Various Treasury Briefings to Incoming Ministers have been released in the past week including that for the incoming Finance Minister. The slide pack discussing the Economic and Fiscal Context has attracted some attention because it discussed the option of introducing more taxes on capital.

Prepared on 24th November, the Briefing sets out

“Treasury’s view on New Zealand's economic and fiscal context, including some of the key policy issues you will likely grapple with. It's intended to provide context for subsequent, more detailed conversations between you and the Treasury.”

The summary section has a really fascinating slide not just about this podcast’s focus, tax and the fiscal outlook for the country, but about the Treasury’s snapshot of the present state of the New Zealand economy and the challenges ahead. And the summary gets straight to the point, “a substantial fiscal consolidation is required to bring revenue and expenses back into balance and support fiscal sustainability.”

The Briefing discusses the state of the economy and how a clear economic and fiscal strategy will create a strong base for growth. Although fairly routine in some ways it’s very well worth a read.

Fiscal pressures are building…

But what has caught people's eyes are references in the Briefing to the fiscal pressures that are building. Now I've talked about this previously, and in particular He Tirohanga Mokopuna the statement on the long-term fiscal position from 2021. Incidentally, the 2016 precursor of that 2021 statement heavily influenced the last Tax Working group in its decision to propose a capital gains tax.

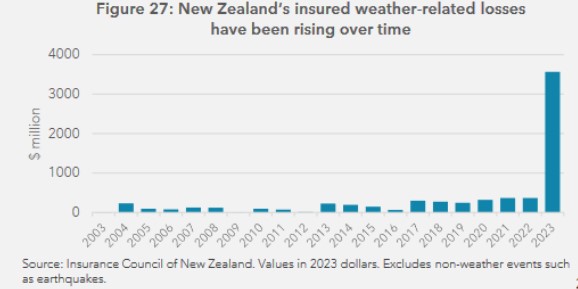

As the Briefing notes fiscal pressures are building. Gross New Zealand Superannuation costs have increased from 4.6% of GDP in 2011/12 to 5% of GDP in 2022/2023 and are forecast to rise to 5.4% in 2026/27. Then there's the issue of weather-related events such as Cyclone Gabrielle which are increasing in intensity. The Briefing includes this really chilling quote

“In addition, New Zealand is exposed to a very high level of risk from its natural environment. Lloyds, the insurance marketplace, assesses New Zealand as having the second highest risk of annual losses in the world, behind Bangladesh and ahead of Japan.”

There's also this interesting graph which shows the extent to which insurance claims have been increasing in recent years.

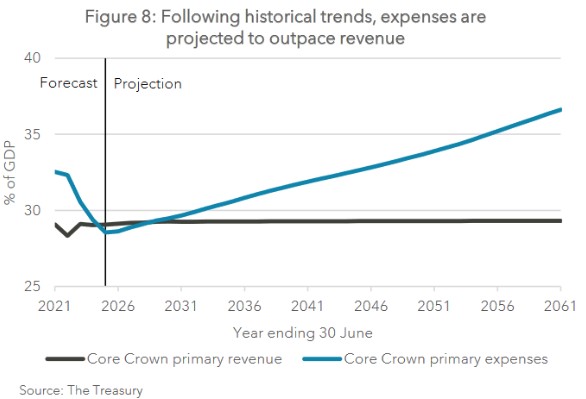

The Briefing references 2021’s He Tirohanga Mokopuna I just mentioned noting it

“…illustrated that at historic rates and policy settings, New Zealand’s core Crown expenditure will significantly outpace revenue over coming decades (Figure 8). The most significant spending pressures come from a combination of healthcare and NZ Superannuation.”

Core Crown expenditure was at a multi-decade high in response to the COVID pandemic, but is now outstripping the rise in revenue, even though core Crown tax revenue has been rising as a percentage of GDP since 2012/13. Treasury forecasts tax revenue will increase to 30% of GDP by 2026/27 on an unchanged policy. However, after stripping out one-off expenditures Treasury calculates the government is currently running a structural operating balance before gains and losses deficit of around 2% of GDP, which is roughly $8 billion.

But the Briefing notes the problem with tightening expenditure at this time in response to this structural deficit is the demographic change now occurring. This increases the fiscal pressure to deal with an ageing population, including increasing superannuation costs and demand for health services.

A heavy reliance on personal tax

Treasury notes one option would be to increase revenue at which point a government will need to consider a capital gains tax. Because as the Briefing comments “New Zealand relies more heavily on personal tax compared with most OECD countries”. The reason for this is that many other OECD countries have significant Social Security taxes, and they're used to pay for the likes of New Zealand Superannuation. We don't have that. We have a very clean system, but because we don't have Social Security, we rely more on income tax and GST.

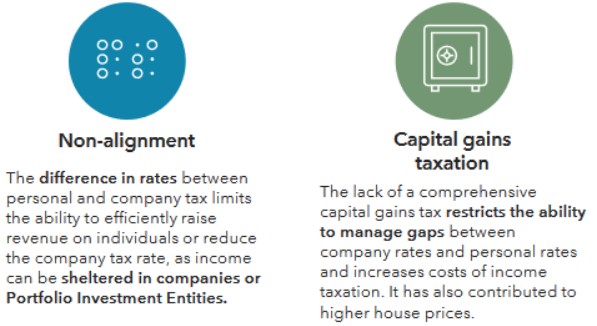

Constraints on the tax system – including the lack of a capital gains tax

On the state of the tax system Treasury’s Briefing comments

“However, there are constraints on our personal tax system which are creating increasing pressures and constraining our options for reform. These constraints arise due to the difference between our personal and company tax rates, and the lack of taxes on capital and capital gains. These limit options to raise revenue alter the mix of taxes or make changes that would meet distributional and economic objectives.”

The comment that the lack of capital gains taxation “has also contributed to higher house prices” will be disputed by some, but it's interesting to see Treasury come out and say it.

Overall Treasury sums up that “At a high-level there are several options to support a return to surplus while delivering priorities” including:

“Increasing revenue through structural reforms of the tax system policy changes to increase revenue or letting fiscal drag continue to increase revenue raised through personal income tax.”

We've talked about fiscal drag ad nauseam and last week I referenced the draft report produced under the Tax Principles Act which showed how fiscal drag increases average tax rates over time. We think the Government is still committed to increasing the current income tax thresholds, whether they will index them regularly for inflation is another matter.

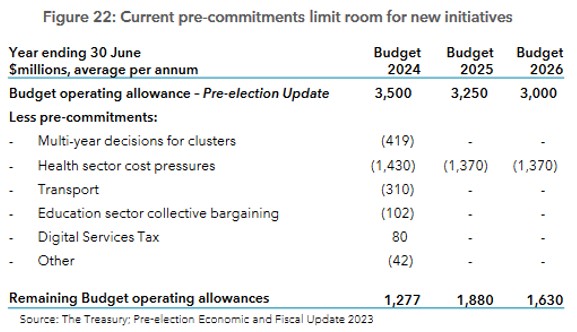

As always, these briefings contain a wealth of little detail. They're fascinating, really, one little detail that hasn't picked up by many was on page 19. This was discussing the Budget 2024 operating allowance, which was set at $3.5 billion. The Briefing discusses the existing pre-commitments and included in those pre-commits is revenue of $80 million from a Digital Services Tax.

This seems a little bit optimistic because I understood the DST wasn’t actually being introduced although it possibly reflects the effect of the expected changes in the international tax base. Either way it’s a little detail I was a bit surprised to see. However, $80 million in the context of $3.5 billion operating allowance and over $130 billion annual Government expenditure it’s a drop in the ocean. Still, it's interesting to see it there.

Inland Revenue consultation on charities’ business income exemption

Mentioning tax working groups, I remember asking the late Sir Michael Cullen the chair of the last Tax Working Group whether there was anything that surprised him. He replied that it was the extent of the charitable sector what was going on there. This is something I see fairly frequently in comments on these transcripts, it seems to be a bit of a sore point that certain charities have a business income exemption (By the way, thank you to everyone who comments, I do read them even if I don't always respond).

Inland Revenue have just released a 46-page consultation document on to what extent is business income a charitable entity derives exempt from tax. As has become the habit and it's very welcome, it’s accompanied by a useful little five-page fact sheet on the matter.

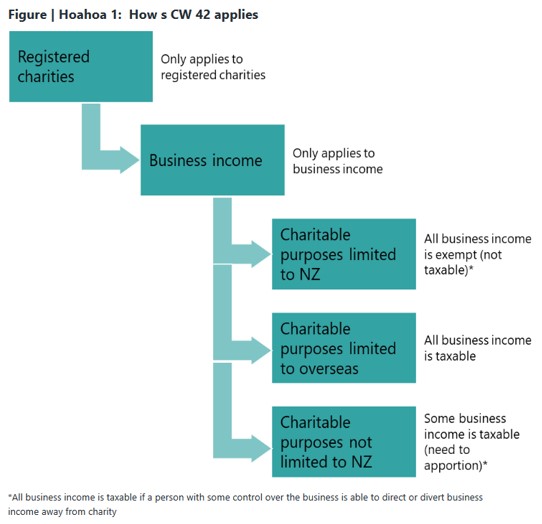

The main business income exemption is in section CW 42 of the Income Tax Act 2007. There's a related section CW 41 treating non-business income as exempt for charities.

But this particular draft interpretation statement is consulting on what constitutes business income and to the extent to which it will be exempt. How the exemption applies is set out in a very handy flow chart produced in the in the fact sheet.

OK.

In summary, if the charity’s charitable purposes are limited to New Zealand, then all its business income is exempt. But if the charitable purposes are limited to overseas, then all business income is taxable. If it so happens that the charitable purposes aren't limited to New Zealand, so charitable services are provided both in New Zealand and overseas, then there's a need to apportion.

The interpretation statement runs through with some good examples what meets the criteria to be business income. It also considers how a charity would about apportioning between business and non-business income and services in and outside New Zealand. Much of this is relatively routine and it's been standard practice for some time.

I think the thing that concerned the last tax working group, and which prompted the late Sir Michael Cullen's comment is that there isn't necessarily a follow through on whether a charity which may meet all these criteria is actually applying its spending to the community. A charity may have an exemption; therefore, they're not paying income tax. Excellent. But are they applying funds for charitable purposes? If so that's all well and good. That's what we want to see. But what if that’s not happening? This is when issues arise about charitable exemptions when the funds are being accumulated and not distributed. That's a whole topic for another time.

CSI Inland Revenue?

And finally, a little story just came out this week regarding Gordon Kenneth Morris, a Waikato sharemilker, who fraudulently claimed COVID support money which he then spent on online gambling. After he was caught, he was sentenced to nine months home detention.

What happened was he submitted fraudulent applications for the Small Business Cashflow Scheme and also for Resurgence Support Payments. He received a total of $27,200 from the Small Business Cashflow Scheme. But his application for $8,800 in Resurgence Support Payments was declined.

When Inland Revenue investigated it found Morris had also filed false GST and income tax returns and in the period between 1st April 2018 and 20th October 2020, he and his wife had spent over $336,000 on online casinos.

It’s a bit of a tragic case, but it's also a good introduction for my guest next week, Tracy Lloyd from Inland Revenue, who is Service Leader Compliance Strategy and Innovation. We will be discussing how Inland Revenue detects fraudsters such as Mr Morris.

That's all for now. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

11 Comments

“a substantial fiscal consolidation is required to bring revenue and expenses back into balance and support fiscal sustainability.”

What was Treasury's advice while Labour was digging this hole?

"The reason for this is that many other OECD countries have significant Social Security taxes, and they're used to pay for the likes of New Zealand Superannuation. We don't have that. We have a very clean system, but because we don't have Social Security, we rely more on income tax and GST."

That's a bit disingenuous, NZ had that seperate pension tax levy for many years until it was intentionally rolled into the general income taxation rates around 50 years ago

Treasury notes one option would be to increase revenue at which point a government will need to consider a capital gains tax.

We don't have a complete absence of capital gains taxes. Anyway, the way the argument is framed is that tax is used as a revenue source as opposed to a way of controlling inflation (money supply). Probably a good sign of the prevailing dogma of our bureaucrats.

If the superannuation problem is the biggie, and growing, then solving it is the one to do. And will produce benefits.

Raising the age a couple of years is just fiddlesticks.

Said it before, but in summary we need to convert to Kiwisaver over a planned 30 -40 year timespan. And Kiwisaver at high rates and highly universal.

There have been three major challenges to this idea. The first comes from people who really cannot get their heads around looking ahead 30 years. We can't help them with that.

The second was typified by the non gentleman who protested he would not pay both my super and his own Kiwisaver at the same time. The answer to that is that I did it. I paid tax for others super for many years and built a considerable Kiwisaver at the same time. Because there was a need to.

The third group believes they cannot afford Kiwisaver so the government has to pay. Believing the government always can afford what they can't. We are not a rich country and not rich individuals - There are limits on government - which is what the article is about.

We need to bring back a form of superannuation surtax to ensure NZ Super goes only to those who need it:

https://www.auckland.ac.nz/assets/business/about/our-research/research-…

As long as Kiwisaver can be withdrawn to pay for things like a first home, and for paying a rental bond(that sounds ridiculous just typing it), it will be impossible to use it for this purpose. NZ super usually can not fully cover someones living expenses, so the purpose of Kiwisaver will be to top it up. Also NZers specifically voted against compulsory super in a referendum run by Winnie. Many people would prefer to invest in houses instead and use the capital gains in that to pay for retirement. Reinforces why a Capital gains tax is needed. Most other countries seem to have some form of a CGT on property.

100% agree. The super system has so many stupid parts to it. For instance, my father turned 65, 6 years ago. He went down to WINZ and asked what he had to do because he was still working and would be for many years (still is, over 70). They said that he had to go on super straight away or he would never be able to start it later. This made no sense to me, he literally could not delay super until he needed it! So he was stuck with paying secondary tax on his work income, which is far more than his super income. So the system encourages people to stop working at 65, which is completely stupid.

Raise the age up to 67 is a no brainer IMO, do it 3 months a year for the next 8 years. And make the system more flexible so you can choose when to start, plus go on and off it. So many retired people I know thought they wanted to retire at 65, realised they were bored as hell, so started working again after.

Yeah I get tired of tax dodgers including religious and other so called charities. Lets tax all at an equal level. Tax is what keeps the wheels turning as in roading etc. How do these so called charities think they contribute to our society if they don't pay their fair share for education, hospitals and other support services.

There is a lot of "lining one owns pockets" going on within many charities.

These large overseas companies that suck money out of NZ and don't pay their fair share of tax are worse.

A possible solution could have something to do with making all income taxable and all expenditure (ie no capital or revenue distinction) deductible. In reality it would need to include a multi year factor too as many charities raise funds in advance. Such a change in law should not alarm most charities if they they are dispensing all their funds for charitable purposes as per their trust deeds.

People lining their own pockets from charities is a separate (but not unrelated) issue. It concerns governance and oversight of the charity sector in general and goes beyond tax issues.

I think the answer is both some changes to the law and better enforcement and oversight. For example, tax exemptions for funds accumulating in advance could be given after application to IRD, rather than being the default position.

If we asset tested Super, but you could only lose 50% it would solve the problem, In addition the the Super fund built up (around 70 billion I think) could be used to help fund the other necessary needs of the government like more for health and education.

Although a comprehensive CGT is off the table right now, I think that it will have to be considered again at some stage-as much for fairness as for the likely revenue from it. Why are we the only OECD member without one?

However, I think we should have a simple stamp duty on all property transactions. It would be simple to administer and collect. We have serious financial issues to face as a country, not least being the huge infrastructure deficit, but also the ever increasing costs of healthcare and Superannuation. We will need other sources of revenue.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.