Statistics New Zealand is reporting that the percentage of residential properties sold to overseas buyers plunged in the March quarter - the first full quarter following the taking effect of the foreign buyer ban.

Home transfers to people who didn’t hold New Zealand citizenship or a resident visa fell by 81% in the March 2019 quarter compared with the same quarter a year ago, Stats NZ said on Thursday.

There were 204 home transfers to people who didn’t hold NZ citizenship or a resident visa in the March 2019 quarter, down from 1,083 in the March 2018 quarter. Total home transfers fell 3.5% over the same period.

“Overseas people acquired just 0.6% of homes transferred in the first quarter of 2019, reflecting law changes in late 2018 that introduced restrictions for overseas buyers,” property statistics manager Melissa McKenzie said.

“Despite the large fall in the number of transfers to overseas buyers this quarter, it’s unlikely to ever be zero, due to exemptions for some overseas buyers,” Ms McKenzie said.

The share of home transfers to overseas people peaked at 3.3% in the March 2018 quarter when the law changes were being discussed.”

The new legislation fully came into effect on October 22 last year - so, this is the first quarter to capture its full effects.

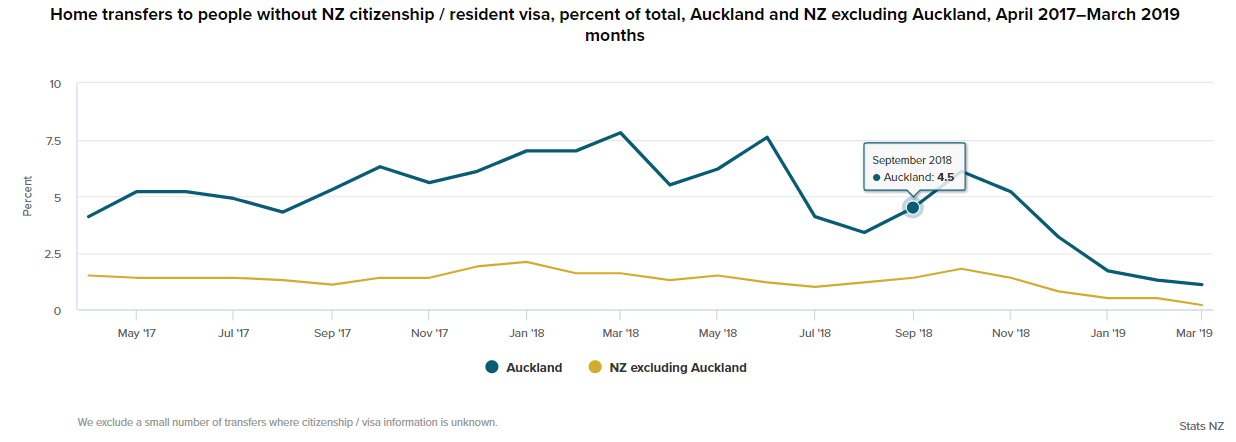

In Auckland, on a monthly basis, the share of homes transferred to no NZ citizens or resident visa holders varied from a high of 7.8% in March 2018, down to 1.1% in March 2019. On a quarterly basis, the number of homes transferred to that group went from 678 in the March 2018 quarter to 111 in the March 2019 quarter.

A detailed look at the latest statistics within Auckland shows the extent to which foreign buying has dried up.

In the Waitemata area, which takes in Central Auckland, just 3.2% of transfers (21 by number) were for foreign buyers in the March quarter. That's down from 13.7% (159 by number) in the December quarter.

If you go back to the June quarter last year, there were 321 transfers in the area to foreign buyers, which was 22.2% of the total.

“In both Auckland and New Zealand as a whole, the fall in overseas home buyers this quarter coincided with about an 80% drop in home transfers to Chinese tax residents,” McKenzie said.

Note: the statistics probably only paint a partial picture of overseas buyer activity in this country because they only include data on properties purchased directly by individuals.

The statistics do not include purchases made by overseas persons through a corporate entity such as a company, and probably do not capture most of the purchases made by overseas persons through a trust.

Stats NZ gave the following breakdown of the latest figures:

In the March 2019 quarter, of all home transfers:

- 82% were to at least one NZ citizen

- 10% were to corporate entities only (which could have NZ or overseas owners)

- 7.5% were to at least one NZ-resident-visa holder (someone who can live and work in New Zealand for as long as they like)

- 0.6% were to no NZ citizens or resident visa holders.

41 Comments

Once again, lies, damn lies & statistics. Remember that the Auckland market is 30% Asian born regardless of their status. The Dragon has well & truly landed.

???

Did you just make that up? Please either add supporting documentation or change it to be factual. Interested to know how you come to make such a bald claim.

Closest info I've found with with a quick google was almost 40% of Auckland's population having been born overseas: "With 39 per cent of its population born overseas, the city is revealed to be more diverse than Sydney, Los Angeles, London and even New York."

https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11575305

While in NZ as a whole: "In 2013, the most common birthplace for people living in New Zealand but born overseas was Asia – 31.6 percent of the population were born there. In comparison, 26.5 percent of the population were born in the United Kingdom and Ireland." Though of those born overseas living in AKL: Asia (15.4 percent)

http://archive.stats.govt.nz/Census/2013-census/profile-and-summary-rep…

No direct source to corroborate Longjohns' claim.

I live on a long North Shore road and none of my neighbours are Chinese; there is a mix and I am sure there must be some but I've never met them - the nearest Chinese born person I know is about 60 houses away and the mother of my grandson's friend (husband Kiwi and kids look Kiwi). The local Glenfield leisure centre is about 25% mainly elderly Asian during the day but probably less so outside office hours. Anecdotal but if you are looking for immigrants you would expect to find them in Auckland North Shore.

Try Sunnynook, Forrest Hill or Milford!

Your figures are for 2013; since then immigration has reduced from UK and increased from 3rd world. Immigrants and especially those from poor countries tend to have more children than Kiwis. Those children of immigrants will be born in NZ and counted as Kiwi in your stats; of course given time and integration rather than multi-culturalism then they will adopt Kiwi values.

I disagree. As you are aware due to population control measures most Chinese from mainland China only has one child. Most Singaporeans have 1-2 children as well due to their countries' birth policy. So the only "Asian" with more children you are referring to are perhaps those from India or Philippines or middle Eastern countries who are Catholics. Not all "Asians" are alike. Putting all together in a big basket is very misleading.

Time, integration and adoption of Kiwi values would seem to be influenced by overall volume and the development or not of isolated enclaves.

It's not going to make any difference.

New Zealand's finest real estate agent Juan Key told us so many many times...

I'm absolutely no fan of this government but credit where credit is due, I'm glad and thankful they banned foreign buyers (more or less). Good move - now if only they could get arond to immigration...

Easier said than done. Immigration is effectively a "product and / or service" that NZ sells to the rest of the world. It is one of the engines of the economy but we don't really understand the impact of its output. Removing it even to "sustainable levels" could be a major impedient to the economy. Same issue in Australia. The general wellbeing of the populace is being squeezed so govts can squeeze more people in and take credit for the increase in GDP (even though it puts downward pressure on incomes).

Probably something they should have thought about before campaigning on it. Clearly an absurd notion, I know.

3 weeks on and no reply to me from Lees-Galloway’s office nor Winnie’s office regarding their broken election promises.

What an utterly stupid way to run an economy.

What an utterly stupid way to run an economy.

Not necessarily, but if you have no capacity or desire to provide infrastructure and a coherent plan, then I agree with you.

by tothepoint | 5th Dec 18, 7:15am "Note that the evidence to date shows the so-called FBB has had little, if any, impact on the housing market"

TTP

Hmmmmmmm. Yet again you've been too busy staring at the sky to notice those boulders that lie between you and your letter box.

Hi Retired-Poppy,

I stand by my post here of "5th Dec 18, 7.15am".

What I said at that time was a true and accurate assessment.

But, even now, the latest evidence shows that house prices in NZ remain pretty steady, with increases STILL being recorded in various suburbs, cities and regions - despite the magnitude of the last upswing.

TTP

Awesome and may they never be allowed carte blanche with our houses ever again!

If you think NZers have it bad, think of the poor Canadians whose institutional ineptitude and corruption has put the country in a precarious situation. Property as a vehicle for money laundering and tax evasion on a scale historically unseen is not healthy.

https://www.burnabynow.com/real-estate/non-residents-own-a-quarter-of-n…

https://www.burnabynow.com/real-estate/foreign-buyer-tax-wreaks-havoc-o…

I expect Canada is more desirable than us

All depends on what your benchmarks are. I think there are many similarities, but the chickens appear to be coming home to roost there. The rot has been so deep. Short selling positions against Canadian banks are high, even though the bet has been a losing one.

https://www.bloomberg.com/news/articles/2019-04-11/short-sellers-wait-a…

If you like snow.

SMH. Thats why Vancouver is so desirable with foreign buyers. Summers hotter. Days longer than NZ & mild winters compared to the rest of the country. Plus VERY lax money laundering laws. Wins all round.

Oh it's happened here too, people just don't like to acknowledge it. But you only have to take a quick look at the expensive areas on sites like www.oneroof.co.nz at the suburb info to see the huge amount of properties bough using 'Trusts Companies' here's an example of Remuera, Auckland at 34% of property owned by Trust companies. https://www.oneroof.co.nz/suburb/remuera-auckland-city-1962

FB "down from 1,083 in the March 2018 quarter".

All will be assuming that this will have a significant effect on demand in the housing market. However, how significant is this compared to the demand generated by current levels of immigration?

Assuming an average of 5 people per home (calculate using your own figure if you disagree); then that equates to 5,400 people occupying FB homes (if they are occupied).

Current immigration is around 60,000 people and on the same assumption (yes an assumption) of 5 people per home, that relates for an additional demand of about 12,000 homes per year from immigration.

OK, argue the assumptions and basis for this and do your own calculations; but the bottom line seems that 1,083 foreign buyer homes in 2019 (just prior to the introduction of the ban), pales a bit somewhat in terms of the demand for 12,000 houses generated by immigration and consequently the affect on demand in the housing market.

Remember a lot of students and low skilled workers count as 'immigrants'. You think they will be buying houses?

This government has been underwhelming but they deserve praise for this policy. Much needed, much overdue, and it will be having an impact on taking the heat out of the market.

Remember that this is net immigration/emigration so the number of students coming in will largely be off-set by students leaving. As for low income workers, whether they either be buying themselves or renting they will be creating an addition demand for housing.

Bottom line is that current levels of immigration create a demand for about 12000+ houses which is a far more significant than the 1000 previously purchased by FB. Yes decline in FB will have an negative impact on the market but immigration is having a far greater impact. If immigration is halved then that will have a far great impact on continuing demand compared to the FB ban.

dp

Until now, a typical villa house in Herne Bay is cheap comparing to this!

https://www.domain.com.au/news/average-four-bedroom-house-for-sale-in-k…

Hang on, I thought we do not keep a record of this activity? So how would we know the rate has fallen?

What I would like to know is the number of properties that have been sold by foreign owners over this period.

Now that would be a better indicator for what has been going on these last few years.

Would be interesting to see if sales to trusts went up over the same time period.

What will be interesting to see is when China lifts its capital flight restrictions. I'm guessing that's going to happen as soon as Trump is impeached or voted out in 2020. Lets see how effective the ban will be then?

It's good to have seen our Government finally take a stand and recognize the damage done by Foreign Buyer (Non-resident buyers) can inflict on our economy, creating a false economy. And has tried to doing something about it, hence the ban. But lets face it, there's huge amount of evident that what has really reduced Foreign Buyer activity here has been China's champing down on their 'Capital Flight', that happened in early 2017. Due to pressure of trade tariffs from Trump.

This has drastically effected not just our housing market, causing it to go in to decline but also Canada and Australia which were also being inundated by Foreign Buyers from China over the last few years.

Here's a quote from Juwai article: Chinese buyers look set to increase their demands in Australia and New Zealand during the coming 12 months.

"The question for Australia and New Zealand is this. When will Beijing relax the restrictions that make it harder for Chinese families to move more money overseas to buy real estate? When they do cut the red tape, you can expect to see a surge in investment in Australia and New Zealand".

https://list.juwai.com/news/2019/01/why-chinese-buyers-still-looking-at…

Question surely is whether the CCP can afford to relax the capital flight restriction. Other news articles have suggested that they're looking to bring more of that flown money back to China.

https://www.project-syndicate.org/commentary/oecd-common-reporting-stan…

"NZ-resident-visa holder (someone who can live and work in New Zealand for as long as they like)"

Excellent Statistics NZ is finally breaking out "Temporary visa holders" (students etc) from "Permanent Visa holders". It took a change of government to see these statistics.

To think that 7.8% of buyers in Auckland in March 2018 were neither citizens or permanent Visa holders, there is little wonder that prices shot up so much when supply was already limited. ALso this figure excludes those buying through companies or trusts.

Congratulations Jacinda/Labour on the Ban !!!! Finally a government that takes action after nearly 10 years of talk only leadership.

Did anyone hear Ashley Church on tv1 breakfast show this morning, madly trying to spruik the market. I wonder who he thought he was talking to when he quoted the ropy figure of 3% of foreign buyers over the entire country to make it look like foreign buying was a mere bagatelle.

Also trying to make out, using the same method that the market is just "flat". Seemed pretty desperate to me tbh.

Then they all, including him, said mis-chee-vi-ous which got my hair standing on end, the word is mischievous, notice, no "i" between "v" and "o".

Well that was mischuvus of them, they should of perculated another expresso to woke them up. Irregardless, you managed to interpretate what they were saying.

I get that way when my beers not cold.

“In both Auckland and New Zealand as a whole, the fall in overseas home buyers this quarter coincided with about an 80% drop in home transfers to Chinese tax residents,” McKenzie said.

In the last 12 months the capital gains available in the Auckland housing market fell from marginal to negative. In the last 12 months the capital gains available in the China housing market were very very good. That 80% drop can be explained by Chinese people preferring to make and not lose money.

https://www.scmp.com/news/china/money-wealth/article/2164350/chinas-hom…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.