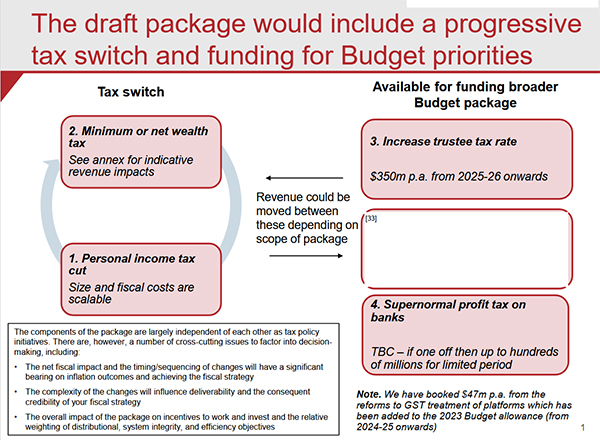

The big news last week was the release of the official advice to Ministers on tax incentives during the lead up to this year's Budget. And it was quite a bombshell. Amongst the wealth of material provided was the surprising news that a key proposal had been until quite late in the piece a tax switch where in exchange for introducing a tax free threshold of $10,000, the Government would introduce a wealth tax.

Now, the Prime Minister immediately ruled out the wealth tax and also ruled out any capital gains tax if the government gets re-elected. So to a large extent, all this fascinating material is largely redundant. But it still provoked the continuing debate around the pros and cons of a wealth tax. And in fact, it’s really very interesting to go through the material and see how the policy developed and where they were planning to take it.

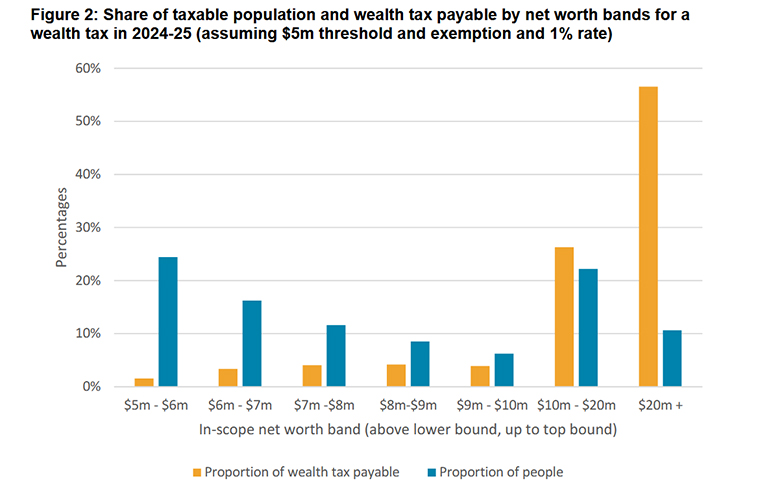

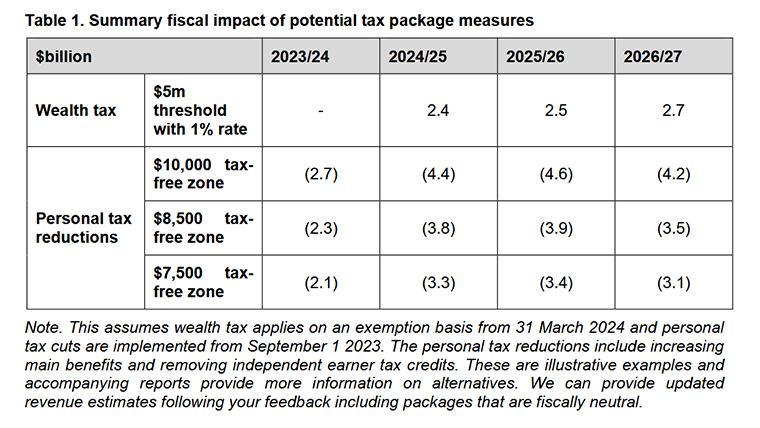

The final scheme would have applied a 1% tax rate to net wealth above a $5 million threshold under what was termed an “exemption approach”. This was initially thought it could raise between $2.7 and $2.9 billion annually and would have affected some 46,000 individuals. According to officials the wealth in scope at a $5 million threshold would be about $210 billion

A minimum tax?

Now, in the course of development the proposal started with something called a “minimum tax” under which proposal a person with high wealth would pay tax on the greater amount of either their deemed income calculated as a percentage of the net worth or the taxable income they have under existing income tax rules. The deemed income would have been based on the idea of economic income, which would include unrealised gains. If you recall when the Sapere report and the Inland Revenue High Wealth Individual research project were released, there was a great deal of controversy around this measurement because once you measured economic income and unrealised gains, it appeared the wealthy were paying an effective tax rate of 9%.

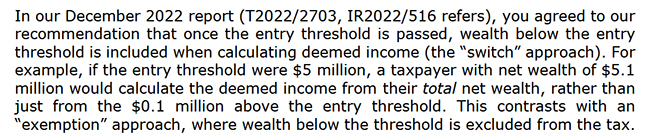

This minimum tax was the initial proposal which then got dropped over time. In the course of discussions, they moved away from what they called a “switch approach”. Under this once a person crossed the threshold, then all the deemed economic income would be subject to the wealth tax rather than just the proportion above the threshold.

And this so-called “exemption” is pretty much what we see in other wealth taxes around the world. It appears in the design of the wealth tax officials took a close look at the Norwegian system. One of the other features I found surprising was that the family home would be excluded. It seems to me that the tax preferred approach to the family home, has led to a large amount of overinvestment in housing.

Wealth taxes – profile of potential taxpayers

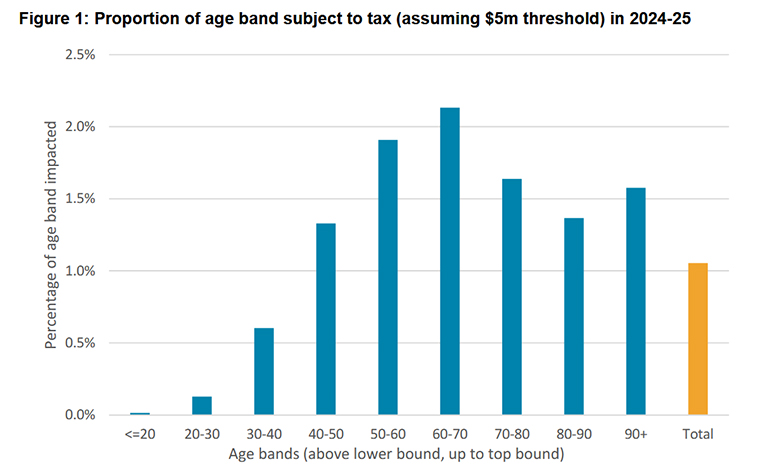

A key report on a wealth tax contained a very interesting discussion, around which group of taxpayers would be most affected. The projection was the age group which would be most affected at the $5 million threshold was that between 60 and 70. An estimated 2.1% of this group population has net worth over $5 million. According to these statistics, 1.5% of the over 90 year old group would be affected.

But in fact, as you might expect, more than half of the wealth tax would have been paid by the high net worth individuals with a net worth in excess of $20 million.

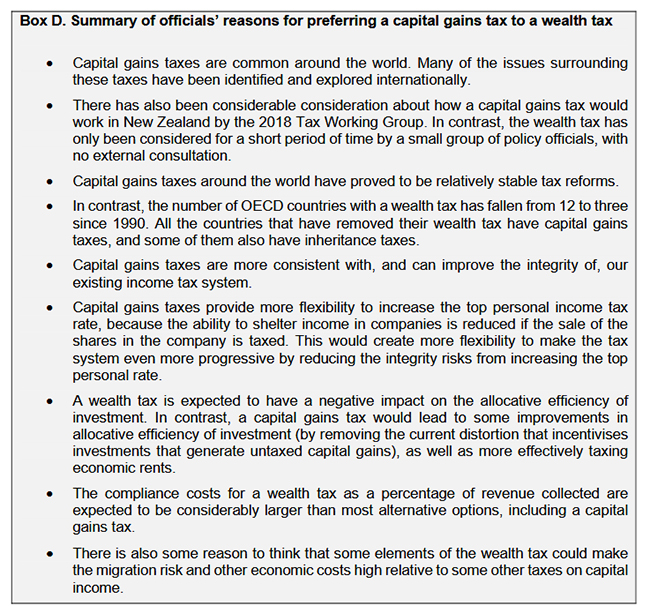

Officials prefer a capital gains tax

But I think the other thing that came out quite clearly from the papers was that the officials were not at all impressed by wealth taxes. They preferred a capital gains tax.

By the way, the officials view probably reflects a reasonably widely held belief if largely unspoken view amongst the tax community, that if we're going to tax capital then a capital gains tax is probably the way forward.

Anyway politics intervened again and so a capital gains tax has now been ruled out in their prime ministerial lifetimes by two successive Labour prime ministers. However, as I said to Corin Dann on Morning Report the politicians may rule out capital gains taxes but we've got a lot of issues with an ageing demographic and the impact of climate change. The strains on the tax system, which have been recognised by Treasury and its Long Term Insights Briefing He Tirohanga Mokopuna in 2021 recognises that. The issues about needing more tax from somewhere haven't gone away.

Paying for Cyclone Gabrielle

There were also suggestions as a one-off response to the impact of Cyclone Gabriel, for a levy on the banking sector. There was a comment that the four main banks have persistently “elevated levels of profitability relative to the smaller New Zealand banks and overseas and comparators in part due to the relatively low costs of the large New Zealand banks.” A temporary levy on the banks could raise somewhere between $230 and $700 million. As the Greens noted, Margaret Thatcher of all people did actually impose a surcharge on banking excess banking profits when she was Prime Minister.

There was also a suggestion of a one-off flood levy similar to what was introduced in Queensland following their catastrophic floods in 2010-11. A temporary 1% levy applied to all taxpayers would have raised $1.8 billion. But one only applied to income above $100,000 would raise $250 million.

The quid pro quo - a tax-free threshold

The quid pro quo for a wealth tax would have been a $10,000 tax free threshold. Once again Treasury and Inland Revenue weren’t enthusiastic. They suggested more significant increases in the lower thresholds including lifting the threshold at which the rate goes from 10.5 to 17.5% from $14,000 to $25,000, which is actually substantially ahead of where it would have been if had it been indexed to inflation. However, they proposed lifting the next threshold rate increases to 30% to $52,000. This is the threshold which I think is extremely problematical because of the large jump and at its current level of $48,000 is now well below both average and median wages.

There are two things of interest here. Firstly, a recognition that something has to be done. Tax free thresholds are very popular, but they're not as efficient is the official advice. Secondly the cost of increasing these thresholds would have been over $4 billion annually. This is an acknowledgement that by not indexing thresholds since 2010, governments have given themselves a permanent headache around having to make threshold adjustments that become increasingly expensive.

A mystery policy?

A tax-free threshold is apparently out of the question. But maybe not because amidst all the papers, there's are parts which have been redacted. These refer to another policy, whether that was capital gains tax, we don't know. But whatever it was, it's been redacted and not been released under the Official Information Act.

We're now within three months of the General Election and Labour is still to release its tax policy. So maybe there's something in that hidden part which will be revealed.

Secrecy and the Generic Tax Policy Process

There’s been some discussion that because this was all carried out secretly and outside the Generic Tax Policy Process (GTPP) that maybe this might not have resulted in a terribly efficient tax. I’m less concerned about governments deciding they're going to do something for electoral gain and requesting work be carried out discreetly. But I do agree that if it's done outside the GTPP, there is a risk that the design could be faulty. We've seen that with the bright-line test and the continual tinkering that has to be done. Worth remembering, by the way, that the bright-line test itself was a surprise. There was no previous consultation before it was first introduced in the May 2015 Budget by Bill English.

I like tax surprises in budgets, and I believe they're part of normal politics. As I’ve said before, tax IS politics. But I do think that if you look entirely at tax through a political lens, then you start to get this narrow view developing right now where everyone says the politics of raising taxes are too hard, but the economic question of, how are we going to pay for the coming challenges just gets sidelined.

To repeat myself, we have serious issues to address coming up. And my view is if you want to maintain the broad based, low rate approach to fund these challenges, you're going to have to do something around capital taxation. And the sooner you do it, the better.

Inland Revenue dropping the ball on investigations?

Moving on, one of the officials’ key objections to a wealth tax was the cost of compliance. Inland Revenue would clearly need to increase its capabilities. In its advice on its Initiative Work Programme it commented “the Government’s current tax and social policy work programme will use up most of our specialist design and delivery capacity over the next three years.”

Now the question of Inland Revenue's operational capabilities came up at the start of last week when it was raised by National's revenue spokesperson Andrew Bayly.

Following some written questions to the Minister of Revenue, he had determined that the number of investigations conducted by Inland Revenue dropped from an average of 77 a month between February 2017 and October 2020 to only 17 a month between October 2020 and June 2022. Furthermore, the time Inland Revenue spent on hidden economy. Investigations has also dropped substantially, from 3094 hours in November 2020 to just 805 hours in May this year.

Mr Bayly thinks Inland Revenue is dropping the ball here. Now, he's tried that for obvious political reasons to Inland Revenue’s work on the High Wealth Individual research project, but that was separately funded. (Incidentally, early drafts of the report were made available to Cabinet as part of the pre-budget preliminaries).

There is an ongoing operational issue, in my view, about Inland Revenue's investigations activity. And actually, it has acknowledged it has not been doing as much work in the investigations and debt recovery field. Page 36 of its Annual Report for the year ended 30 June 2022 notes:

“We did less work than would be typical in areas such as debt collection, investigations, disputes, litigation and liquidation activity.”

Now, part of this is down to the response to COVID. There were great demands made of Inland Revenue to which it responded superbly. But note the number of investigation hours back in November 2020, which is in the heart of the pandemic, was 3,094 but now it’s down to only 805 hours when we’re supposedly post pandemic, or rather a different stage of response to it. Inland Revenue saying that the fall off in investigations is because it has had to deal with COVID and this year's weather-related events is not a satisfactory explanation in my view.

And when you start digging into Inland Revenue’s appropriation statements which are published as part of its annual report, you can see the amount spent on investigations for the past five years has fallen quite considerably in absolute terms, let alone when adjusted for the impact of inflation.

Reduced investigation funding

In the year to June 2018, the investigations appropriation was just over $140 million. But for the year to June 2022, it was just over $113 million. That's a significant drop of nearly 20% in absolute terms.

Inland Revenue investigations appropriation per annual reports.

30 June 2022 $113.235 million

30 June 2021 $124.325 million

30 June 2020 $109.720 million

30 June 2019 $134.706 million

30 June 2018 $140.164 million

So, what this points to is the claims being made by Mr Bayly about Inland Revenue taking its eye off the investigations ball does appear to be backed up by the evidence of where it’s been spending its money. One of the explanations for this appears to be tied into its massive Business Transformation project. Inland Revenue, once it got started on this, seems to have pretty much solely focused on getting it across the line.

Where did the investigations staff go?

Part of Business Transformation included substantial reductions in its headcount, which went from 5789 in June 2016 to 3923 in June 2022. Now, that's nearly a third of the workforce gone. We also know that although there was a substantial number of staff (nearly 800 apparently) whose sole purpose was simply re-inputting data so it could be used, a large number of very experienced investigation and operational staff were also let go. I know that because I've been speaking to a few of them.

Therefore, other tax advisers and agents and I are wondering whether Inland Revenue now has a diminished Investigation capability. There's also another matter which Andrew Bayly also picked up on, the fact that Inland Revenue has decided to adopt a completely new metric for measuring its investigation performance. That makes you wonder why it’s done that. We won’t know what they're measuring and how effectively, as the year just ended on 30th June is the baseline for this new metric.

But it's important in a system that relies on voluntary compliance, there is the expectation by all of those taxpayers who comply that Inland Revenue is making sure that those who are not playing by the rules will be found and investigated. The concern is if Inland Revenue’s capacity to do that is diminished and it's not fulfilling that role, then the overall perception of the integrity of the tax system is undermined. And that's not good long term because naturally people will start thinking “That person is getting away with it, so we can too”.

I hope this is something the new Commissioner of Inland Revenue Peter Mersi is paying a lot of attention to. It will be very interesting to see what the department says when its latest annual report is published in October.

Inland Revenue renews its focus on GST

And finally, this week and, coincidentally or not, a couple of days after the story about Inland Revenue's lack of investigation focus, it posted a warning for tax agents about “Its renewed focus on GST compliance”

Now, you can easily interpret this as an implicit acknowledgement of Andrew Bayly's criticisms, but it is in fact another sign which we've seen steadily emerging that Inland Revenue is now repositioning itself back into what you might call its regular routine.

As usual, we'll keep an eye on what that means and bring you developments as they emerge.

And on that note, that's all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

39 Comments

Glad to see the end of wealth taxes as part of this debate, given it would be a new cost to bear on top of relentless increases in existing costs. There'd be some serious questions to examine for businesses in terms of whether to pivot, shut-down or or reduce headcount to make the numbers stack up. There's serious potential for unintended consequences there - although part of me wonders whether they are actually intended consequences given that everyone quietly leaves this bit out of the debate.

As for a CGT, part of the social contract with introducing it would surely need to involve the tax treatment of Kiwisaver. The gulf between the way Australians are able to save for retirement and Kiwis are grows with each passing year, much like the wage differentials on offer. There's also the sticky issue of how we would fund services if there was a drop-off in post V-Day returns, like we are seeing in housing now. In that case, you'd still need to find revenue somewhere else - it's quite possible we end up with our perverse income tax situation AND new taxes on top of them to boot. That's a bad deal.

Glad to see the end of wealth taxes as part of this debate, given it would be a new cost to bear on top of relentless increases in existing costs.

Do you have assets in excess of $5M, excluding the family home? If not, then you have nothing to worry about this "new cost" as it would not have affected you.

There'd be some serious questions to examine for businesses in terms of whether to pivot, shut-down or or reduce headcount to make the numbers stack up.

Or perhaps ownership in the business could be broadened, such that no one owns more than $5M worth of it. For example co-operatives and worker-owned companies.

Just a thought.

"

Do you have assets in excess of $5M, excluding the family home? If not, then you have nothing to worry about this "new cost" as it would not have affected you.

"

Shallow reasoning , on 2 counts at least .

A wealth tax ( especially a poorly designed one like this .. ) would impact everyone - through consequences of inevitable capital flight overseas AND overinvestment in excluded asset class ( family home ) in order to avoid the tax.

Due to reasons above such a tax would only raise a small and quickly diminishing amount of revenue and be soon made more broad - through lowering the the excess threshold and removal of exclusions . Thin end of the wedge.

"inevitable capital flight overseas" Yes. Unless we go the whole hog and un-deregulate the financial markets at the same time; reimpose Exchange Controls and reFix the NZ$. The legacy component of our pre '85 regulated market is what would become the OCR; interest rates, and just keeping that one aspect of regulation is probably why we are where we are today. Or if we don't like regulation, then scrap the OCR and let risk be returned to interest rates as determined by the markets (as the NZ$ is)

"...you have nothing to worry about this "new cost" as it would not have affected you."

Nonsense. Once the thin end of the wedge is locked in, successive Govts addicted to ideological policies consider throwing more of other peoples money at endless dependency squeaky wheels is their only response. Exhibit A GST

Do you have assets in excess of $5M, excluding the family home? If not, then you have nothing to worry about this "new cost" as it would not have affected you.

Do you work in a business where the premises and/or the land they sit on are worth more than $5m? Answer: Yes, and that would have flow on consequences for the businesses that operate on those sites and the people they employ. Wealth taxes sound great being shouted through a megaphone but that's a poor way to design tax policy that has to be applied in the real world.

Maybe not an immediately obvious issue, but given the way land values have been blown out, it's definitely something that would need to be considered. There's also the regional aspect to it, where I could own almost all of a small town and pay no wealth tax, but a single Auckland home and business premises would qualify.

As par for the course with the Greens, it's unrealistic nonsense that says more about their uncomfortable relationship with reality than whatever noble purpose they want to dress it up in.

Do you work in a business where the premises and/or the land they sit on are worth more than $5m? Answer: Yes, and that would have flow on consequences for the businesses that operate on those sites and the people they employ.

Labour's tax proposal (and the Greens) is that the tax is paid by individuals and trusts. Not the companies themselves. At a rate of 1%.

It seems pretty silly to say "well I'm going to downsize my company to avoid paying 1% tax" - any downsizing of your business would cost you far more than the 1% reduction paid to tax.

And paying that money in tax will make NZ as a whole a better country, which should ultimately flow back into your business anyway.

but a single Auckland home

Labour's proposed tax excluded the family home.

Result would be lots of companies being set up and assets moving into these new and existing companies?

Labour's tax proposal (and the Greens) is that the tax is paid by individuals and trusts. Not the companies themselves. At a rate of 1%.

You do get that land, shares and other investments are held by trusts as a common ownership structure, right?

It seems pretty silly to say "well I'm going to downsize my company to avoid paying 1% tax" - any downsizing of your business would cost you far more than the 1% reduction paid to tax.

I'm not saying they'll downsize, I'm saying they'll spend less on other things (e.g. wages) to make things work, or jack up prices to cover the shortfall.

And paying that money in tax will make NZ as a whole a better country, which should ultimately flow back into your business anyway.

Simply paying tax doesn't make NZ a better country. The exploding tax take and dire state of our public services and infrastructure has proven that. It's the quality of how that tax that gets spent that actually matters.

This. In order to maintain net margin after tax, businesses will increase prices and/or reduce other expenses.

"Simply paying tax doesn't make NZ a better country. The exploding tax take and dire state of our public services and infrastructure has proven that. It's the quality of how that tax that gets spent that actually matters."

Surely you don't believe that the amount of tax raised has no bearing on the quality of a country's shared infrastructure, or their public services? Waste reduction only takes you so far.

Sure if governments waste money that is bad, but you really go too far the other way with your argument. You give no proof or examples to back up your claims that the tax take is 'exploding', or that our public services and infrastructure are in dire straits.

I don't think the fact the tax take has rapidly escalated is up for debate, unfortunately for you:

https://www.ird.govt.nz/about-us/tax-statistics/revenue-refunds/revenue…

As for the rest of your comment: Come back to me on the state of our public sector when you have a sick child and get told there's no ambulance and you spend hours in an ED. I'm not really interested in "I'm alright Jack" takes from people who don't want to deal with the same objective reality the rest of us have to live with.

There's also the sticky issue of how we would fund services if there was a drop-off .... you'd still need to find revenue somewhere else

Quite right, and the answer to date has been 'import more taxpayers' which is fine when they are 25. No so much as they all then turn 65.

One way or another, as you suggest, the bills of the last 40 years have fallen due, and it's either more taxes or fewer services - possibly both.

We are already paying more and more in taxes through non-indexation and inflation pushing up the GST take.

We already have declining services despite the Crown collecting more and more tax revenue.

At this point you would be flogging yourself to think there is still a relationship between the amount of tax revenue collected and the quality of services the government provides.

That's because there is zero relationship between those two things.

How much a government spends and what it spends money on has almost no relationship to how much a government taxes and where those taxes come from other than increasing public salaries increase tax. The government does not stockpile taxes to spend. It's the other way round. It juices the private sector to tax.

Your argument that they are collecting more and more tax is cancelled out by the fact that the government ran a $8.5b deficit. That is, it spent $8.5b more than it taxed, and it spent it directly into our pockets. Some of that has been taken, I have a healthy balance, so there's some there too.

Your next argument may be, "that's absurd! they should spend less!" however, considering we're in a technical recession, spending less against our current tax take will constrain the economy, and taxing less will bolster CPI print. So what do?

Let the government manage the balance sheet, spend into the recession as that is surely what we need to avoid carnage. Reallocate spending to productive enterprise, our social services, infrastructure, cost efficiencies. Reallocate tax to a more equitable system. I'm not suggesting CGT or wealth tax. Perhaps land tax? That's the only proposal I can see would make sense.

Beyond that, I am unsure - I'm no policy maker or economist. But that first step of "they're taking my money!" is moot, we need to gtf over that before we can make anything better.

"Your argument that they are collecting more and more tax is cancelled out by the fact that the government ran a $8.5b deficit. That is, it spent $8.5b more than it taxed, and it spent it directly into our pockets. "

Different left / right pockets - more tax from minority of net taxpayers spent mostly into those who pay no net tax.

Reallocate tax to a more equitable system. I'm not suggesting CGT or wealth tax. Perhaps land tax?...

Yea, agree.

"The problem with socialists is that they eventually run out of other peoples money"

Maggie Thatcher

You could argue the exact opposite right now with reference to the privatised housing market. Which is currently running out of viable income streams to support it, and creating large socialised damage.

...leading to the most significant house price reductions in years as the market & economy seeks a revised equilibrium

Not going to find much equilibrium by sending the younger home-owners to the poor house as they fall below 20% equity and can't refinance without incurring even higher interest rates.

If anything, you are likely to entrench the same issues along generational lines that we have now. At some point you end up with the same unintended consequences so many times that it starts to look pretty intended.

A comment which illustrates Thatcher did not understand what a sovereign currency issuing country is.

Counterpoint: literally every tax discussion needs to be framed that way - because that's how people actually live their lives. I can only meet my living costs out of my money. It's the same for everyone else. You can't simply extract more and more from a populace already copping it from every direction living costs, and the government would not be impressed if I took their approach and just printed some of my own.

I'd argue there is an important relationship there: the social contract that underpins the whole system in the first place. A government that takes more, provides less and insists on helping itself over and over is going to quickly find support and compliance drops like a stone. It's a bit hard to convince people to stick around when things like treatable cancer risks becoming a death sentence, when treatment would be progressed far quicker in other countries. Kiwis make an enormous amount of sacraficies to actually live in NZ and our tax system and governments seem somewhat reliant on as fewer people realising that as possible. Not exactly a stellar way to build goodwill amongst the very small number of people you rely on to prop-up the tax take, is it?

As for a broader base or more equitable approach; the actual value of land is so divorced from meaningful utility now that there would be a real risk to values if they were to drop (e.g. you would see people with houses they no longer have 20% of the value upon refinancing) but that would have to be thought around. Probably better something like that was explored sooner rather than later.

Yea fair points - as with the social contract, we have a model designed for an ever exponentially increasing population, I'd say we're not far away from a retraction in population. So you're right, the social contract is written down on smaller and smaller group of people. It's clear as day with recent FHB whose social contract is ~30% PAYE, ~30-40% interest, ~15% of the remainder on GST. We call them "lazy". You have a workforce who have surpressed wages living off ever decreasing portions of income, it's no wonder they're not interested in playing the game. Imagine joining a game of monopoly after 2 hours of play...

So, how many of those people will now be cut off, that's what we get.

As for the devaluation of land, we're in the middle of some form of bust, so is it better to consider now, or the middle of "recovery", or the next peak? Do we let this happen again, to more people, or do we cut the cord? I type as if we have a choice, more interested in finding the better way forward to consider.

I mean 'should we?' and 'are we capable of it?' are two separate questions. Yes to the former, but I have zero trust that foxes running the tax hen-house at the moment have NZers best interests at heart, or would come up with a tax system that isn't more about a redistributive agenda than actually improving the quality of life for New Zealanders.

Thus the importance of little things like indexing your tax brackets more than once a decade in terms of maintaining the social contract around tax. When you do have a chance to do something different, there's no one who isn't perceivably corrupt in someway that you'd actually want to deliver it. The TWG is a classic example of why the horse has probably already bolted in that regard.

Very surprised the comparison between Kiwisaver being subject to tax on income versus Australian Super schemes being largely left out. I guess people simply don't know, or that since it is voluntary that NZ can get away with it.

I have hundreds of thousands in Super and I want to move it but until this changes I won't.

The wealth tax would have killed investment in NZ. Try telling the Greens, with their primitive economic views. Their threshold for the wealth tax was 2 million. Each year, small businesses would have to pay on the value of their assets, on top of GST and income tax. Nuts.

Maybe you should read the actual Greens proposal sometime.

However, I take it you prefer an investment environment where there is no tax on capital gains? Is it sensible to distort investment decisions by biasing capital gains investments over other investments?

Is anyone ever going to suggest a stamp duty scheme in NZ?

Perhaps that is the part of the paper that was redacted?

Perhaps more likely to be inheritance taxes / death duties ?

https://www.legislation.govt.nz/act/public/1993/0013/latest/whole.html#…).-,3%20Estate%20duty%20abolished%20in%20respect%20of%20deaths%20occurring%20on,or%20after%2017%20December%201992.

The actual comment from Treasury and Inland Revenue was that in their opinion capital gains tax and inheritance tax were preferable to a welath tax in terms of achieving the government's aim of a tax switch.

Increase company tax for companies earning more than $ 5 million, and a financial transaction tax.

...and we're going to stop that becoming inflationary by doing what, exactly?

The company tax is on the profit , so not inflationary . the transaction tax would be 0.5% or so , probably 1/2 of it on non trading items, so maybe .25% inflation.

So businesses will just forsake the bottom line and not push prices up to maintain it? What happening in the world around you thinks this is suddenly going to change? Or are they just going to accept lower returns?

Yes , they are gouging the hell out of us .but i don't think 0.5 % is going to make a huge inflationary difference.

With a wealth tax, the proposals seem mute on how wealth is acquired and is focussed on symptoms not causes. #kludgeocracy

Someone who gets wealthy by building a business that does real things and employs people is of greater value to the country than someone who own large amounts of property and becomes wealthy because we don't have a (wait for it) CGT on property bought for the purpose of profit.

I'd bet that last was what was redacted: when does "expert recommendations embarrassing for the government" count as something to block an OIA?? The politicisation of expertise really is becoming overt and undermining credibility.

As to the threshold, the Green's 2 million limit would just about cover an apartment in Queenstown or a reno-ed Auckland villa (plus a modest kiwisaver balance). The haemorrhage of capital, expertise and enterprise doesn't bear thinking about.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.