This week, Inland Revenue published a reminder aimed at tax agents that clients must have a taxable activity in order to be registered for GST.

The notice said if your client is filing regular GST refund returns with expenses consistently more than their income, it may suggest they are not carrying out a taxable activity or have errors in their GST returns.

Inland Revenue then notes that clients “may receive a letter if they have filed regular GST refund returns from registration.” Tax agents are advised to “please review the refund returns filed and if required take any necessary action”. Inland Revenue then add that letters may be sent to clients who have been filing regular GST refund returns in the last 36 months.

If anyone receives such a letter their response will be expected to include one or more of the following:

- a description of the taxable activity or activities undertaken and an explanation for the regular GST refunds.

- A voluntary disclosure to correct any errors in the GST returns,

- Cancellation of the GST registration if they are no longer carrying out a taxable activity. The final GST return should be filed with the required adjustments.

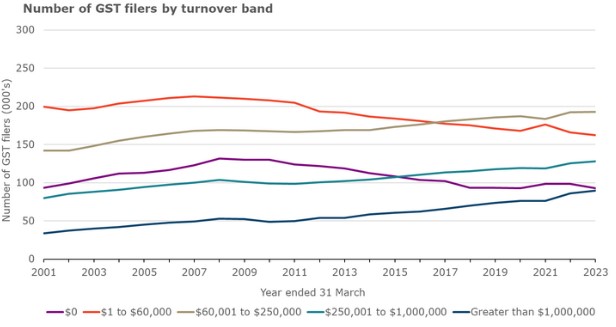

Inland Revenue are clearly about to run a campaign on this issue. Based on Inland Revenue’s statistics during the year ended 31st March 2023 there were just under 100,000 GST registered persons with nil turnover. (About the same number as have turnover exceeding $1 million). There's another 160,000 or so who have a GST turnover of between $1 and $60,000.

According to Inland Revenue the net GST refund paid to GST registered persons with turnover below $60,000 has increased from $463 million in the March 2001 year to $1.473 billion in the March 2023 year.

Clearly Inland Revenue has looked at this and thought “How genuine are some of these GST registrations?” It will probably be looking at some of the lifestyle blocks that I've encountered with some grazing income, but the expenses of running outweigh the grazing income. Inland Revenue looks to be gearing up for a campaign to review those such clients in some detail. We'll track to see what happens on this and give you updates as and when information emerges

When is a subdivision project a “taxable activity” for GST purposes?

Moving on and still on the matter of GST, and actually on the question of carrying on a taxable activity, Inland Revenue has just released a draft Question We’ve Been Asked (QWBA) for consultation on when is a subdivision project a taxable activity for GST purposes.

Following the 1995 Court of Appeal decision in Newman, Inland Revenue had issued a Policy Statement on this issue.

Under the Policy Statement whether a subdivision project is a taxable activity for GST purposes depends on the facts of each case. Determining this takes into consideration factors such as the scale of a subdivision, the level of development, work time and effort involved, the amount of financial investment and the commerciality of the transaction. Based on this the general view was if a person carried out a subdivision involving three or four sections, it was likely to not represent a taxable activity for GST purposes.

28 years on, it's not unreasonable for Inland Revenue to come back and look at the matter again. In the draft QWBA the Commissioner considers most of these factors are still relevant when considering whether a subdivision is a taxable activity. However, the draft clarifies and, in some respects, differs from the previous Policy Statement.

According to the draft QWBA in determining whether a subdivision represents a GST taxable activity “the most relevant factor will generally be whether the activity is carried on continuously or regularly. This Question We’ve Been Asked focuses on this factor.”

Following on from this, paragraph 29 of the draft states,

“Generally, the Commissioner considers the level of development work involved in the construction and sale of a single house or other residential dwelling as part of a subdivision is not on its own enough for an activity to be considered carried on continuously or regularly.”

On the other hand, the construction and sale of multiple residential dwellings or a large commercial building is more likely to be continuous or regular. This is an interesting change in tone since 1995. But also, when you think about it, the change reflects how generally speaking, it has become easier to subdivide. Certainly, in Auckland if not necessarily everywhere, it has become easier to subdivide.

Clearly, Inland Revenue is seeing a lot of activity in this space. And the question is then arising, well, at what point does a simple subdivision become a GST taxable activity? Hence this updated QWBA.

As I mentioned a few minutes ago, there was always a sort of general conclusion from Newman that maybe three or four lots carved off would not be a taxable activity. But as the draft notes, there's no specific number of lots created that determines whether a taxable activity exists. Our case law indicates that where a subdivision activity involves the creation and sale of multiple lots, it MAY be a taxable activity. But it doesn't necessarily mean a subdivision involving creation and sale of multiple lots will always be a continuous activity because, for example, a subdivision is so straightforward that the number of lots sold is not significant, but it does in revenue.

But…a single section could be a taxable activity

Paragraph 32 of the draft notes although an activity leading to the supply of only one section will not usually be considered an activity carried on continuously or regularly, “this does not mean an activity leading to one supply can never be a taxable activity”. It could be that if other factors are sufficiently present, such as the scale of the subdivision or the level of development work. This will be this will indicate the activity is continuous, even if it leads to only one supply. For example, the construction and sale of a single commercial building on subdivided land would be an activity carried on continuously and regularly.

Changes from previous policy

The previous policy referred to the commerciality of the project as a factor but Inland Revenue have now decided that commerciality is no longer significant. In addition, there was an example in the previous Policy Statement where the construction and sale of a tea shop on subdivided land would represent a taxable activity. However, this draft QWBA now considers that building a tea shop would not normally involve more activity at work than that involved in constructing a residential building and therefore would not meet the criteria to be a taxable activity.

No GST, but what about income tax?

The draft also adds a reminder that although it is focused on GST, even if a subdivision activity is not a taxable activity for GST purposes, the resulting sale may still be subject to income tax. This might perhaps be under the bright line test. But there are other provisions that specifically deal with subdivisions carried out within ten years of acquisition. A useful reminder that although a transaction might not be within the GST net, it could well still be subject to income tax.

A few examples

There are some good examples at the end of the draft QWBA. It’s just worth repeating again that the material being put out by Inland Revenue is much more accessible than it was in previous years. The draft contains a good example about a basic subdivision then, which would not be a taxable activity because it's not carried on continuously and regularly.

Example four illustrates the GST issues where a subdivision is part of an existing taxable activity. Now this is a question that does pop up quite regularly in my experience. In this case, Loammi and Marissa are GST registered as a partnership with a taxable activity of residential property development. They buy dilapidated houses and renovate them to sell for a profit.

In this example they realise they could make a larger profit on a particular piece of land by subdividing before sale. And therefore, even though the subdivision and sale would not be a taxable activity on its own, in this case the sale of the subdivided land is a taxable supply because it was done in the course of furtherance of their existing taxable activity

Overall, this draft QWBA is probably a good warning for anyone considering subdividing property, maybe carving off two, three or four sections, and thinking that that would not represent a GST taxable activity. This view is no longer so clear cut. Like much of tax it's fact dependent. It’s also another good example where it pays to get good advice beforehand, otherwise a nasty GST surprise could be awaiting.

Foreign Investment Funds – a welcome change of heart from Inland Revenue

Finally, a few weeks back I discussed an interesting Inland Revenue Technical Decision Summary about which methodologies must be used to calculate income under the Foreign Investment Fund (FIF) regime. Under the FIF regime individuals and trusts may switch between the fair dividend rate, which applies a flat 5% to the opening value of a persons FIFs or the comparative value, which looks at the gains, losses and income during the year.

However Inland Revenue had suggested this could not happen where people were making voluntary disclosures of FIF income for prior tax years, something I see quite frequently. Inland Revenue’s proposal was this ability to change methodologies was not available and all taxpayers making voluntary disclosures would be required to adopt the fair dividend rate.

This prompted a fair bit of pushback from quite a number of advisors, including myself. I'm pleased to say that Inland Revenue has now issued an updated draft QWBA on this matter. The updated QWBA notes the Commissioner accepts that taxpayers have a choice of methods to calculate income, even if they fail to declare the income in a tax return and later file a voluntary disclosure or fail to file a tax return by the due date and later provide one including the FIF income.

This updated QWBA is another example of the Generic Tax Policy Process working with Inland Revenue taking on board feedback from advisers. It’s a good result for taxpayers. I was concerned that if Inland Revenue adopted a harsh approach on this, then people would just simply stay in the undergrowth and hope that Inland Revenue never noticed them. And that's not good for the tax system at all, where you've got people who are become compliant and feel that they are unfairly penalised for doing so. Meanwhile other non-compliant persons see this and decide to just take a chance on not being caught in the first place. This is never a wise approach in my view.

And on that note, that's all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

2 Comments

This land subdivision discussion illustrates the confusing grey areas of gst, these are open to interpretation depending on whose point of view. Income tax grey areas as well ie intention rules, application of brightline, 10 year land rules which have been around longer than brightline test

A damn good reason why we don't want govts to meddle with gst such as the recent proposal by Labour

You are involved in the subdivision biz aren't you ITGuy

Nothing really to add other than its great to get these updates communicated by Terry

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.