Recently we discussed the Taxation (Annual Rates for 2025−26, Compliance Simplification, and Remedial Measures) Bill which coincided happily with the New Zealand Law Society's annual tax conference.

Making compliance with the financial arrangements regime easier

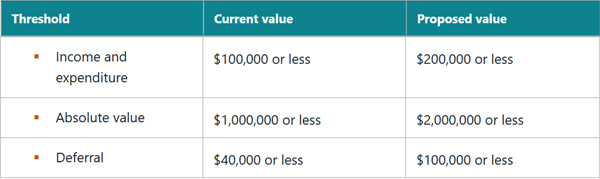

Amidst all the excitement, I overlooked a fairly critical measure in relation to the financial arrangements regime. As regular readers will know, the financial arrangements regime is highly complex, and little known to the average taxpayer. A major issue with the regime is that once certain thresholds are breached unrealised gains and losses must be included in taxable income, i.e. on an accrual basis.

These thresholds have not been amended since 1999 which was the last time there was a serious review of the financial arrangements regime. It’s therefore very welcome news to see a proposal to significantly increase the three key thresholds allowing persons to be treated as a ““cash basis person” and therefore able to return income or expenditure from a financial arrangement on a cash (realised) rather than an accrual (unrealised) basis.

However, Robyn Walker of Deloitte has pointed out the continued existence of the deferral threshold remains problematic. At present, even if the other two thresholds are met, income may still have to be returned on an accrual basis if the difference between income and expenditure calculated on an accrual basis and that under the cash basis exceeds the deferral threshold. In other words, in order to comply with the cash basis method taxpayers are required to calculate and track income and expenditure under the accrual basis.

As Robyn notes the deferral threshold just needlessly complicates matters. (The anecdotal evidence is that its effect is often not realised). She is therefore campaigning for the repeal of the relevant provision requiring the deferral threshold calculation. I fully support her suggestion as bringing about a much-needed simplification. As an aside my personal preference would be for the new thresholds to have retrospective effect from 1st April 2025, rather than 1st April 2026 as proposed.

PepsiCo and Big Tech

One of the papers at the recent New Zealand Law Society tax conference reviewed the Australian PepsiCo case involving what's called an “embedded royalty”. In this case the Australian Tax Office (“ATO”) said that a bottling agreement for concentrate agreement between PepsiCo and Schweppes Australia Pty Limited involved an embedded royalty and therefore withholding tax was due on a portion of the payments under the agreement.

The ATO won in the initial court case in March 2023, but on appeal and a majority of the Full Federal Court ruled in favour of the taxpayers in March 2024. The case then went to the High Court of Australia which has just ruled 3:2 in favour of Schweppes Australia/PepsiCo.

That would appear to be the end of the matter in Australia but as the paper and session at the New Zealand Law Society tax conference noted, the case remains of interest here. In particular, could our non-resident withholding tax and non-resident contractor’s tax rules apply to part of any payments made to an offshore related party by a New Zealand company.

The PepsiCo decision coincides with the release of a report from Tax Justice Aotearoa entitled Big Tech Little Tax - Tax minimisation in the technology sector. This report examines the publicly available records of the major tech companies in New Zealand to determine how much income tax they are paying and how they are structuring their affairs.

There's a lot to pick apart in this report. It notes the Government has decided to withdraw the bill introducing a Digital Services Tax (DST) given the Trump administration’s plain declaration that any form of DST would be viewed unfavourably. Inland Revenue had estimated a DST would have been yielded perhaps $100 million in annual revenue.

Targeting the tech giants

The purpose of the paper (written by ex HMRC/Inland Revenue international tax specialist) is

“…to identify practical options to capture a greater proportion of income, including through the application of existing legislation. It argues, for example, that applying the 5% withholding tax stipulated in the New Zealand US double tax aggregation agreement to the service and licence fees of Google, Facebook, Amazon Web Services and Microsoft would have yielded withholding tax revenue of $130 million.”

The paper analyses the various types of fees paid by the New Zealand subsidiaries of companies like Google, Facebook, Amazon Web Services, and Microsoft, and explores whether some of these payments might, in substance, constitute royalties and therefore subject to non-resident withholding tax of 5%. This is where the PepsiCo case becomes particularly relevant, as it provides insight into how such payments might be classified.

The paper analyses the tax practices of the tech giants and their three primary models of tax minimisation: the service fee model, the inflated licence fee model, and the service company model. Facebook, Google and Amazon Web Services appear to use the service fee model involving substantial “service fees” to related offshore companies.

Oracle New Zealand and Microsoft New Zealand use the inflated licence fee model, under which the local subsidiary pays a large percentage of their revenue to offshore subsidiaries for the licensed use of certain intellectual property rights. According to the report in 2024:

“Oracle New Zealand earned revenue of $172.7m but paid licensing fees of $105.3m to an Irish related party, leaving taxable income of just $5.3m. In previous years, the company has disclosed royalties, which, at that time, made up between a third and three-fifths of total revenue.

Microsoft New Zealand earned revenue of $1.32bn but paid $1.075bn in “purchases” to an Irish related party, leaving taxable income of $62.8m.”

It so happens that Oracle in Australia is currently in the middle of litigation with the ATO regarding the sub-licensing of software and hardware from Oracle Ireland to Oracle Australia and whether these should be treated as a royalty. This is a major case as apparently at least 15 other multinationals are facing a similar dispute with the ATO. Inland Revenue (which tends to follow Australia’s lead on transfer pricing issues) will be watching with interest.

A lack of transparency

The paper also discusses MasterCard, Visa and Netflix where we really don't know what's going on because there is no publicly available information. At present all three companies meet the requirements to be exempt from publishing financial statements. The paper surmises the three companies utilise the service company model under which “the local subsidiary operates only as a marketing and support service to an overseas group company, while sales or service revenue is booked offshore.”

I agree with the paper’s recommendation that the Companies Act reporting requirements are changed “to require all local subsidiaries of overseas-headquartered companies to file accounts publicly.” The numbers are reportedly quite large for MasterCard and Visa; it’s the commission on $49.5 billion of credit card payments. In the case of Netflix, if it has 1.2 million subscribers in New Zealand then its expected subscription revenue should be approximately $250 million a year.

Overall it appears there is substantial potential profit shifting happening through the use of various fees, some of which could be subject to non-resident withholding tax. As noted above there is significant litigation happening in Australia on the issue and I don't think the ATO is going to back off on the matter. I do wonder where Inland Revenue is on this and I expect that we will see more chatter and more discussion of this topic.

Tax agents survey results

Finally, what do tax agents think of Inland Revenue? Quite a few times it depends on what we receive in the morning mail and how our clients react. Joking aside Inland Revenue regularly surveys tax agents and it has just published its Tax Agents Voice of the Customer survey results for the just ended 2024/25 financial year.

According to Inland Revenue tax agents “continue to report strong satisfaction with our services. Some of these results are at their highest levels so far:

- 92% of tax agents are satisfied with their overall experience

- 95% found it easy to get what they needed, which is a significant improvement

- 88% trust Inland Revenue.”

Those are all fantastic numbers and very encouraging.

The benefits of answering the phone

Inland Revenue considers these results “reflect our improved responsiveness” which includes that “Over the past six months, many of you have noticed it's now easier to talk to us on the phone.” Not being able to get through and speak with someone at Inland Revenue has been a sore point for many tax agents.

The reality is that although Inland Revenue would prefer tax agents and the general public interacted online with it, sometimes there is no substitute for a phone call. This is the swiftest way of sorting out any issues resulting from Inland Revenue not processing a transaction correctly. Often a tax agent will come under pressure from a client to resolve an issue swiftly. I think Inland Revenue doesn't always appreciate that when it drops the ball, we as tax agent cop the flack for it because something we've said is going to happen hasn’t been done. It’s therefore encouraging that phone response times have improved.

Tax agent satisfaction with responsiveness on web messages is now 74% up from 70% for the year ended 30th June 2024. I think that's too low it should be at least 80% in my view. To be fair I think Inland Revenue would want to reach this level too. Satisfaction with consistency of Inland Revenue’s advice was 76% for the year which is down from 79% for the 2024 year. As Inland Revenue notes consistency of advice is important but remains a challenge.

Outside of survey bodies such as the Accountants and Tax Agents Institute of New Zealand, the Chartered Accountants of Australia and New Zealand, and the New Zealand branch of CPA Australia all regularly discuss service delivery and operational matters with Inland Revenue officials. Overall, the survey is a pass mark for Inland Revenue, but areas for improvement remain and it's good to see it acknowledging this.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

3 Comments

This rort is really annoying. The only thing more annoying is the intellectualising but no action over the issue.

The government would get big votes if it got tough and effective. I don't understand why it does not.

Yip.

There used to be a saying - "Never argue with someone who buys ink by the barrel." Alphabet and Meta dwarf the influence of the press.

If the NZ government gets tough, there is zero chance it will be effective.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.