Before we preview next Thursday’s Budget a quick note on a couple of other interesting developments this week. The announcement of the UK General Election on 4th July will further delay details around the replacement of the current remittance basis of taxation. You may recall this was originally announced in the UK’s Spring Budget on 6th March. The proposal was for the remittance basis to be replaced by something similar to our Transitional Resident’s Exemption.

We were meant to have seen draft legislation by now, together with consultation on the related inheritance tax implications of the proposed change. But neither of those had materialised by the time the Election was called. We therefore remain in limbo as to what will be happening, although we do understand that the Labour Party, currently odds-on favourite to win the election, is broadly in favour of the new rules. As always, we'll keep you up to date on when further developments arise, but in the meantime, anyone potentially affected should continue to plan on the basis that the existing remittance basis rules will remain in force.

Fallout from the ATO’s investigation into the Exclusive Brethren

In early April, I covered the Australian Tax Office’s (ATO) no notice raid on the offices of businesses related to the Exclusive Brethren. This week, the accounting firm Universal Business Team Australia or UBTA which is controlled by the exclusive Brethren, advised its clients that its accounting division would close with immediate effect. The same announcement said that UBT’s UK and New Zealand operations will continue unaffected for the moment.

As I said at the time of the initial ATO raids it would be interesting to see whether Inland Revenue will initiate a similar investigation of the Exclusive Brethren’s New Zealand related operations. It has to be said that closing down the accounting operation indicates that something fairly serious has been identified by the ATO. But no doubt we’ll find out more in the coming months.

A much anticipated Budget

Thursday is Budget Day. This will be my 14th Budget lockup and I'm looking forward to it as I always do. But this year is probably one of the most anticipated budgets in a long time. There are two reasons for that. On the one hand, many people are very keen to finally discover the size of the proposed tax cuts and how they will personally benefit. On the other hand it's a pretty anxious time for civil servants and a myriad of agencies and organisations waiting to see how the accompanying budget cuts will affect them.

Lessons from Bill English

Former Prime Minister Bill English, who's been advising the current government, delivered eight budgets during his time as finance minister and it would be surprising if Nicola Willis had not absorbed a few lessons from his experiences. Clearly what she would love to do is match what English did in 2010, when he masterminded a so-called tax switch. This cut the top personal income tax rate from 38% to 33%, together with a reduction in the corporation income tax rate to 28%. But at the same time, he increased GST from 12.5% to 15%. As former Labour Minister of Revenue David Parker ruefully admitted it was a masterpiece of political campaigning and delivery.

But Bill English was also a master of slipping in some quiet and relatively unnoticed tax increases. There was a controversy in 2012 about the removal of an old measure which primarily affected paper boys. But one which was turned out to be very significant was the reintroduction of employer superannuation contribution withholding tax on employer KiwiSaver contributions in 2011. That’s now worth almost $2 billion a year according to Inland Revenue's annual report to June 2023

Bill English, and to be fair, Grant Robertson, were both happy to allow fiscal drag to increase the tax take, hence the fact that tax thresholds have not been adjusted since 2010. Tax cuts were a key promise of the National Party and the ACT Party and the key delivery in this budget will be increasing income tax thresholds. These are certainly one of the tax measures we know will happen. We also know that there will be increased funding for Inland Revenue for investigations as that was included in the coalition agreement with New Zealand First.

What did National promise?

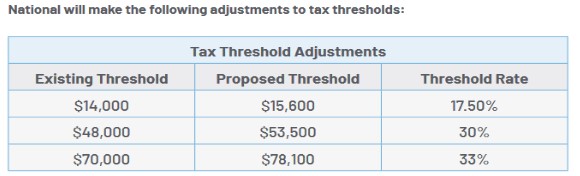

On the tax threshold adjustments, National’s promises in its election manifesto were fairly modest.

As long-standing listeners to the podcast will know, I think the $48,000 threshold is highly problematic.

Steven Joyce and the Independent Earner Tax Credit

Now it's worth noting and remembering back in 2017, then Finance Minister Stephen Joyce proposed quite a significant family incomes package, including threshold adjustments, for the 17.5% and 30% rates. As part of the measures to pay for those increases, he proposed cancelling the Independent Earner Tax Credit (IETC). This is a tax credit worth up to $520 a year for people earning between $24,000 and $48,000. One of the rationales given by Joyce for cancelling the IETC was that only 30% of those people who could claim it actually did so.

Here's where it gets quite interesting. According to the Tax Expenditure Statement (tax expenditure statements estimate the cost of a specific tax relief) released at the time of the 2017 Budget, the estimated cost of the IETC for the year ended 31 March 2017 was about $223 million. The Tax Expenditure Statements released in last year's budget estimates the value of the IETC for the year ended 31 March 2023 to be $174 million. According to Treasury the amount of IETC claimed “has fallen by 9.5% over the past two years.

The Independent Earner Tax Credit to be abolished?

My first big prediction is therefore that the tax threshold adjustments, the IETC, will be abolished, which would free up $174 million. As I said, it would be interesting to see where the emphasis of those threshold adjustments will fall. I'd like to see them focus around that $48,000 mark.

By the way, Steven Joyce would have increased the threshold where the 17.5% rate kicks in from $14,000 to $22,000 and the threshold at which the rate increases to 30% would have been increased to $52,000. Inflation has really devalued those thresholds, so it will be interesting to see what comes out on Thursday relative to what was proposed in 2017.

What Inland Revenue investigation activities will get funded?

Now the other thing that definitely is going to happen is increased investigations and enforcement funding for Inland Revenue. I expect there to be a reasonably substantial increase. At present in the Appropriations to June 2024, there's $133.8 million of funding for investigations. Just to put some things in context, in Steven Joyce's 2017 Budget, the Appropriates for investigations for the year to June 2018 was $173.7 million. Inflation adjusted that would now be close to about $200 million. However, I doubt whether Inland Revenue presently has the capacity to use what would effectively be in a 50% boost in funding. (As an aside, the reduction of investigation staff funding since 2018, has been a matter of some controversy - were too many skilled people let go just to make the numbers balance?)

A fringe benefit tax review?

Whatever additional funding is provided I expect to see tied to specific initiatives. One of those will be in relation to fringe benefit tax (FBT) which has just been in the news. Inland Revenue’s Stewardship Review of FBT in 2022 has clearly caught the Minister of Revenue, Simon Watts’ attention, because he's mentioned it in a couple of speeches. We also know through an Official Information Act release that he has received advice on his options for review. These are either a once over lightly approach or a more fundamental review. Inland Revenue prefers the latter approach. As previously mentioned, FBT has been around for a long time and it’s long overdue for serious review. Expect the Budget to contain funding for that review.

Dealing with the hidden economy and organised crime

There will also be substantial funding given for an initiative into the hidden economy. Minister Watts has received advice on Inland Revenue’s role in defeating organised crime which includes money laundering and tax evasion. Increasing funding here would not only tick the box for the Coalition agreement with New Zealand First, but also with the Coalition Government’s wish to get tough on crime and the gangs.

Cracking down on Student Loan debt

I also expect to see a fairly substantial amount of funding given to addressing the question of student loan debt which currently stands at over $9 billion. There’s a particular problem with overseas based borrowers, many of whom are in default either because Inland Revenue doesn't know where they are, or they're simply ignoring any requests for payment.

At the moment, Inland Revenue’s record with overseas defaulters is not terribly impressive. According to Inland Revenue’s annual report for the June 2023 year, it received just 108 payments totalling $16,421 from 18 overseas based student loan defaulters. (*See update at the foot of this article).

You can therefore expect a crackdown. Not only will there be increased funding to track down defaulters (including greater use of the existing agreement with Australia), I expect the Government will make it very clear that the already existing powers to detain student loan defaulters at the border will be enforced. Expect to hear more stories about that.

More Student Loan changes?

I also wonder whether the student loan repayment rate may be increased. One of Bill English's sneaky tax measures was back in April 2013 when he increased the repayment rate from 10% to 12%. Another increase would mean student loan borrowers would have one of the highest effective marginal tax rates because this 12% or whatever it might be, is on top of their PAYE deductions.

Alternatively, the Government might introduce a nominal interest charge on student loan debt, or they could increase the minimum amounts of repayments required by overseas borrowers. Re-introducing interest on student loans would be a controversial measure. But my view is, if you're going to have controversy around tax, you do it in your first budget.

What about GST on fund management fees?

If Nicola Willis is considering measures which could help claw back the cost of threshold adjustments GST on management services to managed funds is one which I think might come back onto the table. You may recall when the Labour Government introduced this proposal in August 2022 it withdrew the bill within 24 hours in the face of some ferocious pushback, which also included the fairly creative use of some long term fiscal impacts as to the potential impact on KiwiSaver funds.

That measure would have done two things. It would have clarified the treatment, which is currently very ad-hoc, but it would also, and this is where Finance Minister Nicola Willis, will be paying attention, have been worth about $225 million a year from 1st April 2026. So don't be surprised if it's reintroduced again to help pay for the tax threshold adjustments and as part of a “rebalancing.”

Could Cash PIEs be in the firing line?

Potentially the most controversial measure, though, would be to tackle the question of the prescribed investor rate (PIR) on portfolio investment entities (PIEs). Currently the highest PIR for a PIE is 28%, which means there’s an 11-percentage point difference between the top maximum prescribed investor rate and the top personal tax rate, (and also now since 1st April, the trustee tax rate). This has helped the development of what are called Cash PIEs, which are largely invested in term deposits/money markets. If the funds had been directly invested in term deposits held with banks, the interest would be taxed normally up to 39%. But because they're in PIEs, that's capped at 28%.

Inland Revenue has increasing concerns about this mismatch between the corporate income tax rate of 28% and the top marginal rate of 39% and it tried unsuccessfully back in 2022 to introduce some measures around this issue. If it was going to make a start on addressing these issues, I think you could see a proposal to income of Cash PIEs taxed at 39%. The Government might even try to make all PIEs except KiwiSaver funds subject to ordinary tax rates. Such a move would be hugely controversial, but it would probably also raise a fair bit of cash as well.

Anyway, we’ll find out on Thursday. As usual, I’ll be in the lock up and you'll be able to hear our view on this year’s Budget just after 2PM.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

*The reference to 18 overseas based student loan defaulters making repayments totalling $16,421 during the year ended 30th June 2023 only relates to defaulters identified through Inland Revenue’s approved information sharing agreement with the Department of Internal Affairs. In fact, 26% of overseas based borrowers are making repayments and they repaid $155,488,824 during the year ended 30th June 2023. My apologies for any confusion.

113 Comments

Re-introducing interest on student loans seems to fit with this govts plan on shafting the younger generations

Shafting younger generations has been occurring for the past fifteen years

Much longer than 15 years!

Goes way back the Muldoon government (National Party ... Again!) scrapping the super scheme that Australia kept.

Shafting younger people is what the National Party does. They know they'll lose few votes because of it.

(Those last two sentences say way more than a casual first read indicates. Read them again.)

They swapped places though. 6th labour govt were muldoonists, and this one is being run by the junior party of rogerites

At least 30 years actually. Governments from both sides allowed (or should I say encouraged)the boomers and following generations to accumulate property by way of taxation advantages that were not equally enjoyed by first home buyers and families moving up the ladder to get their better or bigger home. This has resulted in many boomers ending up very comfortable. To the detriment of their children and grandchildren. But who cares. Successive governments certainly have not.

NZ isn't North Korea, and obsessed with screwing those who make an effort to take care of themselves and be independent from government handouts.

What 'taxation advantages' are you referring to? Buying property's a risky business and plenty have gone bust doing it. If it's so easy why aren't you doing it yourself? And get rich...buy yourself a new Jaguar, First Class tickets to Europe and live it up?

It also removes another possible barrier to those student loan borrowers moving to Australia. I've had mates that didn't want to head over because they didn't want to attract interest on their student loan. If you're paying interest either way, it's a moot point.

Taking from children and giving to the landed gentry

Be a brave National party that takes on the hallowed double cab ute.

I'd like to see a study on the perceived inverse relationship between overall ute size and utilisation of the tray. I have never seen one of those new, monster truck-sized Ford Ranger, for example, with anything in the tray.

On the other hand, I see plenty of old 80s/90s 'little utes' taking lawnmowers to do the lawn rounds, or moving equipment.

They couldn't possibly put a nick on the pain job in the tray of the new ranger XD

Yeah, the wife is constantly nagging me about the dents and scratches on my ute(she brought it). I point out that i actually use it for work , which often involves off road, to no avail.

I was also amused at sales reps, who would look at you on horror if you suggested they take gear back to the base in their use. Arrange a courier was always the answer, though the one that would deliver and pick up was a young lady.

Always laugh at the ones with off road tires and guards etc , that have never been off the road.

I'd wager my beat up old Subaru Outback has seen more action than the vast majority of 'toughed-up' utes with the all-terrain tires, guards etc. In fact I can't quite believe some of the places I've managed to drive it without getting stuck.

When you get out in the back blocks , That's the kind of thing ,most people are driving. Though the utes and SUVs are becoming more common.

I drive a Ranger...I love it. I've had utes for decades and I buy a new one about every 5 years.

Lots of space, handy, great resale value, safe in a crash, my one's a 4 door 4wd Wildtrak X. Most of the time I don't carry anything around in it at all. I'm not driving a sewing machine, I'll leave that to you guys.

My Twin-cab Ute

I’m cruising down the highway in my twin-cab ute

With its big chunky tyres isn’t she a beaut

My lunchbox just fits in the tray at the rear

But that’s all good cause I don’t have other gear.

I’ve four spare seats but one’s for me dog

I’m your regular white man, I’m no wog

I hope you’re all thinking I’m a man of the land

To anything practical I can turn my hand

If I only had the tools I could show you how it’s done

But I spent all my money buying my twin-cab ute.

I do the same with an old wagon. Everything goes in it - fencing gear, irrigation gear, salt blocks, hay bales, premature calves, bags of cement, and so on.

It's covered in dents and scratches, has an intermittent check engine light, and is on its return trip from the moon, but it just keeps going. Best of all it's theft-proof since no one would want to steal it. Bloody marvellous old thing.

Toyota by chance?

Clearly what she would love to do is match what English did in 2010, when he masterminded a so-called tax switch. This cut the top personal income tax rate from 38% to 33%, together with a reduction in the corporation income tax rate to 28%. But at the same time, he increased GST from 12.5% to 15%. As former Labour Minister of Revenue David Parker ruefully admitted it was a masterpiece of political campaigning and delivery.

Indeed. A switch from a progressive to regressive. I.e. poorer people paid more tax so richer people paid less. If the Nasties believe that was such a success then - then I see no reason why they'd not repeat that 'success'.

again, you choose to ignore the fact that 60% of NZ households pay no net income tax after transfers & the majority of income tax is paid by the top 10% of income earners

again, you choose to ignore the fact that your statistic ignores all the other tax that those households pay and that those households also include people getting Super

Maddening isn't it. So willfully blind.

Ergo it also ignores all the benefits and credits that some households get?

It does include those other benefits but it doesn't distinguish between which benefits/transfers people are receiving . It also includes "in-kind benefits" like education and healthcare which somewhat distorts the whole picture.

Like no shit there's a lot of people receiving transfers when we have close to 900,000 people on superannuation. That is where the majority of the "transfers" are going. That same age group also costs a lot more in medical care. The next biggest is jobseeker, followed by the accommodation supplement which basically ends up being a transfer back to the wealthiest anyway.

So kiwikids continuously saying that 60% of the population aren't net-tax payers as some kinda shocking gotcha comment is such a bullshit statistic since all further context has been removed to the point that it's highly misleading.

Here is a link to the actual document.

Here is a link to the new one that was released very recently.

We really need breakdowns of benefits to be taken into the equation so that we can more accurately build policy that is fit for purpose and plan for the future of the nation. I'd have thought that with the number of citizens claiming super currently they would choose to do this but it seems not.

Demographic spread. Lets loook at the tax base. Kids at school mostly not working, retired mostly not working, those serial unemployed or unemployable not working, educated youth future tax payers exporting themselves and paying tax elsewhere. Then look at low wage being offset by accommodation supplement significantly reducing their net tax contribution to prop up the ponzi. How many actual net tax payers are left. Demographics have forcast the boomer retirement wave for decades.

If we eve needed another source of taxation it is now. Que a land tax. Simple, unavoidable, and catches every one with a possibility for a higher rate on foreign and laundered cash hiding here.

Let's add the qualification and fix up the Property Valuation Act so the QV can do a proper job and not have close to two identical properties adjacent to each other with a 15% difference when comparing land values on a $/m2. It'll take at least 5 years and a hundred million or so do this.

A land tax? Another kick in the guts for those trying to get themselves a roof over their heads.

The operative word was INCOME TAX.

A week or two ago you mentioned you get belittled by regulars on here, but somebody has to stick up for the man, right?

This comment has been disproven at least three times in the last couple of weeks where you specifically have chosen to raise it.

The fact that it proves the exact opposite point that you think it does really makes this the most moronic comment of the month. At least since jeremyr said his free beers in the pub are more important when it comes to benefit recipients than a solo mum raising kids.

Have you figured out why yet or what the solution might entail?

No use harping on about it if you're not willing to understand cause and effect.

Let's fix the broken record and put on a new song.

And let's not overlook the fact that without an increase in the tax rates for the upper bands, any movement in the lower bands become 'tax cuts for all' ... Not just for those on low and middle incomes as is claimed by Willis et al. Yes. They'll be lying if they don't increase tax in the upper bands!

Everyone will get a tax cut if earning over 14k. It is how the thresholds work.

A full time minimum wage worker (assuming 40hrs/week) will earn gross $48,152.00/year. They won't be getting very much from the proposed tax bracket shift once tax is factored in.

Just bring Labour back.. everyone seemed to know how every government waste were going to be fully funded without question so no article every week in the media b*tching about Labour's spending... sudden explosion in the number of people sleeping in cars since Nats came in too... the current coalition needs to go

The increase of people sleeping in cars is multifactorial and would, most likely, have continued whoever won the last election.

Stev o - Your share of National debt in 2017 was $65,000 its now $90,000 - please send your thank you letter to Grant Robbers son at Otago Uni.

A timely reminder that National are all talk and their supporters have selective memories .

$65,000 ! after National inherited next to no debt in 2008.

Anyone wanna bet that the 'tax cuts' are spread over a couple, or even three, years?

Those that are really worried about the government's deficit should embrace such an approach. (But how many only pretend to be worried - and where their back pockets are concerned - their worry evaporates quite quickly.)

absoulutly 100%, wouldn't be surprised if there is nothing until April 1st 2025.

Would be an own goal to put too much money in peoples pockets too soon. Inflation would roar.

A staggered implementation of a change to tax brackets would be fair, with each years change being dependant on inflation.

They could try to stagger the removal of public service jobs and cuts to match the process. so we fund the tax reduction from savings and let people go as the economy provides more jobs.

Should be a tax switch, reducing income tax but bringing in revenue from elsewhere. Ridiculous that what you earn through your own labour is taxed at such an extortionate rate whilst assets get massively preferential treatment.

Old School - non tradeable (Domestic inflation - Rates/Energy/Insurancec etc) remains at 5%+ tradable inflation - imports 1%+, I have identified were the problem is but have no easy answer. If as claimed "Public Servants" earn in region of $100k terminating more/all of those employed under the Ardern regime excluding any who can demonstrate their employment improved the services provided the saving at say $70K a year is substantial.

Domestic inflation - rates, energy, insurance have a captured customer base, inflated asset values (ROI demands) and decades of under/malinvestment (local & central govt).

I doubt the wage bill has as big an affect as we're led to believe. It's simply a blame shifting exercise.

In Neoliberal lite NZ: "I also expect to see a fairly substantial amount of funding given to addressing the question of student loan debt which currently stands at over $9 billion."

Meanwhile in full on neoliberal USA, student debt is being written off by the current president.

Student loans represent a significant part of the intergenerational theft of wealth in NZ from younger generations to the older generations who didn't pay for university.

There needs to be some lever to stay in NZ. Interest free while paying it off paying tax in NZ or perhaps some sort of credit per year paying tax in NZ.

Otherwise we should just ask Aussie to fund the medical schools.

It's not all medical degrees, likely a fraction. Arts degrees are among the most popular university programmes in NZ. STEM degrees made up 9 percent of tertiary qualifications in NZ in 2021, which was the 2nd lowest in the OECD. International students make up about 20-25 percent of STEM students.

Therefore, only about 7% of student loan volumes in NZ are for STEM qualification.

Hmmm...BA student or Med students. What to do.

Many kiwis simply will never return to NZ now as their student loan debt spirals (my brother included who has just bought a house in Oz and has a new baby with another on the way). Lucky we have highly skilled uber drivers from other countries ready to take their place.

(my brother included who has just bought a house in Oz and has a new baby with another on the way)

Won't he get a surprise if the govt manages to get this ironed out with the Australian authorities. Might be tempting for the ozzys to deport those kiwis who did this and aren't yet citizens. They seem to love turfing back the troublemakers across the tasman.

Yeah bit of risk trying to pull that off in Aus. Might be easier to get away with that in countries that don't have quite as close of relationship as Aus and NZ.

Doesn't seem that hard:

https://www.stuff.co.nz/business/129325762/new-zealanders-overseas-face…

I went to school with a guy who did the same, racked up a loan on hopeless quals and left. He came back once and got a letter sent to him about the loan, so he's never been back since and never intends to. Can't imagine what the loan is now after over a decade abroad.

Productive tax paying tradie with no criminal record or any run in with the police who has an Oz missus and 2 kids is not your normal 501 deportee. Oz doesn't want to give the information to NZ under the current information sharing agreement (see https://www.ird.govt.nz/about-us/information-sharing/international-agre…), and even if it did IRD would have to hire debt collectors in OZ including lawyers etc to try and collect the debt. This has never been done and with the cuts earmarked for IRD staff the chances of debt collection occurring in the future is 0.

Probably a low chance of it happening but just because it hasn't been done doesn't mean it can't be done. I imagine people overseas who are non-payers have a low amount of sympathy from NZ taxpayers. Honestly it will probably be fine but personally I wouldn't risk it, but everyone makes their own choices. Imo bit of a dick move to not pay them back.

I wouldn't risk it either, and I agree its a dick move (I paid my loan back).

Interesting 1234 - So you are unlikely to see your brother in NZ again!

Thats HeavyG you mean?

That's right. I told him he should sort it out and he made an offer to pay back his loan with no interest. IR said "no thanks, you'll need to come home at some time (family death, wedding etc...)".

Bro reckons it will be all facebook live from now on:). Lucky he's in the Gold Coast so we don't mind visiting him (especially around this time of year).

At what point do we address how education got so expensive to require tons of debt?

Same question will apply to all "cost of living" issues.

Yes, and the lunacy of student loan forgiveness will cost Biden the election (well, at least contribute to it). Some tax payers are not keen to pay for others' gender studies degrees.

The last government seemed to have rather good success in just funding IRD to collect taxes owed instead of introducing more new taxes. Might that be an option again?

Any time you can collect a dollar in taxes for less than a dollar it seems worthwhile to me, if only because you don't have to announce unpopular new taxes.

Return to IRD of $8.92 for each $1 spent on audits. But, if the people getting audited are your voters it pays to tighten the leash on IRD.

https://www.ird.govt.nz/about-us/publications/annual-corporate-reports/…

Sqqishy - If thats true Ill add to the one other thing Labour achieved that benefited NZ.

Great summary! As usual as a productive income earner I get F'd by both parties while landowners and small business owners get all sorts of loopholes to avoid tax. I'll be really mad if the PIE rate goes up. I would be somewhat okay with this if it was spent on things useful to me but instead we have car-centric transport and dysfunctional justice, health and education systems and the bill only gets bigger as imported low-skill population growth increases demand for infra without the ability to pay for it all.

Another wtf is the FIF tax, which unlike a bracketed system where the first $x,000 would be tax free, instead FIF has a threshold where $1 over will get you a 1.9% wealth drag on the top tax rate.

I'd be interested to hear what loopholes my small business has ? I can't really think of any, It pays 250k + in tax a year, employs 7 people yadda yadda...

What about an excess profit tax. Don't think the banks etc profits have dropped much

Treasury says "no".

https://www.stuff.co.nz/business/132536927/treasury-dubbed-big-four-ban…

Hilarious. Supermarkets get an absolute bumper year or two from lockdowns where they are given a monopoly and preferential treatment, banks are given record profits through RBNZ decisions such as LVR restrictions being dropped, LSAP and the FLP, then the govt doesn't want to go near them despite having handed them these profits. Sometimes you have to shake your head.

Getting a statute passed and 'on the books' specifically allowing governments to execute an 'excess of profits tax, or windfall tax as it is also known, would fire a shot across the bows of every business owner thinking about rising prices.

Will they? Not a chance!

Tackling inflation is what the RBNZ is tasked with, don't ya know. This ensures governments are free to spend money where their supporters demand it and the rest of NZ Inc. be damned!

Agreed and use that tax to increase KiwiBank capital so they compete more effectively in the market

As a super receiver still working, I can report that we are both paying twice as much in tax than we get back in our super. In other words we are still net contributors to the greater govt good [tax take] in our aging years.

But that's the problem in a nutshell.

For every individual super claim, an individual with an income of $123,000 becomes a net zero tax contributor.

For the two of you to receive super while working, not only are there two fewer jobs for under 65yos, but an additional two individuals with incomes of 100,000 each are completely net zero tax contributors. The average income in NZ currently is ~$70,000. Mind blowing.

Currently there are 3.3 workers per person receiving Super, 900,000 recipients, and the percentage of the population over 65 is going to increase significantly over the next 5-10 years. This can only end one way, and it ain't good. It's a shit show.

Anyway, according to some on here we just need fewer solo mums raising kids so wtf do I know, right? In my 30s with children, I feel like facepalming a brick wall at how mind bogglingly stupid this all is.

Apparently those jobs only exist because of said superannuant and will cease to exist when they retire. If not, they're the most suitable candidate for the job so we shouldn't poke the bear, because if they do retire early the country will be toast.

...but presumably much smaller net contributors than you were before passing that arbitrary birthday? Did you feel like you were more deserving of welfare payments at that point?

Not meant to be an attack - I don't blame you for claiming what you can entitled to, but I do question the system.

Assuming all of your tax is paid on income in one way or another, it's fairly easy to work out that if you're paying 2x tax as you are receiving in super ($41,500 net), you're paying ~$83k in tax. To pay that much in tax between two of you, and assuming you're both meeting the top tax threshold, that would put your income at $306k.

The tax and benefit system is completely broken.

Edit: was using gross super figure, updated to net.

People who work for a living shouldn't be taxed as highly as they are.

The biggest issue is how our tax system has become far too reliant on income taxes which is bleeding the young and middle class. We really need some kind of asset tax to take the burden off of income earners (e.g capital gains, land value tax, etc). This isn't an argument for more tax, but shifting how that revenue is gathered. This is becoming especially important as demographics keep shifting towards less workers and more retirees, and with the way our superannuation scheme is structured that is a recipe for disaster.

Problem is, many on here see it as extra tax, precisely because at the moment, it is a tax free capital gain for them.

It's how tax law has been first written is the problem and no Govt. has been willing to change it.

It was always designed to tax the workers and not the capitalists/owners/rulers.

Remove the distinction between revenue and capital and in theory we don't need to add any new taxes.

It's how tax law has been first written

Not true according to this link, more recent governments have gone out of their way to shift the burden onto income tax:

Taxation in New Zealand - Wikipedia

Income tax was introduced in New Zealand by the Liberal Government in 1891.[5] The tax did not apply to individuals with income less than £300 per annum, which exempted most of the population, and the top rate was 5%.[6] Most government revenue came from customs, land, death and stamp duties.[5]

Duties are effectively a tax but I hear what you're saying. Thank you. Maybe NZ being a new colony saw the errors of other countries tax systems.

It would appear then that as the ownership class are more likely to hold the reins of power, the burden has slowly shifted. It would also appear that funding war is detrimental to a balanced tax system and Govt. are very slow to return to a non war tax system.

As the law is titled Income tax it would make sense that all forms of income are taxed. There is easily a case for some capital income to be taxed higher than salary/wage income.

Was the comment inclusive of GST/REGO etc etc.

Personal income, so PAYE only.

Not sure about you, but I don't file my yearly grocery receipts to IRD for GST purposes. Unless you're suggesting the income is derived from business which would put the figure much higher than $306k because GST is lower than PAYE, and in business WJ and his partner could claim expenses on their tax bill. So to have a net figure at $83k would require a fairly significant revenue stream, greater than $306k in all scenarios.

The point is, if you're earning over $300k in this economy you do not need a government benefit and should under no circumstances qualify for one.

So you're saying the super isn't enough to pay your tax bill? Poor you. That's a tragedy.

Wrong John - 24% of NZ workforce over 65, still working and paying tax and contributing knowledge and experience, and that a real benefit to NZ.

That number doesn't pass the sniff test for me, do you have a source?

I found this which is a little old, but the proportion back in 2017 was 6%, projected to rise to 9% by the late 2020s

https://www.stats.govt.nz/news/labour-force-will-grow-and-age

I think Rumpole's just worded it poorly, 24% of over 65's are still working, not 24% of New Zealand's workforce consists of over 65's.

That makes sense.

For those whiners here complaining about those that have made something of themselves with property, I say give it a go.

Borrow a million or two and see how easy it is. NZ's chokka with socialists grizzling about how hard it all is while pumping out kids and buying stuff on HP.

To level the playing field you need a time machine. Comparing a boomer that paid purchase price of 3 x avg wage with a Gen Z paying 8 x avg wage is not really apples and apples.

https://www.stuff.co.nz/business/130289663/was-it-harder-to-buy-a-house…

It can still be done. Tell the kids these days they might have to start in Otara or Mangere and they'll choke on it. That's not for them, they want to start off in Takapuna or Herne Bay.

Such special mollycoddled people. I started off in Te Atatu which was extremely working class.. Some of my workmates asked me why I wasn't buying in Howick or East Coast Bays? I told them I could buy 2 houses in TAT for the cost of one in Howick. And that's what I did....and made heaps. I sat on a chair, I couldn't afford furniture, tell the current generation to do that and they'll laugh and think you're joking.

They could buy a wreck at a mortgagee sale and fix it up, but 2020's Millennials and Gen Zers aren't used to roughing it, they want it all, right now!

Howick x 2. Worked in a well paying corporate job plus had a second job in the family business. Killed me. Friends laughed at how I lived (1 beer on Friday, passed on the Ponsonby 'brunches,' cheap clothes....). Kiwis are some of the biggest whiners I've met. Everything is too hard and they deserve more.

Cute.

I bought a house in Grainger Road, Te Atatu South for $30,000 at a mortgagee auction. It was so bad, there was only one other bidder at the auction.

First mission was to get the tenants out because they wouldn't leave. Then clean the place up. Chokka with fleas, disgustingly filthy, a hole cut in the floor so the kids could get in after school from under the house, the toilet so bad it had to be thrown out, clean all the junk around the section, paint the house, and get the lawns into shape. You couldn't imagine how bad it was.

I subdivided the section, sold the house a couple of years later for $100k, and built another house out the back.

Problem is now the cost of doing all that is through the roof, material costs alone are now a massive barrier to entry, then you need council approval for everything, and people are far more NIMBYish now and can throw a bunch of crap at you to stop anything being done. And then a lot of the problems are incredibly expensive to fix e.g leaky homes which go beyond what most could realistically DIY on top of their day jobs. The standards everything has to be done to is a lot higher as well especially if it's intended to be rented out. So many more costs, regulations and litigious people around it's certainly not as easy or even profitable as it used to be if you're not already set up for it.

You don't need council approval to clean the place up, paint it and wallpaper it.

Not saying it isn't possible of course, but for reference, how much is that same house valued at currently? Also I'd add the thought of how much in savings or equity someone would need now to even borrow a million or two off the back of hard work. Still doable, but magnitudes harder and a longer grind to get there than when you bought your 30k house and had the fortunes of ever lowering interest rates over time and increasing income as well.

They could buy a wreck at a mortgagee sale and fix it up

I'm more going off what you refereed to above. I wouldn't classify a house that just needs a bit of paint and wallpaper as a "wreck", today's wrecks are more the plaster clad 90's houses that need massive remedial work, which is honestly a bit of a questionable project to take on even for someone with a huge amount of experience and knowledge to fall back on, let alone a FHB.

I'm sure there is still some deals to be had but you have to balance that out with other considerations, like back in the day buying a house a bit further out wouldn't actually add all that much to your commute, but now buying further away from where the jobs is has a massive opportunity cost of it's own especially with traffic continually getting worse, hard to do up a house after work if you're spending 3 hours a day in traffic. Maybe there's more opportunity outside of the big centres but then the issue becomes getting an income to support a mortgage is much harder as there are less decent paying jobs outside of those centres.

What year did you buy and what was your income at the time?

1983. My income at the time? That's a tricky one. Probably a tad above the average wage. I was a single man, and getting a mortgage was almost impossible unless you were married in those days, but I knew the local Belton's Real Estate Manager who organised a mortgage for me through Countrywide I believe it was.

Property speculation was frowned upon then, when the government owned nearly everything and NZ was in the grip of socialism and extortionate taxes.

Then Roger Douglas came along and set NZ free.

ᴜᴘʜɪʟʟ, 𝐁𝐎𝐓𝐇 𝐖𝐀𝐘𝐒!

So the average annual wage around that time was $11,000 at that time (see https://teara.govt.nz/en/income-and-wealth-distribution/print#:~:text=L…) so you paid at most 3x the average wage in 1983 for a house and land (I am presuming a stand alone house with a decent section).

So in 2023 3x annual income for a person in their 20s that would equate to a house purchase price of $150k or a person in their 30s of a house for $225k (see https://www.stuff.co.nz/business/money/133048565/heres-what-you-should-…).

If you can find a house for those prices anywhere in Auckland please post a link.

DP

What's funny is that the only comment mentioning property before you turned up was by ex agent, and wouldn't say they were complaining, simply acknowledging the situation. The irony of your comment is how much easier it was for you than it is for young people today and how much lower the birth rate is than it was then. Yet young people are lazy and expect it all for nothing and pumping out kids? C'mon Grandma, back to bed.

It was easier?????..You need to study a bit of history Einstein. Mortgage interest rates then went above 10% for 10 years, and reached around 25%.

And that's the reason I had to sell that house, the mortgage interest was killing me.

Posters here whine about how hard it all is endlessly, grizzling about property speculators, the government,and how it's all so unfair.

I'll start crying soon if they're not careful.

PS...I'm still doing a bit of property, it's fun and profitable...most of the time.

If you applied the average wage to house price modifying in 2023 of 8x then you would have had to pay at least $80k for your house back in 1983. What were your chances of paying/borrowing that amount (zero I would think)?

What about if the interest rate was 7% (as opposed to the 10% you had to pay) on that $80k, you still buying?..

I'd happily pay 10% on a mortgage if I could buy a house in Auckland for $300k, especially in Te Atatu South.

Mortgage interest rates got to 25%....just like I told you. NOT 10%.

... oh dear.

Over the last few years, the amount of money young people have had to try and save for a deposit for their first home compared to the income they earn would have just about been enough to buy a house entirely with cash back then. So your point is entirely moot, makes for a nice wee whinge though.

You profit at a rate faster than cost and incomes increase, but that somehow doesn't make it more expensive? Wow, must be some magic new AI backed economiks I have never heard of before.

Well maybe these 'young people' need to do what I did. And other 'young people' I see on the internet from time-to time who've managed to sock enough away to get themselves a roof over their heads. Those headlines always attract loads of condescending posts from others who aren't prepared to make the necessary sacrifices.

Drive old bombs, don't breed, don't borrow money for depreciating assets, and do without - but I guess that's expecting a bit too much in 2024.

BTW I'm just starting a new build in an area that's going to absolutely boom. I'm certain fortunes are going to be made, but you wouldn't be interested in that because it's all just so unfair.

25% interest in 1987? Average wage $25k, average house price $88k. 3.2 x average income to buy the whole house cash.

6.5% interest in 2024? Average wage $70k, average house price $930k. 13.3 x average income to buy the whole house cash.

Assuming both have 20% deposit:

1987: Mortgage 70% of average income and 8.4 months worth of income to save deposit.

2024: Mortgage 80% of average income and 2.65 years worth of income to save deposit (nearly equivalent to paying cash in 1987! Whoopee!).

Wah.

As I've already said, maybe buyers need to lower their expectations and buy in areas that aren't so ritzy, but that's not for a lot of kiwis. Can you imagine some 25 year old from the North Shore or Remuera being told to buy in Otara?

They'd turn their nose up. That so not 2024. Can you imagine someone from a lux suburb in Auckland inviting their mates to party in Otara? Hahaha

But there is something called gentrification, which has made a lot of people very wealthy.

Or move out of town a bit. I see in the news the other day, that the place that no one wanted to live, Huntly, is now attracting a lot of interest.

As I said above though there is a real opportunity cost to moving out further, it's a lot harder to make more income if you have to spend 3 hours a day in traffic to get to the jobs that can actually support a mortgage.

This also has a very real effect on our productivity, having people spend heaps of time just moving around the place not doing anything is a massive drag on the economy which further reduces our already pretty dire productivity. Pushing people further and further away from job centres has a lot of external costs which you don't seem to be considering.

I don't think kiwis are mentally equipped for high rise accommodation. That's not their style, and I think it's coming unraveled a bit at the moment as some of the newer developments are making the news. Some of the cheaper accommodations being built aren't selling.

Did you see in the news today about the container apartments from China being stacked up at Sandringham and Hobsonville Point?

https://www.nzherald.co.nz/business/surprise-at-new-chinese-container-s…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.