By Jacob Frenkel, Raghuram Rajan, and Axel Weber*

As the world continues to experience a prolonged period of unanticipated inflation caused by economic and non-economic shocks over the past four years, it is time for a frank reassessment of central banking and monetary policy. It is time to acknowledge what we got right and where we went wrong, to recognise the limits of our data and understanding, and to own up to the weaknesses of our models and frameworks. Above all, it is a time for humility – and for a return to core goals.

Central banks cannot solve all that ails our economies. They should not be expected to solve problems that other actors can better address, such as collective global goals outside their competence. Instead, central banks and their leaders should focus on three objectives: price stability, financial stability, and macroeconomic stability. Achieving these three goals is hard enough. We should dial back public expectations that central banks can or should do more than this.

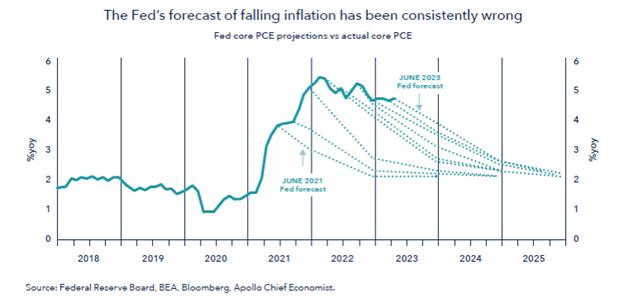

What does a humble approach to central banking mean in practice? For starters, central banks need to be more realistic about their ability to forecast macroeconomic outcomes with great precision. Their recent track record has demonstrated this. If we look at the Federal Reserve Board and the “hair” diagram, as inflation jumped, staff economists repeatedly projected a return to 2% inflation from wherever the current estimate stood. Again and again, the forecasts were wrong – and in both directions.

Other central banks have suffered similar forecasting failures as the return to the inflation anchor of 2% is “baked in” in most forecasting models. Advanced-economy central banks and their leaders misread the early indications of the inflationary spike with which we are still grappling, owing to the wrongheaded belief that the emerging price hikes were transitory. This led to a lag in monetary-policy responses, which exacerbated the height of the inflationary spike and the economic pain that ensued, and ultimately required historically steep interest-rate hikes.

Policy planning and decision-making were muddied further by the adoption of new or adjusted monetary-policy frameworks during the previous prolonged period of low inflation. These models contained assumptions that slowed responses when exogenous shocks (the pandemic), supply shocks (the trade impacts), and fiscal shocks (the size and persistence of the stimulus that was triggered) adversely impacted inflationary pressures and outcomes.

First Things First

A key part of adopting a humble approach to central banking would require policymakers to return to fundamental, time-tested principles of macro- and monetary economics. In particular, policymakers must avoid overreliance on specific predictive models of inflation. Ideally, central banks should develop frameworks that achieve reasonable forecast results, regardless of the nature of the shock hitting the economy, and they should communicate the degree of uncertainty to the markets and the public. In doing so, they can preserve the option of shifting policy stances as circumstances change, rather than promising long periods of policy stasis based on problematic assumptions.

A humble approach would also require that central banks’ preserve future policy space. In this recent suboptimal policymaking cycle, we all witnessed leading central banks locking themselves into policy stances that constrained their ability to act swiftly via long-term policy commitments when the economic situation shifted suddenly, particularly when inflation reared its head. We believe central banks should tilt toward simpler and more transparent rules, rather than implementing drastic long-term discretionary measures that threaten to undermine their ability to act in the future.

Crucially, embracing the humble approach requires central banks to maintain their focus on the inflation anchor, typically set at 2%. All major central banks – the Federal Reserve, the European Central Bank, the Bank of Japan, the Bank of England, and others – have converged on the 2% target. Now is not the time to question or lose sight of that objective. Suggesting doctrinal flexibility or raising inflation targets at a time of higher price growth and ongoing worries over long-term expectations is the wrong answer. Central banks must remain committed to preventing inflation from spiraling out of control, and their credible commitment to an inflation anchor is central to achieving that objective.

Reputation is like a capital stock. The central bank can temporarily let inflation run above target if it fears the consequences of raising rates will be too severe, but its reputation for competence will be eroded. If the public’s view of the central bank becomes sufficiently negative, inflation expectations could stray from the target, possibly leading to price spiral. That would be a terrible outcome, and one that can and must be avoided.

Avoiding Financial Dominance

Some pundits now believe that the worst is behind us, and that we can relax. We do not agree. Around the world, public debt levels are high, and with interest rates rising and payments growing, issues of debt sustainability have come to the fore. Tensions between the necessity for tighter monetary and fiscal policies and governments’ desire to relieve the pain will thus emerge and grow.

Governments may be encouraged to put political pressure on central banks to keep interest rates low or lower than is needed. As costs loom for the public and governments, a “blame game” will surely arise, in which policymakers attempt to avoid culpability for inflation. We must be clear on the absolute necessity of controlling inflation, even in the face of political brickbats and attacks. Only by doing so can central banks ensure their public support and continued credibility.

Given high private debt and leverage levels, we worry about the emergence of a new regime of “financial dominance.” In this situation, central banks may be loath to tighten monetary policy because of worries about the risks to the stability of financial markets, which have become perhaps too reliant on central-bank support. The bank failures in the United States and Europe in the first half of 2023 demonstrated this link, and the prolonged nature of central-bank support may still hide sources of financial instability when policymakers finally withdraw support from addicted firms and sectors.

Central bankers are right to worry about such risks, which partly reflect their own past actions. Looking ahead, to avoid succumbing to financial dominance, central bankers will need to turn to their supervisory staff to deal with the negative spillover effects of past monetary-policy largesse as rates tighten.

Independence Is Everything

To achieve their core goals, central banks require independence from political interference. With independence comes a heavy burden of responsibility, and this is a key reason why central bankers must accept the deliberately narrow mandate that the humble approach implies.

Independence is also best served when central banks communicate their policies clearly and effectively, and there has been progress in this domain in the US, Europe, and elsewhere. It is appropriate that central-bank governors testify to legislators and answer questions raised by elected officials. The public and other market participants need to understand why and when central bankers decide to act.

The real test for central-bank independence comes when necessary monetary-policy tightening causes public-debt levels and payments to rise. As governments confront hard fiscal decisions, the danger to central-bank independence increases. We know what a lack of independence looks and feels like. Ask any resident of Argentina or Turkey about the sky-high inflation that has become a painful fact of daily life. The economic effects are real, impoverishing, and socially devastating. Those of us from small open economies (like Israel) can remember the corrosive economic effects of inflation, as well as the dramatic positive effects of the return to price stability.

Crucially, once inflation is allowed to take hold, if independence and credibility are lacking, people’s inflationary expectations for the future are adversely affected, and the results can be deeply harmful. Only with operational independence can central banks continue to fulfill their price stability and other related mandates, learn from policy mistakes, address ongoing inflationary pressures, and chart a way forward, mindful of emerging and morphing risks.

Here, we can learn a valuable lesson from emerging-market central banks. The improved resilience and performance of emerging markets is due in part to the lessons learned from their severe debt and macroeconomic crises in previous years. While advanced-economy central bankers delayed responding to the recent bout of inflation, believing that it was transitory, (and thereby raising the cost and monetary-policy pain needed in the end), emerging-market central banks acted early as the inflationary impulse was becoming visible, hiked rates aggressively, and quickly halted and reversed inflation.

As advanced-economy central bankers assess their recent policy responses, failures, and lessons learned, they should recognise where others got it right and where they got it wrong. Humility requires nothing less.

The commentary draws on a recent G30 study, Central Banking and Monetary Policy: Principles and the Way Forward.

Markus Brunnermeier, Professor of Economics at Princeton University, contributed to this commentary

*Jacob Frenkel is a former governor of the Bank of Israel (1991-2000). Raghuram G. Rajan is a former governor of the Reserve Bank of India (2013-16). Axel A. Weber is a former president of the Deutsche Bundesbank (2004-11). Copyright: Project Syndicate, 2023, and published here with permission.

5 Comments

It's been hard for central bankers to adjust from a macroeconomic environment where consumer prices where well anchored by globalisation and demographics to the one we have now where those trends are reversing.

Yes - essentially we have the biggest debt bubble there has ever been - with less real underwrite that there has ever been.

They have used the one 'tool' they have (printing money - I regard inflation as subsequent) since 2008, and the can is near the far end of what was always going to be a cul-de-sac.

I predict - with 100% certainty - that the next debt bubble will be the biggest ever.

"This article considers fiscal dominance, which is the possibility that accumulating government debt and deficits can produce increases in inflation that “dominate” central bank intentions to keep inflation low.”

"The above quotation from the Treasury’s Financial Report admits that the current combination of government debt and projected deficits is not feasible as a matter of arithmetic because it would result in an outrageously high government debt-to-GDP ratio.”

This is from a paper published by the Fed itself. If you think you know how the system works, skip to the bottom half.

Oh please. Central banks have lost all credibility, and it goes way beyond shitty forecasts. They, and the commercial banks are just an extension of govt desire to "manage the economy". The disastrous wealth transfer they have practiced for decades has been ruinous to incentives and many peoples' lives. The quicker we turn our backs on central planner folly the better.

The only humility I want to see from these guys is for them to close shop. They can't be fixed because they are doing the wrong thing.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.