By Nouriel Roubini*

Now that Russian President Vladimir Putin has launched a full-scale invasion of Ukraine, we must consider the economic and financial consequences of this massive historic development. The Ukraine war is not just another minor, globally inconsequential conflict of the kind seen in recent decades. This is a major escalation of Cold War II, in which four revisionist powers – China, Russia, Iran, and North Korea – are increasingly challenging the long global dominance of the United States and the Western-led international order that it created after World War II.

The risk now is that markets and political analysts will underestimate the implications of this global regime shift. By the close of the market on February 24 – the day of the invasion – US stock markets had risen in the hope that the war would slow down rate hikes by the US Federal Reserve. Yet in terms of the broader economy, a global stagflationary recession is now highly likely. Analysts are asking themselves if the Fed and other major central banks can achieve a soft landing from this crisis and its fallout. Don’t count on it. The war in Ukraine will trigger a massive negative supply shock to the global economy, reducing growth and further increasing inflation at a time when inflation expectations are already becoming unanchored.

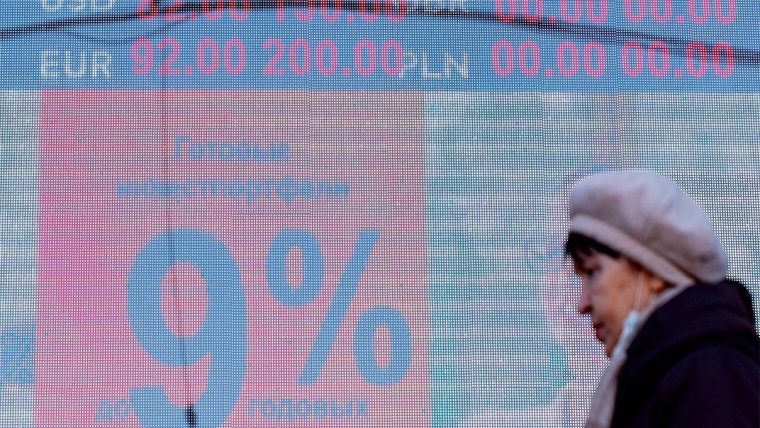

The short-term financial market impact of the war is already foreseeable. In the face of a massive risk-off stagflationary shock, global equities may move from the current correction range (-10%) into bear market territory (-20% or more). Safe government bond yields will fall for a while and then rise after inflation becomes unmoored. Oil and natural gas prices will spike further – to well above $100 per barrel – as will many other commodity prices as both Russia and Ukraine are major exporters of raw materials and food. Safe haven currencies such as the Swiss franc will strengthen, and gold prices will rise further.

The economic and financial fallout from the war, and the resulting stagflationary shock, will of course be largest in Russia and Ukraine, followed by the European Union, owing to its heavy dependence on Russian gas. But the US will suffer, too. Because world energy markets are so deeply integrated, a spike in global oil prices – represented by the Brent benchmark – will strongly affect US crude oil (West Texas Intermediate) prices. Yes, the US is now a minor net energy exporter; however, the macro-distribution of the shock will be negative. While a small cohort of energy firms will reap higher profits, households and businesses will experience a massive price shock, leading them to reduce spending.

Given these dynamics, even an otherwise strong US economy will suffer a sharp slowdown, tilting toward a stagflationary growth recession. Tighter financial conditions and the resulting effects on business, consumer, and investor confidence will exacerbate the negative macro consequences of Russia’s invasion, both in the US and globally.

Likewise, the coming sanctions against Russia – however large or limited they turn out to be, and however necessary they are for future deterrence – inevitably will hurt not only Russia but also the US, the West, and emerging markets. Moreover, one cannot rule out the possibility that Russia will respond to new Western sanctions with its own countermeasure: namely, sharply reducing oil production in order to drive up global oil prices even more. Such a move would yield a net benefit for Russia so long as the additional increase in oil prices is larger than the loss of oil exports. Putin knows that he can inflict asymmetrical damage on Western economies and markets, because he has spent the better part of the last decade building up a war chest and creating a financial shield against additional economic sanctions.

A deep stagflationary shock is a nightmare scenario for central banks, which will be damned if they react, and damned if they don’t. In an environment of rising inflation where central banks are already behind the curve, slower policy tightening could accelerate the de-anchoring of inflation expectations, further exacerbating stagflation. But if central banks remain hawkish (or become more hawkish), the looming recession will become more severe.

Although central banks should confront the return of inflation aggressively, they most likely will try to fudge it, as they did in the 1970s. They will argue that the problem is temporary, and that monetary policy cannot affect or undo an exogenous negative supply shock. When the moment of truth comes, they will probably blink, opting for slower monetary tightening to avoid triggering an even more severe recession. This will further de-anchor inflation expectations.

Politicians, meanwhile, will try to dampen the negative supply shock. In the US, policymakers will try to mitigate the rise in gasoline prices by drawing down its Strategic Petroleum Reserves, and by nudging Saudi Arabia to increase oil production. But these measures will have only a limited effect, because widespread fears of further price spikes will result in global energy hoarding.

Nor can Western leaders rely on fiscal policy to counter the growth-dampening effects of the stagflationary shock. For one thing, the US and many other advanced economies are running out of fiscal ammunition, having pulled out all the stops in response to the COVID-19 pandemic. More to the point, a fiscal (demand) stimulus is the wrong policy response to a stagflationary supply shock. Though it may reduce the negative growth impact of the shock, it will add to inflationary pressure. And if leaders rely on both monetary and fiscal policy in responding to the shock, the stagflationary consequences will become even more severe, owing to the heightened effect on inflation expectations.

It is tempting to think that the Russia-Ukraine conflict will have only a minor and temporary economic and financial impact. After all, Russia represents merely 3% of the global economy (and Ukraine much less). But the Arab states that imposed an oil embargo in 1973, and revolutionary Iran in 1979, represented an even smaller share of global GDP than Russia does today.

Putin’s war will strike a massive blow to global confidence at a time when the fragile recovery was already entering a period of uncertainty and rising inflationary pressures. The knock-on effects from the Ukraine crisis will be anything but transitory.

Nouriel Roubini, Professor Emeritus of Economics at New York University’s Stern School of Business, is Chief Economist at Atlas Capital Team, an asset-management and fintech firm specialising in hedging against inflation and other tail risks. Copyright: Project Syndicate, 2022, published here with permission.

24 Comments

Great piece.

I can't believe how dismissive some have been of the wider economic impacts.

Agree - another nail in the coffin of a recovery in house prices - confidence and imported inflationary pressures on living costs.

Interesting. I think he may be broadly correct in his reading of the situation.

I found it quite extraordinary to hear Adrian Orr be so hawkish on rate rises. It's as though he hadn't yet heard about ' a minor scuffle in a faraway country'. Consumer spending is, I think, going to contract very sharply once the implications sink in. The OCR will not reach 3.50% unless he wants to crucify the economy.

I know nothing of the inner workings of the fuel market, but to me, the government's reassurances sound pretty hollow. It may be unlikely but certainly not impossible that we will see fuel rationing and my EV will become ever more valuable.

I saw yesterday's stockmarket bounce as something of a 'dead cat bounce' and used it to sell another holding.

As I have been saying the last 6 months, the OCR will be lucky to get above 1.75

uhm...

I am keen to consider also different scenarios.

One possibility (not remote at all) is that Kiev falls in one week or less and a new govt pro-russia gets "elected". Donbass and co to become russian protectorates. Russia will face sanctions and oil goes up, but they got enough internal manufacturing/resources and some very good friends in the east block. The eastern powers demonstrate the foundamental no-go of USA+EU. USD goes down, inflation goes up, but this time with USD less capable to influence the rest of the world.

Will FED be forced to act in a different way then, to collapse internal demand?

Are we going to face another holy war, to justify running inflation?

I am not keen to take any bet honestly :|

We were heading for stagflation before this kicked off. So lock it in I guess?

Some articles have been suggesting this is a wake-up call for the world to wean off fossil fuels in a bid to punish Russia.

Makes sense, until you realise Russia and Ukraine control majority supply of critical minerals for tech hardware.

Australia has plentiful rare earths in ground, and South Africa can supply PGMs. PGM demand should drop, if West makes major drive for EVs, as major requirement for PGMs is in catalytic convertors.

Russia can cause short-term pain, but they are merely a convenient source of minerals/ fossil fuels. Alternatives could be in production within 12 months, if Western governments deemed this a strategic priority, principally Australia for minerals and North American fossil fuels.

Excellent Article.

Agree 100% as it always happen - " When the moment of truth comes, they blink" and even this time is no difference.

Time to change defination and role of central bank and current democratic system, need more accountability with consequences, which may act as a detterent and will think hundred times before blinking just like RBNZ governor, who had the perfect opportunity but being over cautious refused to take necessary action now, which was not the case earlier, in dropping interest rate to zero overnight without thinking and blinking under massive money printing programme.

Earlier it was 'Act and than Think' AND Today is Think, Think and Think with No Action or show concern and again think of future action.

Every definition of Stagflation I can find references high unemployment...

I think Europe has realised they cannot go on relying on Russia for oil and gas supply. Strategically it leaves them too vulnerable.

Britain has a known reserve of at least 200 years worth of natural gas .. but ... thanks to Greens extremists , cannot frack & get it out ... so , they're reliant on Russia instead ... rather than be self sufficient ...

... not entirely different from NZ , with Jacinda's ban on offshore gas exploration ... leaving us dependent on Saudi Arabia for oil & Indonesia for black coal .... hmmm ... yessss ... didya really think that through, Miss Ardern ?

Slow day?

Those resources - what's left of them, Brent is down way under 20%-remaining - are finite. 'GBH', who seems to appear on slow days, may argue for short-term continuance all he wants, but nothing based on finite resources lasts forever.And exponential growth based on consumption of same, lasts even less time. And of course, the quality of the stock remaining, gets ever-worse.

So 'self-sufficient' is a factually incorrect description.

We are indeed, entering the Turning. Putin - mensa-level and with a page-photographic memory, I'm told - is well aware of this. Biden would be struggling to be aware of anything. And we suffer from a local media conflating optimism with fact.

"And we suffer from a local media conflating optimism with fact."

Hope you don't mind if I borrow this. Really does sum up our media.

GBH, at least get your facts right. For reference, the shale reserves of the UK were downgraded in 2019. I know you love to blame everything on the boogie man of 'the greenies' but facts just don't line up with your wishes. People need to face the reality that fossil fuels are slowly on their way out, the economy as people knew it will be a relic to a time when we were blowing through this energy bonaza like 'crack'. The smart thing for countries to do would have been to bring all houses as close to passive standard and to minimize dependence on fossil fuel infrastructure. PDK has been raising this point on this site for over a decade but now the chickens are slowly coming home to roost. Worse still, what has NZ done so far to minimize our dependence? SFA.

The BGS (British Geological Survey) also collate external estimations of economically recoverable resources for the purpose of international comparison. They quote a figure of 538bcm for the UK (BGS 2013:10). Whilst this is a sizeable amount of gas it only equates to around 20 per cent of everything that has, and will, come out of the North Sea (BGS 2013:47). Even at the top end of the BGS estimates total gas in place is 64.6 tcm, which would still be unlikely to see production exceeding domestic demand for any substantial period of time.

http://www.ukuh.org/media/sites/researchwebsites/2ukuh/89490%20SGUK%20E…

The Markets seem to have already shrugged off the Ukraine Imbroglio. Loss of Ukraine to the new Soviet Union is not going to affect the world economy much. Even the US may come around to that.

... the fact is , Russia has been left behind ... years of Putin's corrupt dictatorship has left his country mired in economic stagnation ... regular citizens are growing restless , fed up with him & his cronies using that great nation as their personal plaything & piggybank ...

Sorry Prof Roubini : but , the West / Asia / Africa ... all have moved on , progressed ... who the heck needs Russia , North Korea , Iran ... stay in your self imposed hermit kingdoms ... suits us ... right , Jacinda ? ...

Reminds me of someone who repetitively blamed everything on Trump.

Cause, causal.

Such a small keystroke difference; such a big Systems one.

Perfect time to get a million dollar mortgage on a shack in Manurewa!

probably 1.2 million ho ho ho for that shack

NZ is a "strong economy" right? Robbo has been saying that comparatively NZ has been doing better than other nations. It's not backed up by any rationale or metrics, but he says it quite frequently.

Completely agree, Nouriel - smart as always. Everyone in NZ will pay some price for the inconsiderate money printing, some by a lot (the greedy ones). On the whole, NZ should do fine because we export food commodities, and believe me people don't stop eating in recessions.

Oh yeah we'll pay a price for sure... probably an exorbitant price for food.

A quick advance and conquest is the best result for Russia. Should the Ukrainians fight back, unlike in Crimea, each passing day of resistance tilts the odds. Putin may have underestimated Biden, who has responded decisively. And the UK too.

Even our Jacinda responded promptly, beating certain larger european nations. By day two of this invasion, it looks like the sanctions imposed by so many nations will be too much for Putin to bear. Unless he wants to join North Korea in the pariah grouping.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.