Total profits from gain-making property resales in Auckland were $1.56b in Q3 2017, half of the peak value of $3.0b in Q3 2015 according to new figures from CoreLogic.

The property information company’s latest Pain and Gain Report signals a general slowdown in the New Zealand property market, with the number of resales resulting in a gross loss climbing from 3.7% to 4.3%.

CoreLogic NZ Head of Research Nick Goodall says although resale gains continued to dominate resale losses over the quarter, total gains nationwide declined nearly $900 million.

“Capital gains have slowed, and in some cases, moved into negative territory. This may be a sign of market fatigue with buyers choosing to cash out of the market rather than risk holding the property and potentially experiencing further loss.”

The report found that of those properties that resold at a loss, the length of time that owners had held onto their properties reduced from 6.6 years in the previous quarter to 4.5 years in the September 2017 quarter.

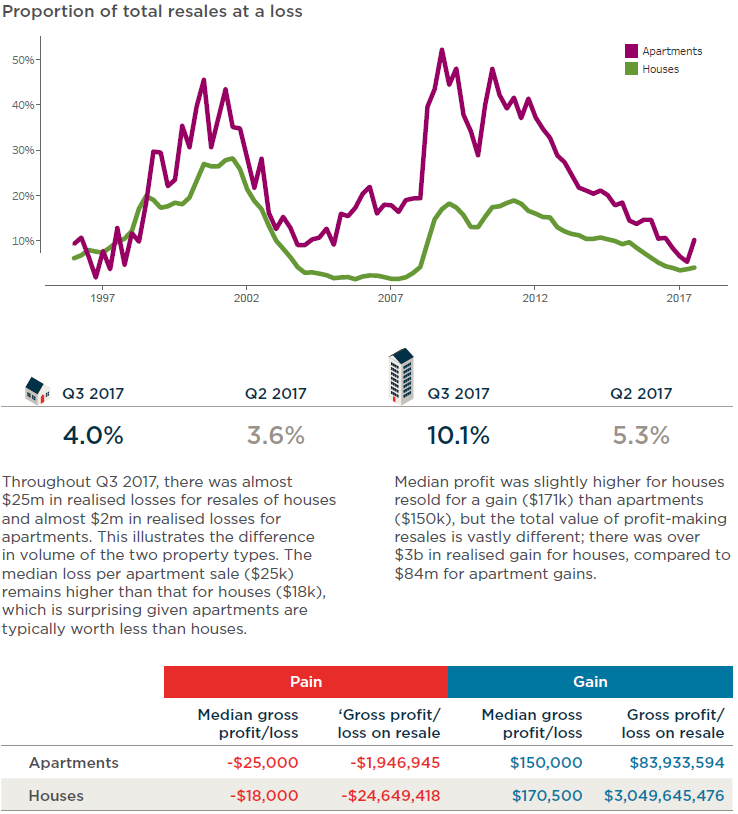

Over twice the proportion of apartments (10.1%) than houses (just 4.0%) were resold at a loss, with a median loss of $25,000 for apartments compared to $18,000 for houses.

Looking to the main centres, Christchurch held the highest proportion of loss-making resales (11.1% up from 8.1% in the previous quarter), followed by Tauranga (3.9%) and Auckland (3.3%): representing a slight increase for both areas compared to the previous quarter. Hamilton and Wellington’s share of loss-making shares remains flat, hovering around 1.5%.

Auckland and Christchurch are both seeing an upwards trend for resales at a loss for both investors and owner occupiers but it is higher for investors (4.1% in Auckland and 15.2% in Christchurch). Goodall says the lift in the investor proportion bucks the trend of the last few years.

“Investors are under increased scrutiny from the new Government with the quality of rental properties needing to improve and to be managed by future regulation by the recently passed Healthy Homes Guarantee Bill. This may cause more investors to sell out of the market to avoid bearing the costs of improvement or to raise funds for other rental properties.”

Outside the main centres, Queenstown deserves a special mention. For the second quarter in a row, there have been no resales at a loss in Queenstown, reflecting the strength of the market there.

Whangarei, Rotorua, Hastings and Napier continue to have the highest median gain of North Island main urban areas at roughly $150k.

In the South Island, Queenstown saw a median gain of $339k in Q3 2017 which is comparable to Auckland ($360k), while Nelson’s median gain was $165k.

Outside the main urban areas, Western Bay of Plenty has the lowest proportion of loss-making resales at just 0.6%, closely followed by Waikato and Waipa Districts. Conversely, the entire West Coast region continues to see a large proportion of loss-incurring resales.

66 Comments

Even digging around in the trademe property information there's been a clear step up in realised losses. A lot of people have paid too much for their residential properties. I guess people get excited and buy at the peak of the market then sell when prices start sinking. Buy high sell low seems to be the mantra.

Any property owner either investor, fhb or any other who buys and sells in short succession deserves to make a loss. Leave trading to the true renovators and developers. Otherwise they should invest in shares for easy in and out haha

That Q3 2015 was a glorious time to sell in

Seems logical with this measure in alignment with most other property market indicators. Nothing much to see here. BAU.

With a fall in the RATE of dwelling price increases, the potential for profits through buying/selling in quick succession must be reduced. Accordingly, it becomes tougher for short-term speculators. Pretty logical, really. (Notably, house owners have fared much better then apartment owners.)

But investors, by definition (and inclination), hold for longer periods of time. As often said, they are "in for the long haul"....... That's a well-proven strategy - as most people know.

TTP

Last time I checked this series does not include real estate agent fees, or any other holding costs. The percentage selling at a true loss is higher than this.

There seem to be some questionable mortgages that have rapidly gone into default with people selling within a year or two. There's also this property which is a mortgagee sale two years after purchase for $1.535m. Did the finances for it ever stack up, or did an unexpected event occur? Difficult to say.

https://www.trademe.co.nz/property/residential-property-for-sale/auctio…

Totally agree. I think the data doesn't include any selling & holding cost. It would be good if they can estimate the cost.. if you buy a house for 2mil and sell it for 2.1mil a year later (will you consider it a profit or loss :)

RE agent and lawyers will have profited.

redcows, despite the slowdown in house sales, the number of active real estate agents has continued to increase;

Nov 2015 - 14,875

Nov 2016 - 15,494

Nov 2017 - 15,952

There is only so much commission to go around and as is the case with lawyers, only a small percentage are truly creaming it.

http://occupationoutlook.mbie.govt.nz/service-industries/lawyers/

Hi R-P,

Those figures seem really high to me.

There must be quite a few agents not making much of a living from their efforts right now.

Surely, some of them must be looking for other jobs??

TTP

TTP...it will be interesting to see what figures are produced for Nov 2018. Going by the figures of late there are plenty positive minds out there willing to give it a go!

Hi R-P,

Agree with you - there seem plenty willing to give it a go.

A pity they can't channel their energies into something more worthwhile. At the moment, they won't be doing much for NZ's labour productivity statistics.........

Problem is, that some of them would have made so much loot during 2014-16 that they can probably live off the fat for quite a while (if they haven't already gone and spent it all on fancy German cars).

Maybe an outright ban on the issuing of new real estate licences would be the best response??

TTP

No that's just conjecture, what if it was private sale?

Only in hindsight does the peak of the market appear. Unless you’re Nostradamus. I bought a number of times at a peak only to be vindicated months later. I guess if you are stretched then it may be an issue but likewise, buying and selling in any market has a risk attached. Sometimes its a savvy option to cut your losses and duck out if your strategy demands it. Takes courage sometimes and can be as personally and financially rewarding as letting it run.

Exiting a bad trade and wearing the loss is sensible. How many of the people wearing losses are operating as property traders though? Or are they forced by circumstances, such as a credit tightening, to liquidate their position?

15.2% property sales in Christchurch are at a loss. Why do that if it rental yields were so good like someone claimed on this site? Anyway, this is just a ripple, en mass panic will come when interest rates rises, inflation takes a toll on household income and it is met with more NZ housing related regulations, harder international clamp down on money laundering and tax avoidance / evasion facilitated by the TPPA cooperation clause and the absence of free flow cash buyer from international players.

Yes those of us who did not listen to The Boy and did not buy those wonderful investments down there will be pleased with our decisions.

Zombie, you are not wrong. Like anything these figures are merely showing a developing trend for who knows how long and how acute but as I infer from your comment, some, ie REs are still able to make a reasonable earn in changing conditions.

All those mad gainz seemed so easy and safe with all that yuan splooging over the property market...

Is it squeaky bum time yet?

Gosh, I was just thinking when I returned back to NZ early 2000s and had to get a place to live. Apartment market was flooded but chose to buy a house in the burbs as had tired of the rat race in big cities. Would have been a premium time back then to have loaded up on quality Akld apartments and could be retired now. Bugger!

Gosh, I was just thinking when I returned back to NZ early 2000s and had to get a place to live. Apartment market was flooded but chose to buy a house in the burbs as had tired of the rat race in big cities. Would have been a premium time back then to have loaded up on quality Akld apartments and could be retired now. Bugger!

Apologies for my fat fingers double tapping.

Haha Brock. Love the ‘splooging’. Says it all in a word.

I thought the only way is up!, more of this to come one suspects

The properties that are being resold we do not know why they are needing to be resold?

We don’t know that they are being sold by investors or owner occupiers?

If they are from so called investors, all I can say is that they are not very good investors and shouldn’t be in the business anyway.

Investors should be buying for rental return and if they are negatively geared then they are relying on capital gain which we don’t do.

Profit for investors is made when you purchase the profit and not down the track.

Never ever sold any property including our own property we have lived in for any loss and will never need to!

TM2,

"We don’t know that they are being sold by investors or owner occupiers?"

It's more likely that investors are selling at a loss, isn't it?

I mean, owner occupiers would just hold, wouldn't they? Unless of course they are fleeing the region..

"Profit for investors is made when you purchase the profit and not down the track."

I don't know what the hell you mean by that statement.

Call me naive, but I always calculate profit as revenue minus costs..

"Never ever sold any property including our own property we have lived in for any loss and will never need to!"

Good on you.

Obviously that's not the case with many other Christchurch residents.

Plus, as someone else has alluded to, remember that buying a house today for $100k and selling it next year at $110k is not necessarily and economic profit. So, if anything these numbers could be underrepresented.

Nymad he means buy it under its true value.buy it for less than it's actually worth

Prices are still high yet inventory has increased, demand & sentiment have declined

Either you sell today or take a bath tomorrow

Unless you’re in a leafy suburb & wish to spend your life writing here how utterly smart you are because you have a rental property or two !

Perhaps developing some useful software might be a wiser proposition & vastly more cerebrally stimulating

Investors should be buying for rental return and if they are negatively geared then they are relying on capital gain which we don’t do.

If investors were only buying foe rental return, they would buy property investment trusts. Why would someone incur all the costs involved with investing in rental properties if their sole objective is rental return?

You're talking garbage. The rental returns on residedtial property are no better than term deposits at present and even going back 5 years. The sheeple have only been attracted to rental property because of spectacular capital gains, which is sponsored by a political economy that has doubled down on housing as an economic be-all-and-end-all.

Maybe because the trend is for Christchurch property values and rentals to be moving downwards. Oh to be diversified.

But he's returning ten percent return on investment. That's not too shabby is it?

FYI, an Auckland based property accountant specialist, property developer, property investor and property investment promoter has been selling some of his investment property portfolio due to a change in strategy due to changes in market conditions

http://www.gra.co.nz/articles-by-matthew-gilligan/property-market-jan-2…

Seems an astute synopsis of the part of the cycle we are in, would be interested to see if he can pick the bottom or whether like most he buys on the way up again.

Presuming he sold the "problematic" houses at a profit? Bought with the intention of resale so bright line does not necessarily apply. Paid some tax ;-)

It's frankly scary. It's 2008 all over again

So if its 2008 all over again how much did house prices decline back then?The biggest financial crises in most of our life times and prices declined maybe ten percent.

The Aussie banks were there to save us, not this time around. Their household debt is200%

And don't forget the influx of insurance money after the earthquakes. Not going to get that rescue package twice.

How did the banks save us???

Go figure

Read more here:

The irony of Granny Herald publishing this when the media organ in itself has been an apparatus to promote the same behavior instigated by QE that caused the whole problem in the first place!

Agree. Pushing it as hard as they could since 2008, now saying "hey, wait..."

Read more here:

The irony of Granny Herald publishing this when the media organ in itself has been an apparatus to promote the same behavior instigated by QE that caused the whole problem in the first place!

Thanks Rick

Can't wait for the next one. No interest rates left to cut this time.

Maybe they'll cut them to two percent

The majority of new build apartments will be completed this year. They will get hammered on price as off the plan buyers bail and developers start discounting heavily. It'll be similar to the early 2000s apartment bubble bursting. Picking 20% plus price drop in the next 18 months for apartments.

Sure - apartments are not as desirable as houses. And the apartment market is far more volatile than the house market.

But the key drivers for apartments are location (they tend to be closer to CBD's) and demographics (Auckland's huge population growth).

The apartment market could fall back - but 20% plus is wishful thinking.

TTP

JC, I wasn’t aware that you can get up to 15 % on term deposit nowadays????

Also, where can you get capital gain profit from not having to cough up any physical cash?

Property investing and managed by yourself sure beats an 8 to 5 job hands down.

No it doesn’t suit a lot of people as it involves some things that are outside the comfort zone for them.

However, reality is that property done properly is extremely rewarding.

Gordon, please don’t bother replying about dropping prices and rents in cold Chch as you haven’t got a clue!

Property investing and managed by yourself sure beats an 8 to 5 job hands down.

Especially when folk (not you) can pretend they're not buying and selling for profit, thus avoiding tax. Tax is for suckers who work 9-5.

JC, I wasn’t aware that you can get up to 15 % on term deposit nowadays?

You can't. And the aggregates show that a similar ROI is highly unlikely to be achieved with property investing. Troll all you want, but the data doesn't lie.

THE MAN 2 is not trolling. You do yourself no favours by constantly accusing people of being trolls.

Agree with you Zachary.

Accusing people of being trolls is unhelpful and childish.

TTP

Also, where can you get capital gain profit from not having to cough up any physical cash?

Isnt capital gain on any appreciating asset a non coughing episode ?

If you had bought a 1970's 911 Porsche in the early 2000's, your return now would be in the 200% region. Property is not alone in capital gains. And the Porsche is infinitely more fun.

Yes The Boy the current data and analysis coming out of Christchurch sure indicates that the housing market and rental returns are in a far worse state than what my sources have been telling me. You should follow the actions of the Auckland Accountant and trim your rubbish from your portfolio. Mind you if you did that you would have nothing left.

We normally have a big percentage of our rentals due up in January each year.

Most have renewed and the odd one we reduced the rent about $10 on average and with interest rates having dropped we are ahead financially.

However 6 required us to find new tenants and we have rented 5 of them with absolutely no down time and the last one we have had applications on, so to,us the rental market is just fine.

Prices don’t worry us one iota as we don’t sell positively geared property as it is our income.

Currently on the Gold Coast On holiday and I would say things here are nowhere near as rosey as what the future of Christchurch is.

“Currently on the Gold Coast On holiday and I would say things here are nowhere near as rosey as what the future of Christchurch is.”

Love the Gold Coast – either Coolangatta or Burleigh – too old for things touristy.

From your comments I’d have to think the Gold Coast has suddenly taken a terrible turn for the worse, or that Christchurch is currently going through some sort of meteoric burst of unprecedented growth.

No matter - don’t go out above your waist!

Wow on holiday at the Gold Coast. I went there in 1997 with the family to do the theme park thing. It was a hole then. Possibly more to do than in Christchurch though. Can’t you afford a nicer spot to holiday at?

Cute quote from a recent article floating around:

“There was an intoxicating optimism at the top of every unstable boom when people convince themselves that risk is fading, but that is when the worst mistakes are made.”

This stuff appears all the time – and one day in the future it may prove correct, or not.

At the moment in residential real estate – “unstable boom” could be argued either way I think.

IE– is it unstable, and is it a boom?

It seems astonishing that anyone could own a house in Auckland for 4.5 years and then sell it at a loss. Are the figures skewed by investors selling to their own companies at inflated prices to maximize tax returns I wonder?

Agreed. However there has been some very shonkey flipping debt stacking done, some reported on this website, and especially where overseas funds are involved. I would suggest the approaching loss ring fencing will be a big driver. Have seen several domestic specuvestors whose only goal was tax minimisation and tax free capital appreciation. Personally picking this to have a bigger impact (lowering overall pricing) than many predict.

Or maybe they're just bad investors.

Well I recall holding a residential in Christchurch for 6 years and selling it about 3% less. (did not need it anymore to house the kids at uni). I then plugged that money onto commercial and it did well. But that was 20 years ago and we all know we never learn from history. If I had held onto it might have tripled my money in residential but would have lost making the 12% + net return from rents alone. This surely is good legitimate productive business investment. Why are all the cardboard experts standing and beating their chests.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.