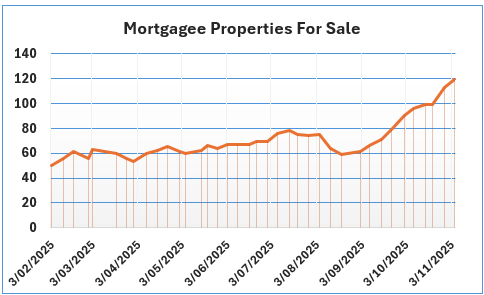

The number of mortgagee sale properties on the market has almost doubled over the last six months.

Interest.co.nz tracks the number of mortgagee properties advertised for sale each week.

In the first week of May this year, 60 properties were advertised for mortgagee sale. So far in the first week of November the number is 119, an increase of 98% on May.

It's easily the most mortgagee sales on the market since interest.co.nz began tracking their numbers in late 2022. (The graph below shows the rising trend since the beginning of this year).

Just over half (54%) of the mortgagee sales currently being advertised are located in Auckland, followed by Waikato on 11%, Canterbury 9% and Wellington 8%. Other regions mostly just have one or two mortgagee sales currently being advertised.

Standalone houses are the most common type of property, accounting for 58% of the currently advertised mortgagee sales, while apartments make up just 10%. Vacant sections, both urban and lifestyle, are the second biggest group of mortgagee sales at 28%.

There can be many reasons that property owners can face financial difficulties that eventuate in a mortgagee sale, but anecdotal evidence suggests a sudden drop in income caused by loss of employment or a business failure are particularly common at the moment.

The comment stream on this article is now closed.

18 Comments

Green shoots...

And he asked the King for little as payment but to place 1 grain of rice on the first square of a chess board, and to double that on the next square, and to keep doubling until the final square of the board....

Probably Nothing

Averageman,

Mortgagee sales is a result of what has been happening in the past, i.e. higher interest rates leading to tougher business conditions, leading to some business failures and rising unemployment.

"Green shoots" is looking at current conditions like lower interest rates which will lead to better business conditions and more employment in the future.

I agree, the increase in Mortgage sales is going to provide some great buying IF you know what you are doing and buy cheap land in the right place. Hopefully with a cashflow. winter 2026 !!!!!

Absolutely.

But banks have been suppressing the truth with interest only and all sorts of funny games. IRD is chasing revenue...hard. Banks will be able to see lack of payments to IRD as well. Perhaps the are jumping in before the ird arrives.

Summary. Yes rearward looking, but how much have banks had on extend and pretend...?

On the flip side, there are many who get themselves into trouble but then take the necessary action to get back on their feet.

If lenders put up the mortgagee sale sign at the first indication of problems, there would be a lot of repairable situations that are ignored. No one wants to toss anyone out on the street if they don't have to - even banks.

Buying a pile of specu boxes would be a sign of faith in green shoots. How many are the speculative actually buying?

In my opinion 'green shoots' has been marketing propoganda promoted by vested interests (to encourage people to buy houses - ie it's been a complete 'BS' phrase not worth listening to - a bit like the phrase 'trust the science' when nobody will tell you who is paying for that scientific research) while disregarding what the data has been really saying - and for years now. And all of those green shots weren't green shoots at all. More like weeds popping up in a garden that hasn't been well cared for (ie an economy that is sick due to excessive government spending, excessive bank lending, excessively loose monetary policy, reckless lending at high LVRs, low productivity coupled with debt speculation and capital gains etc etc etc - ie the poor decisions and behaviours of the past still influencing the present).

Green shoots appear when you actually have good soil and do the work to maintain the garden - we haven't done that now for decades but just expected to keep throwing more fertilizer onto a neglected garden and expect green shoots to keep appearing. It worked for a while but I don't just believe that 'lower interest rates will bring green shoots' is always a true mantra. Once you've made a complete mess of something due to neglect and laziness you have to get down on your knees and do some weeding to fix the fundamental issues going on that are preventing green shoots - a bit more fertilizer feeds both the weeds and the 'green shoots'. ie lower rates can actcually make your problems worse, not better, until you actually do the work for fix the fundamental issues (ie our private debt to GDP figures are absurd and that problem isn't going away without some sort of painful change ie we either need to dramatically increase our productivity some how or dramatically reduce our private debt vs our low productivity - which will it be?).

Well said. So many seem to just think the answer to all problems is lower interest rates when in fact excessively low rates has been a large part of the problem

Banks obviously feel it's a better time to sell now, than in winter.

Liquidators trying to get current account drawdowns back....

I would rather face the dogs of war https://youtu.be/1gbE7MtI_co

On the radio news last week was also news of record/high levels of financial hardship withdrawals from kiwisaver...but yeah green shots will be everywhere while people tap into their kiwisaver to pay for their rates/power bills/groceries. ie drawdown current savings just on daily necessities reducing the capacity for future investment from those savings.

Word on the street is that the hardship withdrawals are being exploited for frivolous reasons, providers are asking for changes to make them harder to access.

https://www.rnz.co.nz/news/business/577963/people-learning-to-manipulat…

"One banking industry source said he had heard about people using a withdrawal on "botox and lip fillers". Another KiwiSaver provider said a hardship application had been approved because someone could not sell their Range Rover fast enough"

If people are rushing to sell their RangeRovers then it could be another sign of the property bubble unwinding (ie opposite sign of green shoots). A sign of the property bubble exploding, which I was talking about on here 2016-2020 was watching young Mums in their 30's visiting cafes and gyms in Auckland in new Range Rovers - something which most people that age, working for normal wages (and paying normal expenses), would never be able to afford without the capital gains of flipping houses. ie a sign of speculative overshoot which was most likely going to turn to bad in the future when reality set in.

It could do. But my point is, if hardship withdrawals for reasons other than true hardship are increasing, then it's not necessarily a useful data series.

Maybe you can find some data on Range Rover prices to support your second hypothesis.

That's kinda the equivalent of blaming beneficiaries for being on the benefit while ramping up unemployment deliberately.

One banker heard about.......

I don't think it's the same. The observation that's being reported is people are gaming the system to get some instant gratification, rather than all of the hardship withdrawals being because of hardship.

"The other message people are getting from some of the social media stuff is if you don't qualify for financial hardship that's fine, spend the money and get yourself into debt and then the hardship withdrawal will work.

"Technically that's within the rules. Now the cat is out of the bag and more and more is going to happen every single day."

I'm just interested in the data, and it looks like this data source is being polluted so be wary of drawing conclusions from it.

It's all observations, peoples biases, differences in heuristics, skewed statistics, financial coercion (conscious or unconscious), opinions, hearsay, desire.....all mixed in together from which people process differently and then conclude with certainty and confidence that their view 'is the truth of the particular matter'.

Whether kiwisaver withdrawals are a good indicator of anything - well who knows! But apparently there are 'green shoots' again. I call BS! My personal view is that we are only about halfway through whatever economic malaise that it is that we are experiencing.

Until something significant changes - I think we're going sideways for years still and 'green shoots' (whatever that means? ....unsustainable booming house prices??!!!) are a thing of myth, desired by those with a financially vested interest in the housing market.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.