By Alison Brook*

At the beginning of 2020 empty supermarket shelves were a common sight as consumers rushed to stock up on goods they thought might run out. Suppliers struggled to keep up with soaring COVID-induced demand.

Governments reacted by pouring billions (or trillions) of dollars into their economies to avoid an economic meltdown. Locked-down consumers who could not spend as much on services, and buoyed by the wealth effect of high asset prices spent more money on physical goods. At the same time production in China was shut down or limited. Retailers, responding to the demand and shortages, ordered even more stock and upstream wholesalers and manufacturers did the same. Supply chains became congested and freight charges skyrocketed.

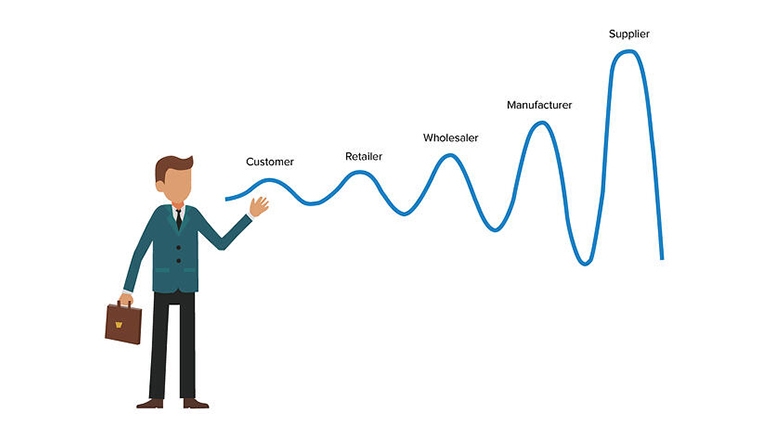

The Bullwhip Effect

By the second half of 2021, the combination of these factors triggered inflation and set the scene for the so-called “bullwhip effect”. The bullwhip effect has been described as “a cowboy lassoing the ground: each rope swing corresponds to an event in the supply chain. A small jolt from the cowboy can result in a violent whip at the end of the chain. More concretely, the various stakeholders cannot anticipate sufficiently: a slight variation can create increasingly significant stock increases as you move up the chain. So, the further away the perception of demand is from the final consumer, the less accurate it is.

Increasingly, international commentators now argue that inflation may be about to ease as the bullwhip effect takes its next twist. According to Paul Krugman supply-chain issues “may well be about to fade away”. In the US this will lead to a significant reduction in inflation in the next few months. He warns the US economy is still overheated, but there is little chance that inflation will become entrenched as it did in the 1980s. At that time the US was experiencing a particularly painful combination of rising prices and high unemployment.

With inventories now high at a time when consumer demand appears to be falling, the world faces a growing risk of recession.

New Zealanders have not yet registered the change in economic outlook despite the faltering levels of consumer confidence. Consumer spending is still “concerningly high” according to the ASB and debit and credit card spending rose in April across all categories.

A Looming “Trucking Recession”

Craig Fuller, CEO and Founder of FreightWaves which monitors millions of trucking transactions in the US argues that the bullwhip effect will do the Fed’s job in reining in inflation. “Prices for freight will come down. Supply chain bottlenecks will ease. What were recently inventory shortages are now gluts, and will likely result in price discounts, not increases. This is a late-stage supply chain correction.”

While the trucking industry globally found itself with a labour shortage throughout 2021 there is now evidence of “plummeting demand”, suggesting consumers globally are tightening their belts for everything from food to furniture. This is consistent with the shipping data with shipping logistics company Xeneta reporting lower costs for shipping across major routes, including from East Asia to Europe and the American Northeast.

The recessionary factors which have been building up over the last two years may, unfortunately, be triggered by the invasion of Ukraine according to George Kokoris in Supply Chain 247. For businesses, this means they should prepare as much as they can by conserving cash, reducing inventory levels and prioritising their key customers. For consumers, it will mean curtailing spending and drastically reducing debt-fueled spending.

The Bullwhip’s Sting

Forecasting in an ever-changing pandemic environment – and now with the added unpredictability caused by the war in Ukraine – is fraught. However, after two years of massive demand, it seems we are heading into the final phase of the bullwhip effect where an oversupply in certain industries starts to bring down prices for transport and goods.

What’s next, according to Yossi Sheffi in the MIT Sloan Management Review is the “bullwhip’s sting” where an amplified demand surge is “followed by an amplified plummeting of demand”. The signs are now pointing to a global recession in the next painful, but inevitable twist of the bullwhip effect.

*Alison Brook is from the Knowledge Exchange Hub at the Massey University campus at Albany, Auckland. She is on the GDPLive team. This article is a post from the GDPLive blog, and is here with permission. The New Zealand GDPLive resource can also be accessed here.

28 Comments

Can't see supply chain issues resolving that fast - hope I'm wrong.

what usually occurs at this stage of the economic cycle is substitution and development of cheaper alternatives as companies strive to address demand issues. we are already seeing examples of this from big supply chain moves to small individual moves

1. Companies onshoring manufacturing - this enables companies to secure supply for customers quicker - but this creates less demand for offshore products.

2. Using Steel framing rather than wood framing on housing - this creates less demand for wood.

3. Growing your own veggies instead of buying from the supermarket or trading vegetables/ excess food with family and friends

All of these start to spread the demand into other areas and create greater supply. The consequence is if those in industries where supply is short don't notice their demand is being diffused away they end up producing too much supply that they cant then get rid off at the same prices as today - prices fall as a result of the increased supply.

The Inflation problem starts to be fixed but for a number of industries they will run into massive cashflow problems as they hold too much inventory and at higher values than what they can sell it for (this is the ugly consequence of the bullwhip effect - lots of stock, that has a declining value) .

This is NOT a cycle.

Just as growth is not linear.

And the submitted piece of writing is total nonsense. From a University. Go figure - if you do, you'll be ahead of them. Disgraceful.

Growth IS linear, right up until a point it suddenly isn't and that's the problem, we all carry on like nothing is ever going to change. Its just a normal human response really, carry on doing what we have been doing for the last couple of hundred years, what could possibly go wrong ?

Now if only steel prices weren't going up 10% a month too.......

Modern houses don't have big backyards, many have none at all

Raw materials for onshoring still mainly come from overseas, I know, having to import my raw paper to convert here because one of the 2 fibre types doesn't grow in NZ, and a paper mill is $300m, pulp mills triple that - an impossible challenge.

You might be right in terms of the substitution but the economic of the changes, and the unusual demand issue with supply chains means that even if you want to bring machines in to onshore manufacturing, you might be waiting 2 years to even get the machine, the delay leading to more hyperinflation before the eventual collapse.

Your suggestions belong in an other time.

Consumer spending is still “concerningly high

It has long been said that many NZ’ers are poor savers and not particularly financially literate. The modern mentality of financing your dream life style with excessive amounts of debt has no doubt put us in an even worse place literacy wise. Unfortunately this lack of understanding of where we are currently heading is going to lead to exponential issues down the track.

The creation of excessive amount of debt has been directly fostered by the RBNZ and its stupid ultra-loose monetary policy. The OCR should have never been lowered below the 2% threshold, and it should be at the very least 3% right now.

Just had to squeeze the last little bit of juice from the housing stone, then cater to inflation.

... yup , the RBNZ got it badly wrong ... and are still behind the 8 ball on the OCR ...

Plus ... why do we still punish savers by taxing them on the pittance they get in interest on their term deposits ?

It's a bit blunt pointing to consumer spending and saying we're not good savers.

The spending in dollar terms might be the denominator, but if you look to the numerator being number of widgets.

Well, I don't really know what I'm saying right here. With us only ever having dollars and not widgets, who knows what the real consumptive behaviour is of the average household.

A surprising feature of the data is that the saving rates of younger generations appear to be generally higher than those of the generations preceding them.....Contrary to popular opinion, successive generations of households appear to be saving at significantly higher rates than earlier generations did at the same age. One plausible explanation for this rise in saving rates, supported by other related research, is that it reflects the precautionary response of younger generations to an economic environment with higher unemployment and less generous public welfare than faced by their parents.

https://www.treasury.govt.nz/publications/research-and-commentary/rangi…

Previous generations gorged themselves on housing debt, they'll constantly remind you by bringing up 25% interest rates and second mortgages at a time when 15%+ term deposits existed and a house could be bought for the equivalent (in income ratio terms) of a down payment today.

Hold on, I thought the reason young people couldn't afford houses was because they were spending too much on smashed avocado, lattes, european holidays and iphones?

I mean you've worded it in a terrible way but the sentiment remains.

PART of the reason young people can't afford a home is because they aren't good at saving (which there are a multitude of reasons for, smashed avocado being delicious isn't one of them).

Kiwisaver

And of course the younger generations haven't yet bought houses or married because they're too busy buying smashed avocado breakfasts and travelling

"A surprising feature of the data is that the saving rates of younger generations appear to be generally higher than those of the generations preceding them"

.Dont think theres any mystery there....its called Kiwisaver, replete with employer and government contributions and available for a house deposit.

Absolutely. There was nothing like Kiwisaver for Baby Boomers-plus they knew they could finance a house a 3x's annual income, and once they had their finances in order and had savings to invest they didn't put in the bank or stocks, but instead did the entirely government tax supported thing and ivested their savings in a Renter-or 2 or 3 etc. Result-30 to 40 years of unprecedented returns tax free --not to mention the yield on top. Very few Countries Baby Boomers had it so good in terms of preparing for retirement. No loss of capital in stock market cycles-just continuous growth decade after decade.

lol, no kidding.

They built and encouraged an entire system based around spending. Every time the spending slowed, money got printed and lent out. So that the money go round could continue.

Now they are concerned people are spending too much?

Thank god, the experts and economisseds are finally catching up to the rest of us. Another 20-30 years and they might be able to see Covid approaching.

It has long been said that many NZ’ers are poor savers and not particularly financially literate.

Why save when the house does all that for you and provides capital growth in spades? That's the mentality.

I was at Sylvia Park and Newmarket Shopping Mall the last few weeks and it was packed to the rafters and people spending up big which made me wonder if people are taking any notice of the headwinds we are facing. Not sure where the money is coming from either, but perhaps they just think the Government will save the day again.

People often act once its too late and the recession and fallout hits them in the face...

If anything like the US, it might all be going on the credit card.

It’s the calm before the storm. The vast majority of people are oblivious to the economic storm on the horizon, even clever (but economically illiterate) people.

Alot of window shoppers, I don't get the appeal of walking around a mall looking at stuff you can't afford but some love it... I guess afterpay & credit cards might help some...

The current environment does not imply a harsh recession ahead. There is plenty of 'fat in the system' that has accumulated over the long term in this country, and whilst yes much of it is concentrated in rich listers coffers there is also a lot of wealth in many peoples balance sheets although some of that is being depleted by the government via excessive taxes and some is also going to rich listers.

Not everyone got a mortgage rate of 2%, I think almost half of all mortgages were already fixed or floating at around current mortgage rates and 80% of homes have NO mortgage, thats right no mortgage payments need to be paid on those.

If you lived through the 80's and 90's you would know this is an economic blip for most kiwis, not a bomb.

Unfortunately this government have turned the wealth gap, that existed when they took power 5 years ago, into a crater... because it's the lower socio economic population base, and to a lesser degree mid socio economic, that will experience the sharper edges of recession..

I guess thats quite convenient for a political party whose loyal voter base are largely lower to mid socio economic. Driving a bigger wedge to enhance the class divide appears to be the aim and they seem to have hit a bullseye in that respect.

No wonder there are so many brazen ram raids recently, expect it to get worse until the governments childish game of excessive expansive monetary policies followed by excessive contractionary policies comes to an end. We need leaders that are grown ups that have some real world experience of tough economic times and prosperous times. People who are not green around the gills and know how to grow an economy, not the youth we have today herding us around the NZ economic paddock for their own political purposes bandying around their BS catchphrases like "sustainable this or that" as excuses for extra taxes and harsh impositions.

Thankfully one thing that is clearly becoming more and more unsustainable is this government.

The current situation with GIB wallboards is the best example of a bull whip situation.

Well, pretty consistent with what I Have been arguing for the past 6-9 months.

deep recession, inflation abates, OCR cut

Yup, pretty much. I've cut spending drastically over the last 6 months and built up a cash reserve for the upcoming sales.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.