Under the Generic Tax Policy Process (“GTPP”) “Inland Revenue is primarily responsible for the detailed design, implementation and review of tax policy.” As part of the GTPP Inland Revenue in conjunction with the Minister of Revenue will periodically release Work Programmes reflecting the Government's current priorities.

The latest, or “refreshed” Work Programme as the Minister of Revenue Simon Watts put it, was released on 29th October. According to the Minister “The refreshed work programme is about removing regulatory barriers and delivering a stable, predictable tax environment that directly supports growth and opportunity.”

Four key workstreams

There are four workstreams in the Work Programme:

- Attracting and retaining capital and talent to make New Zealand a better place to invest capital, work and do business. The intention here is to minimise biases on economic decisions, reduce international tax barriers and rewarding effort and individuals' investment in their own skills.

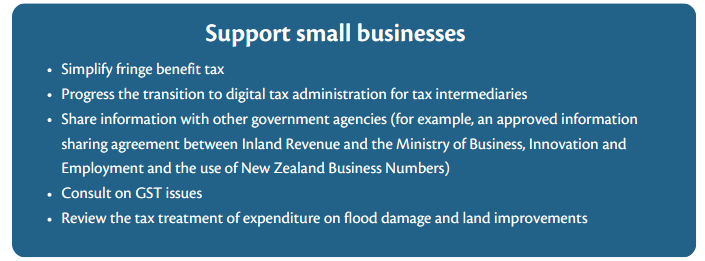

- Supporting small businesses, primarily by reducing compliance costs and making tax treatment simpler and fairer.

- Simplification and integrity of the tax system, again by reducing compliance costs across the board for all taxpayers but also protecting “against tax avoidance and evasion to maintain a simple, stable and predictable tax system.” Simplification is the easier part the harder part is making sure that the system operates as is intended and that taxpayers are compliant and are seen to be compliant.

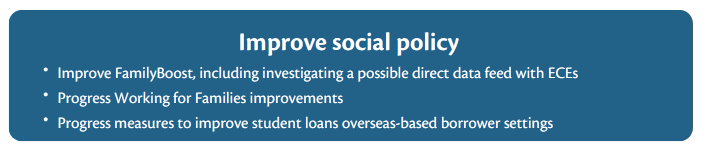

- Finally, improve social policy which is described as “improving the delivery of income support payments administered through the tax system and increasing work incentives.” I have some doubts about how some of the other initiatives we've recently seen will actually work.

Remedial legislation

In addition, as the two-page summary of the Work Programme notes, “the remedial programme plays an important part in maintaining the tax system.” The current tax bill going through Parliament contains 43 remedial amendments covering matters such as investment boost, employee share schemes, GST, FBT and KiwiSaver, as well as what's called termed a further 24 maintenance amendments. (Worth remembering further items may be added as the Bill progresses. Although submissions on the Bill have closed, it is possible for the government to introduce further provisions to an existing tax Bill.

Supporting small businesses

There's nothing terribly unusual in the Work Programme, quite a bit of which is in the current tax bill going through Parliament. In the small business workstream it’s interesting to see simplifying fringe benefit tax listed, as that got kicked down the road. Sharing information with other government agencies is one of the more controversial measures in the Bill but it’s good to see proposals to consult on GST issues and review the tax treatment of expenditure and flood damage and land improvements.

Revising provisional tax for small businesses?

But I was intrigued to see the Minister of Revenue in the accompanying press release make the following comment.

“We are also working with intermediaries to reduce compliance costs and make tax treatment simpler and fairer. Inland Revenue is currently exploring a more flexible approach to income tax payments for sole traders and small businesses and plans to consult on this on the first part of next year.”

That's actually good to hear because I think it's time for a thorough review of the provisional tax system, which is not terribly friendly towards small businesses in my view. Currently, for taxpayers with the standard 31st March year-end payments are due on 28th August, 15th January and 7th May. The 15th January payment falls at a particularly awkward time for small businesses because many are on holiday at that time.

(The current timing of provisional tax payments was largely for the convenience of larger companies, many of which do not have a 31 March balance date so do not face this issue. I still find it astonishing that in a country where 96% of businesses are small businesses, landing a major tax payment in the middle of the summer holidays seems quite bizarre.)

Anyway, according to the Minister, we're going to see something in this area in the New Year which I fully welcome.

Changes to FamilyBoost but no review of abatement thresholds and rates?

In relation to the social policy initiatives, in here they're talking about improving family boost, including investigating a possible direct data feed with early childhood education centres.

In terms of improving Working for Families it’s not clear what’s involved but I consider a real look at the thresholds and abatements is really critical here. As a Treasury paper earlier this year noted, 30% of solo parent families have an effective marginal tax rate of above 50%. We also have the proposals to remove Jobseeker benefit for 18- and 19-year-olds living at home where the annual family income exceeds $65,529. This move if implemented would result in an effective marginal tax rate of over 1.34 million percent, a very clear disincentive to work.

So there's lots of work to be done in the social policy space in my view. It will be interesting to see what emerges over time and of course, we'll bring you those developments in due course.

Are repairs to leaky buildings deductible?

Moving on, as we recently discussed with John Cuthbertson of Chartered Accounts Australia and New Zealand, Inland Revenue’s Tax Counsel Office regularly releases draft guidance for consultation about particular aspects of the tax system. As John explained a major part of his team’s role is reviewing and responding to these draft guidance releases.

I expect he and his team are going to pay particular attention to the draft interpretation statement on the income tax deductibility of repairs and maintenance expenditure. Now, this is updating the Commissioner's guidance from 2012 on the topic Interpretation Statement IS 12/03 which is widely used and often referenced in other guidance.

All or nothing, the impact of withdrawing depreciation for buildings

As the draft guidance notes, since depreciation is no longer allowed for buildings, it is now more important to correctly characterise repairs and maintenance expenditure. The withdrawal of depreciation means repair and maintenance expenditure is a bit of an all or nothing matter. It's either going to be deductible or it's not deductible and there's no depreciation either, so the stakes are higher.

According to the introduction, the Commissioner's interpretation has not changed since 2012, and this guidance has been updated to reflect recent legal developments, improve clarity and reflect a more modern format. The full interpretation statement itself runs to 81 pages but there’s also a handy summary fact sheet which at seven pages, is a lot more digestible.

What about leaky buildings?

Despite the Commissioner not changing his interpretation one of the areas I think is going to provoke some controversy is in relation to the treatment of leaky buildings. To be fair, this is a complicated area, and enormous amounts have been spent in dealing with remediating leaky buildings since the crisis first emerged in the 1990s. I think it would have been better for Inland Revenue to have issued separate guidance on the treatment of leaky buildings expenditure because the numbers are very big.

It's worth citing out at length what Inland Revenue says about the issue, because it’s sure to provoke controversy. Paragraph 193 of the guidance starts,

“Inherent defects are faults in an asset's design, construction or manufacture that can subsequently cause a need for work to be carried out on the asset. This may be because the defect requires routine maintenance and repair work to be brought forward or because it results in additional required work or both. In New Zealand, an example of inherent defects in a repairs and maintenance context involves properties that have been referred to as called leaky buildings or leaky homes.”

It’s the next paragraph [194], which is the kicker as far as I'm concerned. It reads,

“As noted at paragraphs 100 to 102, the courts have considered a repair involves the restoration of a thing to a condition it formerly had without changing its character.

[So far, so uncontroversial].

In the case of leaky buildings, this raises the question of what is the asset's relevant former condition. In the Commissioner's view, this is likely to be the “as constructed” condition of the building, including the inherent defects in that construction. Therefore, works to remediate damage caused by the inherent defects that goes beyond restoring this original condition may not involve repairs if the building is improved or enhanced by removing the inherent defects. In that case, the nature of the work undertaken is more likely to be considered an improvement, the costs of which involve capital expenditure.” [my emphasis]

Paragraph 195 continues in the same vein.

“With leaky buildings, an improvement is highly likely to incur. The removal of an inherent defect is likely to be a legal requirement imposed on work done to remediate damage in a leaky building so it meets current building standards. It is also likely that work required involves replacing original materials used in constructing significant and integral parts of the building with superior materials.”

That's a hell of a couple of paragraphs in my view, because this interpretation would appear to rule out claiming deductions for large portions of any expenditure on leaky buildings and remediation.

I see where Inland Revenue are going with this, but a counter argument is that the building was built or purchased to be used as a building, and it was unfit for purpose in the first place. How is it an improvement to make it fit for purpose, because, basically, properly constructed buildings shouldn't leak in the first place? That's perhaps oversimplifying the argument, but Inland Revenue have adopted an unduly strict interpretation which is not likely to be welcomed.

As I said, you can see where Inland Revenue are coming from, but you can also see that investors have a building that's not fit for purpose and requires remedial expenditure. In some cases, they are able to continue to use the building at some reduced capacity. But based on this draft guidance they are unable to get a deduction for those repairs to get it to the standard to which it originally should have been at all times. Furthermore, because depreciation is no longer available for commercial buildings, this becomes an all or nothing issue.

As an aside its’s quite possible that the original builders or constructors of these defective buildings will face lawsuits and they may be to pay compensation or carry out remedial work in which case the building owner is not out of pocket. However, many leaky building owners face the problem of having to expend a substantial amount of expenditure, not get a deduction for it and not be able to claim depreciation. I therefore foresee quite a bit of pushback on this guidance.

We'll have to wait and see for developments. Notwithstanding that, I also think this is perhaps such a vital matter it should be left to Parliament to determine the appropriate treatment. Watch this space.

[This is an edited transcript of the episode released on 3rd November 2025]

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

2 Comments

What do the IRD expect, the leaky building owners to reinstate the faulty product and systems that led to the disaster in the first place? What a kick in the guts.

This seems to be actively disincentivising bringing buildings up to a minimum standard required by the regulations from another government department.

Do you think said departments should, you know, talk to each other before the public get lumbered with the result?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.