By Bernard Hickey

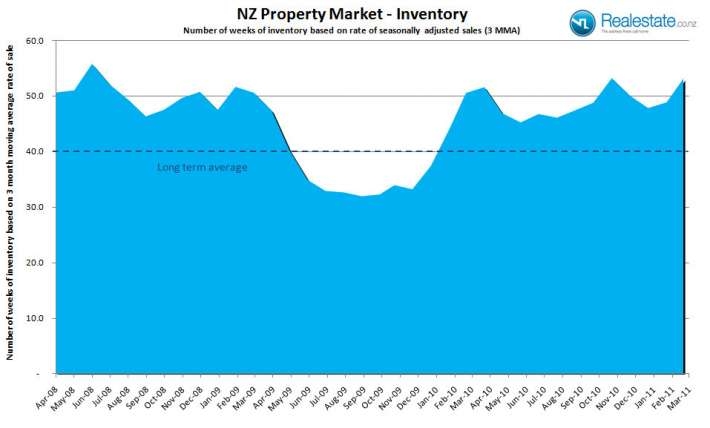

Realestate.co.nz listings data showed the number of unsold properties reached a near-record 53.1 weeks of sales in March.

Yet asking prices rose slightly and the number of new listings rose 9% on a seasonally adjusted basis in March from February.

"Given this high level of inventory, matched to slow levels of new listings, it is becoming clear that the high asking price is more likely to be the result of keen interest focused purely on new listings, leaving older listings somewhat “languishing on the shelf” at what could be unrealistic prices or presentation that needs refreshing to attract buyers," Realestate.co.nz said in its monthly report published at Unconditional.

"The key driver of this rising inventory is more a reflection of somewhat lacklustre sales than excessive new listings. The absolute level though at over a year of equivalent sales will continue to impact the market and maintain the “buyers-market” perspective," it said.

Realestate.co.nz said the truncated mean asking price for all new listings in March rose to NZ$421,940 from NZ$420,265 the previous month. The trend of the last two years is of continued strength in asking price expectations.

New listings rose 9% on a seasonally adjusted basis and the 12 month moving avrage of new listings was 131,722. This is down 6% on the previous 12 months. Sales in February totaled 4,502.

Asking prices were strongest in Auckland and Wellington, while asking prices fell in most provincial areas, with Northland and Marlborough hardest hit.

Realestate.co.nz said activity in Christchurch had been resilient despite the earthquake.

A total of 1,297 new properties came onto the Canterbury market in March, which was down 36% on a year ago.

“Property is still being listed, marketed, viewed online, researched, enquired about, negotiated and sold,” he says.

The average asking price for Canterbury homes was also resilient, with the truncated mean asking price falling 2% from the previous month, to NZ$357,986.

'Prices to rise 3%'

Meanwhile, ASB economist Chris Tennent-Brown said the stronger new listings was a positive for the market. He noted that relatively subdued inventory levels showed the market was in better balance than it had been in the pit of the recession 2008 when prices fell 9%.

The figures showed the Auckland and Wellington markets were tighter than the rest of the country, he said.

"The Auckland market remains tight relative to the rest of the country, with Auckland accounting for around 25% of New Zealand’s listings, but 35% of the turnover at present, and only 8 months of inventory based on the current rate of sales. Wellington is even tighter, with a ratio of 6," he said.

"A contained level of inventory, positive migration and population growth, as well as the recent drop in interest rates are all positive for the property market over the year ahead," he added.

"We expect nationwide prices are troughing out now, and should increase by around 3% over the year ahead. Behind this lift will be a range of experiences, from stronger price appreciation in areas such as Auckland, and ongoing weakness in areas where population and income growth are less supportive."

Housing inventory

Select chart tabs

100 Comments

"We expect nationwide prices are troughing out now,

Gee this guy can read the future. I give him a call next time I head down the TAB.

Crap website also. There used to be one all allrealestate.co.nz and that was much nicer to use. Don't know what happened to that one.

I thought it was supposed to be an april fools story, that house prices have bottomed out. Yeah right. I would concur about their website, it is very dated and difficult to use. However their iphone app is way better than their website, and has a google map allowing you to find house easily.

Of real concern:

The economy in some rather rural regions, especially businesses involved in tourism are coming almost to a still stand. How much longer can businesses hold on to their staff ? Where are they going after made redundant ? Some businesses go under before winter - a high number during the next 12 months.

righ now: Crude Oil $107.- some commute 30km plus.

Get used to expensive oil/petrol and move....simple....some areas will become vastly different in population and jobs.....Tourism will decline, there wont be the money or the numbers, jet fuel costs too much, Air NewZealand will go bankrupt....I set myself up more than a decade ago to minimalise transport costs and have options....most NZers are going to have to do the same....

I expect un-employment to go well past 10% as well, 15% could be possible....how many ppl employed in tourism? look for 75% un-employed....retail? 75% unemployed.......

Car and associated services? well there will be a lot less cars more buses, more trains......so 1/2 the garages? 1/2 the petrol stations? as the economy starts to unwind its going to be pretty unpleasant IMHO.....right now for the semi-skilled all i see are poorly paid farming jobs as an energy alternative....muscle power instead of fossil fuel power.....very bleak IMHO.

and to fund all these changes/costs? taxes are going up 50%....and it will have to be a broad based thing....very little spare money....those in jobs very lucky.

regards

Things are going to be tough for a whole lot of us. Now is the time to decide if we're going to die rich, or show a little compassion to pur fellow man...

Bottom has been and gone - long gone in my area.

Other areas following now.

Horse has bolted, ship has sailed, bus has been missed by some.

(most of you lot probably)

etc.

Spot on, SK ! "Horse has bolted, ship has sailed, bus has been missed by some." That's for the people trying to desperately sell into the 53 ( point one ) weeks of supply. I did try to tell you, many months ago, "Sell whilst you can, SK" But you didn't listen. Too late now.....Soon all those 'hidden' sellers' will come out, to. Those waiting for 'the bounce' that hasn't come; banks and finance companies with 'grey supply' and those who sadly try to esacpe the coming Budet changes. 53 ( point one) weeks supply....will look small in a few months time... ( Psst: It's still not too late to sell, SK. You may nave missed the better prices, but don't wait untill your in the cellar...)

Rubbish darling.

2 new listings this week in the whole of Westmere and Grey Lynn.

7 figures being achieved regularly.

Must be all those Herne Bay people downsizing right?

Certainly not, they would rather die than move to Grey Lynn from Herne Bay.

The ultimate humilation surely?!?!

Agree that the bottom has long gone about 18 months ago.

When you finally read something like this on the news, things are usually very different already.

I hear everywhere people talking about now being the best time to buy a house.

Its a clear sign when I can see people at work surfing on the internet looking at propeties during their break times...etc. Things are slowly changing, remains me of early 2000's.

I'd get ready for something nasty arriving from over the Tasman, for our property market, if I were you, Small Kev. When 'they' go down, we won't be able to avoid it! After all, our banks, are their banks...

"..The housing industry is demanding a new stimulus package to prop up the property market .." .. "With the housing downturn having only just begun, expect calls for ‘urgent’ stimulus to grow louder...."

Agree SK. I've heard from a few agents in Akl that there are no bargains due to strong buyer demand...sales numbers very strong...stats that come out in a month's time will support this. Will Akl solid prices/strong demand last?

Who knows? - maybe the answer lurks below amongst the next 20 or so comments from learned experts in this field - them guys on this blog with their fingers on the property pulse.

Best don't believe the agents, they might be hiding an obvious conflict of interest. Family friend of ours signed on the dotted line yesterday, $725,000 for a North Shore house that had an asking price of $850,000 last year.

Unfortunately, however, they were buying and selling in the same market...

yay!

This is all just real estate " porno " and akin to the nodding dog in the back window of the car in front of you..!!

a house is worth what you're prepared to pay for it on the day... and a home is a place you like living in...your call..incl. you SK, petal ..

Hey guys

Been absent for a bit, busy with work and family :)

Auckland's bottom long gone, come on Matt in Auck get that offer on paper this weekend :)

Completly off the topic, see below, this saddens me, where are the tough judges in NZ? Justice (I assume you are an ex-judge :) what's your take on this?

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10716415

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10716431

A lot of those listings in ChCh are of properties in wrecked neighbourhoods still asking the pre-earthquake prices. If a single one sells I would be extremely surprised. All current sales will be in less affected areas.

Here's some wishful thinkers:

http://www.realestate.co.nz/1525252

http://www.realestate.co.nz/1509806

Overlooking the Avon in Avonside on the one small stretch where houses are still attached to their foundations. Note the "peaceful river views", I can't see the sandbags stopping flooding in the river shot - it must be an old photo!

http://www.realestate.co.nz/1512586

On the recently drained "Lake Keller", now a nice sandswept undulating street.

Then of course the ones that were fine when listed but probably need to come with a bulldozer now:

Love how several of those listings mention 'in need of TLC'

Mind you, there has been a lot of interest in these wrecked houses. Purchase one on an area of land that's stuffed from a distressed owner (which most people are distressed at the moment), take over the insurance policy and bob's-your-uncle, new house in a new area. (if you're prepared to wait 3 years at least)

A friend of mine has such an offer from an Aussie knocking on his door a week after 22/2. Been all along the street, just a numbers game until he found some ready to sign the papers. Arse.

NZ has no economic reports scheduled for next week, Japan had a terrible event, Australia had huge rain floods and Yasi, Chile had a terrible EQ and tsunami. All three countries continued to report ..... What is this Mikey Mouse of hiding the reality from investors, Does the NZ government think that because they are not made public they will go away ? C`mon Mr Key get real.

"The bull run in house prices is set to run out of steam as investors realise that credit costs are dwarfing anaemic yields", according to a senior banker. National Australia Bank finance chief Mark Joiner yesterday said the property market was fully valued ...."I don’t think property can go up from here,” he said.“It’s at the top of the range on affordability. It’s well out of line internationally.....We had banks growing credit at 15 per cent per annum – that’s not going to happen any more.”

Of course it's just another opinion; and from Aussie to boot. But this is a bank speaking! You know, the one that owns the BNZ....

And now even Westpac joins in ".. an associated return to rising house prices, stronger credit growth, and a consumer much more confident in their finances is unlikely without further ( household) balance sheet consolidation. That takes time and brings with it the risk of further weakness for consumer demand and the housing market. - Bill Evans, Chief Economist at Westpac."

@Murray - if you're listening! From Oz yesterday. It's still on for 0% OCR here, as well...

"The first effect of this imbalance between demand and supply is an increase in the time to sell, and in the number of unsold properties on the market. The second effect is a moderate fall in prices, once sellers who have to sell realize that they have to take a haircut. The third effect ....may well be an increase in sales by property speculators, if they see their capital gains diminishing the longer they hold on to their “investments”. The Scheme could be kept alive by a reduction in interest rates to entice new buyers into the market...but even there, there’s a limit. ... This would require the RBA to drop its cash rate to zero from its current level of 4.75 percent.

Divide what you reckon you'll get for your house when you sell it by a rolling average of your weekly (increasing alarming) non-discretionary outgoings. That'll tell you how many weeks that 'safe as houses' asset will sustain you and yours. But don't forget to subtract the settlement value of your mortgage before you do. Then keep doing the same exercise until that 3% increase materialises...

I have perosnally found that sellers are very reluctant to sell for under the RV of the property. Also they will not sell for less that they paid for it. The fact that Bollard as reduced interest rates again, I think will create another small bubble, as affordability gets better, and people can afford to borrow more again. I don't think NZ has learnt anything. We do need a land value tax (exclusions or different ratings for lifestyle land owners) and a captital gains tax, but I can't see that happening.

I think Bernard was right about the 25% drop in house prices, but he couldn't have predicted the Christchurch earthquake, which has put more demand on housing in other areas, and lower interest rates. This is no doubt going to cause some major inflation, and will hurt savers hard. I think buying property now, and getting a good deal on it, could be a way to preserve some of your savings from this inflation.

Just as Olly predicted- renting is for suckers:

The great disappearing home

By Kieran Nash

HoS. Sunday Apr 3, 2011

Auckland is facing a major housing crisis if current development trends continue.

Local officials predict that, at the current rate of development, there will be a shortage of 50,000 homes in 30 years - equivalent to all the homes in Hamilton.

Auckland Council chief planning officer Dr Roger Blakeley warned that Auckland needs to be proactive by subdividing smaller properties and expanding into semi-rural areas if it is to avoid a major housing crisis

It also said that renters would leap to 40 per cent of households - either by choice or because they could not afford to get on the property ladder.

Link:

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10716795

What Olly Newland failed to pick was the re-densifying of dwellings that will become a feature of our housing market in Auckland; as those who can not afford to 'be independent', either the indebted young ,the money strapped old or the financially challeged, start 'bunking up'. How could he, either? None of could have forseen that absolutley massive wealth distruction, on many fronts, that has occurred in our country in the last few years. Add up the number of empty berdooms in Auckland, or new Zealand for that matter BigDaddy, and ask yourself "How many more houses do we need if even half those empty bedrooms have an occupant tonight? My suggestion is that we have far too many houses in the current environment, and shall do for many years to come.

A classic case in point from our poster Chairman Moa ( a fellow 'bull' of yours); who, having rented his house a few weeks ago, before he toddles off to Australia, has let his place out in Auckland to... two couples. That, I assume, is 4 people in the place of two, in the same house - as well as the original two....leaving the country!

One tiny anecdotal example of this:

Our neighbours, three bedroom house with sleepout.

Two years ago: Three occupants, small business/workshop operating from sleepout.

Now: Six occupants, no small business.

Wonder if ASB is expecting 3% throughout NZ.? Might be true in the growth areas, but what are the growth areas of any note, seem to be few and far between- obviously Auckland, Hamilton and Tauranga which keep on growing and growing. Even Wellington may struggle if / when cuts to civil service start to bite, and Cristchurch is not what it used to be.

So three and a half years into the GFC and house prices in New Zealand still have not crashed the way the doom, gloom and despondency brigade on interest.co.nz have been predicting.

When is it going to happen guys?

Note that now asking prices are rising. Couple this with the Herald on Sunday report posted by Big Daddy above and this thread has made me feel very chipper indeed.

Where's "Happy Renter" or Nick A to describe for us the dark art of renting in the face of a clearly-developing housing shortage in our biggest city?

Reading,4 Your Landlord : "Those who are trying to cash out—existing house owners who are selling as speculators, or selling to realize a paper capital gain and upgrade to a more expensive house, or selling an investment property to fund their retirement—are now selling into a dwindling market. The first effect of this imbalance between demand and supply is an increase in the time to sell, and in the number of unsold properties on the market. ( That's NZ, right now) The second effect is a moderate fall in prices, (Ditto) once sellers who have to sell realize that they have to take a haircut. The third effect ...may well be an increase in sales by property speculators, ( That's just about to arrive for NZ) if they see their capital gains diminishing the longer they hold on to their “investments”.

I'm still here! My position hasn't changed! I thought I was wasting my breath trying to warn people about what's coming. It will be epic. We are living history. I hope I'm wrong. I want you to be right, not me.

re: Bernard eating humble pie and Steve Keen losing his bet- I think both will be vindicated- not a matter of "if" but "when"

Bernard's prediction of 30% drop is conservative before it's over. I think 60% is more realistic. All you guys look at what's happening in Auckland and think it is somehow shielded from what is happening in the rest of the world. It's a microcosm, but not immune to world activity. Therein lies the problem, and why I am in no hurry, whatsoever, to but property, when I can buy it from the bank much cheaper a couple years from now for CASH.

Thousands of Property investors are "walking dead" financially. They just haven't realized it yet. The market will awaken them soon enough.

A big reason I gave up on posting is because this website set-up is ABSOLUTELY RETARDED!!!! I hope BH reads this, because it's absolutely true. We can't keep up the debate if stories like this drop off the front page for seemingly "more important" stories. Debates like this, with lots of participation and comments, should stay on the front page regardless of whatever new news comes out. If the new news story gets more comments, or more activity, then this story drops off the front page.

Basically the most active stories, bearing the most comments, should have their own place on the front page, listing them from highest activity at the top. Until then, I am a HAPPY RENTER.

They were never going to crash The Man. Just drop in value a little month by month and when you add in inflation the result is shocking for a large number of investors and that is why so many rentals are on the market all over the country. Add in the changes to depreciation and it gets worse. As the cost of living escalates in New Zealand more and more landlords will jump out of the market. The only bright light might be central Auckland which has been saved by the earthquake migration but that will come under pressure from migaration to Australia. My nephew who lives in central Auckland says a lot of professionals in his twenties age group are looking seriously at moving over there to get the higher incomes on offer. Incomes are pretty pathetic here for the majority.

Central Auck listings getting scarce - people holding as prices creep ever upwards.

Have you seen some of the prices being paid in Grey Lynn lately?

Forget the 'creep' SK ! Just go the whole hog and put 'em up 50%. What does it matter what the asking price is, if they don't sell? Here's what putting price up in your "Grey Lynn's" does....people look somewhere else, and then Grey Lynn is left on the shelf. Do you hear that wispering in the property winds, SK?...53 ( point one) weeks of supply.... Until general disaposable wages in the community rise, prices are going nowhere...but down. And with increasing unemployment... wages are going in that same direction. Why else do you think the GOvernment is 'cusioning the blow' with lower interets rates?

Grey Lynn (and central auck in general) becomes more and more sought after - prices go up - prices keep getting paid. No evidence at all that it's being put on the shelf.

I'm talking about "What is actually happening"

You keep banging on about what might happen some time ifs, buts maybes.

No they don't, SK! They become less and less affordable. Markets never just 'drop dead', there will always be movement... but at a price. And I don't know anyone, who is prepared to pay 'full price' at the moment..Maybe you do...maybe that's you?

And as for 'people sellnig'? I see the Barfoot boys have put their family home on the market after X number of years. I guarantee you that they haven't done that.... now...because they expect the price to be higher any time soon!

Head along to a barfoots/bayleys auction one Wednesday and see who is willing and able to pay.

This is actual - not anecdotal.

Think you may need to note the difference.

The Barfoot brothers have put...their family home ..on the market after X number of years. I guarantee you, they haven't done that...today...because they think the price will be higher, anytime soon :) (NB: That's not anecdotal...that's fact...page A6, The Herald) Sorry. Doubleish post as you must have reponded to my above comment, first....

7 Westmere Crescent. Sold last week. 2million dollars. V nice place.

69 Francis Street. Grey Lynn. Sold last week

$870k - Do up with no off street parking.

If people are happy to live in Avondale - this is no problem for them!

What did they last sell for and when, SK? Two million $ ...looks good...unless it sold for four million $ in 2007 etc.

Price records being achieved in the last few weeks.

So: Let's say, you had one of the pieces of your portfoilo for sale at/valued at $5m in 2007; and last weekend it sold for $3m...but it was the highest actually paid in your area...'a record'. Is that a good result for you? And if we then go on to concider how much you actually owe on it....again I ask..is that a good result? "Record paid !" is a mraketing tool.... in any market.

The ever increasing trend to report on "Asking Price" vs. "Sale Price" is rather telling. (Are we now reporting on the market results, or the level of delusion of the vested interests?)

I first noticed this in the wake of 'Black January' this year, with one of the lowest sales volumes ever recorded. (See here http://www.interest.co.nz/property/52252/house-sales-hit-new-low-3252-january-while-prices-drop-reinz-says-new-listings-lowest-ever )

We see:

National Median Sale Price = 340,000

National Average Asking Price = 406,500

...now I'm aware that Median is not equal to Average, but that still shows an unhealty disparity between perceived value and realised sales. Since the January figures were released, I have noticed increasingly reporting on only the "Asking Price" of NZ property. What are the spruikers trying to conceal?

These figures are not intended to capture agreed figures to settle.

Right... So you're confirming a move from reporting on the "actual" to reporting on the "hoped for"?

Surely the "agreed figures to settle" are the only relevant figures? Anything else just reflects the wishful thinking of P.I.s who failed to realise their on-paper gains when the market peaked over 3yrs ago...

Missing the point.

There are lots of figures that come out in a month - these ones only collate asking price - because its a sales website - they only know advertised prices.

No, you're subverting the point.

Of course realestate.co.nz only has access to the asking prices - they are an advertising channel, not a sales channel.

My point is that the MSM commentary has transitioned deftly from reporting almost exclusively on unconditional sales prices & volumes to a new paradigm where these figures are reported as a seconday consideration, if at all.

Yeah the asking prices are getting higher and the actual selling prices are getting lower haha

Haha.

Put the crack pipe away.

Now now

I have observed that areas with high Asian migrant populations on the North Shore are holding up well. These tend to be in popular school zones.

"For example, on July 23, 2007, Henry M. Paulson Jr., the Treasury secretary at the time, said the housing slump appeared to be “at or near the bottom.”

The above from today's top 10. What happened to the US housing market after that?

"We expect nationwide prices are troughing out now" from the ASB economist above.

Let's all take an economists comments as gospel, especially one with a vested interest.

According to most reports both Australia and Canada have property bubbles and their economies came through the GFC relatively unscathed. Why? Apparently because of their reliance on China. The timing of their corrections was never going to match those of the US, UK and Europe. According to reports New Zealand was also reasonably strong enough to deal with the GFC in the same way that we rely on Australia and China. The timing of any correction to our property bubble will closely align with that in Australia.

Our bubble is also artificially inflated by those with a vested interest and low interest rates delaying the pain. What happens when inflation becomes more of an issue and the RBNZ steps in with the only tool it has - the OCR?

When inflation becomes an issue asset prices will be going through the roof.

No they won't! Asset prices will fall, as people have to sell what they have...to live. Ask yourself: At what stage do I sell that 6 litre V8 because petrol costs so much...or that property portfolio, because I can't affrod to feed the children. There's a point for all asset holders that's unbearable "Inflation in all you need; Deflation in all your own" SK It's coming; if it's not here already. TradeMe is going to do a roaring trade, from now on........eg:

http://www.trademe.co.nz/Trade-Me-Motors/Cars/Lexus/isf/auction-366071039.htm

Melbourne house prices up 15% in the year to February (smh.com.au, today).

The shortage of dwellings here in New Zealand, and especially Auckland, mirrors Australia of the last few years and now looks ominous for renters here.

What say you Nick A?

Melbourne is doing a 'catch up' after taking a relative belting a few years ago. GIve me that stats. today for.....let's say...Brisbane or Perth...and give us an alternative view! ( Off the top of my head, I'd guess Brissy is down about 20%?)

Here ya go Your Landlord.....just the first thing I dragged out...

http://macrobusiness.com.au/2011/04/fresh-calls-for-housing-stimulus/

Oh, and also from the Aussie press, today "NZ moves to limit exposure to housing "

http://macrobusiness.com.au/2011/04/nz-moves-to-limit-exposure-to-housing/

I think it's the middle of your head that's the problem NA. The grey spongy bit. Brisbane prices barely down on a year ago. Not bad for a place that has just suffered catastrophic flooding.

Really ? I'll do a scratch about and see what I find ....

So far: "I am a lender with a one of the big four and based in Qld. I can tell you that lending is very quiet here in Brissy. This time last year was one of the busiest periods we had in the last eight. We achieved 125% of our half year target (which ends on the 31st of March). This year we reached 67%. That is almost 50% less than 12mths ago. Lending is down in NSW, Vic and SA. However it is WA and Qld that impacted the most. They have already let go of over 20 corporate staff and if business lending is doing well it is not here in Qld, speak to the commercial bankers everyday and they have never seen it so quiet. We are also loosening lending policy almost back to 2007 levels and some of our biggest interest rate discounts and still no real uplift. Valuations are coming considerably lower than 12 mths ago and this seriously effecting our ability to get loans approved.

… The valutions are down for the whole market from million dollar homes to small homes in the outer burbs. We have three real estate agents who are in serious financial difficulty and the bank is doing everything it can to keep arrears levels low. The slow down became most evident just before Christmas and has gotten worse in last three weeks with a small uptick this week. I have been in banking and this company since 1989 and this is much worse than the slow down in 2008.

And .."The unit market has fared even worse, median prices as at Dec-10 were -24.4% below their Feb-07 peak.

Perhaps it's the wider Queensland property market I was thinking about :). It was, after all, a quick repsonse off the top of my head, as I asked .....

And.....

I note your article sources : RP Data-Rismark Hedonic Index. I believe that controversial index discounts 'improvements' to any particular property. So if I buy a $1m house and sepnd $500 k on it, and sell it for $1.25k... it says the index has gone up 25%!

@Vera Fayed : It was in the link I posted in my comment! Did you read it? It's by your guys too ( if you believe them!), RP Data Rismark " Rp Data senior research analyst Cameron Kusher said .... The average time taken to sell properties was climbing, as was the amount sellers had to discount their initial expectations to achieve a sale..Certainly in markets like Brisbane and Perth we’re seeing a bit of a correction underway”, Mr Kusher said. “In real terms, you’re probably getting a drop of 15-20 per cent”…"

ok all you astute bulls and bears, I have a serious question.

Where are the investors who are looking really long term and building houses/apartments/flats whatever to make money from renters in the future? Surely not all the property developers went down the googgler during the big recession a few years ago. It just seems odd to me that no-one is running with the long term investors ball and scoring big future points by building. Building consent is down to stalling level... surely if things are going to be so dire for future renters in the NZs biggest smoke more of the big money people would be capitalising on this and breaking ground for some serious construction.

I have been nicely corrected in my view of the rental crisis in Auckland by you all, so am hoping for a solid bit of insight and enlightening debate. Thanks and cheers...

mandalay

In what way were you corrected re: rental crisis in Auckland?

There is a rental crisis in AKL and I thought there wasn't, I thought it was just seasonal demand. But it's not and their is...

There is no need for any more accommodation in Auckland or New Zealand, for that matter, at the moment. Neither will there be for many,many years. We have overbuilt, not in 'unit numbers', but in capacity within those unit numbers. We have couples of all ages living in 4 and 5 bedroom houses with all the attached extra facilities. Those same couples can be accommodated, at it's minimum, in one bedroom properties. That is where the supply' will come from. The release of under-utilised property through necessity. People will do the sums "Do I own/rent this 5 bedder for X$ or do I rent a 1 -2 bedder for X-Y$" and as the large properties come onto the market, their rents will have to drop-per-room to attract mulit tennancy occupants. It's all down hill from here for prices and rents :)

Prices are going up - demand outstrips supply.

This is actually happening.

Again you are talking about the future and what you imagine might happen.

That's how I make money SK :) Having a future view; backing it and assessing it, continuously.... ( NB: That's what you are trying to do....)

Lots of reasons for lack of rental developments Mandalay. Major uncertainty over tax treatment of rental investments. Uncertainty over interest rates. General spirit of deleveraging. Bugger all finance companies left for mezzanine finance. Mom and Pop investors all still hiding in the wardrobe. Within a year the powers that be will be talking about incentivising rental property investment. This has all happened before, in just the same way.

Where is the new breed of developer going to get finance?

Not finance companies.

I don't understand this rubbish about a rental shortage. How many more people are there in Auckland than there were 2 years ago? There was no rental shortage then, none now, its a complete myth, just idiot RE spruikers trying to justify over-inflated prices, best of British luck I say.

How many rentals do you own MK ?

Just the 1, why do you ask?

Just wondering how close to the coal face you are...particularly in light of your comment re idot RE spruikers.

Based on the postings I see on this site that term appears to be used to label anybody who owns rental property......

In my experience rents are facing upward pressure, and I dont need Tenancy Services, The Herald or any other so called expert to tell me that.

Yeah like I'm all for my tenants paying more rent to me, sure, but not at the expense of housing unnaffordability for the whole country or Auckland city at large, its ridiculous. It's a bloody big ponzi and people are going to pay for it, and so they should, for the greed that is rife within the property industry. RE agents are paying already with lack of sales, developers are already paying with their bankruptcies etc, pretty much all finance companies were born from the property ponzi and they have almost all been liquidated, all because of one simple untruth, that your home is worth megabucks, when its actually not.

Yes people will pay for it.

And they are paying.

And they will continue to pay.

There is no other option.

Totally disagree, there is always another option. If the government frees up supply of land and cuts red tape, which I anticipate it will, then land prices will plummet, and houses will be more affordable for all. Ordinary times call for extraordinary measures.

Agreed, and not a lot of sympathy for those 3 groups you mentioned to be honest.

We are told by all and sundry that the rental pricing is set by the tenant. It appears that in certain areas tenants are willing (although not necessarily happy about it) to pay more at the moment. In a few months time the pendulum may or may not have swung the other way. You've just got to take it as it comes really.

However I do laugh at the smugness of those like NA......over the next few years we are all going to pay to varying extents to fix the ills of the economy...not just those who own property.

NA is not smug, he has an opinion and backs it with sound reasoning, I, like him, do not understand how people can think that property prices always go up! Its stupid to think that and many businesses have failed through such a false premise, I would know as I used to work for one.

Thx, MK. And , no, I am not smug ( I hope!). Maybe if I'd left for Oz previuosly I would be, and not had to face what Kermit knows is coming. So do I. And if anything, I'm apprehensive at best, and worried at worst. But, whilst I'm here ...."The median house price has fallen $10,000 in the past three months to now stand at $350,000." That's an annual rate fall of >11%....

Reasoning?

More like wishful thinking.

.

A couple of sentences about Manuawho/Tiramasu?

Thanks.

Social responsibility SK, get some.

The housing market is doing what markets do.

Stock markets are doing what they do - loads of cash printed - looking for a home - stock markets rise.

What does social responsibiltiy have to do with this.

Social responsibility is being resopnsible for scoiety at large, how is it socially responsible if all these people just want house prices to increase, pricing the common man out of his own home? I don't want a country of tenants SK.

oops. double post

A long-term investor does not need to build new houses if they think a shortage of property is on the way.

She/he can operate by purchasing existing houses and still grow their business.

I would suggest many long-term investors have no interest in the development of new properties. Personally, I am usually happy to leave it to those of the developer mindset rather than have a go myself.

I have done some developments, yes, but it's only a small part of my portfolio (and of course they were never for sale).

Improving affordability comes from the drop in average monthly mortgage interest rates - which decreased from 6.63% to 6.59% over the three months, while the average weekly wage increased from $972.69 to $991.05 over the same period.

Affordability not due to price decreases. Equalibrium being gained though other influencers.

".. in the three months to February 28 as the median house price fell by $10,000..." Price is a significant part of any affordability calulation, SK. It's not just " I paid out less this month" ( a cashflow excersise) so 'what I have already bought is more affordable"

So .04 decrease in mortgage rates + .018 increase in wages = MASSIVE AFFORDABILITY IMPROVEMENT. You need to think outside the box mate.

Improving affordability does not equal affordable!

Where is the breakdown detail on these stats

The point is that Auckland is firing again NOW - and where Auckland goes - the country follows.

Did you mean to say "hiring?" If so, then you may have had a "freudian slip" to type "firing" instead, because a little bit of your subconscious knows that your beliefs could be wrong. Unless you are just a troll, trying to stir us up.

Firing = lost income = can't pay house = mortgagee sale = more housing inventory for sale = collapse

I've seen this all before. it doesn't end well. The best we can all hope for is flat prices going forward, but it usually doesn't happen that way. RE is fcuked for a generation. Auckland doesn't reflect the rest of the country. Let's talk after the sugar high of the Rugby world cup.

In the meantime, the Chinese have yet to figure out something to do with that bird-cage stadium they made.

HAPPY RENTER

Auckland's current SLIGHT pick up will prove to be temporary. It is supported by low interest rates, and seasonal factors

The pick up will be stifled as migration to Aus picks up over coming months, as we enter winter, as further rising costs of living bite further, and as Auckland's economy stagnates. Inevitable interest rate rises in 2012 will further keep prices subdued

I'd suggest interest rates still have quite a bit to fall from here, MIA....and that's not a sign of any thing good....

NA - they might do. But as you allude to, if they do fall then that will be indicative of a very very weak economy with growing unemployment which will mean that support for house prices is weak regardless

God, here we go again, rents are going up, no they aren't (NA), yes they are, not so(NA again), yes they are, not so(NA once again), yes they are, not so (NA continued)......

How about some are going up and some are coming down??

Should I look for a house to buy??? I am in a quandry, My partner and I rent in central Auckland and are contemplating whether to buy or not. It would stretch up financially but living in cold places where landlords only want to do the bare minimum on upkeep is a drag and as we have a dog our rental options are limited.

I read often lately that the central Auckland market is performing well so I am somewhat concerned that if I don't buy soon it will Henderson for me and my mut. On the other hand I have a friend in the Kingsland/Western Spring area who bought a house in early 2007 and was trying to sell her house in November/December and gave up. She bought it for 530k and spent 30k on renovations, nothing flash, some regibbing and painting, insulation, french doors and decking and a bit of landscaping. It is a nice, small, renovated, 3 bedroom. She was trying to get 600k, but only got one offer and it was so far off her price that she didn't even bother to counter.

So 560k compared with 600K, she was only wanting to sell at 7% premium, with an ownership period of nearly fours, that is less than 2% per year, that is less than inflation.

I contrast her experience with, all this talk of a desperate shortage of properties on the market in the central suburbs, great prices being achieved, prices rising, quick sales.....etc etc.

I find it so contradictory, part of me thinks just bite the bullet and do it, I want a home long term, so buy one as the ups and downs of the market will meaning nothing over a twenty year period. Another part thinks, there is only 50/50 chance I will be in this country in five years so maybe buying a house isn;t such a good idea. hmmmmmm. What do you all think?

Wait 6 months to a year, and don't make any rash decisions. Financial decisions based on emotions fail a lot.

Agree. Be a happy renter for a couple more years. You might be surprised what you can buy then, for what price. In the meantime, you should pay for rent what you had planned to pay monthly for the mortgage, rates, upkeep and insurance on your "home" that you were getting ready to rent from the bank for the next 30 years.

You might be surprised how much nicer of a house you can get for the same money each month- nicer than the one you wanted to buy. After the World Cup, I think you will see a lot of desperate sellers. Another thing you might consider is to continue saving, or buy gold and silver with your cash. It's only going up, and you can't print it. Silver has doubled since the last time I posted anything. It will probably triple from here, as shortages become evident. There is no bull market like a gold bull market. It's just getting started. Real Estate is dead for a generation. Just wait till the oldies start moving down to smaller places. Lots of mcMansion for sale soon. You don't want to get tied to a payment like that. It can sink you.

Its nice to know that if your situation changes, you can give the keys to the landlord and walk away. Try to be polite and not watch as he cries, watching you go, wallet in your back pocket.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.