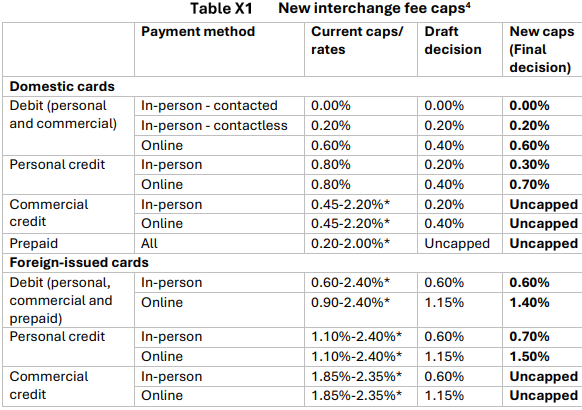

The Commerce Commission's final decision on interchange fees on the Visa and Mastercard networks delivers only a third of the savings estimated for consumers in its December 2024 draft decision.

Today's decision estimates a $90 million annual reduction in the benefits to merchants and consumers of lower caps on the fees paid by New Zealand businesses to accept card payments.

That's down from the $260 million suggested in the draft decision.

The commission said it would continue to study the surcharges by which merchants pass these fees through to customers.

"Consumers can expect these cost savings to flow through to fewer and lower surcharges, but regulation may still be needed to curb excessive surcharging," said Chairman John Small.

“We’ll be exploring what regulation may be needed to address excessive surcharging, which we consider to be anything more than the cost businesses face to accept Visa and Mastercard payments."

The Commission decided not to regulate fees for commercial credit cards or prepaid debt cards, but will continue to study that area.

The final ruling will replace fee caps introduced in the 2022 Initial Pricing Standard, which the Commission says is saving businesses $140 million a year.

In the document explaining the reasons for its final decision the commission says businesses are "still paying too much," $1 billion a year to accept MasterCard and Visa payments of which $600 million in interchange fees.

The current retail payment system "lacks strong competitive pressure, and most merchants are still price takers for interchange fees."

Interchange fees remained significantly higher than in comparable jurisdictions and were more than double those of Europe for personal domestic credit card transactions.

However, Small told RNZ, the commission "decided we needed to leave a bit more money in the system [than proposed in the draft decision] to incentivise new entry and dynamic competition."

The document says some submitters argued setting fees too low could reduce innovation, stifle competition in the retail payment system and hamper the emergence of open banking.

"Many" submitters called for changes to or the removal of caps on credit cards on the grounds that these involved higher fraud costs, among other things.

Submitters (other than retailers) also called for a ban or reduction in surcharging. Consumer submissions were skeptical merchants would pass on savings from interchange fee caps.

Not all merchants imposed excessive surcharges and some imposed none, the commission said.

However, it said it "expects to regulate surcharging," adding that it wanted to deal with interchange fee cost first.

Fees on commercial credit card transactions will not now be regulated.

The commission said it considered fees currently charged to be excessive and "unless we see these fees coming down ... we will consider consulting further."

Submitters argued online transactions also have high underlying costs.

ANZ submitted that online transactions make up approximately 92% of the value of fraudulent transactions.

The commission appears also to have accepted arguments personal credit cards should attract higher fees because thy have high underlying costs, including fraudulent use.

6 Comments

Government failure here. Card users buying online ought not to pay extra.

When in shops, I use credit cards only if there is no surcharge; if there is, I use my eftpos.

So you make a considered decision on how to pay. But the great unwashed need their hand held, yet again.

Meanwhile across the ditch, APRA came out yesterday seeking feedback on scrapping interchange altogether. What the banks in NZ won't tell you is that the interchange income (merchant services income) largely funds their rewards schemes offered on their premium credit cards - it's got very little to do with the cost of security/innovation etc. So we have small business funding the rewards schemes being offered by banks. I have long held the view that if banks want to offer rewards programmes, then they should fund these themselves, don't fleece merchants to pay for this.

Toothless tiger strikes again!

What's the difference between personal credit and commercial credit in the table (which is uncapped)?

Is my regular bank Visa card personal credit?

Yes, personal credit.

Commercial cards are the company/corporate credit cards you might be given by your employer.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.