New Zealand has undoubtedly entered a slowdown economically and that's flowing through to lower tax receipts leading to claims this week of the Governments being in a big fiscal hole. According to the Companies Office's latest statistics for the quarter ended 30th June 2023, there were 461 liquidator appointments in the quarter.

That's 47.8% up on the 312 for the same quarter last year.

As Professor Lisa Marriott noted in an article late last week, the ripple effect of companies going into liquidation is considerable, particularly for unpaid suppliers and employees. Her research suggests that Inland Revenue could be doing a lot more to share information about businesses that are failing. According to Professor Marriott Inland Revenue is actually less proactive than some comparable overseas government agencies such as the Australian Tax Office.

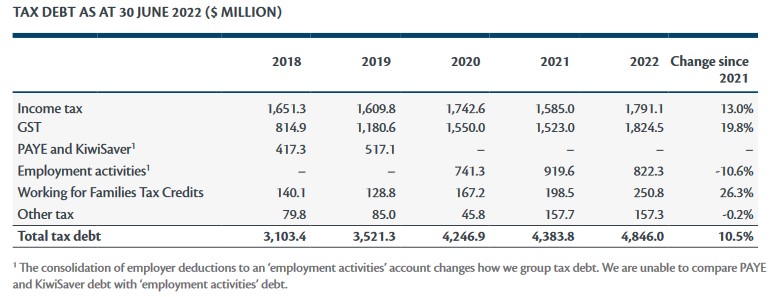

Inland Revenue initiates more than 60% of liquidations in the average year, and that sometimes happens after quite a considerable period of non-payment of key taxes such as GST and PAYE. For example, $2.6 billion or over 54% of the $4.8 billion owed to Inland Revenue as of 30th June 2022 represented GST and what it terms “employment activities” (i.e. PAYE and KiwiSaver contributions).

(Inland Revenue June 2022 Annual Report)

Professor Marriott's research points to non-payment of these particular taxes as being a very early warning sign of businesses running into trouble. Picking up overseas initiatives she suggests three particular responses could be adopted here to help businesses be aware that a particular business they may be dealing with may represent a credit risk.

For example, in Ireland, Revenue Ireland produces a quarterly list of tax defaulters which identifies the name, address, occupation and the amount of tax owed. This is triggered when the debts exceed €50,000 or approximately $90,000.

Another option would be as the Australian Tax Office does, to advise credit rating agencies that a business has tax debts. This happens if the amount owed exceeds A$100,000 and is more than 90 days overdue.

A third option and one the Tax Working Group looked at, is following another Australian initiative and making business directors personally accountable for unpaid tax through Director Penalty Notices. These are issued in relation to the Australian equivalent of PAYE, GST and KiwiSaver. Once a Director Penalty Notice has been issued, it can only be cancelled by full payment of the tax debt within 21 days or some other action such as commencing winding up proceedings. If no action is taken, then the director becomes personally liable, effectively sidestepping creditor protection and limited liability issues.

These are sensible suggestions, but in my view perhaps another thing Inland Revenue could do would be to be much more proactive in managing debt, particularly in relation to GST and PAYE. I occasionally get involved with helping taxpayers who have fallen behind with their tax payments. And there's invariably a couple of common points in every case.

Common problems with tax debt

Firstly, Inland Revenue’s present policy of charging interest and late payment penalties doesn't seem particularly effective to me. In fact, arguably, I'd say it counterproductive.

Debt builds up very quickly and consequently, at a remarkably low level somewhere between $10 and $20,000, the taxpayers often just feel defeated and basically give up. At this point they haven't engaged with Inland Revenue and all they see is just the amount owed going up and up and up resulting in a sort of death spiral procrastination spiral.

The second common factor in dealing with clients in this scenario is that the situation has been allowed to carry on and develop over a long period of time. These businesses have been going through a slow decline before Inland Revenue finally steps in and decides either to liquidate it or impose some other form of action to recover the outstanding amounts.

One of those actions is the use of “Deduction Notices”. These enable Inland Revenue to go to a customer of a defaulting taxpayer and require them to withhold a certain percentage of any payment they may make to the defaulting taxpayer, and instead pay it over to Inland Revenue. Most often Deduction Notices are issued to employees and often in relation to unpaid child support. But they can be used in other circumstances. In one case I saw a Deduction Notice applied was 100%, although I'm not entirely certain what was meant to be achieved by issuing such a notice.

Adopting the measures suggested by Professor Marriott would take some time to go through the full consultation and legislative process. Although these are tools Inland Revenue perhaps could consider adopting, given the current rise in liquidations, I consider it needs to be taking action sooner rather than wait for these additional options.

Harden up Inland Revenue?

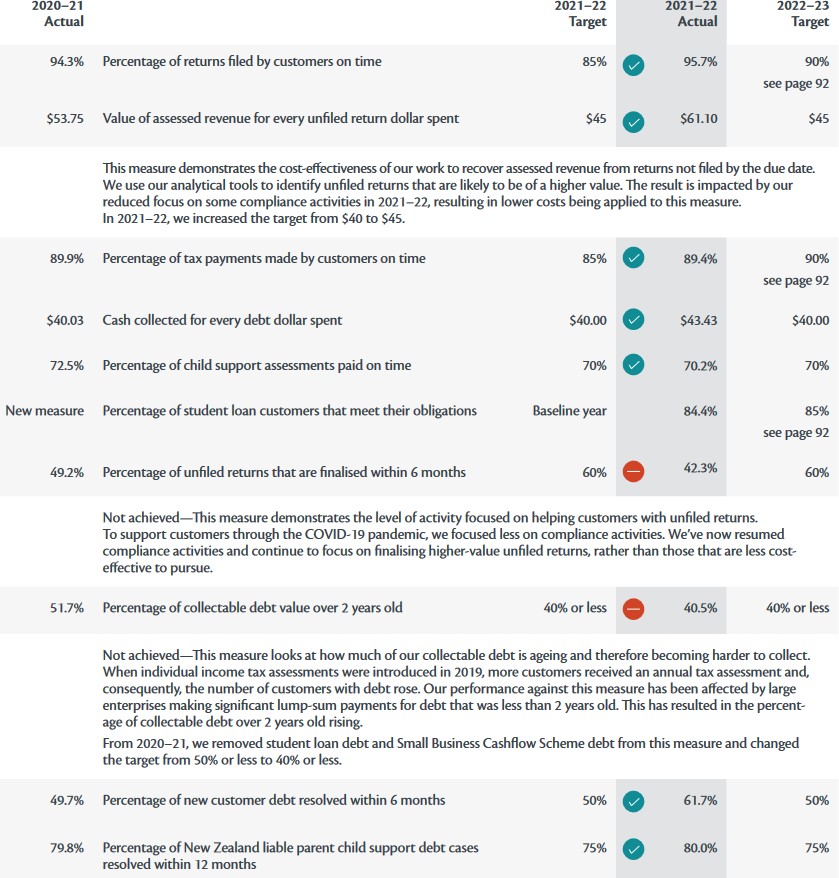

One of the things it ought to do is toughen up its own performance measures in relation to the management of debt. Each year in its annual report Inland Revenue will publish its performance measure results broken down by various sectors. For the year ended 30th June 2022, it achieved seven out of nine measures that it set in relation to the management of debt and on file returns.

But critically, one of the measures where it fell down was the percentage of collectable debt over two years old. The target for the year was 40% or less and in fact it achieved 40.5%, just above its target. That, by the way, was a considerable improvement on the 51.7% achieved for the year to June 2021.

But I would suggest that the 40% target is actually too generous. Inland Revenue really should be looking to drive that down to 20% or less. In fact, looking at this measure, it used to include student loan debt and Small Business Cashflow Scheme debt, but they were taken out and the debt target was then reduced from 50% to 40%.

(As an aside, student loan debt is a particular problem where I think Inland Revenue inaction has allowed very large sums of debt built up with people going overseas as the main issue here. But Inland Revenue, to my mind, has not been quick enough to develop the tools it needs to keep on top of that particular issue, which means often applying to overseas tax agencies for details of defaulting taxpayers.

I think it's picking up its efforts in this space, but the scenario perhaps shouldn't be allowed to develop to the extent it did. I've recently come across a case where the taxpayer left over 20 years ago but basically Inland Revenue has only now really started to take action to collect the outstanding debt.)

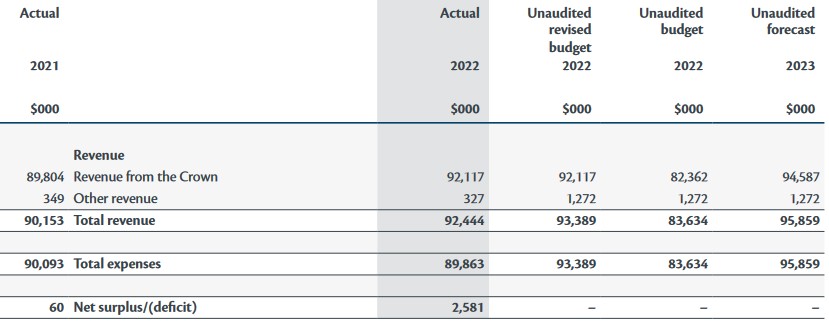

The other thing that's also noticeable from Inland Revenue's June 2022 annual report is that it did not actually spend the full amount allocated to it from the relevant budget appropriations.

Some questions for Inland Revenue

The amount allocated was just over $92 million, but in fact Inland Revenue underspent by $2.5 million for the year. A couple of questions I have about this are how did that happen and what's being done to improve the performance and make sure that the funds allocated are effectively used? (I note that for the year to June 2023, there was an increase in the appropriations.)

It will be interesting to see how that's played out when we see the annual report later this year. This debt management issue, by the way, points to something I've mentioned in previous podcasts - has Inland Revenue's Business Transformation program deprived it of some capacity in key areas? Inland Revenue has reduced its staffing by more than 25% of your staff and not all of that might be dead wood no longer needed because of the upgrade. I think vitally important staff have gone from key areas such as investigations. And it may be that debt management is another area where key personnel have been allowed to go and the gap has been allowed to develop as a consequence.

As I said, it will be interesting to see the annual report later this year. But in summary, I'd have to agree with Professor Marriott, there's plenty of room for improvement.

More interest rate rises…

Moving on, a key weapon for Inland Revenue in ensuring payment of tax debts is the ability to charge use of money interest on unpaid tax debt. The current rate is a fairly chunky 10.39%. But as of 29th August, the day after the next provisional tax payment date, the rate will increase to 10.91%. (Incidentally, the rate payable for overpaid tax will also rise, and that goes from 3.53% to 4.67%).

It is necessary for Inland Revenue to have a tool such as an interest charge for unpaid tax. Otherwise, people would just not take any action. But I think that is only one of the tools in its arsenal, as I just mentioned it really does need to back this up with greater enforcement and earlier interventions.

At the same time, Inland Revenue and tax advisers can all work together and let people know that when you take proactive steps on tax debt, you will find Inland Revenue is much more prepared to work with taxpayers in default than people might imagine. This has always been my experience. You front foot these issues with Inland Revenue, and you will find they will be prepared to work with you and your clients unless they are actually dealing with a serial defaulter.

For example, yesterday I was speaking with someone who'd run into some difficulties and had gone to Inland Revenue. They had been very pleasantly surprised by how proactive Inland Revenue had been in working with them on sorting out their unpaid tax. I could see clearly see that they felt a lot happier about the position. They still owed money, but they were in a position where they knew there was a way forward.

The key lesson is if you're in trouble with Inland Revenue over unpaid debt, talk to it and your advisers and then you'll hopefully get better results.

Incidentally, the rate of prescribed rate of interest for calculating fringe benefit tax on employer provided loans and some other measures is also being increased with effect from the quarter starting 1st October. From that date, the rate will rise from its current 7.89% to 8.41%.

Upstart Nation? Changing the tax system to boost startups

And finally this week, an interesting report called Upstart Nation from the government's Start-Up Advisory Council.

This has been the business group looking at how to improve the rate of startups and develop more startups into major companies. On 1st August it released its report which included suggestions regarding changes to the tax system to help boost startups.

The report’s objective to “present a comprehensive strategy aimed at transforming New Zealand into a thriving hub for innovative UpStarts”. The Council identified four primary pillars as key: Capital Capability, Connectivity and Culture. Specific recommendations were made by the Council for each of those pillars to address identified gaps and leverage opportunities.

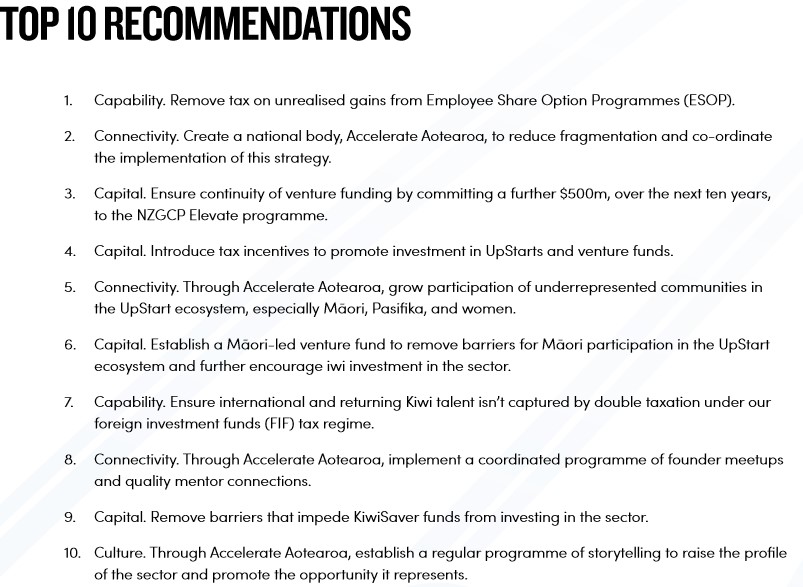

It had ten recommendations which it felt “will have the greatest impact on our ecosystem”.

Interestingly, three of those recommendations involve changes to the tax system. The first was wanting changes around the taxation treatment of share options and employee share option programs (ESOPs) in particular.

Generally, the current position is a taxable gain arises on the exercise of the options. The Council thinks it would be more appropriate to move that taxing point to when the underlying shares relating to those options are sold. ESOPs are intended to attract and retain investors and key employees as the business grows. Accordingly, hitting them with early tax charges ahead of when they actually can realise their position is a bit of an impediment. There are also questions around the compliance costs involved in getting accurate valuations in what is often an illiquid market. I hear this quite a bit.

Another was specific incentives to promote investment in UpStarts and venture funds in is some form of deduction for such investments. The Council recommends officials carefully review the Australian and UK tax concession schemes and develop something tailored to the New Zealand setting. In particular, they were looking at the Australian Early Stage Innovation Company scheme, which provides a deduction for an investment and a capital gains tax exemption.

The council suggests a deduction of maybe up to 30% of the capital invested directly in an UpStart or UpStart venture fund capped at $200,000 a year. That's an interesting suggestion and one worth considering even though it probably won't be accepted by fiscally prudent governments.

An urgent issue with the foreign investment fund regime

The third suggestion included in the top ten recommendations was to “Ensure international and returning Kiwi talent isn't captured by double taxation under our foreign investment funds regime.” This issue almost exclusively affects American investors and employees with overseas investments. Once their four-year transitional residence exemption expires and the foreign investment fund (FIF) regime takes full effect, they are essentially taxed on an unrealised basis. At the same time, because America requires all its citizens to file tax returns, they are still subject to tax there and in particular capital gains tax.

This is something I've discussed with a number of clients. Although they can claim foreign tax credits in America in relation to the FIF tax payable, it often exceeds the equivalent amount of US tax payable on the realised gains. They are therefore accruing a tax liability, which in some cases they can never fully offset. In effect, they feel they are facing a double tax charge.

The Council recommended “this issue be investigated under urgency with a view to removing FDR on people caught under this double tax conundrum to ensure we can attract and retain them in New Zealand”.

I agree this needs reviewing. We hear frequently we are in the business of attracting talent here. In this particular case, we have an issue (somewhat ironically, a by-product of not having a comprehensive capital gains tax) which potentially hinders getting vitally important migrants.

You could argue that not this particular issue doesn't just affect investors in the startup sector, but also any American citizen or returning New Zealanders who have acquired American citizenship or a Green Card and are among the groups of skilled migrants such as doctors or other specialist engineers, etc. This is a real impediment we need to consider.

Well, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

6 Comments

Interesting idea re publication of taxpayers in default.I stumbled across a copy of the Gazette from the 1980s which showed a list of people convicted of tax evasion.

I wonder to what extent the recent Government shortfall in tax take might be down to the public seeing IRD as a bit of a toothless tiger? While it is now supposedly easier to identify discrepancies with new technology - the lack of resources to actually do anything about it and general malaise lingering from the Covid era might mean that people are just taking their chances that nothing will happen if they just under report or default.

Yes. Publish a searchable public database. No minimum $ amounts. But if overdue by a small time, it goes on the list.

Include everything, including student loans and child support.

It's public money. We have a right to know.

Further, it let's us know who is dodgy. Useful for businesses and individuals alike.

If you don't like being on the list, pay up.

Here's my flipside argument:

https://www.ird.govt.nz/contactus/current-processing-times

If my return is a minute past the deadline at midnight that day, I get hit with a fine instantly.

Yet IRD can take almost a full quarter to process a tax return and issue a refund. So perhaps what is good for the goose should be good for the gander, before we go trying to shame individual citizens who have a fraction of the resources IRD does at their disposal.

That's a situation

But it's not a flipside argument.

Cool. Do you want to pay for that level of service too? Unless you have it on good authority that IRD pay a shitload of money for people to spin around in their chairs, and they should just work harder?

So just on this, and for reference, it took 15 working days to get a reply to a MyIR message on a personal tax matter. That's far longer than anything else I've experienced before when working with IRD, who for all their flaws, are actually usually pretty good with responses through their own platform. The only time I'd usually see a delay of more than a week was for something like a payroll query which involved a processing lag while Pay day files were worked through.

There's pretty clearly been some sort of resourcing challenge or adjustment made in the background that's led to this kind of timeline for service requests. I would be extremely surprised if this is a normal state of affairs. It really is far longer than at any time I can recall, but I can't speak for quality of service on the Agent side anymore.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.