By Greg Ninness

This could be a volatile year for the residential property market, particularly in Auckland and one of the big uncertainties hanging over the market is whether Chinese buyers will return to the market in any significant numbers this year.

Over the last few years they were a major force in Auckland’s residential property market and their presence added fuel to fire that heated up the region’s rapidly escalating house prices.

But when new rules were introduced on October 1 last year requiring anyone buying or selling virtually any property apart from their own home, to have a New Zealand bank account and obtain an IRD number, ethnic Chinese buyers rapidly disappeared from open homes and auction rooms and their absence had an immediate impact.

The number of Auckland properties being sold under the hammer at auctions declined and so did the REINZ’s median house price, which dropped from $771,000 in September last year to $748,250 in October, before climbing back up to $765,000 in November and finishing the year at $770,000, just $1000 shy of September’s record high. However, in January it slumped to $720,000, putting it back to where it was in April last year.

While it’s unlikely that all of that movement could be attributed to Chinese buyers, anecdotal evidence suggests their considerably reduced presence in the market would have been a significant factor in that price volatility.

Can we assume they will return?

Most of the people I have spoken to in the property industry have had the view that Chinese buyers will eventually come back.

Their broad view is that the Chinese buyers will eventually get their paperwork in order and adjust to the new regime and return to the auction rooms with renewed vigour.

I don’t think we can assume that will be the case.

There has been talk around the traps of a backlog of applications for IRD numbers and delays in these being issued, and this has been blamed by some in the market for the reduced numbers of Chinese buyers.

But that is not the case.

IRD says it aims to have applications for IRD numbers processed within 10 days and it is currently processing them within five days and urgent applications can be processed on the same day.

From October 1 2015 to the end of January this year, IRD had received 106,922 applications for IRD numbers and had issued 94,265 IRD numbers.

Of those, 67,211 were issued to individuals and these were almost equally divided between NZ residents (34,177) and overseas or non-resident individuals (33,034).

Another 27,054 IRD numbers were issued to other entities such as companies or trusts and the vast majority of these (26,830) were entities resident in New Zealand with just 224 of them based overseas.

However that does not mean all of these IRD numbers have been issued to investors lining up to buy property.

The numbers include all people and companies applying for IRD numbers, such as young people starting work, migrants and new businesses.

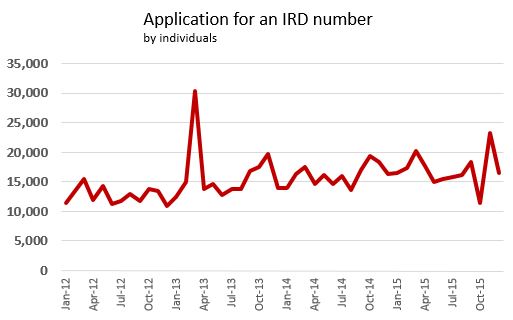

And although the number of IRD numbers issued between October and January was well up on the same period a year earlier, that number had been growing dramatically for several years before the new rules for property investors were introduced.

In the four months from October 2012 to January 2013, IRD issued 66,987 numbers, in the same period of 2013/14 that had increased to 86,577 and by the same period of 2014/15 it was 89,871.

So against that trend, the 94,265 IRD numbers issued from October 2015 to January 2016 does not look unusually high.

If investors need an IRD number they should be able to get one within a week or two and if they are staying out of the market and not applying for IRD numbers, there must be another reason.

Part of a bigger picture

What the people I have spoken to don’t seem to have taken account of is that the requirement for property investors to have a New Zealand bank account and an IRD number is only part of a bigger picture.

As well as having to have a New Zealand bank account and IRD number and providing these to IRD (via a Land Transfer Tax Statement) when buying or selling property, buyers and sellers must also provide their taxpayer identification number from any country in which they are required to pay tax on their international income.

That will assist the sharing of information between the IRD and tax authorities in other countries, including China.

While that will assist tax authorities both here and overseas to collect any tax that is due as a result of the sale of a property, the information could also be of particular interest for Chinese authorities for other reasons.

The Chinese government is trying to stem a torrent of money leaving that country and enforce rules which limit how much money Chinese investors can send overseas to places like New Zealand.

At the same time they are also waging a fierce campaign against corruption.

So the information sharing arrangement with IRD could be helpful to Chinese authorities on a number of levels.

Getting caught for not paying tax on an overseas property they sold or for sending money out of the country by unconventional means to buy it, may be a risk that some Chinese investors would be prepared to take.

But questions about how the money was transferred could also lead to questions about where the money comes from, and those inquiries could extend to other family members, friends and colleagues.

If the Chinese Government’s crackdown on capital flight has been vigorous, its clampdown on corruption has been ferocious.

In China, Big Brother has a reputation for being heavy handed.

If you have not been playing by the rules, you do not want him knocking at your door.

So while some investors from China may not have been too concerned about giving their details to New Zealand tax authorities, the possibility of having their dealings scrutinised by authorities back in China could be a greater worry for some.

The same safe bet?

The other factor that may weigh on overseas investors’ minds this year is that Auckland property may not seem to be the same safe bet it was over the last couple of years.

If someone’s main motivation for buying an overseas property was to get money out of their homeland and park it somewhere safe, they may not be too concerned if it produces a negligible income return.

In a rising market they may even be happy for it to sit vacant and watch it appreciate in value.

But what if there is a risk that prices could fall?

When the herd is in full flight, it doesn’t have to actually see a lion to turn on its heels.

A rustle in the undergrowth may be enough to spook it.

And last month we had just such a rustle when the REINZ’s median Auckland price dropped by $50,000.

A price drop in January is not unusual but a price drop of that magnitude was worrying.

It doesn’t mean that the market has crashed or that prices will keep falling.

But what is has shown is that they can fall, and might again.

The Auckland market is not as invincible as many had believed and that creates uncertainty.

While the motivation for many Chinese to get money out of their country is undoubtedly still strong, concerns about the ability of Chinese authorities to scrutinise their transactions and uncertainty about the robustness of our economy and the housing market could see many of them deciding New Zealand isn’t worth the risk, and start to look elsewhere.

The links between New Zealand and China are now so strong that buyers from China are likely to be a feature of this country’s housing market for the foreseeable future.

But people hoping they will return in the same numbers and with the same enthusiasm they showed over the last few years, may be disappointed.

You can receive all of our property articles automatically by subscribing to our free email Property Newsletter. This will deliver all of our property-related articles, including auction results and interest rate updates, directly to your in-box 3-5 times a week. We don't share your details with third parties and you can unsubscribe at any time. To subscribe just click on this link, scroll down to "Property email newsletter"and enter your email address.

78 Comments

"The same safe bet"? I didn't realise the Auckland market had been such a "safe bet" for the past couple of years. If it was and chinese money aside, what fundamentals have changed to make it a riskier bet now?

I would say it's as safe as it's ever been *wink*

"IRD says it aims to have applications for IRD numbers processed within 10 days and it is currently processing them within five days and urgent applications can be processed on the same day."

There goes that argument.

Good article, hits the nail on the head.

Chinese fear govt. esp when they are illegally moving $ out of China (which almost all property purchases would be as the 50k p.a legal limit isnt enough to buy anything in auckland).

Could be waiting a long time for their return, hence why JK took his time fixing the problem, had to give warning to his mates so they could sell up - any one remember Hoskings, Matt G (posted a few articles on here - I had a bet with him that is looking like a sure thing now), others who all made massive public statements start-mid of last year about the rise and rise and auck property- just in time to stoke the market so they could get out themselves.

Many of these IRD numbers will be required for off plan apartment sales that were made prior to announcement of the new IRD & Bank account requirements. Many of these buyer will not be settling until after April and will have been planning to onsell however now they will be captured by the new criteria and have to pay tax if they do not hold for 2 years!

Classic Hosking, http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=114…

Good call Simon, that's him going on in April last year.

Thanks Greg for casting some real numbers on the speculative c..p. We have been seeing speculative misinformation from interest.co common taters. Specifically about applications for IRD numbers.

Real info is great and thanks again.

The sad thing is that this Government knew most of the Chinese property money was money laundering and turned a blind eye due to vested interests.

It was not until the Chinese Government put pressure on National that they put in IRD #s etc.

So what? Property owners should be happy.

Why are houses so expensive? Here's the answer:

https://www.youtube.com/watch?v=dcbjWGj3jBk&feature=youtu.be

As we know there has been a massive clampdown on corruption in China. I'm sure the Chinese Authorities are very keen to freeze some Auckland property assets to set an example to those who have moved money offshore illegally.

With everything going on the Chinese might yet become net sellers.

Not seeing as many of those 21 year old Chinese students driving Audi Q7's at the Manurewa auctions these days.....

edit (the Chinese who where getting cash out bought in trust and probably already have trust bank acc's they wont be sellors, they have to have an IRD number to sell, they will keep that property just like a swiss bank acc)

IT GUY,

Is it true you now need an IRD number to sell as well? If so it won't be like a Swiss Bank account as most people managed to get their money out. In the case of property it will effectively be locked up in a "zombie property" and an asset unable to be realized without alerting the authorities.

In the UK they are now calling for retrospective anti-laundering on London property which is a sensible move.

http://www.theguardian.com/money/2016/feb/13/dirty-money-uk-homes-retro…

There is an irony that when the UK Govt tried to stop the money laundering going on in Switzerland the funds ended up going into their own back yard buying property in London!

and yet our Government still insists that there is no evidence whatsoever that the Chinese have been investing in the Auckland property marketplace in recent times... but great that they are now "pulling all the levers" to rectify the property disaster!

I think we're still going to hit the iceberg with big flashing lights on it!!!!

Sad though, I was talking with lovely young woman today (In her late twenties), who is six months pregnant. Both her and her husband have being trying to find a home near the area she grew up in near Massey (West Auckland) and they're both working and in a middle income bracket. I felt really bad that they've simply given up. :(

I for one really hope that the Auckland property market will drop - because we're headed for much higher crime rates and a fortress society if we keep selling out to over seas investors! Immigrants are very welcome - Overseas investors who are just looking to cash in, we really need to do introduce more punitive measures.

What! Auckland property prices won't be going up for ever? Everyone has been telling me porkies... here's to watching the down-hill slide...

GFC (TBO - the BiG ONE) is going to be a doozy...

Seriously though, it would be great to hear Olly Newland's opinion!

So in the Year of the Monkey it won't be "going bananas"???

Thank you Greg...this is the best and most honest piece you have written.

We will now wait for the "spruikers" to come up with another "positive" mantra about Auckland property prices, they can blather on about round the BBQ to their mates, now that your article has firmly dismissed "The Chinese Will Be Back" theory.

At these prices, why would ANYONE want to buy an investment property in Auckland ....... whoops !! I have forgotten the mantra already ...."Auckland Property Never Goes Down" !!

"Spruikers" do you mean the Real Estate Agent!! ;)

And oh yes and the property market can go down!!

A RE agent said to me yesterday that he can't believe that the market is still relatively buoyant here when so many other markets in the world are going down with so much global financial uncertainty. I think people still have their heads in the sand here probably due to the lack of honesty in The Herald. I think things could be very different here in a few months time. I, for one, am going to hold off buying for now.

I'm not sure if it is heads in the sand or people are just do desperate to get on the property wagon for fear of being "left out" - i.e. get something, anything.

Isn't that the same thing, kind of? Just out of touch with reality, gullible, whatever you want to call it.

When you say the Herald you mean 'Aunty' which I hereby dub the new name for the Herald.

@ Buzby, Did you tell him that when the Titanic went down, the tail end was still above the icy water until the very end, this is where Jack Dawson was but he didn't make it.

My relation in Auckland who is currently trying to sell turned down an offer as she believes more overseas buyers will be in the market soon. They are currently being held up by IRD bureaucracy. She has been in the the market for three months now. Don't they say the first offer is usually the best one.

Wishful thinking and I suspect she's been relying on The Herald or a friendly estate agent for her views? It might happen but if she is relying on the proceeds for retirement then she is taking a big risk. She should accept a 5-8% hit, take the offer and celebrate the 50%+ profit she has probably made over the years?

A good proxy for the return of the Chinese is the Macau casino industry which is driven by VIP junkets, where money is brought out of China through all sorts of dodgy means. It has been decimated in the last few months. When that start to grow again you might see money come to Auckland. I wouldn't be holding my breath.

Do a google news search for 'Macau Casino Results': https://www.google.co.nz/search?q=macau+casino+results&oq=macau+casino+…

......which is why I am surprised Sky City ain't tanking....but going up? Weird.

The Macau visitor figures for the CNY were pretty good by numbers but probably more the low/medium rollers. It is the high rollers where there has been the massive clamp down as that was were the money laundering was going on with the junkets.

I'm a happy holder of Sky City. Good long term proxy for migration from Asia although recently the price had probably got a bit ahead of itself.

There is a lot of money that has already come out and just sitting in bank accounts. The problem is do they want to buy property and have the details sent back to Beijing and face having their offshore assets frozen?

Bought in April last year. I think she went one step too far.

So she's flipping it on for the profit? Probably better to let it go & realise the gains, much as it pains me to say it.

Sounds like your relative needs to be listening more closely to you, Gordon.

When lots of vendors and potential vendors come to the realisation the sky high bid isn't coming is when the market gets really interesting.

The properties I've been following in west Auckland have all sold well at auction in recent weeks.Some have sold higher than I expected. A trusted agent tells me things have not really slowed down. Would be interesting to see stats on sales in different parts of Auckland. I.e. inner, south, west, east, north.

Remember this property at 37 Benson Road that was sold for $3.74m in Oct 2015 and now in the market again? It was sold at the auction last week for just over $4m. Just to let you know that's all. The Feb stats will be explosive!

https://www.bayleys.co.nz/Listing/Auckland/Auckland-City/Remuera/1750703

so what would have been the costs to sell, does not look they made very much, especially if they have to pay a third on any gain after expenses

Not saying they have to make a profit...just to point out there are serious buyers out there, even for a $4m property.

This is new to the market today, CV is $1.48m. How much do you think it will go for? Would be interesting to find out on auction day mid-March :-)

What is the point of this juvenile property spruiking?

Explosive for sure when the stratified index data shows another drop during February. Expect to see more investors and speculators put some or all of their portfolio on the market to lock in some profits. Not everyone can just sit there calmly and watch their wealth go backwards without doing something about it.

Another drop in Feb? LOL!!

"Auckland house sells for double its council valuation"

http://www.stuff.co.nz/auckland/76977423/Auckland-house-sells-for-doubl…

I agree DGZ. If the feedback from agents is true, the rebound in auction sales type and the increased interest at open homes is anything to go by I think we will see a strong bounce back up in Feb. The bears will be disappointed.

Time will tell though.

nice picture, surrounded on all sides, my guess is last big section in that area which would explain paying overs.

There was never crisis or GFC in NZ. People do not know how it smells or feels. NO ONE believes that the market may change, that the properties will go down (will they?).

I have looked yesterday at trade me for properties for sale. I could not believe how many listings were 'LISTED TODAY' - the panic starts...

Another matter is that if you would like to buy something liveable (for the family home) not a crappy shed that was 'investment property' - you will still struggle. There is basically no selection of nice properties at reasonable price. You need to pay $0.9m in reasonable area for reasonable house.

A friend was on the open homes on Sunday - she was shocked how busy it was!

Inflation expectations have just taken a massive hit, do Aucklanders require the Chinese or lower interest rates to buy homes

"Of those, 67,211 were issued to individuals and these were almost equally divided between NZ residents (34,177) and overseas or non-resident individuals (33,034)."

If that is not a very strong sign of offshore foreign investment in real estate I don't know what is.

In addition there are now so many Chinese now located in Auckland involved in property wheeling and dealing, building, product supply and labour force etc that they are quite possibly making up 33% of all real estate activity even if there is no foreign influence.

Alot of the non-residents will be students on student visas - who are now (thanks to another of JK's 'great ideas'), also able to work while studying.

Head down to Barfoots auction rooms tomorrow and there will be more Chinese in the room than anyone else.

Hong Kong Real Estate Price Plunges 70% In Latest Government Land Sale.... http://www.zerohedge.com/news/2016-02-15/hong-kong-real-estate-price-pl…

fortunately that kinda stuff will never happen here...

I for one am going to watch this from the side-lines, cheering the buyers and sellers and bulls and bears and cattle and sheep along... whichever way it goes, it's going to be spectacular...

Place your bets!!! My money is on a 20% drop for Auckland! I think the Real Estate Agents are still pressuring Sellers to go to Auction on the promise that Chinese Investors will return. But forcing them to accept below prices at auction.

My advice to potential Buyers is put in 'cheeky offers' at CV price!

CJO99. What's your timeframe for your bet on this 20% drop? I would be on for a real bet up to 10k as long as you (and I of course ) would be prepared to to put the money up front and do it with real names right here on Interest.Co. Unambiguous terms etc.

timing as always...

This year? by end 2017? Frankly we will either see maybe 10% ie small or huge and way past 20%, ie I odnt think once at 20% loss its going to be the bottom.

Not interested in your waffling steven. I'm talking real people making a real wager on specified terms.

.

mate if you want to put money on this and think you know the market/can predict the future go to ipredict.co.nz

Last I checked a month or so ago, auckland property had its own market place betting on average (QV) prices exceeding 1 mill by various time periods (bearing in mind is around 900k at moment on this measure).

If you think auckland prices will increase you will see you are a minority, and you'll get getting some very good odds and return on you money (5x plus, more than you'll make from steven on here!).

But you could also make a similar return betting on the blackcaps v aus.

Both events equally unlikely in my opinion

Simon I wouldn't bet on an increase. What I'm saying is that I consider the chance of a 20% fall small enough that a 1:1 bet would be a good bet. I see little chance of a sudden increase in supply, decrease in demand or big rise in interest rates. The stickiness of house prices has been demonstrated plenty of times, 2007-2010 being the most glaring. 10% interest rates, 52 weeks supply and still only about 12% drop. If I got 10k at 1:1 I could flick the position for 15k within a week and have an easy 5k to blow on hookers and cocaine.

Not interested in your waffling steven. I'm talking real people making a real wager on specified terms.

bigblue, how many of those 33,034 were Indian students?

What has their nationality got to do with anything? They are just overseas students. Would you comment differently if they were British students? If so, there is a problem with this comment. If not, why did you label their nationality?

Hope this is not classed as racist as it is simply a cut and paste from a previous interest.co.nz item and backs up zorro15 point:

"Almost a third of the net migration into Auckland in 2015 came from students from India, which is keeping upward pressure on Auckland CBD rents and downward pressure on service sector wages"

http://www.interest.co.nz/news/79784/statistics-nz-reports-record-high-…

because as per the figures two countries are suppliers of nearly 50% of international students and one of those countries students are coming vocational and pathway programmes

the first-time study visas issued to Indian students spiked dramatically in 2014, increasing by 123%.

The international student scheme is now big business and this is also putting pressure of housing

I'm sure if the figures shows british or german etc there would be the same concerns.

is this in NZ's best interests? if we don't have the infrastructure in place to handle the numbers

why are two countries dominating this industry and we are not getting a more diverse spread

http://monitor.icef.com/2015/02/new-zealands-international-enrolment-12…

The reason for Indian students constituting the largest proportion of international students is the generous Visa provision for them: they are attracted by the generous work visa granted, 1 year after graduation, then the prospect of permanent residency once they secure a permanent job in their field of study. Also the NZ Govt has loosened the working rules while studying. However the reality of securing skilled work in their field is tough. Is this entire situation ethical? Attracting these students on a 'promise' which is difficult to deliver on for most unless their English is very good, let alone the pressure on educators to tolerate poor academic work which is undermining our universities reputation.

http://e2nz.org/migrant-stories/chapter-4/why-cant-asians-find-work-in-…

India is a preferred country of origin for International recruitment actively supported by Govt and Immigration

Teams of NZ Immigration employees are full-on processing 1000s of Indian prospective students

http://www.immigration.govt.nz/NR/rdonlyres/8E791F9A-A063-42B3-96F0-77E…..

Anecdotely, I walk up queen Street everyday and the students are back. Hint: their elephants don't have big ears.

But according to national and the banks, it isn't the chinese pushing up prices.

Just look at the scorn they poured on labour for suggesting so.

I commented on their nationality in relation to ird numbers in response to bigblues comment about ird numbers, apparently they are the biggest source of migrants. I don't care if they are Indians are English or Russians. The point is made in relation to house prices, students, where ever they are from are unlikely to be buying houses.

Not only students. there are a few thousands of working holiday visas that apply for IRD number every single year.

They are not likely to buy any house either, in fact most of them leave the country after one year.

I don't see any direct correlation between IRD applications and property demand.

zorro15 I cant answer that as I would be accused of being racist. Did read that the majority of students are from just two countries though so you could be on to something.Do they need an IRD # - many work for cash under the table as per recent Masala debacle

Student arrivals from India rose 28% during the year to 10,800, while China on 5,300 and the Philippines on 2,100 were the two next largest sources of migration.

another bit which brings up questions is "Another 27,054 IRD numbers were issued to other entities such as companies or trusts and the vast majority of these (26,830) were entities resident in New Zealand with just 224 of them based overseas"

This is for 4 months..... another way to obscure who actually owns what? Non-beneficial trusts? Would be interesting to know how this compares to previous periods.

Anecdotal evidence = oxymoron

Another 27,054 IRD numbers .... with just 224 of them based overseas. Hardly surprising is it. Wouldn't you just get a NZ domiciled lawyer or accountant acting to act as the trustee, perhaps a NZ family member in NZ to act as the settlor? Anonymity preserved?

The ease by which any crook can get an NZ company or trust is well known as a huge risk. Either shell out an extremely low fee from anywhere using a credit card, or use one of the local accountants who specialise in setting up these arrangements for foreign terrorists, arms dealers, money launderers, and anybody else who wants the service.

lol zerohedge article today closely related to what you're saying

http://www.zerohedge.com/news/2016-02-16/presenting-most-striking-way-c…

Who is Tyler Durden? Kakapo?

Time the Govt woke up.

Not yet, we still have a long way to go to catch up with Vancouver.

http://natpo.st/1QiX5PU

36,400 people moved out of Auckland last year. The stats are saying Auckland prices have reached a level where people feel it just isn't worth paying inflated prices.

maybe that is the master plan to repopulate other parts of NZ where population have been declining, static or slowing growing for decades.

Flood the main centre and force people to seek elseware to survive.

to my mind the ones that can will and will enjoy NZ a lot more as well as have a much nicer lifestyle

Yep, Auckland is overrated compare to the nearest major cities like Melbourne and Sydney. It's riddled with petty crimes and agro drivers.

My last visit in December, parked my rental car at Sylvia park and within minutes some lowlife smashed the side window. Security guard told me it's very frequent and almost certain if a car has rental company logo in the back windscreen.

Chairman, I've lived and worked in Sydney, Melbourne and Auckland. I'd prefer to live in Auckland over those other two places any day of the week. I have Australian citizenship too. Eye of the beholder I guess.

I haven't had a car break-in in Auckland - ever. Not sure why this is relevant though. Statistically I would expect there is more crime in Sydney and Melbourne than Auckland.

note "petty" crimes.

With the amount of debt required to break into the AKL housing market today, it is a pointless exercise. The only winners are the banks. Yippee for them. There is so much on offer in the rest of the country, my advice would be to run away.

Well I have lived in all of them as well for a very long time and Auckland is not even remotely in the same league as Sydney. Melbourne is also a far better city than Auckland. Auckland is a is really a boring dump compared to those two cities that are world class and pay 30-50% more to do the same job. Auckland is essentially a poor mans Sydney for all the immigrants who cant get into Australia.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.