There was a sharp drop in the number of properties on offer at the latest auctions, suggesting the market may already have passed its pre-Christmas peak.

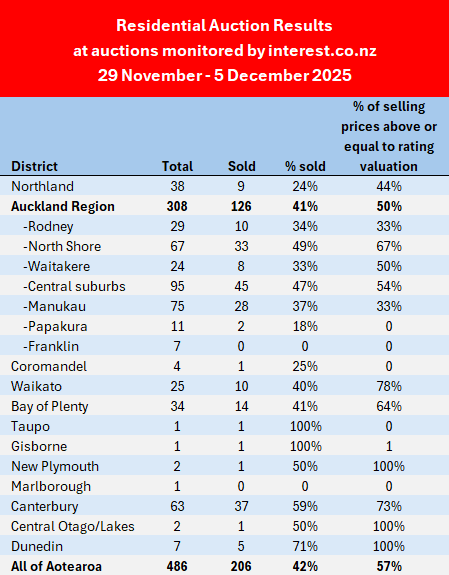

Interest.co.nz monitored the auctions of 486 residential properties around the country over the week of 29 November to 5 December, down from 599 the previous week and 532 the week before that.

Although the number of properties offered at the latest auctions was well down form the previous two weeks, they only dropped back to where they were in mid-October, so were still within the early summer selling season range.

Of the 486 properties on offer at the latest auctions, 206 sold under the hammer, giving an overall sales rate of 42%, which was well within the sales rate range of 39-44% that has prevailed since mid-August, suggesting very little change in buyer sentiment over that period.

Details of the individual properties offered at all of the auctions monitored by interest.co.nz, including the selling prices of those that sold, are available on our Residential Auction Results page.

The comment stream on this article is now closed.

3 Comments

Peak selling season looks very flacid.

The NZ Housing Market Ponzi is poked! Completely.

Be Quick

and speaking of shit sandwiches, property developers going to puke on this change, not only bankruptable on over drawn current acc, now taxed as dividends, baaaaaaaaarf......

Inland Revenue proposes changing tax treatment of loans companies issue to shareholders

Inland Revenue says that in 2024, about 5500 companies were owed more than $1 million by their shareholders. Photo / NZME

Inland Revenue is proposing to close in on companies that lend to their shareholders – rather than pay them dividends, salaries, or wages – to reduce their tax bills.

It is eyeing the whopping $29 billion that shareholders currently owe companies, questioning the extent to which these loans are effectively being used as low-tax ways of paying shareholders.

The tax department is also worried some shareholders are using loans to withdraw funds from companies prior to them being liquidated, leaving creditors out of pocket.

It is proposing to treat large loans to shareholders as dividends (which are taxable) if they aren’t repaid within a couple of years of being issued.

Its suggestion is that the change be applied to loans issued from December 4 onwards.

Companies involved in property would likely be most affected.

The change would only apply to companies owned by individuals or small groups of shareholders, as widely-held companies, partnerships and sole traders can’t use shareholder loans.

Inland Revenue couldn’t put a figure on how much more tax revenue it might collect if the Government forged ahead with its proposal.

Yet again none sold in Wellington....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.