million in August to $2.314 billion.

This is the biggest fall in non-performing mortgage debt since October 2020 during a period in which a brief pandemic spike was unwinding.

Significantly though, the drop in August follows a $55 million fall in July (which had earlier been the biggest fall in nearly five years) and means that the amount of non-performing mortgage loans has reduced by 5.8% in just two months from the peak level of $2.457 billion seen in June.

The $2.314 billion non-performing total is now the lowest such total since December 2024.

Breaking the figures down, as of August $1.751 billion worth of mortgages were classified as being 90 days past due but not impaired. That total has dropped $104 million in the last month. However, the total of loans that are impaired has actually risen, by $15 million to $563 million.

The non-performing mortgage figures began rising after interest rates started increasing around the middle of 2021 (this was even before the RBNZ began raising the Official Cash Rate in October 2021).

If we look at the RBNZ monthly averages of advertised 'special' rates, the average one-year rate as of June 2021 bottomed out at just 2.21%. By the end of 2021 it was 3.59%. As of December 2022 it was 6.40% and the peak, of 7.30% was seen in November and December 2023.

By the end of last year the average one-year rate was down to 5.78% and by August 2025 it was down to 4.74%. More falls can be expected and, indeed this week we've seen the BNZ put out a 4.49% one-year offer.

Of course, what's being offered as rates for new mortgages is a very incomplete picture. What people are actually paying on existing mortgages can be seen from the figures supplied to the RBNZ by the banks for the yields on their mortgages. These figures tell us that the average yield continued to increase some time after advertised new mortgage rates started declining last year, peaking at 6.39% as of October 2024. But the average yield is now falling quite swiftly, down to 5.55% as of July 2025.

And this is all clearly now starting to have an impact on non-performing mortgage loans.

In June 2021 the non-performing mortgage loans total stood at just $838 million and that figure didn't actually change much over the next year and a half. The non-performing total was $850 million at the end of 2022 - but then really started kicking up in 2023, reaching $1.517 billion by the end of that year and then $2.163 billion by December 2024.

While the non-performing mortgage loan ratio did rise very strongly, up from just 0.2% in late 2022, the rise has been less marked than that seen after the Global Financial Crisis. Between 2009 and 2011 the ratio frequently hit 1.2%.

At the peak of the non-performing figures, the total of $2.457 billion represented a little under 0.7% of the then total of over $374 billion worth of outstanding bank mortgage loans.

In forecast information provided to the RBNZ, the country's big five banks had expected non-performing loan ratios to peak at about about 0.7% by the middle of this year - which effectively is what we've seen - and then start to reduce in the final quarter of the year. This now appears to be what's happening.

And the improving trend in the non-performing loans is not the only sign of 'spring' in the latest monthly figures.

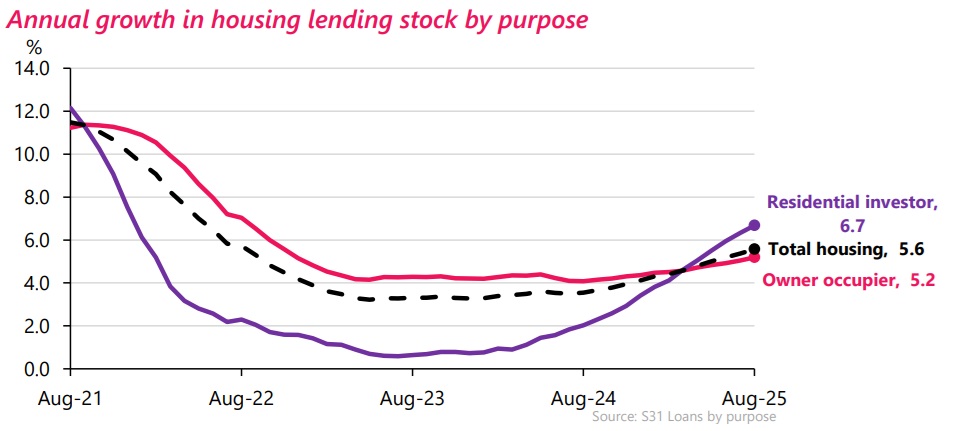

According to the RBNZ's monthly sector lending for banks summary for August, housing lending stock increased by $2 billion (0.5%) in August 2025 to a grand total of $377.484 billion, with the annual growth rate increasing from 5.4% to 5.6%.

Owner occupier lending increased by $1.3 billion (0.5%), while residential investor lending increased by $680 million (0.7%).

Investor lending mortgage stock increased by $6.136 billion (6.7%) to $97.973 billion, with the 6.7% rate of increase being the most in around four years since the tail end of the big investor pandemic boom.

22 Comments

Crickets from the DGM...

We are all prepping for tonight's cricket!....... and next years Rate Hikes!!

Yep, it's a bit sad when good news = fewer non-performing mortgages, is seen as bad news from those who cheer on armageddon.

Crickets from the DGM...

Just my reckon, but this is a meaningless measure and largely used for propaganda to keep the sheeple's spirits high.

It ignores any far larger pool of loans under stress but not yet classified as non-performing. The banks can dress this up as they like. And they have the ruling elite's approval to do so. Essentially, NPL data may lag asset quality deterioration: borrowers and banks may delay recognition of distress, so official numbers can remain low even as cracks appear.

It does not capture broader systemic risks, such as falling property prices, declining borrower incomes, or inflationary stresses. People are encouraged to keep them money and income in fiat currencies, not digital assets like the ol' rat poison and / or digital and physical gold. And that's what the banks want.

And of course, non-performing housing loan statistics lacks sensitivity to macroeconomic developments and changes.

You could spell it out in little words but the polly anna spruikers will not even admit there is a crash that "could" be causing stress.....

Just pointing out reality will get you tarred with the Chicken Little tag

Spec town can stop eating pet food.

Spec town can stop eating pet food.

Pet food is not cheap anymore.

agreed Raw Essentials is not cheap

So I take from the figures that more is being borrowed on a falling housing market. Also the banks have become way more adept at culling the problem borrower's without resorting to fully forced sales, good for both them and the borrowers.

The responsible lending code, brought in after the GFC, worked very well. Very few mortgagee sales.

Update on my non-scientific tracking of trademe mortgagee listings

October 2022 = 26

March 2023 = 37

February 2024 = 44

March 2025 = 65

October 2025 (today) = 89

I did one of these in July or August and it was either steady or slightly down from March 2025. Surprised to see up today.

you also needed to track "urgent sale" "beat the bank" "must sell"

The peak (of residential interest rates), of 7.30% was seen in November and December 2023.

The average mortgage yield paid to banks peaked at 6.39% as of October 2024

So, effective mortgage rates started dropping 10-11 months after interest rates started to reduce. Of course, few will rush out to apply for a new or larger mortgage the day after their interest rate stars dropping, especially after a period of high rates. It may well take a year to rebuild some cash reserves.

Therefore it's not at all unrealistic to expect to see the effects of higher or lower interest rates affecting the market with a delay of a full 18 - 24 months. That's why I still believe that the RE market will rise again in 2026, but not before.

That's why I still believe that the RE market will rise again in 2026, but not before.

There's a Nostradamus at every water cooler and BBQ across the nation.

They all have a common factor: talking their own shop, hopes, and dreams.

I do not benefit from rising house prices in NZ. Is it that hard for you to accept someone's view that is different to yours, without concluding that they have an agenda or self interest ?

Is it that hard for you to accept someone's view that is different to yours,

Not at all. I can't disprove the 7-10 year theory so why would I pretend that it's not true?

I can have a hypothesis. But I can't really have a view on it beyond a reckon.

For the record, I have never claimed that the Ponzi would collapse. I can't discount the probability, but I personally don't think it will.

Any negative implications of the Ponzi will manifest in other issues. And that appears to be the case now.

Yvil has had a good track record. I know this a little more keenly because I didn't follow his advice!

Next few months may be your last opportunity to pick up a bargain at 2015 prices!

yes because then you will have to pay 2013-14 prices

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.