Inland Revenue has begun taking more action on outstanding tax debt. It dialed back how hard it was pushing on overdue tax debt during last year in the wake of Covid-19. But in recent weeks, its activity has stepped up, and those involved with corporate reconstructions are seeing much more activity with Inland Revenue pursuing tax debt.

There are some reports that it's particularly targeting the housing and construction sector, but that's not necessarily the case, as I understand it. But the housing and construction industry has a record of nonpayment. Inland Revenue is particularly concerned about those companies or individuals not keeping up to date in relation to their GST and PAYE obligations. Inland Revenue’s longstanding view is that such receipts are held on trust (because they're being withheld from the payees) and therefore the companies have no right to the payments and need to pass them through straight through to Inland Revenue.

An Inland Revenue spokesperson confirmed they were taking more action adding “We give high priority to any business that has failed to pay employee deductions when due.” In the past Inland Revenue sometimes seemed quite extraordinarily slow in taking action with overdue PAYE. But if it's boosted its efforts in this space that's all well and good because following Gresham's law, bad money drives out the good. And those conscientious employees and businesses that follow the rules and make the payments as required are being undercut by more unscrupulous operators.

In that context, what I've been told is that Inland Revenue is also upping its efforts in relation to developers who are claiming GST on land purchases, but then failing to declare the GST when they make the subsequent sales of the properties. In some cases, you also have what they call “Phoenix companies” where there’s a pattern of developers establishing companies which then fall over leaving unpaid tax debts. Inland Revenue got itself extra powers to try and deal with those matters. And I would expect that with its enhanced capabilities following completion of the Business Transformation programme, Inland Revenue should be on top of that situation.

As always with tax debt the key thing to do if you run into trouble, is talk to Inland Revenue. It is actually surprising how little tax debt can soon become unmanageable for people. Inland Revenue’s own research suggests that break point is as little as $10,000. This ties in anecdotally what I've seen.

The key thing is, if you get in front of Inland Revenue early, tell them that you have hit difficulties and want to arrange an instalment plan, they will be cooperative. Where they won't be cooperative, and in fact they may look to take action and prosecute, is where someone persistently fails to meet their obligations in relation to paying over PAYE and GST and then tries to evade any responsibility by attempting to liquidate the company. Such scenarios increasingly will lead to prosecutions by Inland Revenue.

People will be surprised at how reasonable Inland Revenue can be. But to do so you have to be front up early, put all your cards on the table and you can then hope to get a reasonable hearing. Sometimes it doesn't work out, but you would be surprised at how often these issues can be resolved.

And this also takes the stress away from people, employers and business owners who get into tax trouble quite naturally stress about the matter and often put their heads in the sand. It's remarkable how much of a difference to stress levels it makes once you've spoken to Inland Revenue, and you find is this they are prepared to come to some form of arrangement. That’s dependent on a number of factors, the key factor being willing very early on to deal with the issue.

GST for directors' fees

Moving on and still talking about GST, Inland Revenue has released some draft guidance for consultation on the treatment of GST for directors’ fees and board members fees. This covers a number of draft public rulings and is accompanied as well by a very useful fact sheet. I'm liking how Inland Revenue is sending out a lot of these fact sheets alongside the longer papers with detailed consultation, because the fact sheets of what you can put in front of clients as they are a good summary of the issues.

The rulings will cover directors of companies, board members not appointed by the Governor-General and board members appointed by the Governor-General or the Governor-General in Council. Basically, what the rulings say is board members or directors must charge GST on the supply of services where the director or board member is registered or liable to be registered for a taxable activity that they undertake, and the director or board member accepts a directorship or membership of a board in carrying on that tax taxable activity. Remember, liable to be registered means they are carrying out taxable supplies which over a 12-month period would exceed $60,000.

And the director or board member cannot charge GST on the supply of services where they are engaged as the director or board member in their capacity as an employee of their employer or they’re engaged in in that capacity as a partner in a partnership, or they do not accept the office as part of carrying on a taxable activity.

As I said, these draft rulings are accompanied by a fact sheet, which includes a very handy flowchart, these flow charts and fact sheets makes life a lot easier and more understandable for those affected. The proposed rulings are reissues of previous rulings on the matter. They’re fairly uncontroversial as they generally are simply restating the law, updating the statutory references and setting it out in a clearer and more understandable format for the general public.

Tax take up strongly

Now, this week, the Treasury released the government's financial statements for the 11-month period ended 31st May 2022. And it all looks a lot better than what was being forecast in May’s Budget. Core tax revenue is $2.9 billion ahead of forecast just at just under at $98.9 billion. Now, the main reason it's ahead of forecast is a higher than expected corporate income tax take which is $1.6 billion ahead of forecast. There’s also more tax from individuals which is $700 million head of forecast and PAYE collections are another $600 million ahead of the Budget forecasts.

The corporate income tax take for the 11 months of the year to date is just under $17.9 billion compared with a forecast $16.2 billion. Just for comparison, in the year ended 30th June 2021, the total corporate income tax take was $15.7 billion. So corporate profits look strong, and I think one or two economists might be pointing to whether that might be feeding inflation. But whatever its role is, I'm sure the Government will be grateful for the continued strong growth in the corporate income tax take. By the way, that increased corporate income tax take will also reflect the fact that the New Zealand Superannuation Fund will be paying substantially less tax this year than in 2021 because of the volatility in the financial markets.

Favourable winds for windfall taxes

Elsewhere in the world President Macron in France is under pressure to consider a windfall tax on some parts of the corporate sector where high energy prices have resulted in higher profits. Britain, you may recall, imposed a windfall tax on some oil companies, although it's come with a potential subsidy which may dilute the impact of that. Windfall taxes have no real history in New Zealand, so are unlikely to happen here. But it is to see how other jurisdictions are reacting to questions of what they perceive as excessive profiteering.

Housing's tax-free advantage

And finally, this week the Reserve Bank of New Zealand issued an Analytical Note on how the New Zealand housing market looks in the international context. What it does is compares facets of the housing market in New Zealand with those in 12 other developed countries[1] over the 30-year period from 1991 to 2021.

And it notes that several other economies, Australia is one, have experienced increasing house prices in recent years, but the rate of increase has been the highest here. Interestingly we have also seen the steepest decline in mortgage rates since the Global Financial Crisis and then almost the strongest increase in population. Apparently, although we've been ramping up construction quite dramatically in the past few years, the number of dwellings per inhabitant remains low and below the average for the OECD.

There was some mostly passing commentary in the note about the impact of tax. The paper does touch on the absence of a general capital gains tax commenting:

“Another feature of the New Zealand economy that may support higher housing demand is the absence of a comprehensive capital gains tax. New Zealand is unique in that aspect in the sample of countries we consider, fiscal authorities in other countries tax capital gains from asset sales at or close to the personal income tax rate.”

Being an analytical note, it doesn't make any recommendations as to whether there should be increased taxes on housing, although the OECD has been for a long time pushing that point. It's always interesting to consider the role of tax in our housing market and also whether the absence of the fact that housing is treated so generously for tax purposes means that investment is driven into that rather than into more productive sectors.

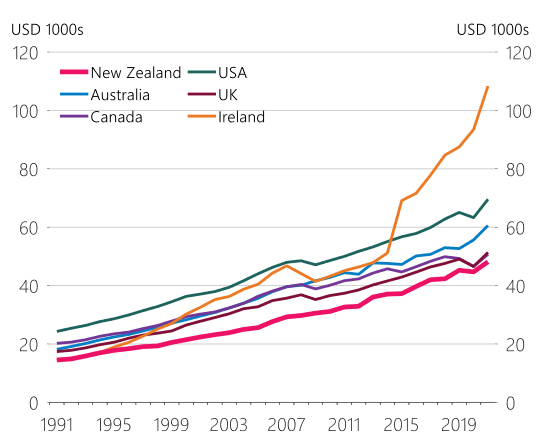

On that point, there's a very interesting graph illustrating the surge in Irish GDP per capita over the last ten years or so, it's really quite marked. The note comments that this surge

“was supported by high-performing multinational companies that relocated their intellectual property assets to Ireland attracted by lower corporate tax rates [12.5%] as well as Brexit-related uncertainty in the United Kingdom.”

Figure 4: per capita GDP in US dollars at current PPP

This Reserve Bank note reinforces my long held view that our favourable tax treatment of housing does divert funds away from productive investment and we need to change that treatment. As previously stated, my preference is for the Fair Economic Return approach Susan St John and I have proposed. .

Well, that's all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week.

[1] Australia, Canada, Denmark, France, Germany, Ireland, Italy, Norway, Spain, Sweden, the United Kingdom, and the United States of America

*Terry Baucher is an Auckland-based tax specialist with 25 years experience. He works with individuals and entities who have complex tax issues. Prior to starting his own business, he spent six years with one of the "Big Four' accountancy firms including a period advising Australian businesses how to do business in New Zealand. You can contact him here.

4 Comments

Great graph Terry.

NZ is at the bottom & unlikely to overtake the other countries in the graph. This is due to a lack of focus on growing the economy.

A focus on redistributing wealth like NZ is currently doing just leads to a poorer society & increasing social issues.

NZ seems to be catching up to the UK and Canada at least, we have certainly closed a lot of the gap since the mid 2000s

Incredible that our GST threshold is still at $60K pa. That's barely a thousand dollars a week net of GST - the additional compliance involved in filing would surely drive anyone just crossing that threshold back down below minimum wage in terms of actual income. Yet another example of our tax administration settings being neglected for far too long and no longer being fit for purpose.

"our favourable tax treatment of housing does divert funds away from productive investment and we need to change that treatment".

Exactly right - the current taxation regime must be changed so that parasitic speculation in residential housing is strongly discouraged, and investment in the real economy is strongly encouraged. The current 18-th century-like focus on housing that sadly defines current NZ financial resource allocation must be eliminated.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.