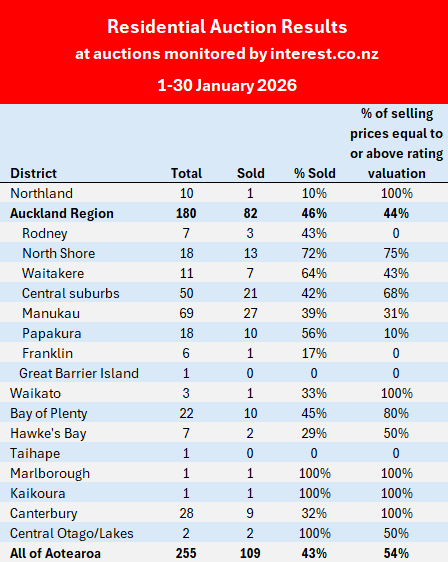

Auction room activity has made a reasonable start to 2026, with interest.co.nz monitoring 255 residential property auctions around the country up until January 30, with 109 of those selling under the hammer.

That gave an average sales rate of 43% for the start of the year. That's slightly better than the average sales rate of 39% over 2025, suggesting a cautiously positive outlook for this year.

January is traditionally a fairly quiet month for auctions, with new listings starting to pour into the agencies from around the middle of the month, but auction activity not building up a decent head of steam until February.

From then on it's all go, with the period from February to April generally being the busiest months of the year for residential property sales.

So auction activity should pick up significantly over the next couple of weeks, providing a more reliable indicator of where the market might be headed this year.

Of the properties that sold at January's auctions, just over half (54%) achieved prices equal to or above their rating valuation (where this could be ascertained).

So not a bad result for what is traditionally the slowest month of the year for auction activity.

Details of the individual properties offered at all of the auctions monitored by interest.co.nz, including the selling prices of those that sold, are available on our Residential Auction Results page.

The table below shows the January auction results by district.

14 Comments

Peak market right now. Limp wristed and waify. No summer Brutus Erectemis strength in sight.

Flaccid as bro.

- Down the Karzi - for the housing Ponzi from here!

Good to see someone's still able to find this subject still worthy of energy.

most of the spruikers have moved to gold and silver

Most of the smart people have moved to gold and silver.

I would consider oil going up soon

Spruikers become traders, what could possibly go wrong

The bitcoin spruikers gone quiet ?

The bitcoin spruikers gone quiet ?

Leverage is causing crypto to puke hard, forced liquidations.

As a serial prop doomer I have to say the biggest impact going forward is the cost of construction. Can see how that can go back ten years. In the current market constraints, land is the meat in the sandwich. Especially for all the speculators that fired their cash shots prior to Plan Change 120 being announced.

Perhaps 3d printing of houses will change the game. The Zuru house project and its very low Sqm rates makes interesting reading.

Sometimes wheels dont need reinventing. Humans have had the knowledge and ability to build solid fixed structures efficiently for thousands of years. Hell, we only managed to surpass the Romans in how tall we could build something in the last hundred years or so.

The actual issue is the huge number of hands that have to touch a house by the time it's a finished building. And I'm not talking about the labour on site.

"land is the meat in the sandwich" Must be fillet steak. Looked at some section prices in Waitakere. Many been on the market for 8 months. Small sizes 160m2 at ridiculous prices. Land banking alive and well. Don't see any of the main parties doing something to minimise it. An option progressive land tax on empty sections or must build within 5 years of a point in the development cycle.

There's a good reason many leave AKL.

Exactly.

DPost.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.